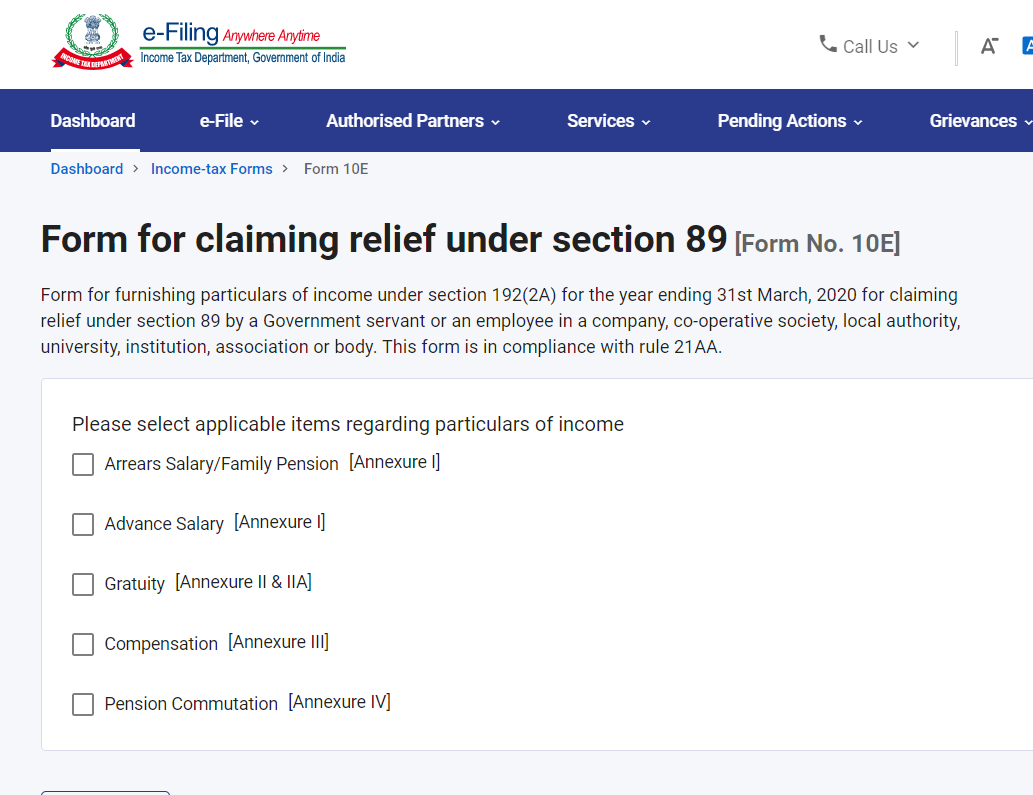

what is relief u s 89 1 What is Form 10E In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file Form 10E It

Section 89 of the Income Tax Act 1961 provides relief to taxpayers who receive arrears of salary or profits in lieu of salary in a particular financial year This relief is designed to reduce the tax burden on individuals who might face Section 89 1 of the Income Tax Act 1961 states that if an assessee s income has dues of salary from the previous year then the assessee can claim relief as per section

what is relief u s 89 1

what is relief u s 89 1

https://www.caclubindia.com/editor_upload/685154_20210823174644_e.png

Relief Under Section 89 1 Income Under The Head Salaries

https://1.bp.blogspot.com/-QyfjTlwqo4c/YHaVGkR9nHI/AAAAAAAAIFk/P1cVPtiNzo4oOoVdIz8eOGwRd6DPQPD-ACLcBGAsYHQ/s600/relief%2Bunder%2Bsection%2B89%2B%25281%2529-min.png

