what is a 1098 employee A form 1098 reports the amounts to the IRS and you receive a copy of the form that you may be able to deduct on your tax return If you have a mortgage loan you ll get a Form 1098 from the loan company showing the

A 1099 employee is a term for an independent contractor They re called this because business owners send them a 1099 NEC tax form at the end of the year What is a 1099 Employee A 1099 employee is one that doesn t fall under normal employment classification rules Independent contractors are 1099 employees Instead of having a permanent worker that takes direction

what is a 1098 employee

what is a 1098 employee

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

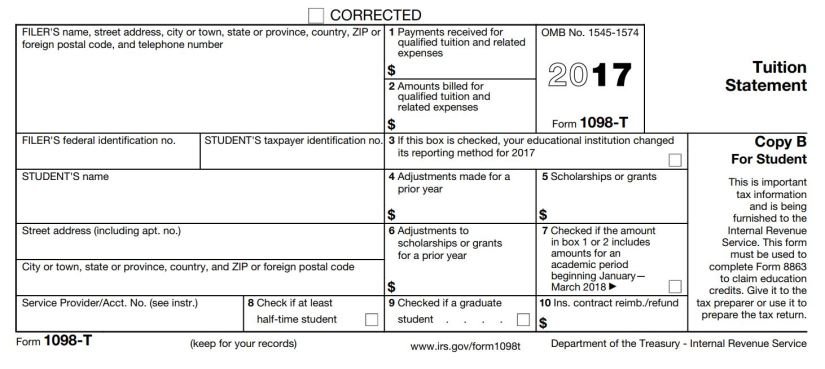

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

It is critical that business owners correctly determine whether the individuals providing services are employees or independent contractors Generally you must withhold and deposit income This article will explain what a 1099 employee is how they differ from traditional W 2 employees and what rules you need to know when hiring a contractor Want to offer employee benefits to your 1099 employees without

What is a 1099 form A 1099 form is a tax statement you may receive from a bank a broker a business or another entity paying you nonemployee compensation throughout the year It will list how To summarize Form 1098 relates to mortgage interest paid by the taxpayer while Form 1099 reports various types of non employment income earned Understanding the

More picture related to what is a 1098 employee

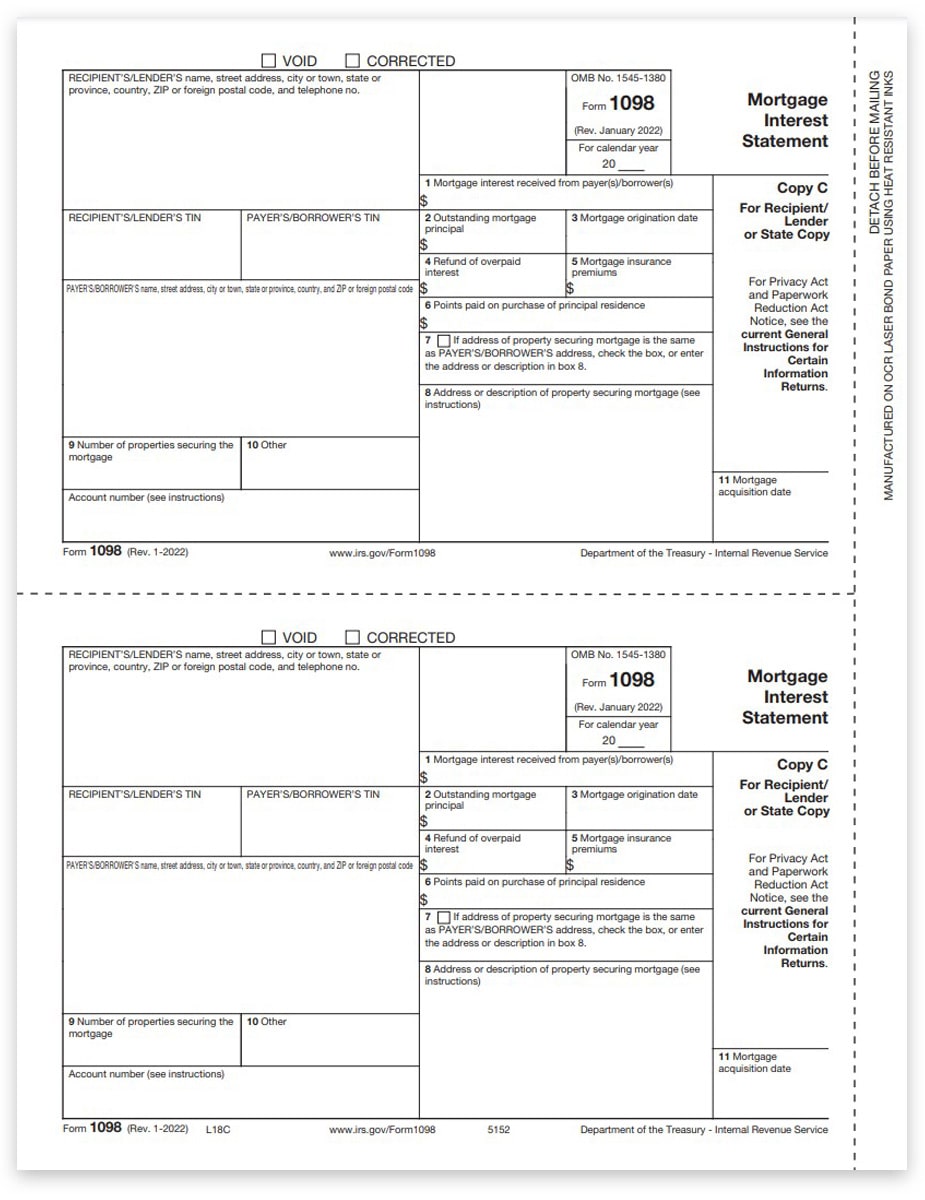

1098 Tax Form Mortgage Interest Copy C For Lender DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-C-Recipient-Lender-State-L18C-FINAL-min.jpg

Instructions For Form 1098 Mortgage Interest Statement Lendstart

https://assets.trafficpointltd.com/app/uploads/sites/136/2022/01/02082507/Form-1098.jpg

:max_bytes(150000):strip_icc()/ScreenShot2021-10-01at12.36.46PM-516841a2dc40455cbb7f24f872435284.png)

41 What Is 1098 Mortgage Interest Statement SarenaEiddon

https://www.thebalancemoney.com/thmb/zcBGQ4fMiBwdeWe7LKzqHsCKlMA=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-10-01at12.36.46PM-516841a2dc40455cbb7f24f872435284.png

The Form 1098 Mortgage Interest Statement is used to report interest that a taxpayer has paid on his or her mortgage Such interest might be tax deductible as an itemized deduction The Form 1098 C Contributions of Motor Vehicles What is a 1099 employee A 1099 employee is another term for an independent contractor The name stems from the form employers submit to the U S Internal Revenue Service IRS to

What is a 1099 Employee The designation of a 1099 worker pertains to individuals freelancers independent contractors or other self employed professionals Payers use Form 1099 NEC to report payments made in the course of a trade or business to others for services

:max_bytes(150000):strip_icc()/Form1098-30d7d922c32748bea2a293a28fbbe778.jpg)

1098 Form 2023 Printable Forms Free Online

https://www.investopedia.com/thmb/1cgL0Yz4cKh8Kk4HagESO39QTdI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Form1098-30d7d922c32748bea2a293a28fbbe778.jpg

What s A 1098 T How To Pay For College

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

what is a 1098 employee - Form 1099 MISC Miscellaneous Information is an Internal Revenue Service IRS form used to report certain types of miscellaneous compensation such as rent prizes