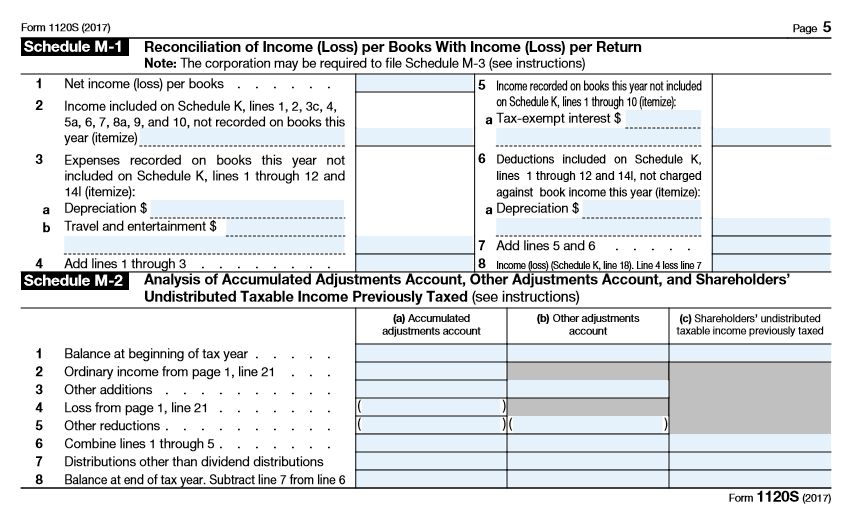

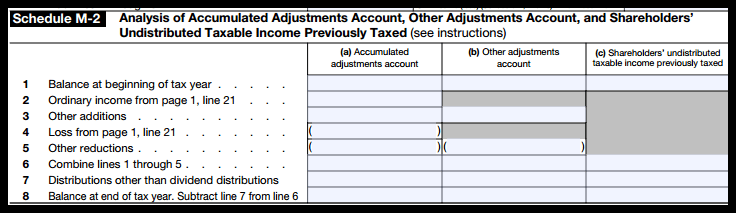

what is 1120s schedule m 2 Schedule M 2 is an important supplemental form that must be filed with the annual Form 1120 S return for certain S corporations It tracks activity in the Accumulated Adjustments Account

Any corporation that completes Parts II and III of Schedule M 3 Form 1120 S must complete all columns without exception If you are filing Schedule M 3 check the Check if Sch M 3 Schedule M 2 requirements for S Corporations Schedule M 2 is required even if the corporation was always an S Corporation S Corporations with accumulated E and P must maintain the

what is 1120s schedule m 2

what is 1120s schedule m 2

http://static1.squarespace.com/static/54a14f8ee4b0bc51a1228894/54a14fdbe4b0bcb26c29e8c6/61ec03a5dd3bd571875aad40/1642857784229/f1120s_Page_5.jpg?format=1500w

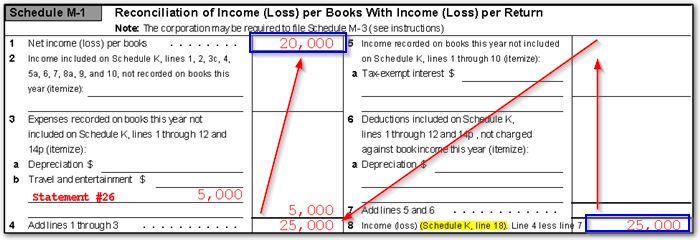

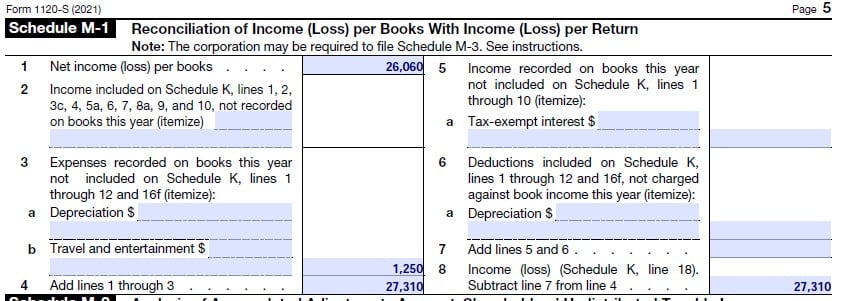

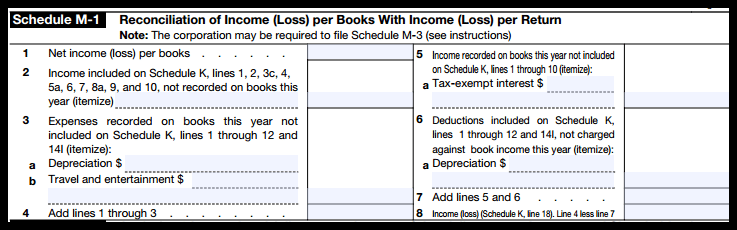

1120S Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

https://drakesoftware.com/Site/Uploads/Images/10411 image 1.jpg

Fill Out The 1120S Form Including The M 1 M 2 With Chegg

https://media.cheggcdn.com/media/e63/e63bdf49-a965-4ee6-b546-748f7b0fb889/phpzQ34qC.png

