when to use a 1099 You should receive most 1099 forms by the end of January although the deadline is mid February for a few Income reported on a 1099 form is usually taxable but not always The IRS also

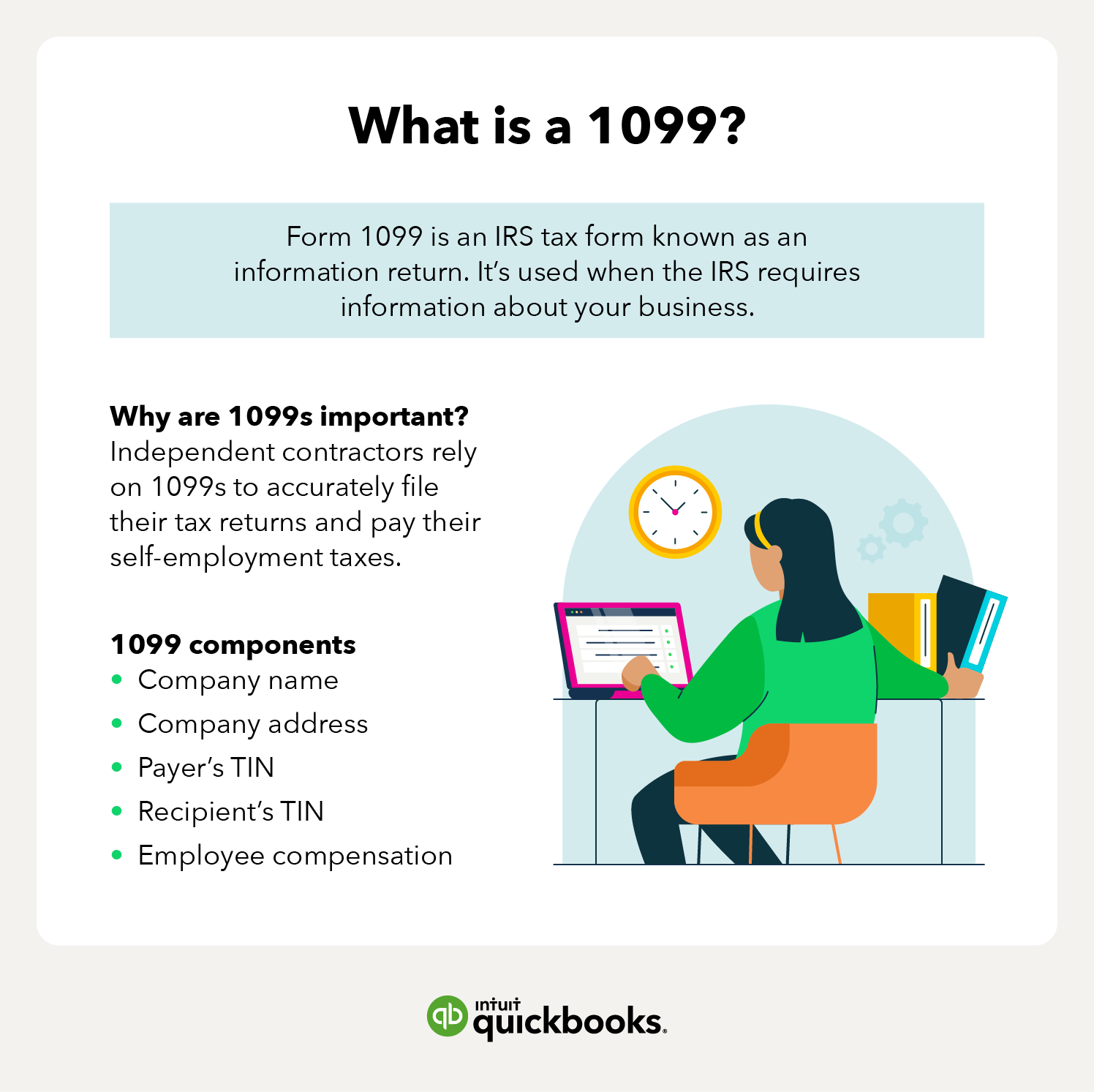

Key Takeaways Form 1099 is used to report certain types of non employment income to the Internal Revenue Service Certain types of non employment income for freelance and independent contract A 1099 form is used to document wages paid to a freelance worker or independent contractor While many business owners aren t sure when to issue a 1099 form to an independent contractor doing so is an important part of tax compliance Here s what you need to know about this important documentation

when to use a 1099

when to use a 1099

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/1099-summary.png

Free 1099 Tax Forms Printable

https://free-printablehq.com/wp-content/uploads/2019/07/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-form.png

