would you like to use the deductions worksheet to calculate your deductions The deductions worksheet requires some math You ll also need to know how much you claimed in deductions on your last tax return If you claimed the standard deduction you don t need to fill this

For 2024 if you believe your itemized deductions will exceed 14 600 if you re single or married filing separate 29 200 if you re married filing jointly or 21 900 if you re the head of There are worksheets in the Form W 4 instructions to help you estimate certain tax deductions you might have coming The IRS s W 4 estimator or

would you like to use the deductions worksheet to calculate your deductions

would you like to use the deductions worksheet to calculate your deductions

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

13 Tax Deduction Worksheet 2014 Worksheeto

https://www.worksheeto.com/postpic/2009/08/tax-itemized-deduction-worksheet_449403.png

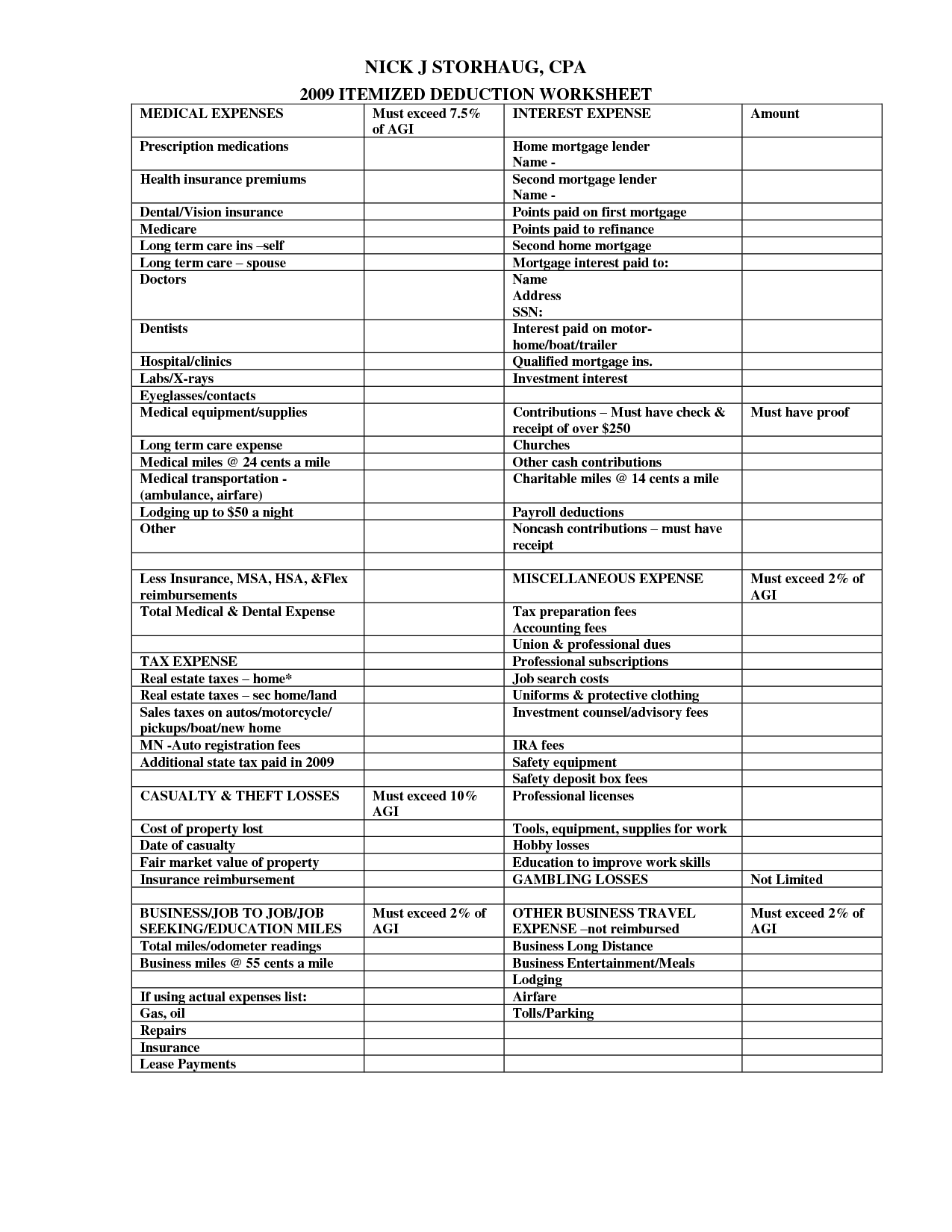

10 2014 Itemized Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/12/tax-deduction-worksheet_449398.png

b Deductions If you expect to claim deductions other than the standard deduction and want to reduce your withholding use the Deductions Worksheet on page 3 and enter the result here c Extra withholding The steps are simple and as long as you follow them you will be able to calculate deductions in a W 4 worksheet With this detailed guide on how to calculate your tax deductions on a W 4 worksheet

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 Check your W 4 tax withholding with the IRS Tax Withholding Estimator See how your withholding affects your refund paycheck or tax due Use this tool to

More picture related to would you like to use the deductions worksheet to calculate your deductions

