schedule m 2 instructions 1120s Form 1120 Schedule M 2 Increases and Decreases Canceling the appropriated retained earnings for the cost of treasury stock will increase unappropriated retained earnings To reflect this increase the is added to

Schedule M 2 provides shareholders and the IRS with necessary information to calculate basis determine dividend treatment and report previously taxed income S corps with assets over Schedule M 2 requirements for S Corporations Schedule M 2 is required even if the corporation was always an S Corporation S Corporations with accumulated E and P must maintain the

schedule m 2 instructions 1120s

schedule m 2 instructions 1120s

https://formspal.com/wp-content/uploads/2022/01/irs-schedule-k-1-form-1120-s-2021-preview.webp

How To File Tax Form 1120 For Your Small Business

https://m.foolcdn.com/media/affiliates/images/Form_1120_-_01_-_Front_Page_rT0vFkj.width-750.png

How Do I Fill Out Form 1120S Gusto

https://gusto.com/wp-content/uploads/2019/06/Form-1120S-instructions-Schedule-K.png

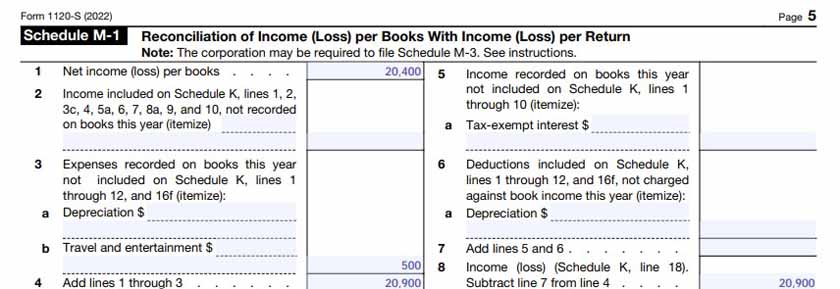

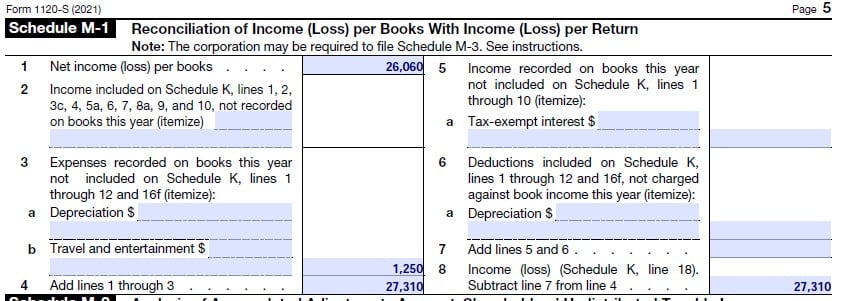

The Schedule M 2 on Form 1120 S is not a reconciliation of retained earnings as it is on an 1120 but rather a reconciliation of the corporate accounts that affect shareholder s basis Schedule M 2 Analysis of Unappropriated Retained Earnings per Books 27 Principal Business Activity Codes 29 Index 32 Future Developments For the latest information

Use Schedule M 2 for the accumulated adjustments account on a S Corporation Refer to the following information to help with Screen 32 Schedule M 2 questions Entering How does Form 1120 S Schedule M 2 work Form 1120 S Schedule M 2 analyzes adjustments to the accumulated earnings account other adjustments account and previously taxed income

