what is a tax and interest deduction worksheet Schedule A is divided into seven sections medical and dental expenses taxes you paid interest you paid gifts to charity casualty and theft

What taxes may be deductible Taxpayers can deduct certain taxes if they itemize To be deductible the tax must have been imposed on and paid by the taxpayer during the current Schedule A Itemized Deductions TaxSlayer Navigation Federal Section Deductions Itemized Deductions Medical and Dental Expenses If MFS and spouse itemizes taxpayer must also

what is a tax and interest deduction worksheet

what is a tax and interest deduction worksheet

https://www.worksheeto.com/postpic/2010/07/itemized-deductions-worksheet_449334.png

Truck Expenses Worksheet Spreadsheet Template Printable Worksheets

https://i.pinimg.com/originals/ed/37/23/ed372359aac4e974a39e6494da5610e6.jpg

Home Office Deduction Worksheet Excel Printable Word Searches

https://www.fastcapital360.com/wp-content/uploads/2021/02/homeDeduction.jpg

With this detailed guide on how to calculate your tax deductions on a W 4 worksheet for tax withholding you will be able to easily calculate deductions and adjustments with ease The steps are simple and as long as Schedule A asks you to list and tally up all your itemized deductions to figure out your Total Itemized Deductions amount line 17 of Schedule A which are then subtracted from your adjusted gross income AGI to determine your total

Schedule A Tax and Interest Deduction Worksheet Double check in the mortgage interest section of your return that you did indicate that the interest is secured by a property At the end of this lesson using your resource materials you will be able to Determine the standard deduction amount for most taxpayers Determine the standard deduction amount

More picture related to what is a tax and interest deduction worksheet

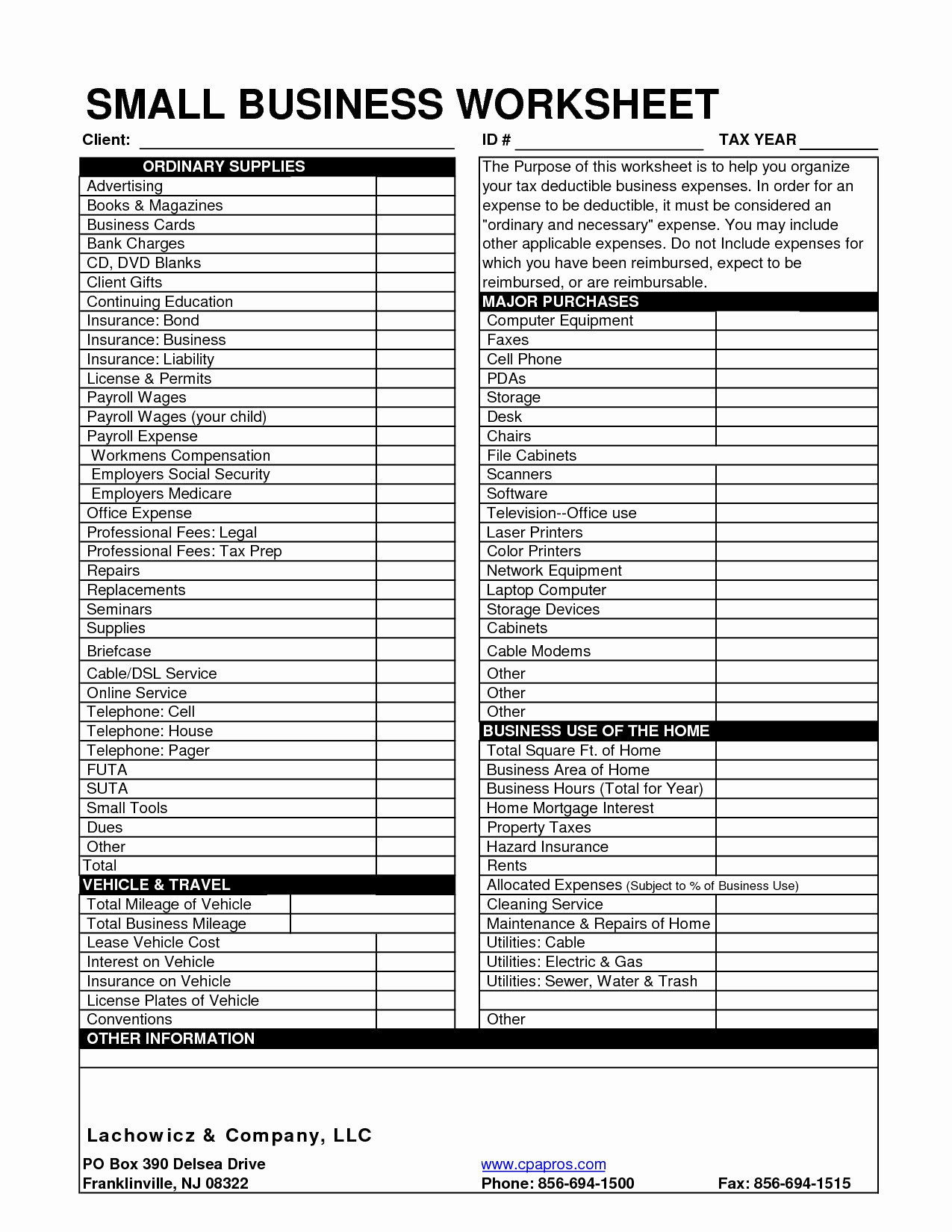

Tax Deduction Spreadsheet Then Small Business Tax Deductions Db excel

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-spreadsheet-then-small-business-tax-deductions.jpg

