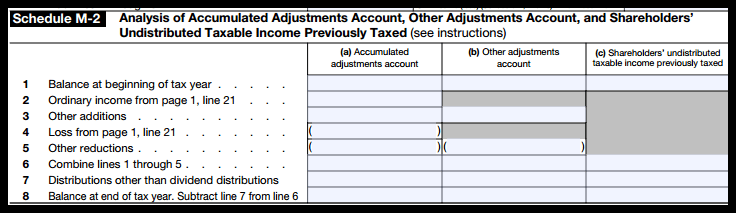

1120s schedule m 2 example Schedule M 2 provides shareholders and the IRS with necessary information to calculate basis determine dividend treatment and report previously taxed income S corps with assets over

Form 1120 S Schedule M 2 analyzes adjustments to the accumulated earnings account other adjustments account and previously taxed income account Unlike on Form 1120 Schedule M Schedule M 2 and Retained Earnings When trying to reconcile the Accumulated Adjustments Account AAA to retained earnings keep in mind that the Schedule L on the 1120S is the

1120s schedule m 2 example

1120s schedule m 2 example

https://fitsmallbusiness.com/wp-content/uploads/2022/01/Screenshot_Schedule_M-1_for_IRS_Form_1120S.jpg

1120 EF Message 0042 Schedule M 2 Is Out Of Balance M1 M2 ScheduleL

https://drakesoftware.com/Site/Uploads/Images/14940 image 5.jpg

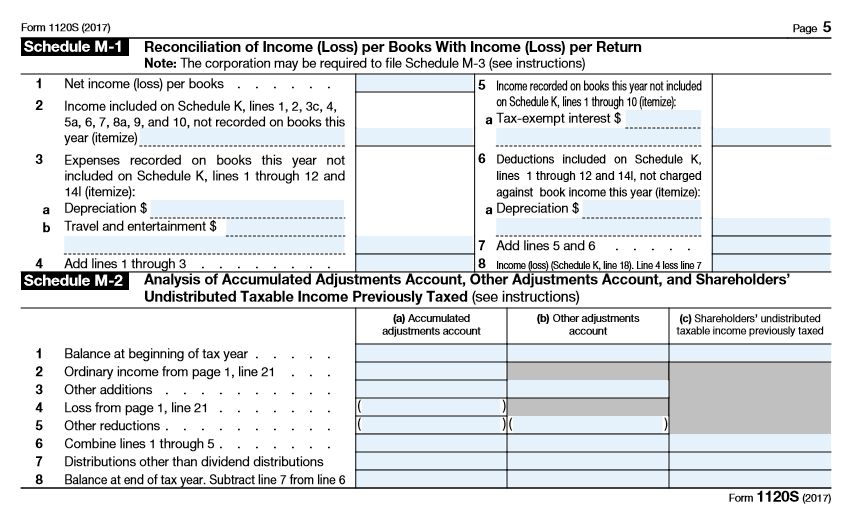

IRS Form 1120S Definition Download Filing Instructions

https://fitsmallbusiness.com/wp-content/uploads/2018/02/form-1120s-schedule-m-2.png

Schedule M 2 is required even if the corporation was always an S Corporation S Corporations with accumulated E and P must maintain the AAA Accumulated Adjustment Account The Any corporation that completes Parts II and III of Schedule M 3 Form 1120 S must complete all columns without exception If you are filing Schedule M 3 check the Check if Sch M 3

Step 8 Fill Out Form 1120S Schedule M 2 The purpose of Schedule M 2 is to show changes in the S corp s accumulated adjustments account AAA during the tax year which is essentially your retained earnings Schedule M 2 and Retained Earnings When trying to reconcile the Accumulated Adjustments Account AAA to retained earnings keep in mind that the Schedule L on the 1120S is the