Relief Maps In Google Earth G ophysique be

http://www.geophysique.be/wp-content/uploads/2014/01/relief.png

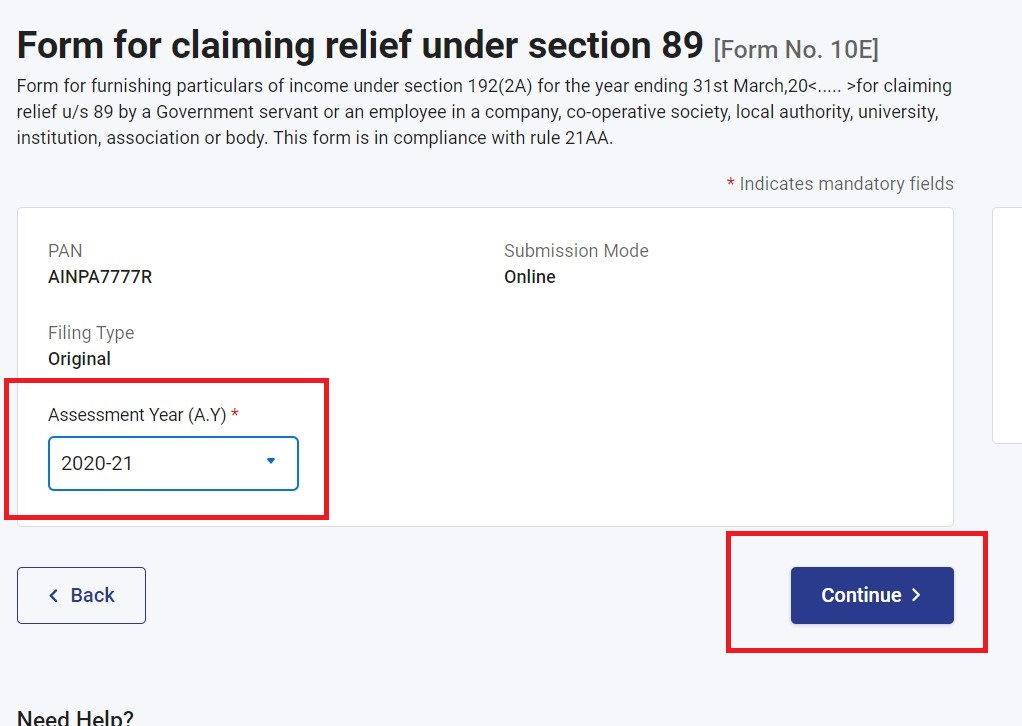

An employee who has received arrears in salary can save tax on such additional income in the following ways Calculate the relief u s 89 1 File Form 10E to claim relief u s 89 1 If you are eligible to claim relief on arrear income under Section 89 1 read with Rule 21A you would have to fill and file Form 10E The form is available on the website of the Income Tax Department and should be filed so

Do you need to know how to claim income tax relief u s 89 on salary arrears and how to compute relief under section 89 1 We ll look into what is Form 10E and how to file it Section 89 1 of the Income Tax Act 1961 provides relief by recalculating taxes for the year of arrears and the year they pertain to Receiving arrears may elevate

More picture related to what is relief u s 89 1

Relief Under Section 89 1 Hindi relief U s 89 1 How To Calculate

https://i.ytimg.com/vi/EIwMEfBtAtM/maxresdefault.jpg

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

https://i.ytimg.com/vi/EF-Mx98SOnY/maxresdefault.jpg

Relief Tablet Prince Pharma

http://princepharma.co/wp-content/uploads/2019/07/Relief-10-Tab.png

The Income Tax Act u s 89 provides relief to an assessee for any salary or profit in lieu of salary or family pension received by an assessee in advance or arrears in a Financial Year This relief is granted as the total income assessed is at a Learn how to calculate tax relief under Sections 89 and 89A for arrears gratuity and foreign retirement benefits Understand the steps and eligibility criteria

If any individual receive any portion of his salary in arrears or in advance or profits in lieu of salary 17 3 he or she can claim relief under section 89 1 of Income Tax Act 1961 Under Section 89 1 relief is provided by the income tax department in relation to the amount received in advance or in arrears in the form of salary which is related to any other

How To Calculate Relief U s 89 1 Of The Income Tax Act

https://www.caclubindia.com/editor_upload/685154_20210823174413_d.png

Relief U S 89 1 Short Taxation CA Inter CA IPCC Shrey Rathi

https://i.ytimg.com/vi/r2CyheMADSs/maxresdefault.jpg

what is relief u s 89 1 - Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is received Calculate tax