relief u s 89 10e It is mandatory to fill out Form 10E when an individual wants to claim tax relief under Section 89 1 of the Income Tax Act 1961 Section 89 1 provides tax relief for delayed salary received in the form of arrears or

What is Form 10E In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file Form 10E It To save you from any additional tax burden due to delay in receiving income the tax laws allow a relief under section 89 1 In simple words you do not pay more taxes if there was a delay in payment to you and you

relief u s 89 10e

relief u s 89 10e

https://i.ytimg.com/vi/NSFQNfIoeTw/maxresdefault.jpg

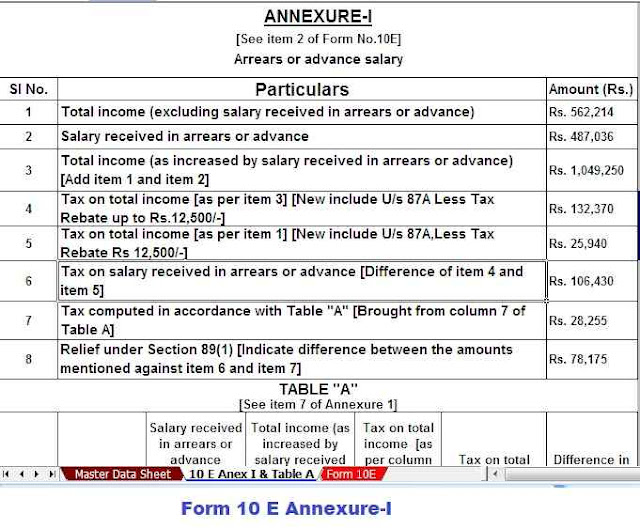

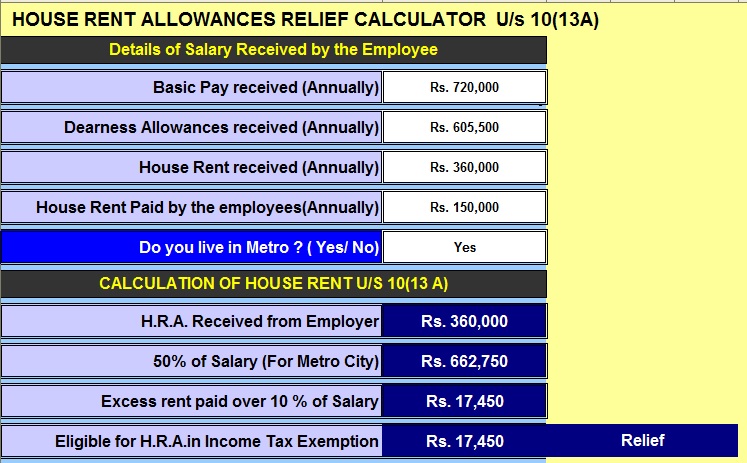

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

https://www.caclubindia.com/editor_upload/671907_20211129141713_form_10_e_annexure_i.jpg

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

https://www.caclubindia.com/editor_upload/671907_20211129141629_hra_calculator.jpg

