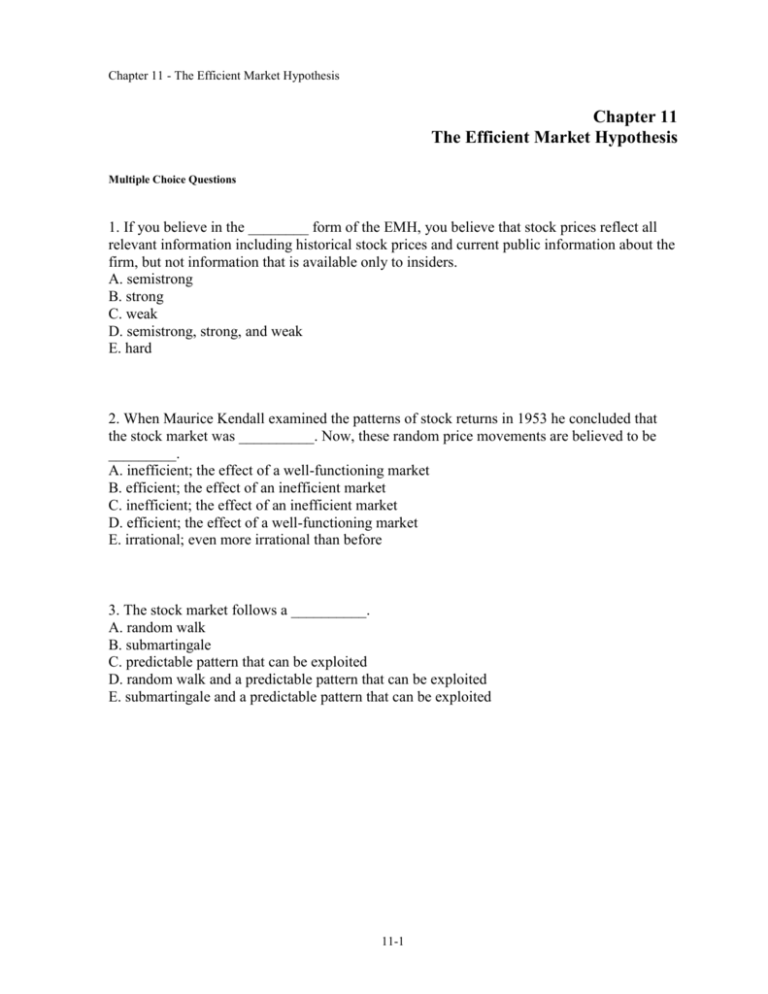

what is meant by efficient market hypothesis The efficient market hypothesis argues that current stock prices reflect all existing available information making them fairly valued as they are presently