More picture related to 1120s schedule m 2 example

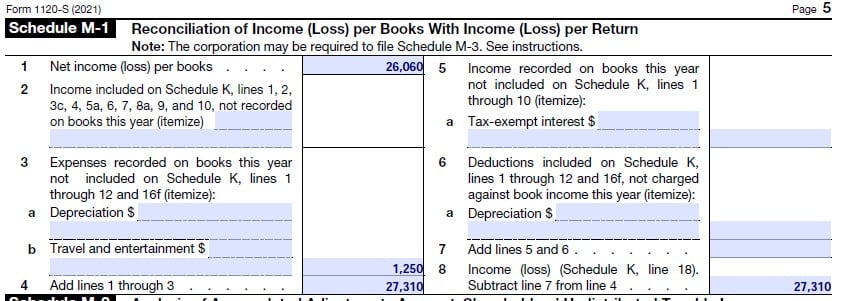

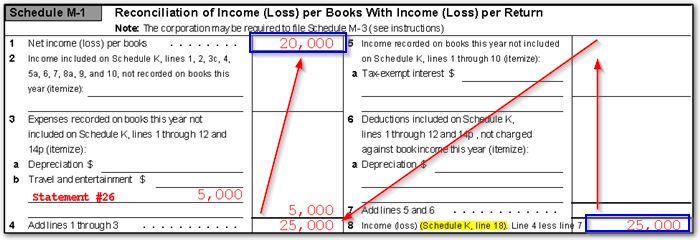

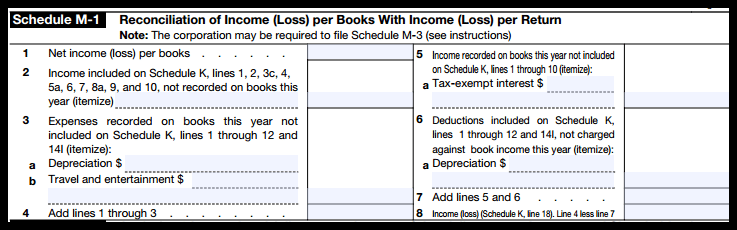

1120S Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

https://drakesoftware.com/Site/Uploads/Images/10411 image 1.jpg

S Corp Schedule K 1 Form 1120S A Simple Guide Accracy Blog

https://assets-global.website-files.com/645d153299ce00e5b32eb70b/64beb81b962a9cd20f6b8ed6_2021_Schedule_K1.png

IRS Expands On Reporting Expenses Used To Obtain PPP Loan Forgiveness

https://images.squarespace-cdn.com/content/v1/54a14f8ee4b0bc51a1228894/03bf9b1e-e954-4786-8289-0f36222a6d69/f1120s_Page_5.jpg

On Schedule M 2 Form 1120S do I report PPP loan proceeds forgiven and proceeds used i e do they offset each other I received a loan in 2020 It was forgiven in An S corporation should include tax exempt income from the forgiveness of PPP loans in column d on line 3 of the Schedule M 2 An S corporation should report expenses paid this year with proceeds from PPP

The purpose of Schedule M 2 is to reconcile the corporation s unappropriated retained earnings account as found on the beginning of the year and the end of the year balance sheets both of which are listed on Schedule L A simple example let s say Sch M 2 is 1 000 and there were 1 500 in total distributions to the shareholder s which the prorata distribution is reflected on the respective K

Fill Out The 1120S Form Including The M 1 M 2 With Chegg

https://media.cheggcdn.com/media/e63/e63bdf49-a965-4ee6-b546-748f7b0fb889/phpzQ34qC.png

How To Complete Form 1120S Income Tax Return For An S Corp

http://fitsmallbusiness.com/wp-content/uploads/2017/02/Form-1120S-Reconciliation-of-Income-Loss-per-Books-with-Income-Loss-per-Return-Schedule-M-1.png

1120s schedule m 2 example - Preparing a Form 1120S for the first time can be a daunting experience Unlike personal income tax returns the corporate tax return seems similar to a company s financial statements