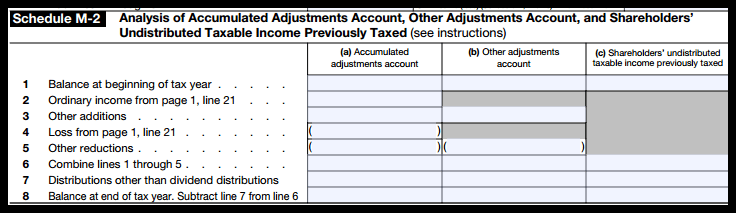

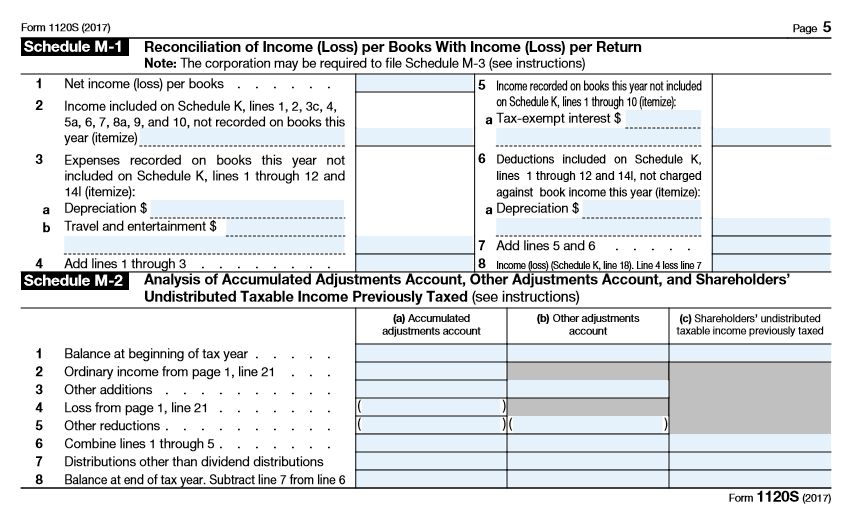

1120s schedule m 2 other reductions Schedule M 2 is an important supplemental form that must be filed with the annual Form 1120 S return for certain S corporations It tracks activity in the Accumulated Adjustments Account

How does Form 1120 S Schedule M 2 work Form 1120 S Schedule M 2 analyzes adjustments to the accumulated earnings account other adjustments account and previously Use Schedule M 2 for the accumulated adjustments account on a S Corporation Refer to the following information to help with Screen 32 Schedule M 2 questions Entering

