what is meant by efficient market theory The efficient market hypothesis EMH or theory states that share prices reflect all information The EMH hypothesizes that stocks trade at their fair market value on exchanges

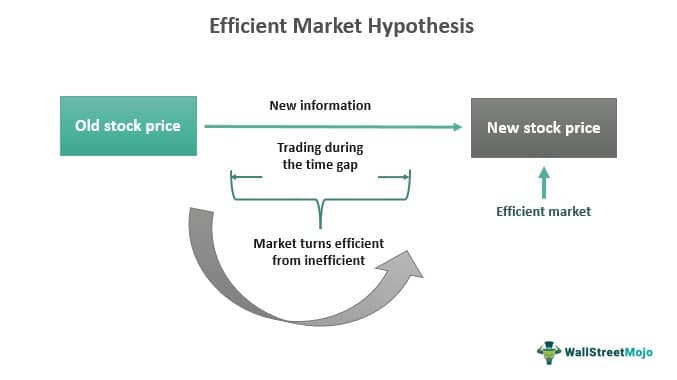

The efficient market hypothesis EMH claims that all assets are always fairly and accurately priced and trade at their fair market value on exchanges If this theory is true nothing can give you an edge to outperform the market using different investing strategies and make excess profits compared to those who follow market indexes The efficient market hypothesis argues that current stock prices reflect all existing available information making them fairly valued as they are presently

what is meant by efficient market theory

what is meant by efficient market theory

https://i.ytimg.com/vi/JBK0HtTFpPM/maxresdefault.jpg

What Is Stock Market Efficiency Efficient Market Hypothesis EMH

https://i.ytimg.com/vi/0WQ6FynDCuc/maxresdefault.jpg

Efficient Market Hypothesis EMH Meaning Types Implications

https://www.financestrategists.com/uploads/Types-of-Efficient-Market-Hypothesis.png

