describe the efficient market theory Efficient Market Theory is a cornerstone of financial economics positing that financial markets are efficient and that asset prices reflect all available information The concept has significant implications for investment decision making portfolio management and market regulation

The efficient market hypothesis EMH claims that all assets are always fairly and accurately priced and trade at their fair market value on exchanges If this theory is true nothing can give you an edge to outperform the market using different investing strategies and make excess profits compared to those who follow market indexes The efficient market hypothesis argues that current stock prices reflect all existing available information making them fairly valued as they are presently Given these

describe the efficient market theory

describe the efficient market theory

https://i.ytimg.com/vi/JBK0HtTFpPM/maxresdefault.jpg

What Is Stock Market Efficiency Efficient Market Hypothesis EMH

https://i.ytimg.com/vi/0WQ6FynDCuc/maxresdefault.jpg

Three Form Of Efficient Market Hypothesis QS Study

https://qsstudy.com/wp-content/uploads/2019/02/Form-of-Efficient-Market-Hypothesis.jpg

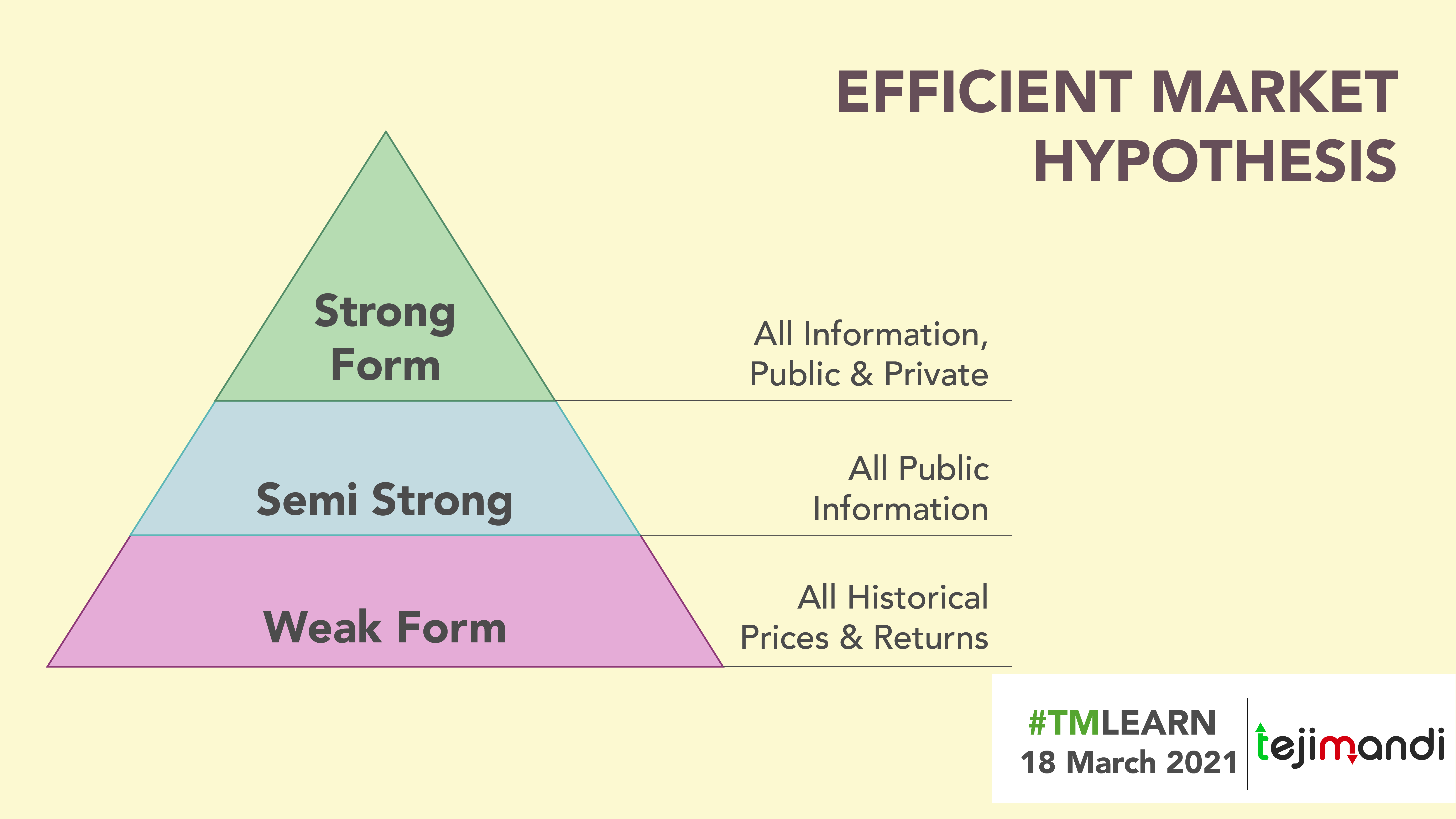

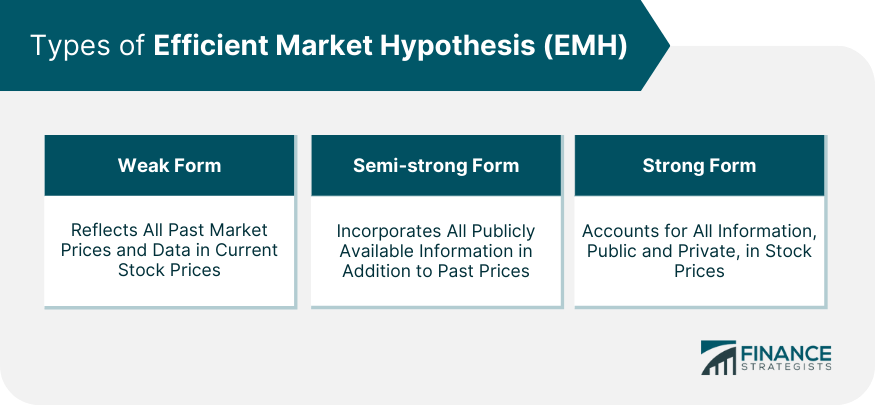

The efficient market hypothesis EMH a is a hypothesis in financial economics that states that asset prices reflect all available information A direct implication is that it is impossible to beat the market consistently on a risk adjusted basis since market prices should only react to new information The Efficient Market Hypothesis EMH is a theory that suggests financial markets are efficient and incorporate all available information into asset prices According to the EMH it is impossible to consistently outperform the market by employing strategies such as technical analysis or fundamental analysis

Key Points The efficient market hypothesis claims that stock prices contain all information so there are no benefits to financial analysis The theory has been proven mostly correct although anomalies exist Index investing which is justified by the efficient market hypothesis has supported the theory The Efficient Market Hypothesis EMH theory introduced by economist Eugene Fama states that the prevailing asset prices in the market fully reflect all available information What is the Definition of Efficient Market Hypothesis The efficient market hypothesis EMH theorizes about the relationship between the

