when to send a 1099 If you pay independent contractors you may have to file Form 1099 NEC Nonemployee Compensation to report payments for services performed for your trade or business If the

The most important point is that only businesses need to issue 1099s if you paid someone for personal purposes you are not yet required to send them or the IRS a Form 1099 Here s a crash course for each type of There are several different types of 1099 forms but the most common for small businesses are 1099 NEC non employee compensation and 1099 MISC miscellaneous The deadline for businesses to mail out forms 1099 NEC and

when to send a 1099

when to send a 1099

https://media.smallbiztrends.com/2022/11/1099-rules.png

Do I Need To Send A 1099

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/2147498518/images/WYEZsgSZTvCwoqZOYFni_EP209.png

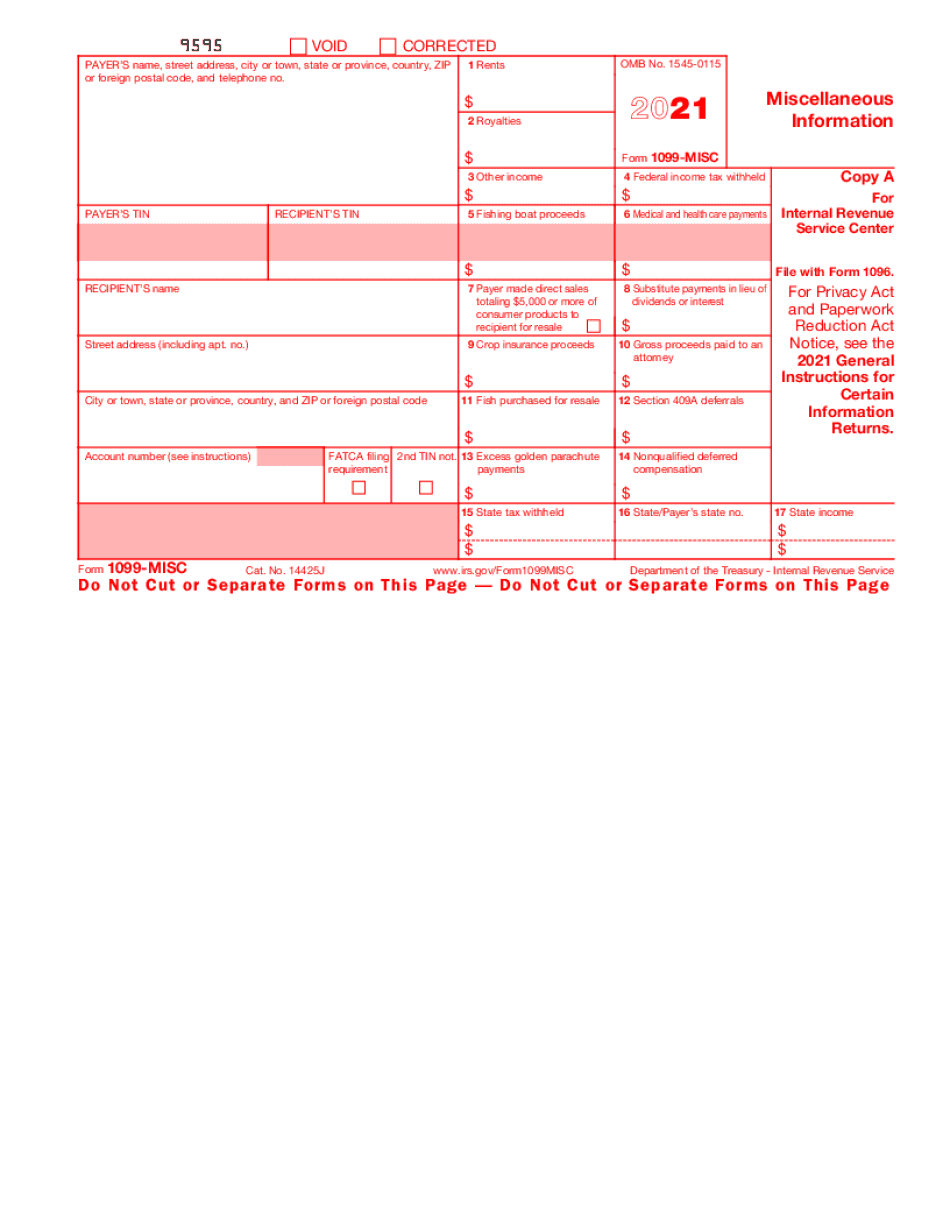

Form 1099 MISC For Georgia Fill Exactly For Your State

https://www.pdffiller.com/preview/533/156/533156767/big.png

You may either file Form 1099 MISC or Form 1099 NEC to report sales totaling 5 000 or more of consumer products to a person on a buy sell a deposit commission or other commission basis for resale Your business will use a 1099 tax form to record nonemployee income The tax form 1099 is a return you file to the IRS which includes information about your business There are several types of 1099 forms but