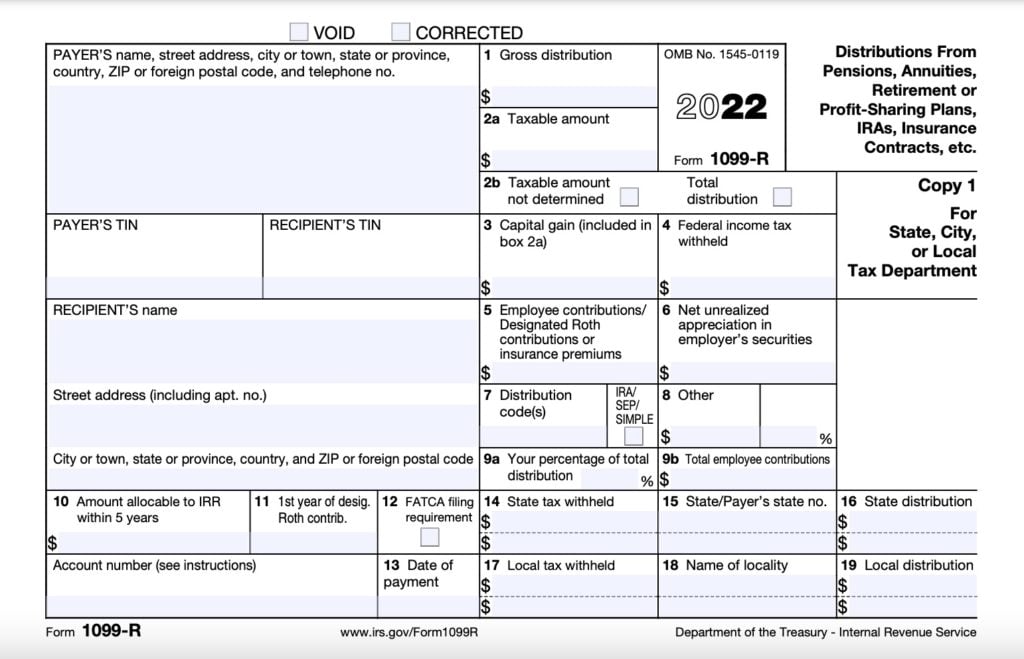

What Is A 1099 R Tax Forms For Annuities Pensions

https://www.annuity.org/wp-content/uploads/1099R.jpeg

By Ana Bentes October 30 2023 1099 meaning 1099 is an IRS tax form known as an information return meaning you fill out the form as a source of information about your business When it comes time to file your small business s taxes you ll likely come across Form 1099 If you own a small business or are self employed use this IRS guidance to determine if you need to file form 1099 or some other information return 10 or more returns E filing now required Starting tax year 2023 if you have 10 or more information returns you must file them electronically

What is a 1099 Form used for The 1099 Form is used to report certain kinds of non employment income to the IRS There are 20 total varieties of 1009 forms Some of the most popular are A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC

More picture related to when to use a 1099

How Form 1099 K Affects Your E Commerce Business Digital

https://digital.com/wp-content/uploads/2022/02/Form-1099-K-1024x672.png

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/1099-example.png

What Is A 1099 Explaining All Form 1099 Types CPA Solutions

https://secureservercdn.net/104.238.68.196/793.969.myftpupload.com/wp-content/uploads/2021/01/1099-1536x1004.png