More picture related to describe the efficient market theory

Efficient Market Hypothesis A Unique Market Perspective

https://tejimandi.com/wp-content/uploads/2022/06/Efficient-market-hypothesis-A-unique-market-perspective.png

What Is The Efficient Market Hypothesis EMH IG International

https://a.c-dn.net/c/content/dam/publicsites/igcom/uk/images/content-2-chart-images/types_of_efficient_market_hypothesis.png/jcr:content/renditions/original-size.webp

Efficient Market Hypothesis

https://mafaheem.info/wp-content/uploads/2022/10/Efficient-Market-Hypothesis.jpeg

The efficient market hypothesis EMH is important because it implies that free markets are able to optimally allocate and distribute goods services capital or labor depending on The efficient market hypothesis EMH maintains that all stocks are perfectly priced according to their inherent investment properties the knowledge of which

What is the Efficient Markets Hypothesis The Efficient Markets Hypothesis EMH is an investment theory primarily derived from concepts attributed to Eugene Fama s research as detailed in his 1970 book Efficient Capital Markets A Review of What is the efficient market hypothesis Definition and explanation It s very unlikely you ll walk down the street and find 100 000 which no one else has picked up

Efficient Market Hypothesis The Only Theory That You Need To Read Today

https://tradebrains.in/wp-content/uploads/2018/04/Efficient-Market-Hypothesis-is-the-stock-market-efficient.png

Efficient Market Hypothesis EMH Meaning Types Implications

https://www.financestrategists.com/uploads/Types-of-Efficient-Market-Hypothesis.png

describe the efficient market theory - Key Points The efficient market hypothesis claims that stock prices contain all information so there are no benefits to financial analysis The theory has been proven mostly correct although anomalies exist Index investing which is justified by the efficient market hypothesis has supported the theory