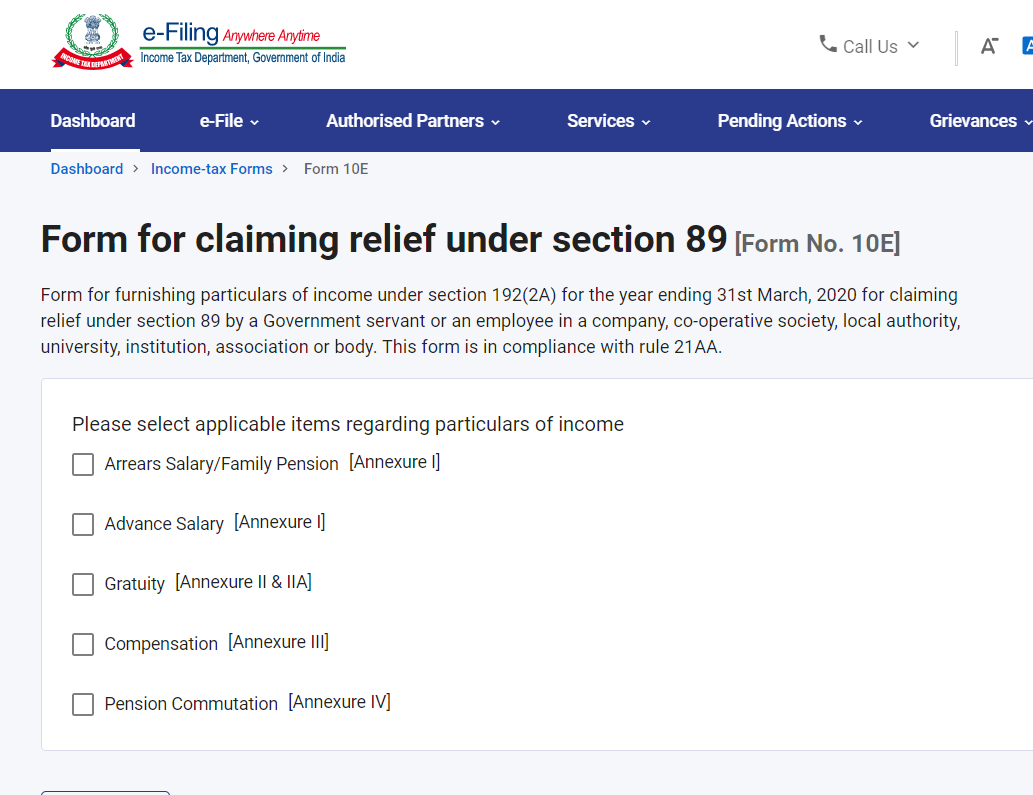

The video provides the step by step guidance on filing Form 10E to claim relief under section 89 of the Income Tax Act 1961 in case of receipt of salary in advance or in arrears To claim relief u s 89 you must submit Form 10E online on the Income Tax portal before filing the Return of Income Remember your salary slips serve as proof of receipt of arrears therefore should be kept safe

If you are eligible to claim relief on arrear income under Section 89 1 read with Rule 21A you would have to fill and file Form 10E The form is available on the website of the Income Tax Department and should be filed so The primary purpose of Form 10E is to facilitate the computation and claim of relief under Section 89 As mentioned earlier this relief is designed to mitigate the additional tax burden that might arise due to the receipt of arrears in a

More picture related to relief u s 89 10e

Relief Under Section 89 1 Income Under The Head Salaries

https://1.bp.blogspot.com/-QyfjTlwqo4c/YHaVGkR9nHI/AAAAAAAAIFk/P1cVPtiNzo4oOoVdIz8eOGwRd6DPQPD-ACLcBGAsYHQ/s600/relief%2Bunder%2Bsection%2B89%2B%25281%2529-min.png

How To Calculate Relief U s 89 1 Of The Income Tax Act

https://www.caclubindia.com/editor_upload/685154_20210823174644_e.png

Income Tax Relief Under Section 89 1 Read With Rule 21A With

https://1.bp.blogspot.com/-NfC7vVdLCss/WfQvjk7wqdI/AAAAAAAAFtA/l58RcloHSosIKsLbvc_gpycm49-JzfVNgCLcBGAs/w1200-h630-p-k-no-nu/Arrears%2BRelief%2BPage%2B1.jpg

In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file Form 10E The Form must be filed before filing the Return of Income Calculation of tax relief under Article 89 1 for back pay Income tax return for failure to file Form 10E From the financial year 2014 15 the tax year 2015 16 ITD has made

For claiming relief under section 89 1 for arrears of salary received it is mandatory to file Form 10E with the Income tax department If Form 10E is not filed and relief is claimed then the It is mandatory to file Form 10E for claiming benefits under section 89 1 The taxpayer has to submit this form online at the income tax e filing portal Calculation of tax relief

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

https://i.ytimg.com/vi/EF-Mx98SOnY/maxresdefault.jpg

Relief Under Section 89 1 For Arrears Of Salary Taxxguru in

https://1.bp.blogspot.com/-tZFrTAS5gvo/XhUd-5p6j3I/AAAAAAAALfQ/Bb1lpmHCvMk08MD2EPLY5qHVFx-Gt0TlgCNcBGAsYHQ/s1600/Picture%2B5%2Bof%2BArrears%2BRelief%2BCalculator%2B%2B19-20.jpg

relief u s 89 10e - To initiate the process of claiming relief under section 89 1 Similarly individuals need to fill out Form 10E In addition This form acts as a formal request to the assessing