1120s schedule m 2 other reductions

1120s schedule m 2 other reductions

https://i.ytimg.com/vi/emJ0fkv-xzA/maxresdefault.jpg

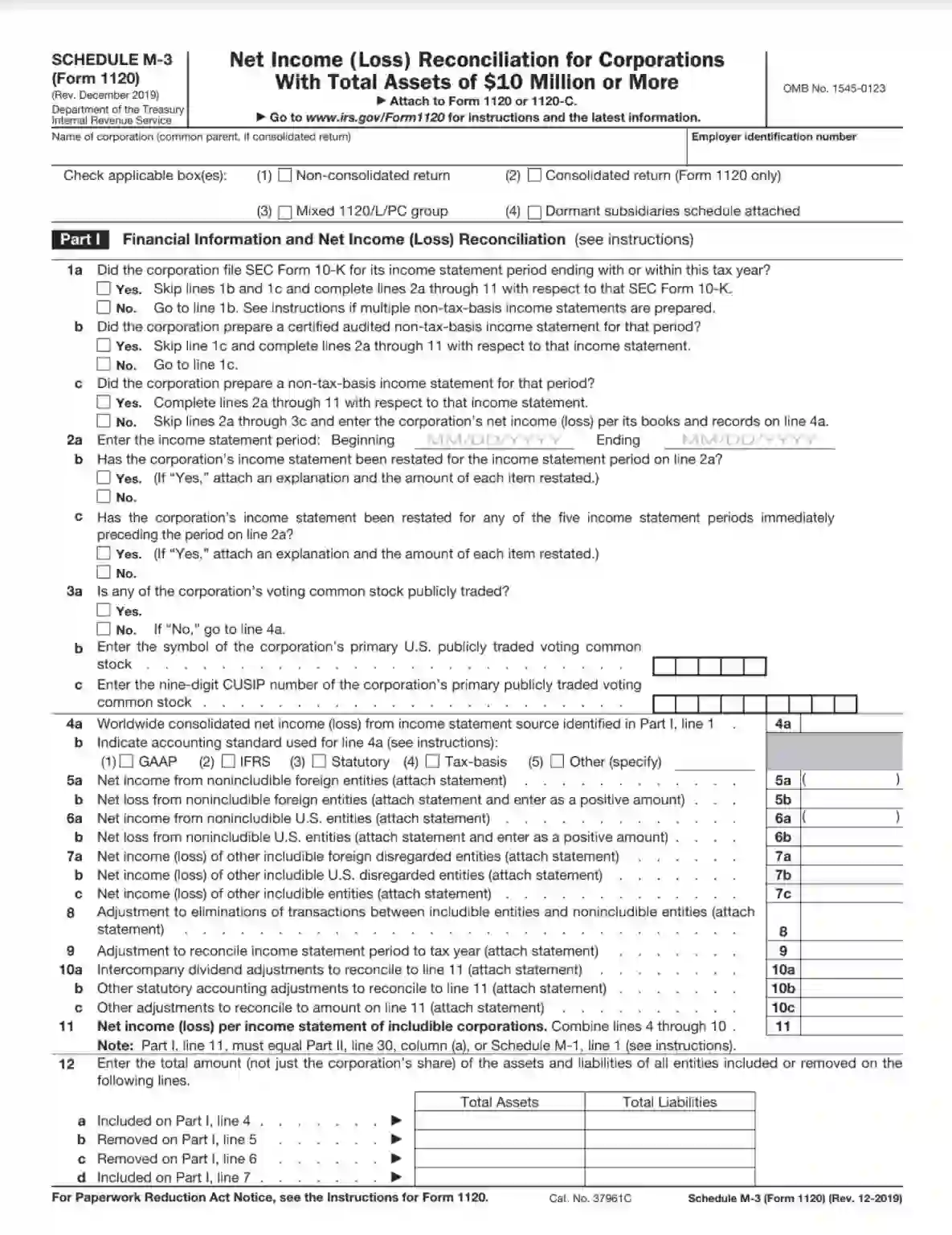

IRS Schedule M 3 Form 1120 Fill Out Printable PDF Forms Online

https://formspal.com/wp-content/uploads/2021/04/irs-schedule-m-3-form-1120.webp

1120 EF Message 0042 Schedule M 2 Is Out Of Balance M1 M2 ScheduleL

https://drakesoftware.com/Site/Uploads/Images/14940 image 5.jpg

To make this determination you will need to analyze the white paper detail for Line 3 and Line 5 of the Schedule M 2 Retained Earnings Adjustments can be either positive or negative and therefore can be included on Line 3 Other To complete the Accumulated Adjustments Account AAA for Form 1120S Schedule M 2 follow these steps Go to Screen 32 Schedule M 2 Enter the Beginning

Schedule M 2 and Retained Earnings When trying to reconcile the Accumulated Adjustments Account AAA to retained earnings keep in mind that the Schedule L on the 1120S is the UltraTax CS doesn t automatically transfer the Schedule M 1 book tax differences to Schedule M 2 for the following Depreciation Depletion other than oil and gas

More picture related to 1120s schedule m 2 other reductions

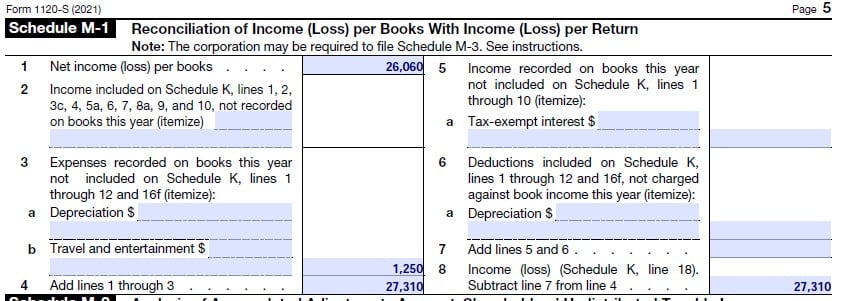

IRS Expands On Reporting Expenses Used To Obtain PPP Loan Forgiveness

https://images.squarespace-cdn.com/content/v1/54a14f8ee4b0bc51a1228894/03bf9b1e-e954-4786-8289-0f36222a6d69/f1120s_Page_5.jpg

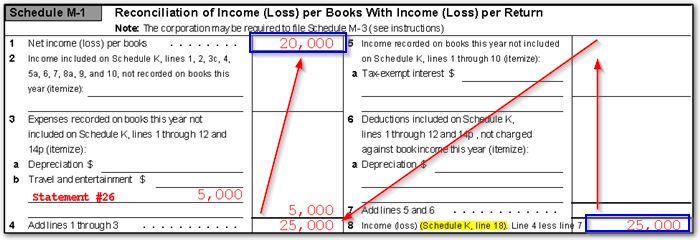

1120S Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

https://drakesoftware.com/Site/Uploads/Images/10411 image 1.jpg

IRS Form 1120S Definition Download Filing Instructions

https://fitsmallbusiness.com/wp-content/uploads/2018/02/form-1120s-schedule-m-2.png

ProConnect calculates the ending balance of retained earnings for the s corporate balance sheet Schedule L Line 24 using your entries throughout the tax return This article The IRS has added more clarification in the final Form 1120S instructions 1 about how expenses paid with PPP loan funds that lead to debt forgiveness should be treated in the computation of the accumulated

If a corporation chooses to complete Form 1120 S Schedule M 1 instead of completing Parts II and III of Schedule M 3 Form 1120 S line 1 of Form 1120 S Schedule M 1 must equal A simple example let s say Sch M 2 is 1 000 and there were 1 500 in total distributions to the shareholder s which the prorata distribution is reflected on the respective K

Tax Table M1 Instructions Brokeasshome

https://fitsmallbusiness.com/wp-content/uploads/2022/01/Screenshot_Schedule_M-1_for_IRS_Form_1120S.jpg

Fill Out The 1120S Form Including The M 1 M 2 With Chegg

https://media.cheggcdn.com/media/e63/e63bdf49-a965-4ee6-b546-748f7b0fb889/phpzQ34qC.png

1120s schedule m 2 other reductions - To make this determination you will need to analyze the white paper detail for Line 3 and Line 5 of the Schedule M 2 Retained Earnings Adjustments can be either positive or negative and therefore can be included on Line 3 Other