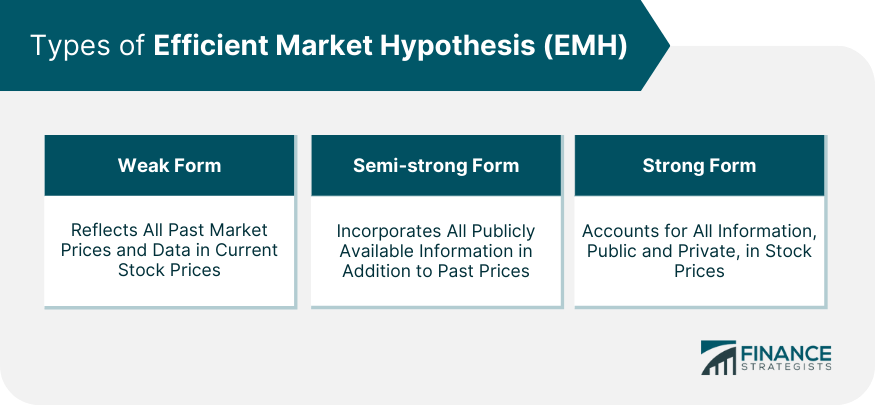

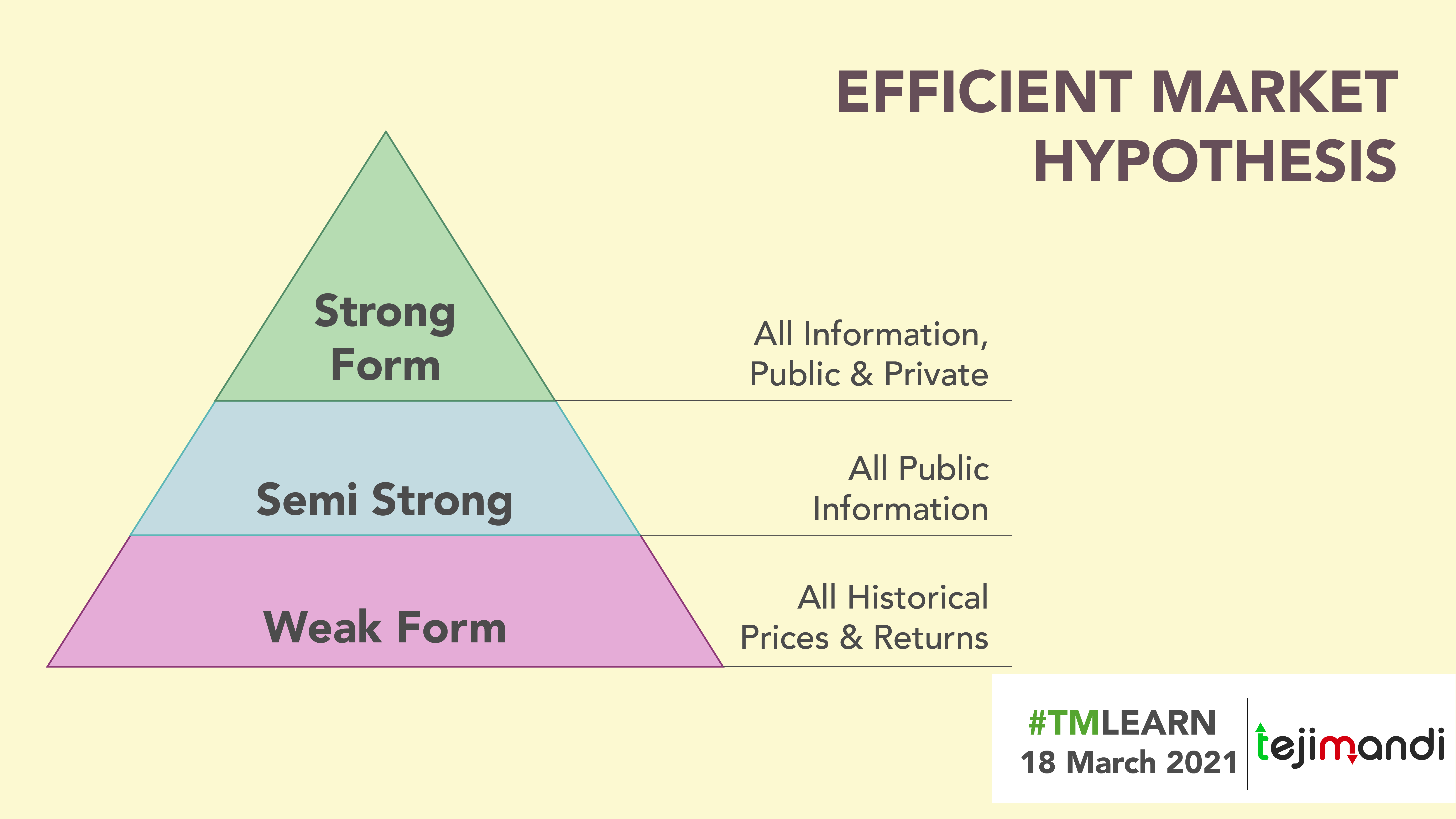

The efficient market theory EMT is the body of knowledge that surrounds efficient markets There are three forms of the efficient market theory weak semi strong and strong Weak form The efficient market theory EMT states that it is impossible to beat the market because stock prices reflect all available information The efficient market hypothesis says that financial markets are effective in processing and reflecting all available information with little or no waste making it impossible for investors to consistently outperform the market

Updated on November 16 2022 Written by Eric Reed Efficient market theory or hypothesis holds that a security s price reflects all relevant and known information about that asset One upshot of this theory is that on a risk adjusted basis you can t consistently beat the market The Efficient Market Hypothesis EMH theory introduced by economist Eugene Fama states that the prevailing asset prices in the market fully reflect all available information What is the Definition of Efficient Market Hypothesis The efficient market hypothesis EMH theorizes about the relationship between the

More picture related to what is meant by efficient market theory

Efficient Market Hypothesis A Unique Market Perspective

https://tejimandi.com/wp-content/uploads/2022/06/Efficient-market-hypothesis-A-unique-market-perspective.png

Efficient Market Theory

https://sb.studylib.net/store/data/010141095_1-b83ec8762a8057b229d3929b322fa73d-768x994.png

Efficient Market Hypothesis The Only Theory That You Need To Read Today

https://tradebrains.in/wp-content/uploads/2018/04/Efficient-Market-Hypothesis-is-the-stock-market-efficient.png

Key Takeaways Market efficiency refers to how well current prices reflect all available relevant information about the actual value of the underlying assets A The efficient market hypothesis EMH is important because it implies that free markets are able to optimally allocate and distribute goods services capital or

According to the efficient market hypothesis if all investors have the same information values and behave rationally conditions which don t always hold all assets will be priced correctly In other words it is impossible to beat the market by finding undervalued stocks or selling stocks at a higher price than they re worth LibreTexts Learning Objectives Is it possible to make large profits in asset markets Is it easy to make large profits in asset markets What are some factors that cause asset prices to increase and decrease Why do asset prices respond to new events but not forecasted ones Are markets efficient

Efficient Market Theory AND WHAT ARE THE 3 DIFFERENT FORMS YouTube

https://i.ytimg.com/vi/BNLPHZjY0pc/maxresdefault.jpg

Efficient Market Hypothesis What Is It Assumptions Forms

https://wallstreetmojo.com/wp-content/uploads/2023/03/Efficient-Market-Hypothesis.jpg

what is meant by efficient market theory - Updated on November 16 2022 Written by Eric Reed Efficient market theory or hypothesis holds that a security s price reflects all relevant and known information about that asset One upshot of this theory is that on a risk adjusted basis you can t consistently beat the market