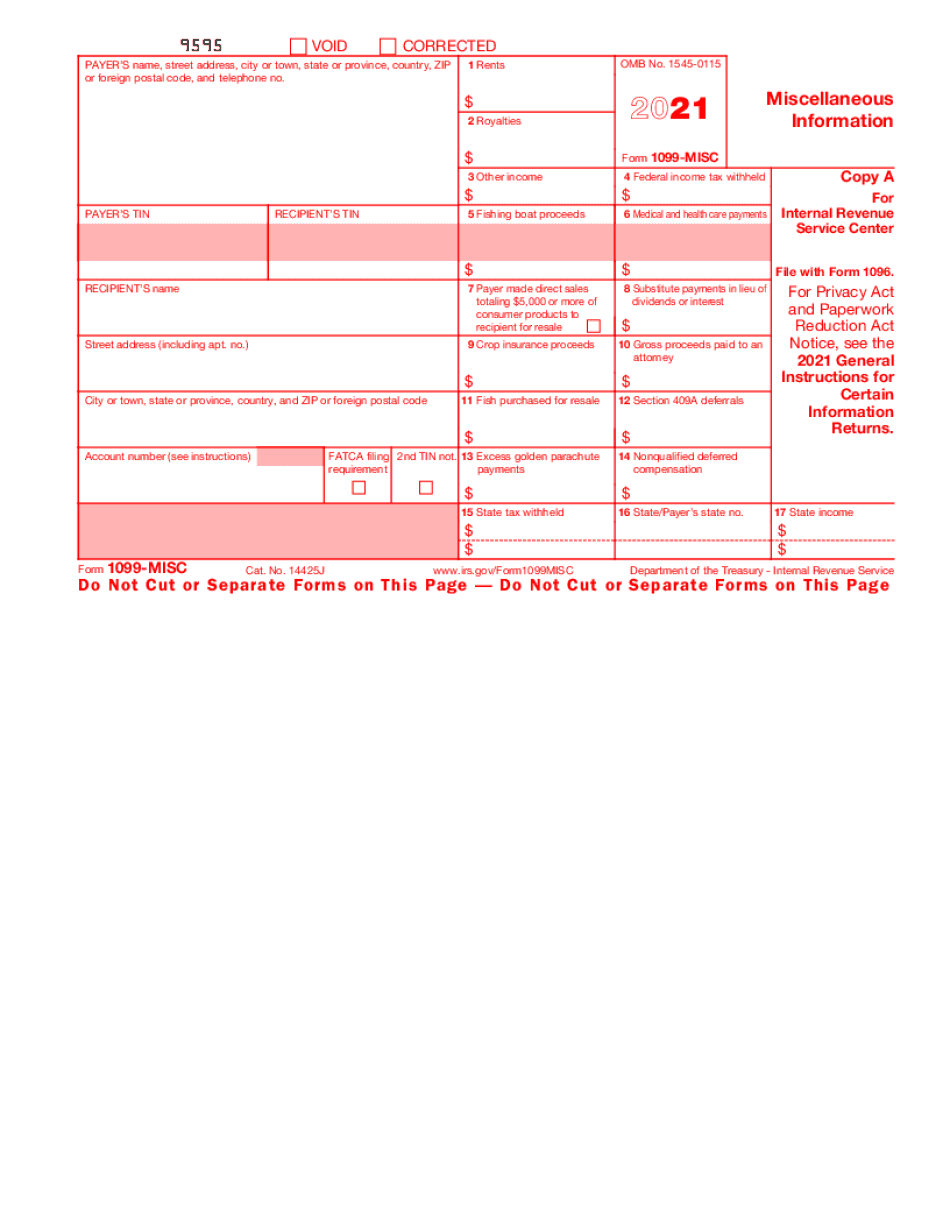

Home Forms and Instructions About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments TABLE OF CONTENTS What is a 1099 Form What is a 1099 Form used for Who receives a 1099 Form Click to expand Key Takeaways Form 1099 is a collection of forms used to report payments that typically aren t from an employer 1099 forms can report different types of incomes

If you received 600 or more in payments from a particular business or client they re required to send you a 1099 NEC form by January 31 as well as a copy to the IRS So if five companies paid you more than 600 last year you should get five 1099 forms one from each company If you use Form 1099 NEC to report sales totaling 5 000 or more then you are required to file Form 1099 NEC with the IRS by January 31 You must also file Form 1099 MISC for each person from whom you have withheld any federal income tax report in box 4 under the backup withholding rules regardless of the amount of

6 Must know Basics Form 1099 MISC For Independent Contractors Bonsai

https://uploads-ssl.webflow.com/58868bcd2ef4daaf0f072902/5ab4028e9825160f3b4e4824_Screen Shot 2018-03-22 at 3.22.21 PM.png

Greensboro North Carolina Online Form 1099 MISC Fill Exactly For Your

https://www.pdffiller.com/preview/533/156/533156767/big.png

when to use a 1099 - What is a 1099 Form used for The 1099 Form is used to report certain kinds of non employment income to the IRS There are 20 total varieties of 1009 forms Some of the most popular are