is a 1098 considered income Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or

Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file Use Form 1098 to report mortgage Outside the United States you must file Form 1098 if a you are a controlled foreign corporation or b at least 50 of your gross income from all sources for the 3 year period ending with the

is a 1098 considered income

is a 1098 considered income

https://americantaxtraining.com/wp-content/uploads/2022/06/form-1098-E.png

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

What is Form 1098 Form 1098 Mortgage Interest Statement reports how much you paid in interest during the tax year including prepaid points of interest The form will be sent to you by the company that services A Form 1098 is a tax document that reports amounts that may affect a tax filer s adjustments to income or deductions from their income on their annual tax return There are several variations of the form some are used

Mortgage lenders need to file Form 1098 with the IRS if the borrower paid more than 600 in a given year and send you a copy which you can frame if you so choose They The form will have separate boxes for these types of income rental and royalty income non employee compensation medical and health care payments fishing boat crop insurance proceeds excess golden parachute

More picture related to is a 1098 considered income

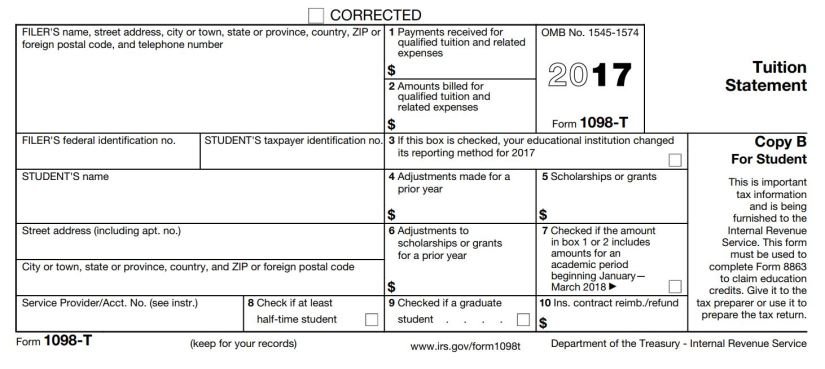

What s A 1098 T How To Pay For College

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

What is a 1098 tax form used for If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form If your mortgage interest is less than 600 your lender doesn t have to send you this form File Learn about the different types of 1098 forms you may receive and how they could affect your taxes A 1098 form is not income but it may help you deduct or credit certain payments or donations

Form 1098 reports this information to the IRS for two reasons The first is to help taxpayers claim tax credits for interest paid on their mortgage Second the corporations and IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year Here s how to fill out the form

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

is a 1098 considered income - Students subject to the kiddie tax may need to file Form 8615 Tax for Certain Children Who Have Unearned Income In some situations students will need to use