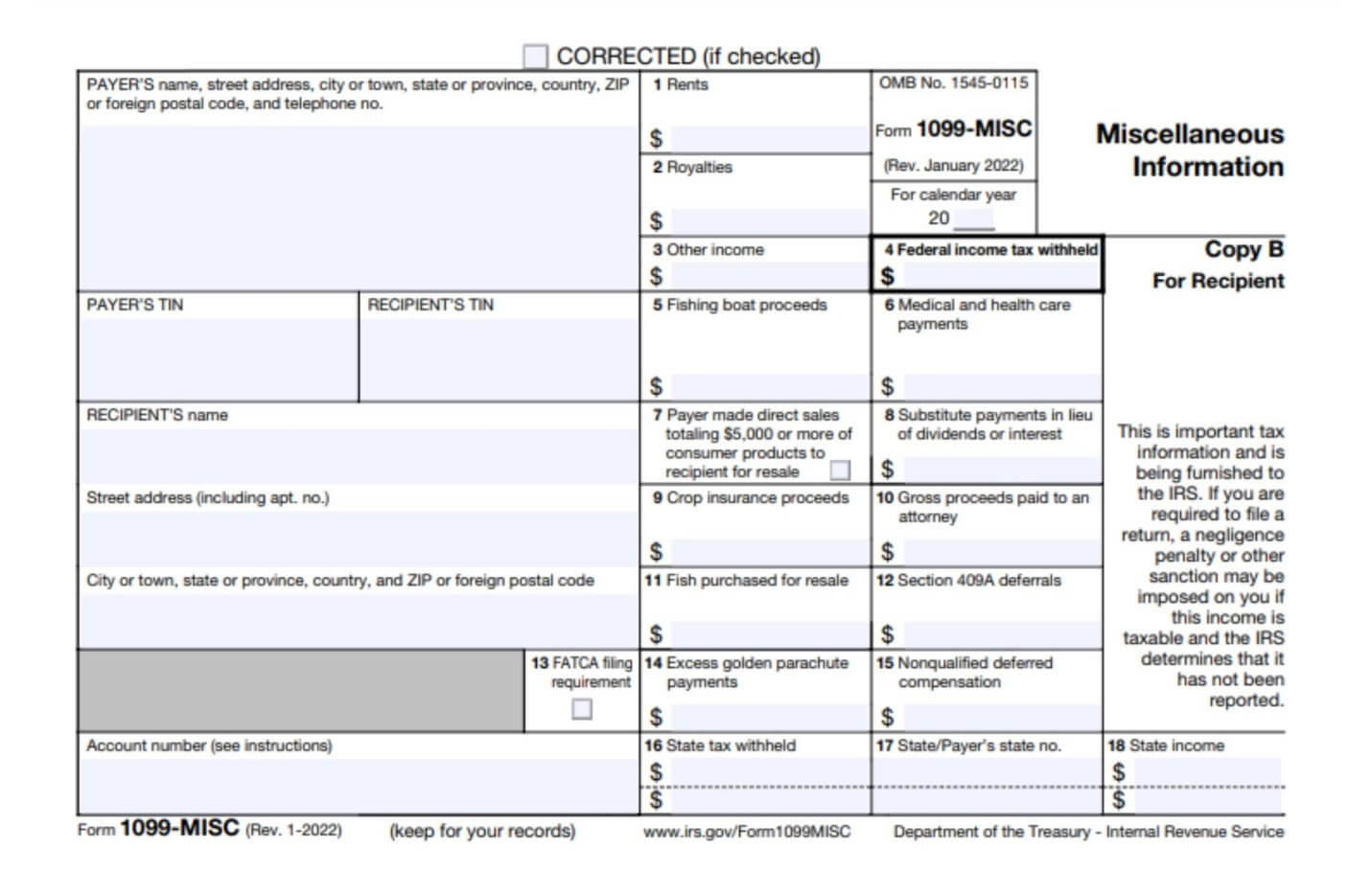

when to use a 1099 misc form Information about Form 1099 MISC Miscellaneous Information including recent updates related forms and instructions on how to file Form 1099 MISC is used to report rents royalties prizes and awards and other fixed determinable income

