is 1098 a deduction If the loan is not secured by any real property you are not required to file Form 1098 However the borrower may be entitled to a deduction for qualified residence interest

Form 1098 Mortgage Interest Deduction is an IRS form for notifying a borrower how much interest they have paid in one year on a qualified home mortgage The 1098 form and its variants are used to report certain contributions and other possible tax deductible expenses to the IRS and taxpayers In particular they

is 1098 a deduction

is 1098 a deduction

https://www.csusm.edu/sfs/images/form_1098_t.jpg

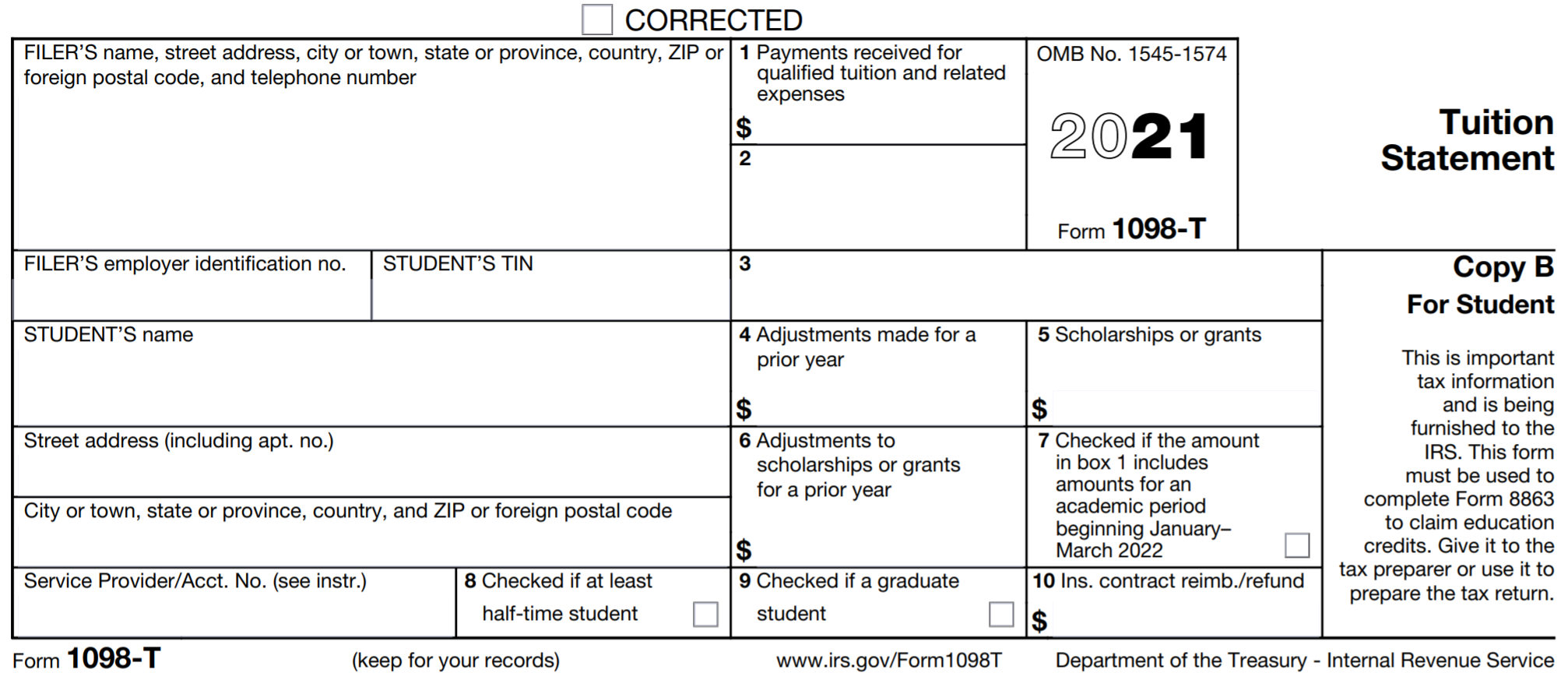

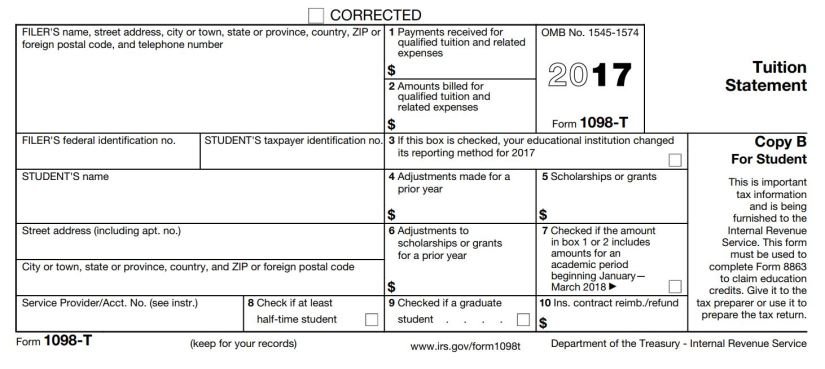

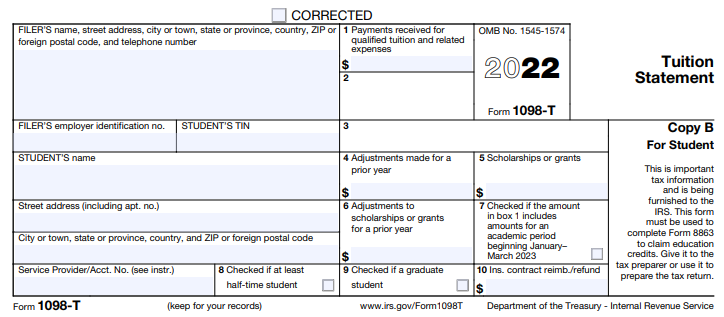

Education Credits And Deductions Form 1098 T Support

https://support.taxslayerpro.com/hc/article_attachments/4408984427162/1098-t.png

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

If you want to claim your mortgage interest as a deduction you must use Form 1098 to file your taxes Otherwise the IRS doesn t require it from taxpayers However you may report any reimbursement of overpaid interest that you are not otherwise required to report but if you do you are subject to the rules in these instructions The

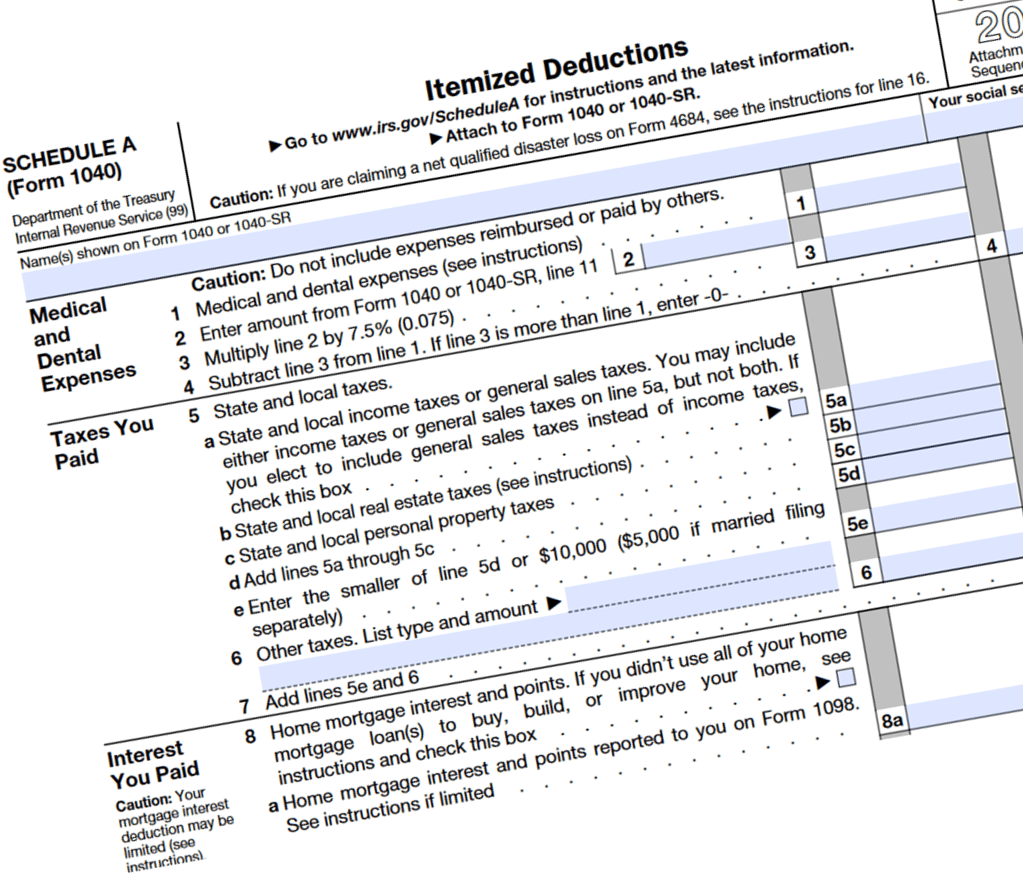

Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the Form 1098 is issued to homeowners by mortgage lenders to report mortgage interest payments and other payments like mortgage premiums Businesses must file

More picture related to is 1098 a deduction

Tax Form 1098 T Office Of The Bursar

https://bursar.utk.edu/wp-content/uploads/sites/37/2022/04/1098-t-e1651503267111.png

How Does A Refinance In 2023 Affect Your Taxes HSH

https://www.hsh.com/imagesvr_ce/1143/1040_cropped_large.png

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

Using Form 1098 to Deduct Mortgage Interest The IRS allows homeowners to deduct home mortgage interest on the first 750 000 of indebtedness The limit drops to 375 000 if you re married and file Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an

You can deduct expenses related to renting the property However deductions are allocated based on the days personally used and are limited to gross rental income The expenses for personal use are deductible Form 1098 is an IRS form used to report mortgage interest paid for a tax year The mortgage interest form allows lenders to inform the IRS when more than 600 interest has been paid in a year Individuals

What s A 1098 T How To Pay For College

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

1098 T Form 2023 Printable Forms Free Online

https://www.rollins.edu/student-account-services/1098t-information/2022-1098-t.png

is 1098 a deduction - Lenders must issue a form 1098 if you paid 600 or more in interest mortgage insurance premiums or points However you don t have to file your 1098 form unless you want to