More picture related to schedule m 2 instructions 1120s

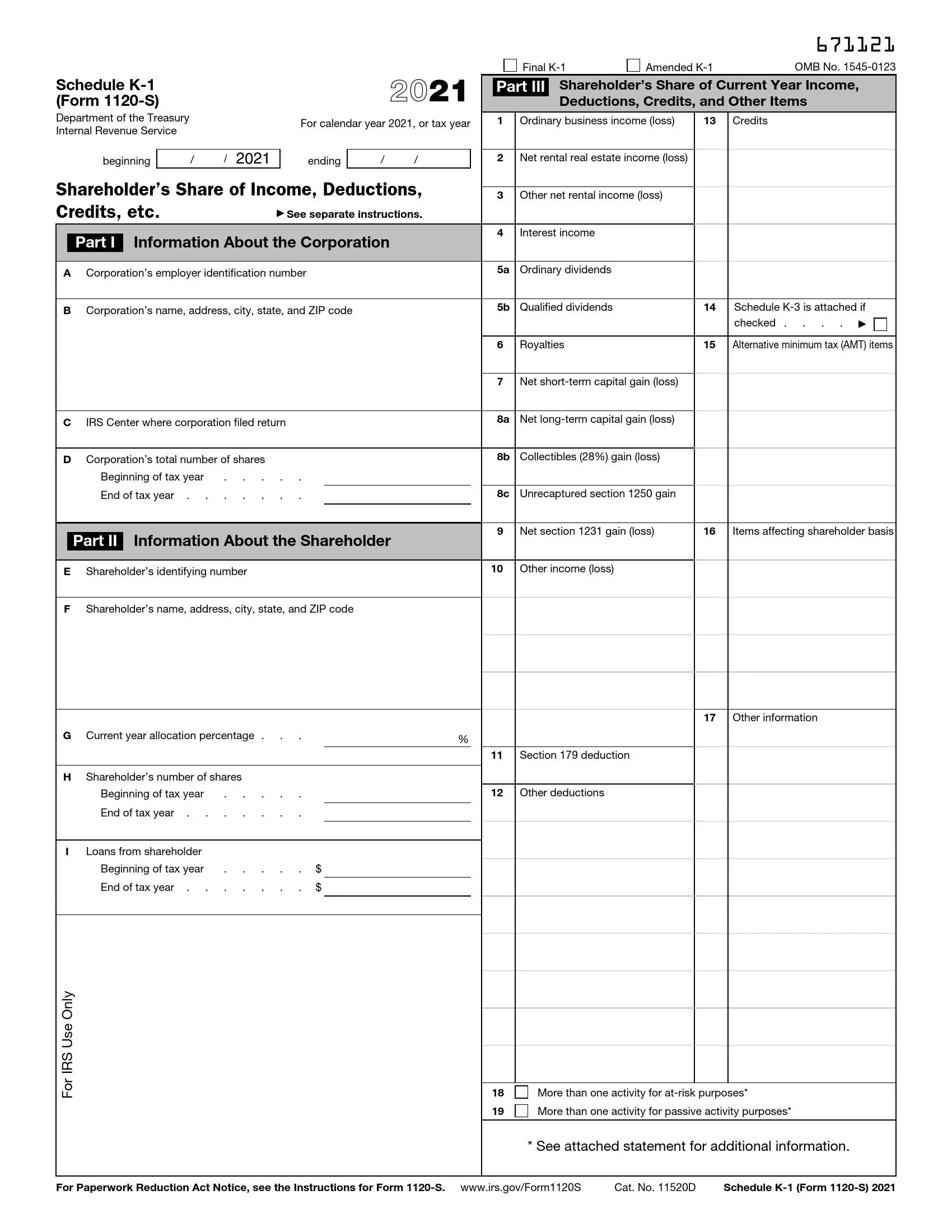

Instructions For Schedule K 1 Form 1120s Shareholder S Share Of

https://data.formsbank.com/pdf_docs_html/352/3525/352588/page_1_thumb_big.png

How To Complete Form 1120S Schedule K 1 Free Checklist

https://fitsmallbusiness.com/wp-content/uploads/2023/03/Screenshot_IRS_Form_1120-_S_Schedule_M_1.jpg

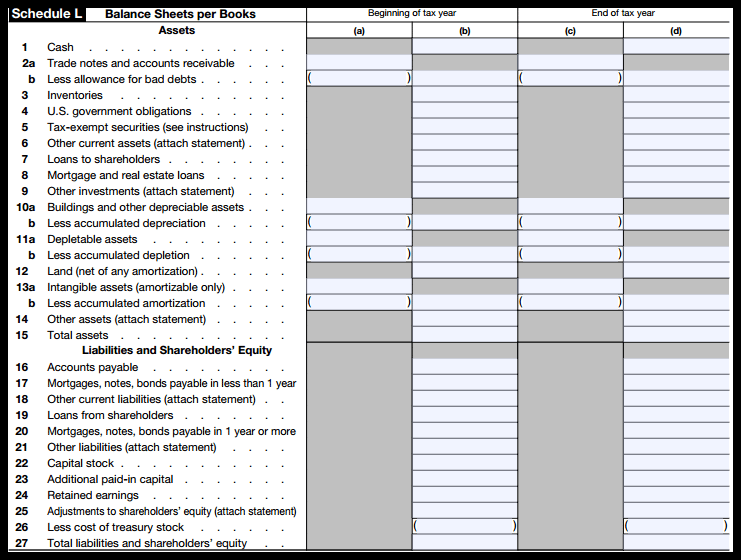

IRS Form 1120S Definition Download Filing Instructions

https://fitsmallbusiness.com/wp-content/uploads/2018/02/form-1120s-schedule-l.png

Per the M 2 instructions in the 2021 IRS 1120 S instructions If column a on line 2 or line 4 of the Schedule M 2 includes expenses paid with proceeds from forgiven PPP Schedule M 2 Analysis of AAA PTEP Accumulated E P and OAA 48 Principal Business Activity Codes 52 Index 55 Future Developments For the latest information about

The IRS instructions for form 1120 has a list of organizations that need to file a different type of return For example many corporations choose to file Form 8832 to elect S Schedules K 2 and K 3 There is a new exception for filing and furnishing Schedules K 2 and K 3 for tax years beginning in 2022 See International Transactions later Reminder Election by a

IRS Expands On Reporting Expenses Used To Obtain PPP Loan Forgiveness

http://static1.squarespace.com/static/54a14f8ee4b0bc51a1228894/54a14fdbe4b0bcb26c29e8c6/61ec03a5dd3bd571875aad40/1642857784229/f1120s_Page_5.jpg?format=1500w

Tax Table M1 Instructions Brokeasshome

https://fitsmallbusiness.com/wp-content/uploads/2022/01/Screenshot_Schedule_M-1_for_IRS_Form_1120S.jpg

schedule m 2 instructions 1120s - You really need to review the instructions for both the 7203 and the 1120 S Schedule M 2 There s a lot of nuance here and we don t have enough information to give you a good