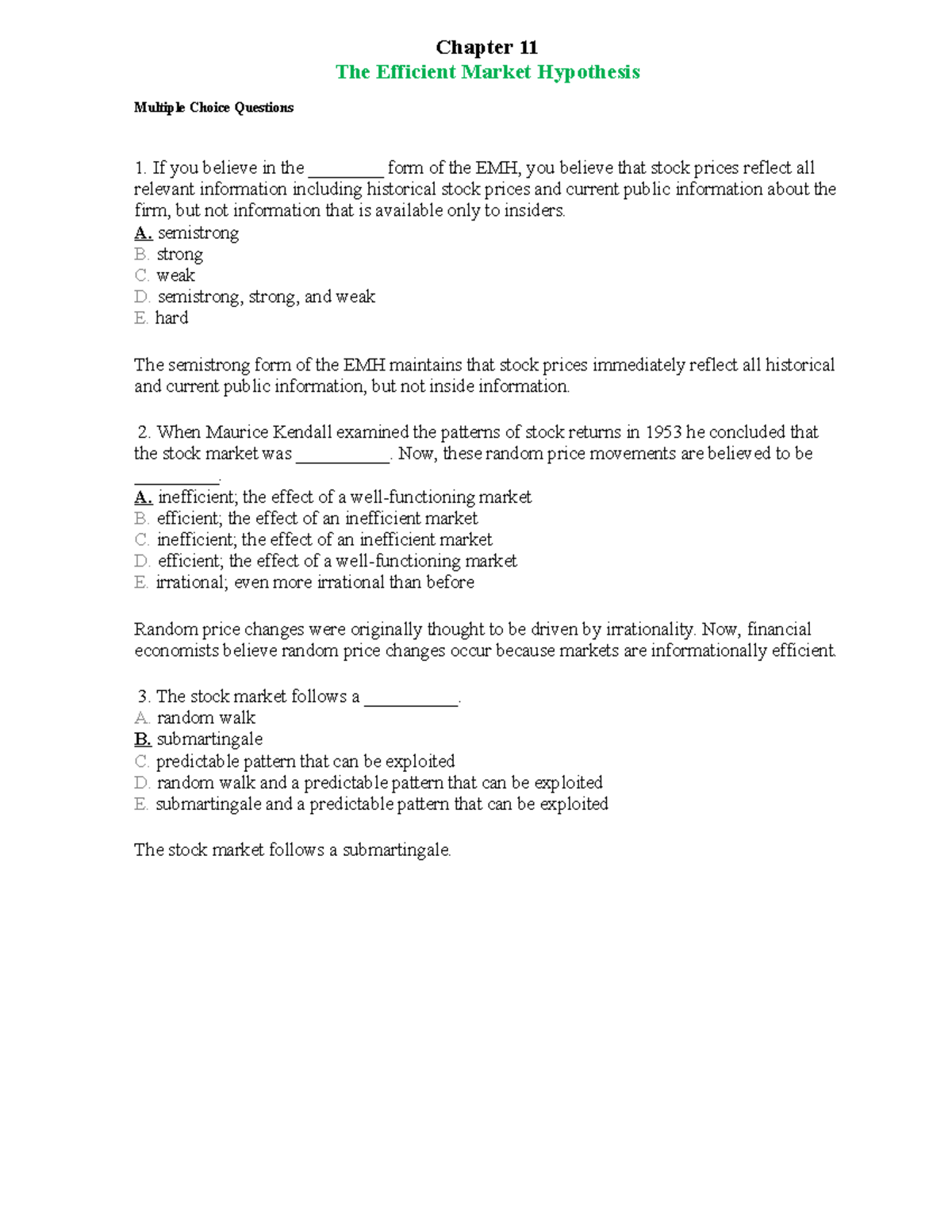

What is the Definition of Efficient Market Hypothesis The efficient market hypothesis EMH theorizes about the relationship between the Information Availability in the Market Current Market Trading Prices i e Share Prices of The efficient market hypothesis EMH claims that prices of assets such as stocks are trading at accurate market prices leaving no opportunities to generate outsized returns As a result nothing could give investors an edge to outperform the market and assets can t become under or overvalued

what is meant by efficient market hypothesis

what is meant by efficient market hypothesis

https://i.ytimg.com/vi/0WQ6FynDCuc/maxresdefault.jpg

Efficient Market Hypothesis A Unique Market Perspective

https://tejimandi.com/wp-content/uploads/2022/06/Efficient-market-hypothesis-A-unique-market-perspective.png

Chapter 11 The Efficient Market Hypothesis

https://s3.studylib.net/store/data/007381274_1-b0b2b77fd597dca7fe31cf57bb7c624f-768x994.png