Most 1099 forms are due to the recipient by January 31 If you re mailing a paper form to the IRS you typically have to send the 1099 by February 28 postmarked by that date If you re using tax software like TurboTax to Taxpayers must mail Form 1099 to vendors by Jan 31 The transmittal form is due to the IRS by Feb 28 If you have an accountant he or she can submit these forms electronically by March 31 Deadline to IRS Jan

More picture related to when to send a 1099

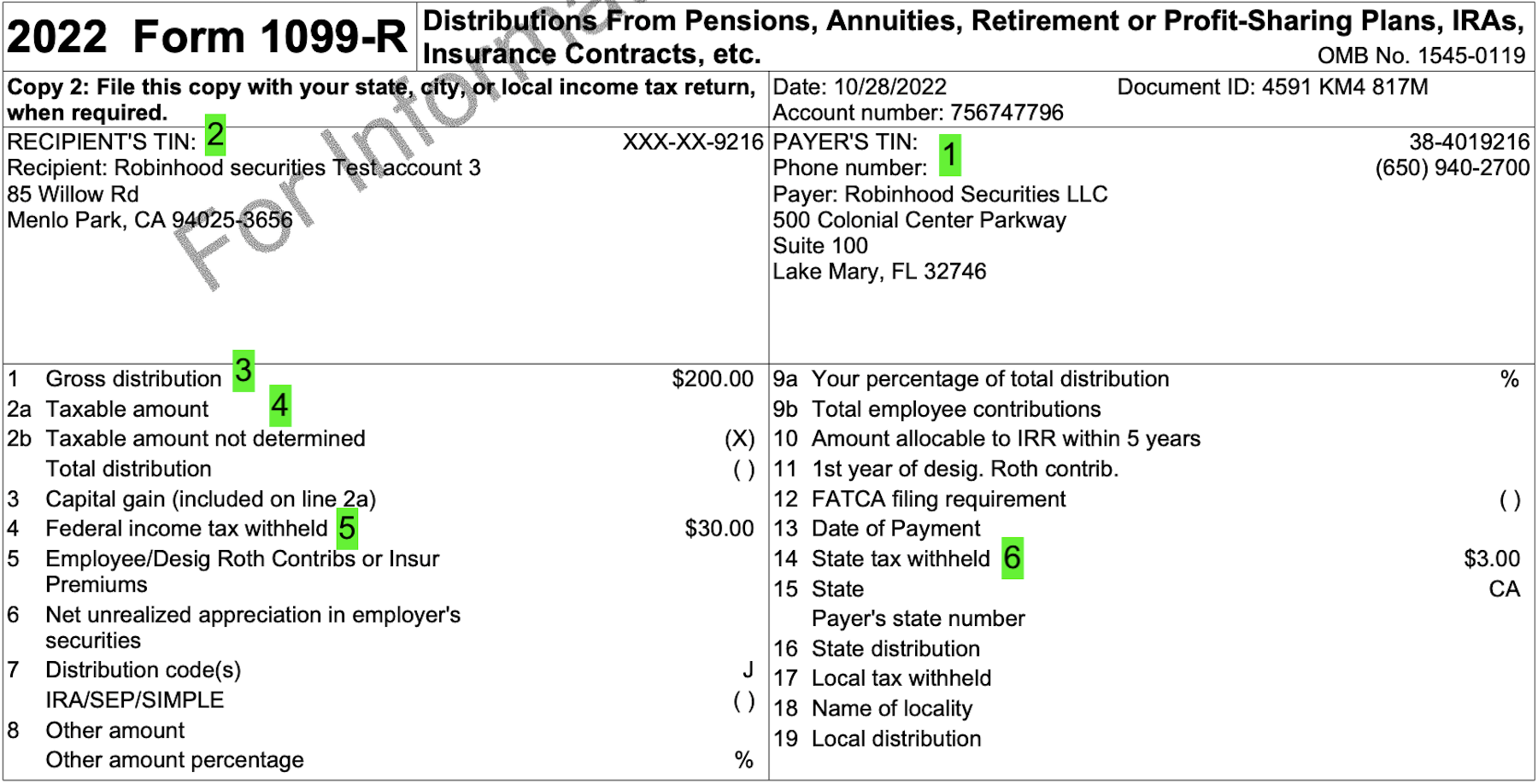

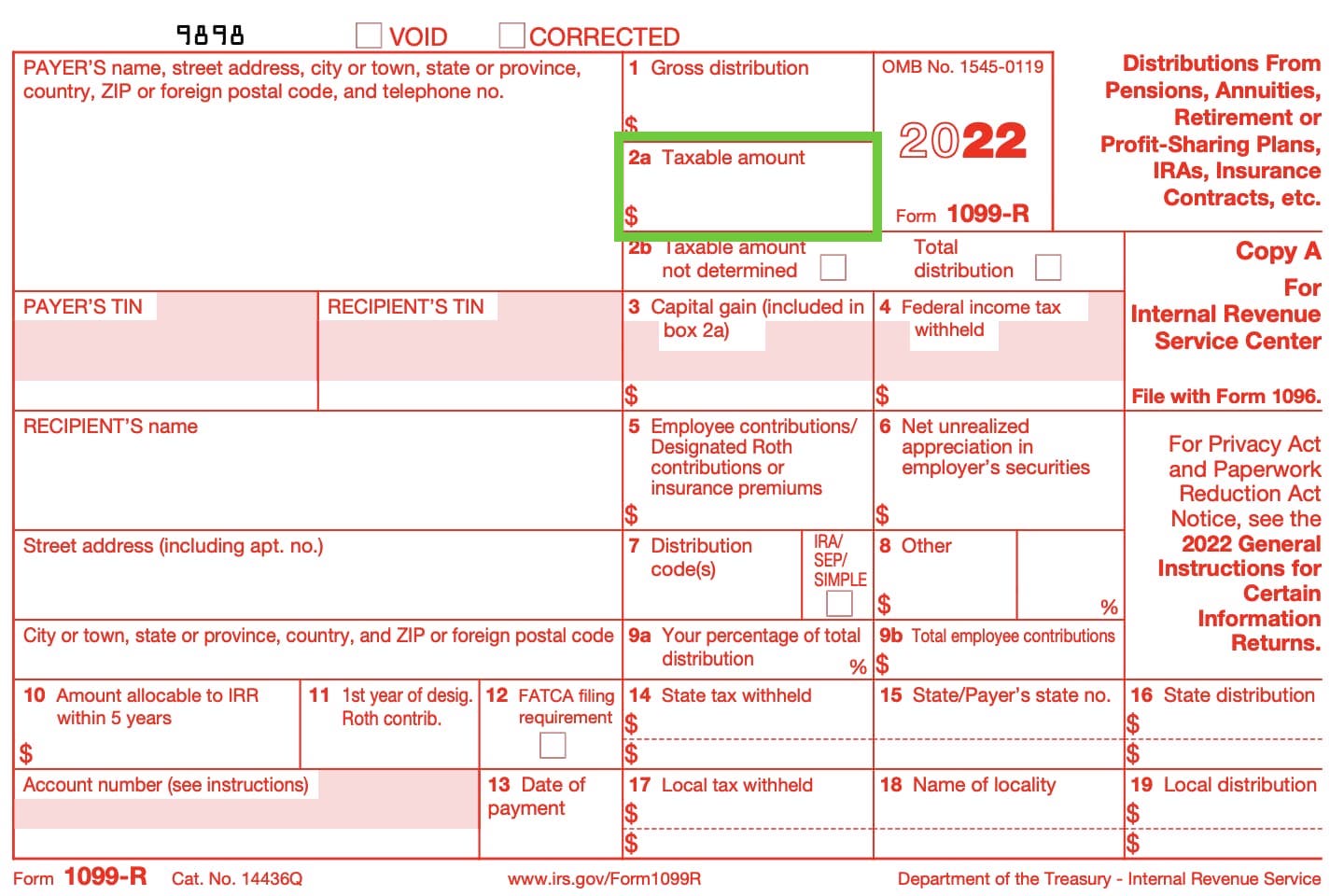

Neat What Is Non Standard 1099 r A Chronological Report About Tigers

https://images.squarespace-cdn.com/content/v1/59c529e3cd0f689fe65fe62d/1608138150930-KFFBJGQLNKJ508EOH2NA/1099R+with+callout+1000px.jpg

How To Read Your 1099 R And 5498 Robinhood

https://images.ctfassets.net/fomw95h5b4ty/750v6J4OcVJ4qgG92KAfQj/548cbf16b32045a5733b44426b765446/example-1099-r.png

How Form 1099 K Affects Your E Commerce Business Digital

https://digital.com/wp-content/uploads/2022/02/Form-1099-K-1024x672.png

When do you need to send 1099 NEC forms When it comes to issuing 1099 NEC forms in particular if you pay any freelancer or contractor over 600 for the calendar year you ll need to send them one Most companies or people are unsure when they should issue a 1099 MISC In this article we go over all the exact procedure for when you are required to issue a 1099 MISC to

Form 1099 MISC Miscellaneous Information is completed and sent out by someone who has paid at least 10 in royalties or broker payments in lieu of dividends or tax When are 1099 forms due The deadline for filing 1099 forms depends on the type of form you are filing For example the deadline for e filing Form 1099 MISC is Jan 31 while most other

IRS Form 1099 R How to Guide Distributions From Pensions

https://silvertaxgroup.com/wp-content/uploads/2022/01/irs-form-1099-r-box-2.jpg

How To File A 1099 Form For Vendors Contractors And Freelancers

https://assets-global.website-files.com/60a6b551be6130e4e5b19b98/6184e97fc0fca378123537f5_Screen Shot 2021-11-03 at 8.41.45 AM.png

when to send a 1099 - You should receive most 1099 forms by the end of January although the deadline is mid February for a few Income reported on a 1099 form is usually taxable but not