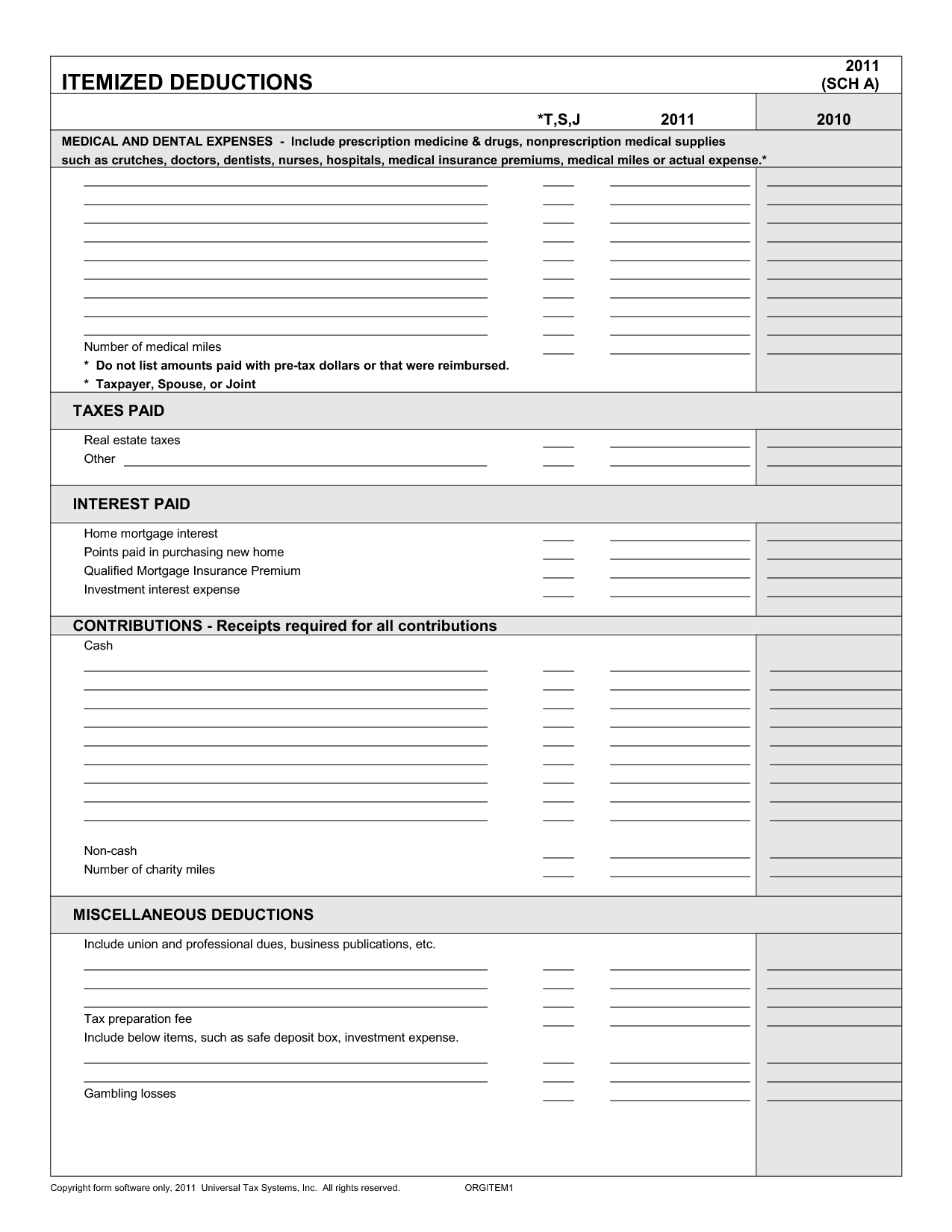

5 Itemized Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/07/itemized-deductions-worksheet_449334.png

Disk U e Zvuk Schedule 1 Kuhinja Rezidencija Ekspertiza

https://images.ctfassets.net/ifu905unnj2g/559i57L2mTIwb0IA9pbpog/7fd2ce773008246da36a27d2552b2643/Schedule_A.png

Deductions Worksheets Calculator

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/09/self-employed-tax-deductions-worksheet-2016.png

This worksheet will help you determine whether you re better off taking the standard deduction or itemizing your deductions You ll also be able to tally up any other applicable tax deductions such as student loan Last updated June 2023 Lana Dolyna EA CTC Senior Tax Advisor Filling out the California Withholding Form DE 4 is an important step to ensure accurate tax

Paycheck Calculator Federal State Local Taxes Your Details Use SmartAsset s paycheck calculator to calculate your take home pay per paycheck for both salary and Some taxpayers may need to use the standard deduction worksheet in the Form 1040 Instructions Objectives At the end of this lesson using your resource materials you

17 Schedule C Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/09/itemized-deduction-list-template_449451.png

For Most Taxpayers The Amount Of The Standard Deduction And The

https://i.pinimg.com/originals/2d/5a/bd/2d5abd52bdb8d039ecf499b8a449547a.png

would you like to use the deductions worksheet to calculate your deductions - The steps are simple and as long as you follow them you will be able to calculate deductions in a W 4 worksheet With this detailed guide on how to calculate your tax deductions on a W 4 worksheet