Section 409A deferrals box 12 or Nonqualified deferred compensation box 15 You may either file Form 1099 MISC box 7 or Form 1099 NEC box 2 to report sales totaling 5 000 or more of consumer products to a person on a buy sell a deposit You use your IRS Form 1099 MISC to help figure out how much income you received during the year and what kind of income it was You ll report that income in different places on your tax

when to use a 1099 misc form

when to use a 1099 misc form

https://www.pdffiller.com/preview/608/781/608781885/big.png

Free 1099 Tax Forms Printable

https://free-printablehq.com/wp-content/uploads/2019/07/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-form.png

Form 1099 MISC For Independent Consultants 6 Step Guide

https://global-uploads.webflow.com/58868bcd2ef4daaf0f072902/5ab4028e9825160f3b4e4824_Screen Shot 2018-03-22 at 3.22.21 PM.png

You ll use Form 1099 MISC to report your payments of 600 or more to certain businesses and individuals but it doesn t include nonemployee compensation anymore that s for Form 1099 NEC If you re receiving rents then you might receive a 1099 from your tenant showing an amount in Box 1 Key Takeaways Form 1099 MISC is used to report payments made to others in the course of a trade or business not including those made to employees or for nonemployee compensation Form 1099 NEC is used to report nonemployee compensation for services rendered in the course of business to a partnership estate or individual

You ll get a 1099 if an organization or business paid you more than a certain amount during the year generally 600 or more for freelance or self employed work and you ll also get 1099s Form 1099 MISC is used to report miscellaneous payments such as rent awards royalties medical and health care payments and more Anyone who has paid at least 600 in one of these categories in the past year will typically use a 1099 MISC form Due to recipient Jan 31

More picture related to when to use a 1099 misc form

Understanding IRS Form 1099 MISC

https://www.taxdefensenetwork.com/wp-content/uploads/2022/02/form-1099-misc-instructions.jpg

IRS Form 1099 MISC Document Processing

https://www.ocrolus.com/wp-content/uploads/2022/03/IRS-Form-1099-Misc.webp

Tax Form 1099 MISC Instructions How To Fill It Out Tipalti

https://lh4.googleusercontent.com/k2lr2QLf9OvFdt0aPeTtU_t9ryklux-DLzsAEo7vztZzgeWxWNS_bp3Jfmd7RXXBkfSp08oMB_5HICrBpvPTBvPnx0jNx1omGKS0qhbKog9ZnHRxa-ojwuj7dEv81zXye_n3IJKW

IRS Form 1099 MISC is used to report exactly what its name implies miscellaneous items of income The treatment of amounts reported on this form generally depends upon which box of the form the income is reported in You should receive Form 1099 MISC if you earned 600 or more in rent or royalty payments You should receive Form 1099 G if you received a state or local tax refund during the previous year Likewise if you paid a freelancer independent contractor or other nonemployee 600 or more during the year related to your trade or business you likely

Form 1099 MISC is used to report various types of miscellaneous income that are not reported on other Forms 1099 Many specific types of income often have their own forms in the 1099 series such as the 1099 R for retirement income and 1099 INT for interest The deadline for businesses to mail out forms 1099 NEC and 1099 MISC is Jan 31 Any person who freelances or works as an independent contractor should receive a 1099 from each client that paid them more than 600 over the course of a year

Printable 1099 Form Independent Contractor Printable Form Templates

https://images.ctfassets.net/ifu905unnj2g/7AaGwx9GYM2YM9YyWJLFqv/b9806db0e4623117df61caf7b38e80e4/2022_1099_Form_Copy_B.png

1099 Misc Software To Create Print E File Irs Form 1099 Misc Artofit

https://i.pinimg.com/originals/61/c3/ed/61c3ed9afad426ba854555347fb9f89a.gif

when to use a 1099 misc form - Learn to file and issue IRS 1099 MISC form for rents royalties and healthcare payments including instructions and thresholds