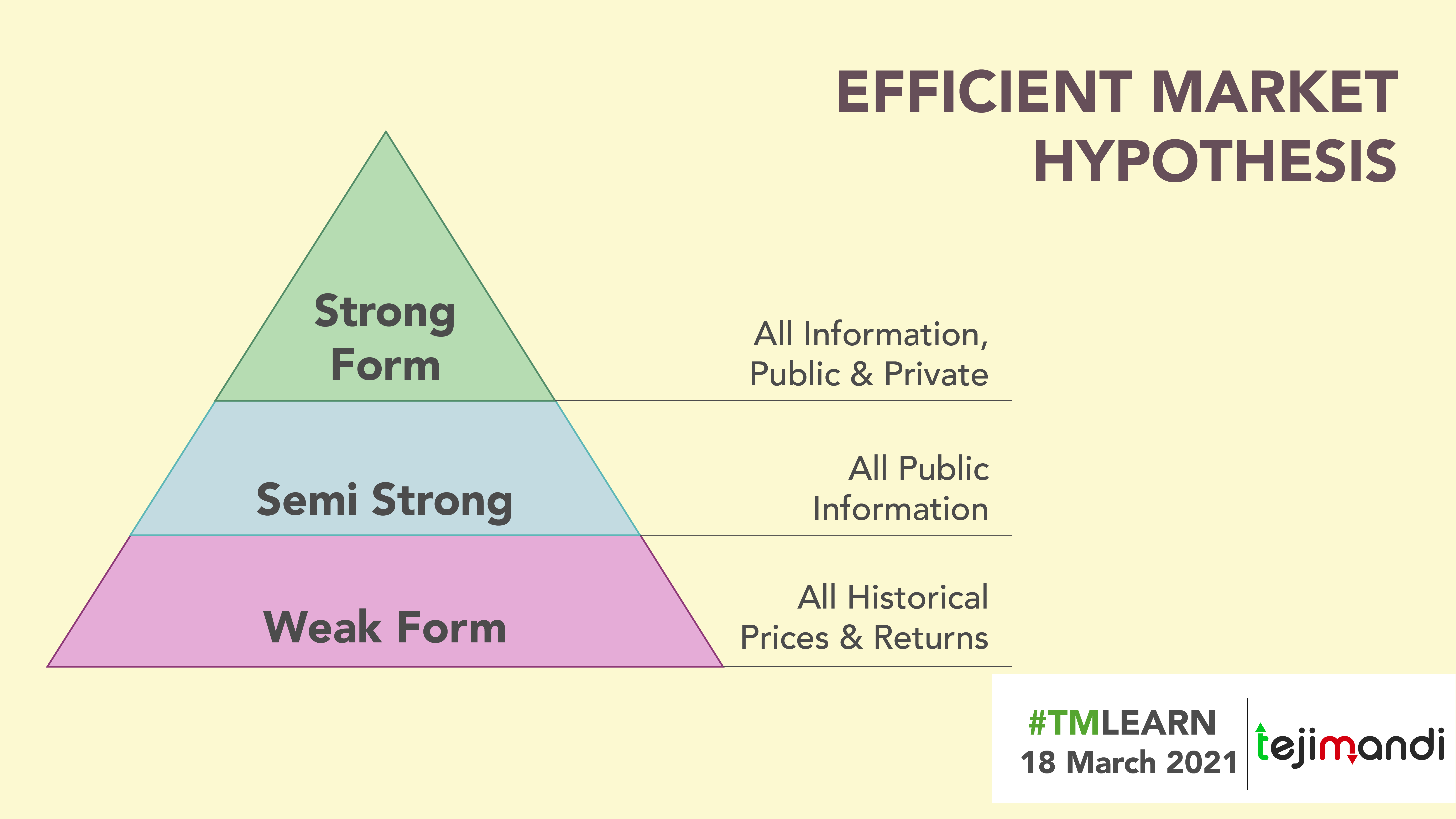

The efficient market hypothesis EMH is a hypothesis in financial economics that states that asset prices reflect all available information A direct implication is that it is impossible to beat the market consistently on a risk adjusted basis since market prices should only react to new information The efficient market hypothesis says that financial markets are effective in processing and reflecting all available information with little or no waste making it impossible for investors to consistently outperform the market based

The efficient market hypothesis EMH is important because it implies that free markets are able to optimally allocate and distribute goods services capital or The efficient market hypothesis EMH maintains that all stocks are perfectly priced according to their inherent investment properties the knowledge of which

More picture related to what is meant by efficient market hypothesis

Efficient Market Hypothesis What Is It TUPA

https://tupa-dns.org/wp-content/uploads/2021/03/1-1.jpg

Efficient Market Hypothesis Definition Variations Arguments

https://study.com/cimages/videopreview/8p6mwfdya3.jpg

Efficient Market Hypothesis What Is It Assumptions Forms

https://wallstreetmojo.com/wp-content/uploads/2023/03/Efficient-Market-Hypothesis.jpg

The Efficient Market Hypothesis EMH is a theory that suggests financial markets are efficient and incorporate all available information into asset prices According to the EMH it is impossible to consistently outperform the market by employing strategies such as technical analysis or fundamental analysis The efficient market hypothesis EMH is an economic and investment theory that attempts to explain how financial markets move It was developed by economist Eugene Fama in the 1960s who stated that the prices of all securities are completely fair and reflect an asset s intrinsic value at any given time

What is the Efficient Markets Hypothesis The Efficient Markets Hypothesis EMH is an investment theory primarily derived from concepts attributed to Eugene Fama s research as detailed in his 1970 book Efficient Capital Markets A Review of The efficient market hypothesis EMH suggests that financial markets operate in such a way that the prices of equities or shares in companies are always efficient In simpler terms these prices accurately reflect the true value of

What Is Efficient Market Hypothesis Tavaga Tavagapedia

https://lh4.googleusercontent.com/hGTW68y3NQXKlHSs3iahv17uiIYHq4eu5wE_5alt8hJLg9dVV0OZ-_09rMH7fdGmfQwNIq0IKOcRSwTq2k5eOUpyo_1Uo4I4plQvV_xvAlacg_XJO8JYquKQob8nyd7o0mfgRx1o

Ch11 The Efficient Market Hypothesis Chapter 11 The Efficient Market

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/619c61c99ee7de2208854cf6cf27e35b/thumb_1200_1553.png

what is meant by efficient market hypothesis - The efficient market hypothesis EMH maintains that all stocks are perfectly priced according to their inherent investment properties the knowledge of which