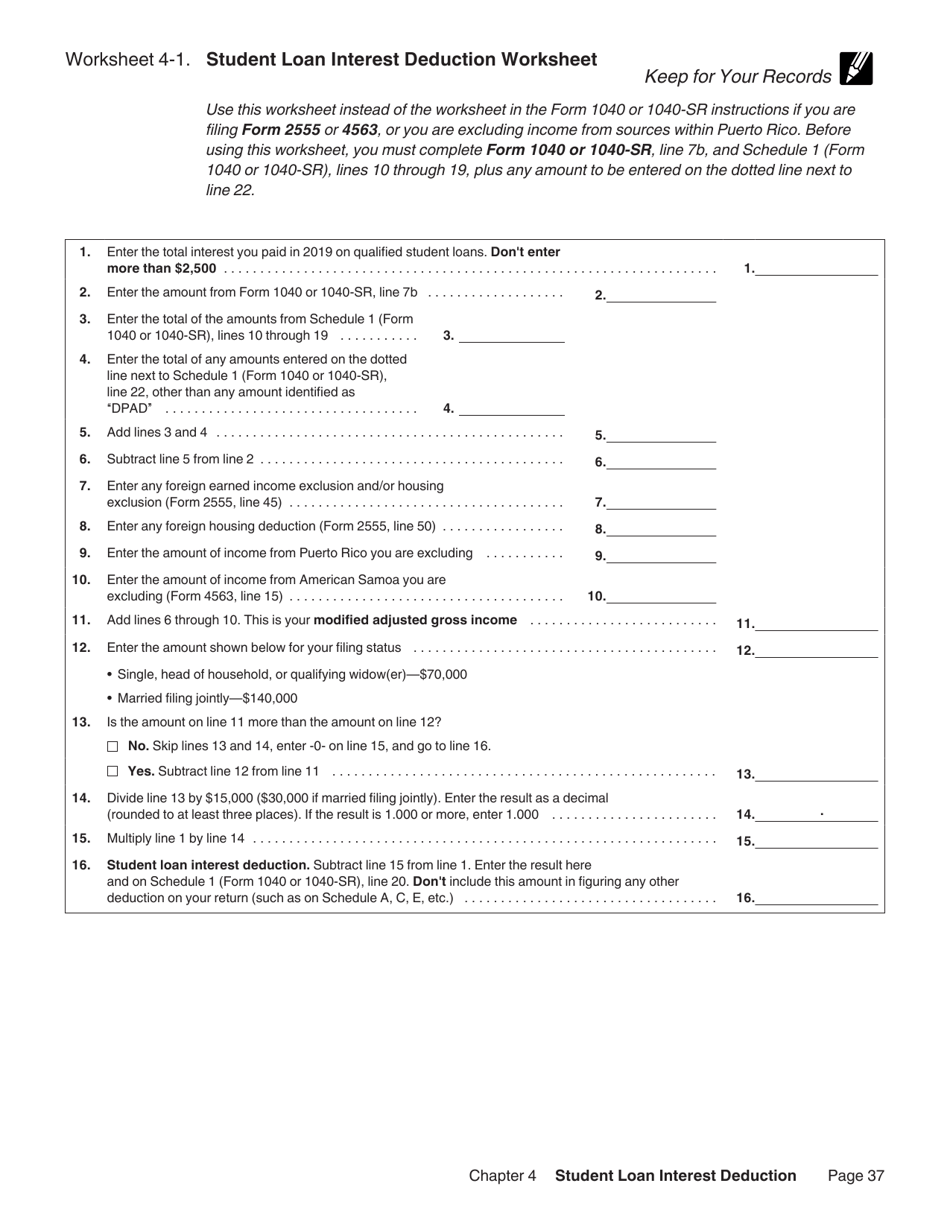

Student Loan Interest Deduction Worksheet Publication 970 Fill Out

https://data.templateroller.com/pdf_docs_html/2058/20589/2058940/student-loan-interest-deduction-worksheet-publication-970_print_big.png

10 Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2012/03/2015-itemized-tax-deduction-worksheet-printable_426931.png

This part explains what you can deduct as home mortgage interest It includes discussions on points and how to report deductible interest on your tax return Generally home mortgage OVERVIEW The federal tax law allows you to deduct several different personal expenses from your taxable income each year This can really pay off during tax season

If you made federal student loan payments in 2023 you may be eligible to deduct a portion of the interest paid on your 2023 federal tax return This is known as a student loan interest Tax deductions are available for Airbnb commissions and fees as well as for most situations mortgage interest insurance premiums and property taxes Additional indirect

5 Itemized Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/07/schedule-c-tax-deduction-worksheet_449335.png

1040 Deductions 2016 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1040-deductions-2016.jpg

what is a tax and interest deduction worksheet - With this detailed guide on how to calculate your tax deductions on a W 4 worksheet for tax withholding you will be able to easily calculate deductions and adjustments with ease The steps are simple and as long as