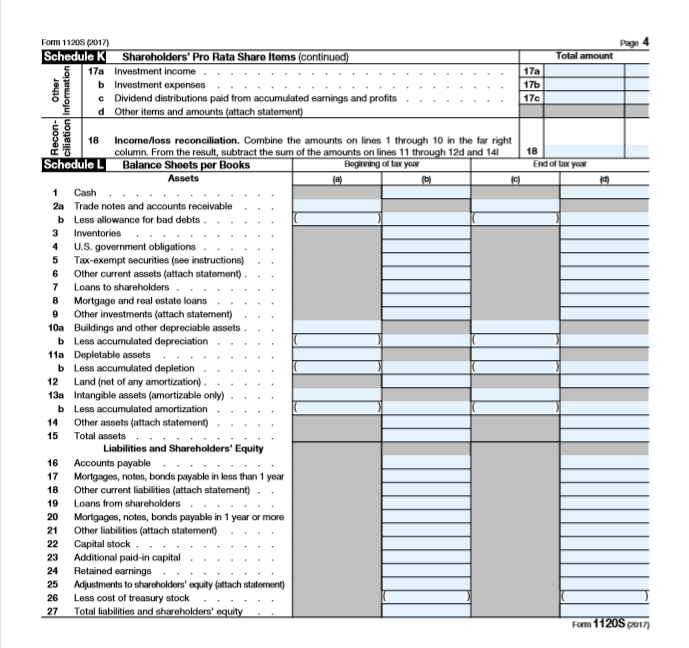

How does Form 1120 S Schedule M 2 work Form 1120 S Schedule M 2 analyzes adjustments to the accumulated earnings account other adjustments account and Schedule M 2 The final section of the 1120 S is Schedule M 2 which is dedicated to reporting the accumulated adjustment accounts AAA Line 8 of this schedule tells you the corporation s year end AAA balance This

Information about Form 1120 S U S Income Tax Return for an S Corporation including recent updates related forms and instructions on how to file Form 1120 S is used by corporations Use Schedule M 2 for the accumulated adjustments account on a S Corporation Refer to the following information to help with Screen 32 Schedule M 2 questions Entering

More picture related to what is 1120s schedule m 2

A Beginner s Guide To S Corporation Taxes

https://m.foolcdn.com/media/affiliates/images/S_corp_taxes_-_01_-_Form_1120-S_SLI0Nvc.width-750.png

IRS Form 1120S Definition Download Filing Instructions

https://fitsmallbusiness.com/wp-content/uploads/2018/02/form-1120s-schedule-m-2.png

Tax Table M1 Instructions Brokeasshome

https://fitsmallbusiness.com/wp-content/uploads/2022/01/Screenshot_Schedule_M-1_for_IRS_Form_1120S.jpg

Schedule M 2 and Retained Earnings When trying to reconcile the Accumulated Adjustments Account AAA to retained earnings keep in mind that the Schedule L on the 1120S is the Step 8 Fill Out Form 1120S Schedule M 2 The purpose of Schedule M 2 is to show changes in the S corp s accumulated adjustments account AAA during the tax year which is essentially your retained earnings

The Schedule M 2 on Form 1120 S is not a reconciliation of retained earnings as it is on an 1120 but rather a reconciliation of the corporate accounts that affect shareholder s basis The program calculates the ending balance of retained earnings for the balance sheet Schedule L line 25 using the Schedule M 2 You can view the Schedule M 2 on the last

How To Complete Form 1120S Income Tax Return For An S Corp

https://fitsmallbusiness.com/wp-content/uploads/2017/02/Form-1120S-Reconciliation-of-Income-Loss-per-Books-with-Income-Loss-per-Return-Schedule-M-1.png

Fill Out The 1120S Form Including The M 1 M 2 With Chegg

https://media.cheggcdn.com/media/dd2/dd23acbf-762f-40c8-8572-c759db2b4b1c/php6pYSDd.png

what is 1120s schedule m 2 - Schedule M 2 The final section of the 1120 S is Schedule M 2 which is dedicated to reporting the accumulated adjustment accounts AAA Line 8 of this schedule tells you the corporation s year end AAA balance This