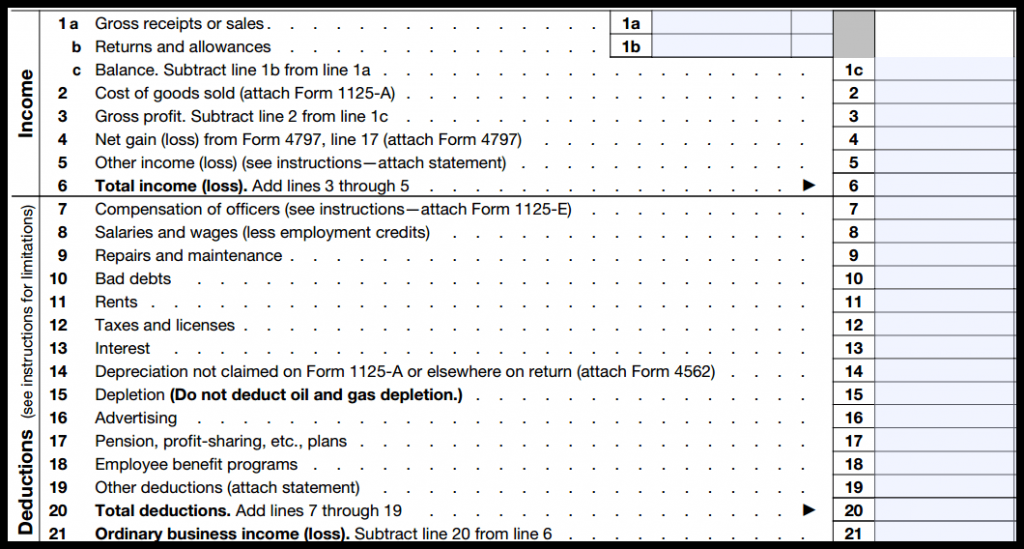

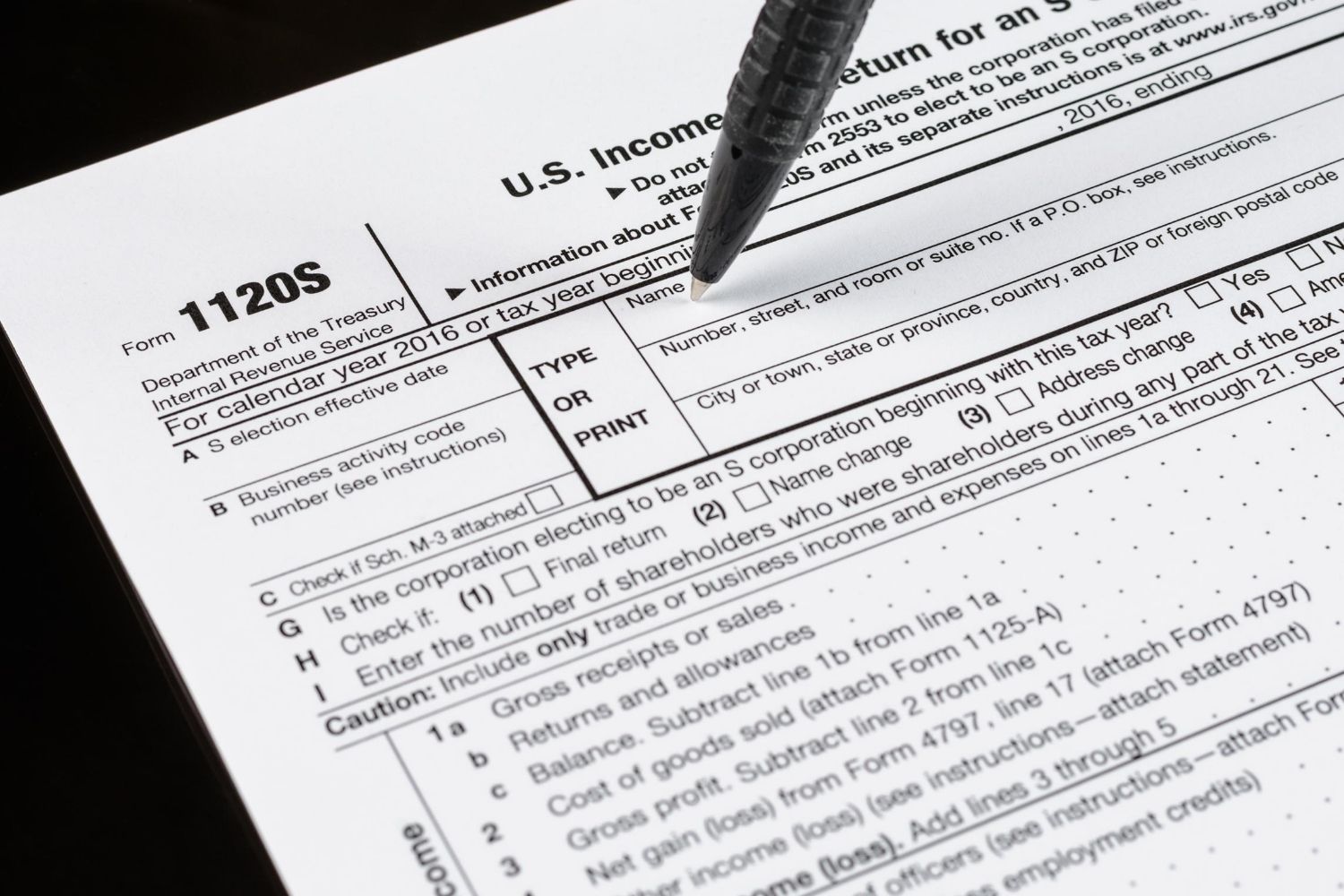

what is irs form 1120s Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax

Form 1120 S is an important tax document used by S corporations to report their income gains losses deductions and credits as well as to determine their tax liability What is Form 1120 S Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains losses deductions and other credits for the tax year

what is irs form 1120s

what is irs form 1120s

https://fitsmallbusiness.com/wp-content/uploads/2019/01/form-1120s-income-and-expense-section-1024x549.png

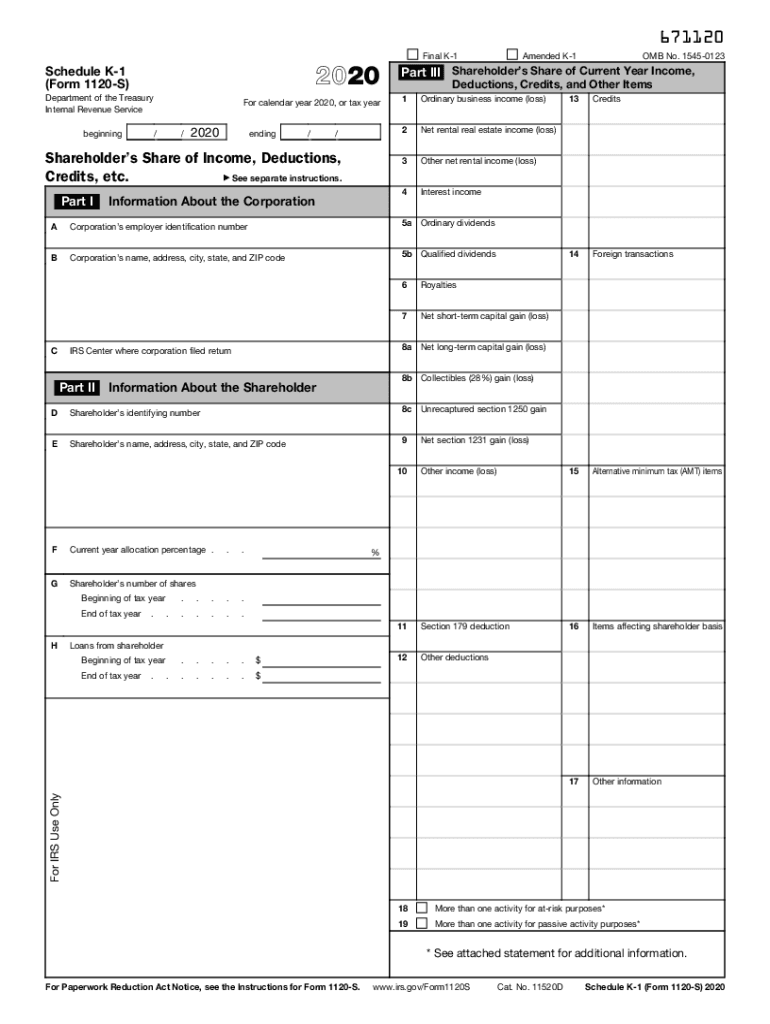

IRS 1120S Schedule K 1 2020 Fill Out Tax Template Online US Legal

https://www.pdffiller.com/preview/533/156/533156814/large.png

Form 1120s K 1 2014 Form Resume Examples MeVR15yYDo

http://www.contrapositionmagazine.com/wp-content/uploads/2020/10/form-1120s-k-1-2014.jpg

Form 1120 S is a U S Income Tax Return form used by S Corporations S corps to report income gains losses deductions and credits to the Internal Revenue Service IRS A sample 1120 S form is available What is Form 1120 S and who needs to file it Form 1120 S is the tax form S corporations use to report their income deductions and losses to the IRS

Form 1120 S is used by S corporations to report their annual income gains losses deductions and credits to the IRS The form facilitates the pass through taxation unique to S corporations where income is taxed at Form 1120S is required annually of every S corporation S corp The return includes a combination of financial information and questions the IRS will use to determine potential tax liabilities We ll cover how to enter the

More picture related to what is irs form 1120s

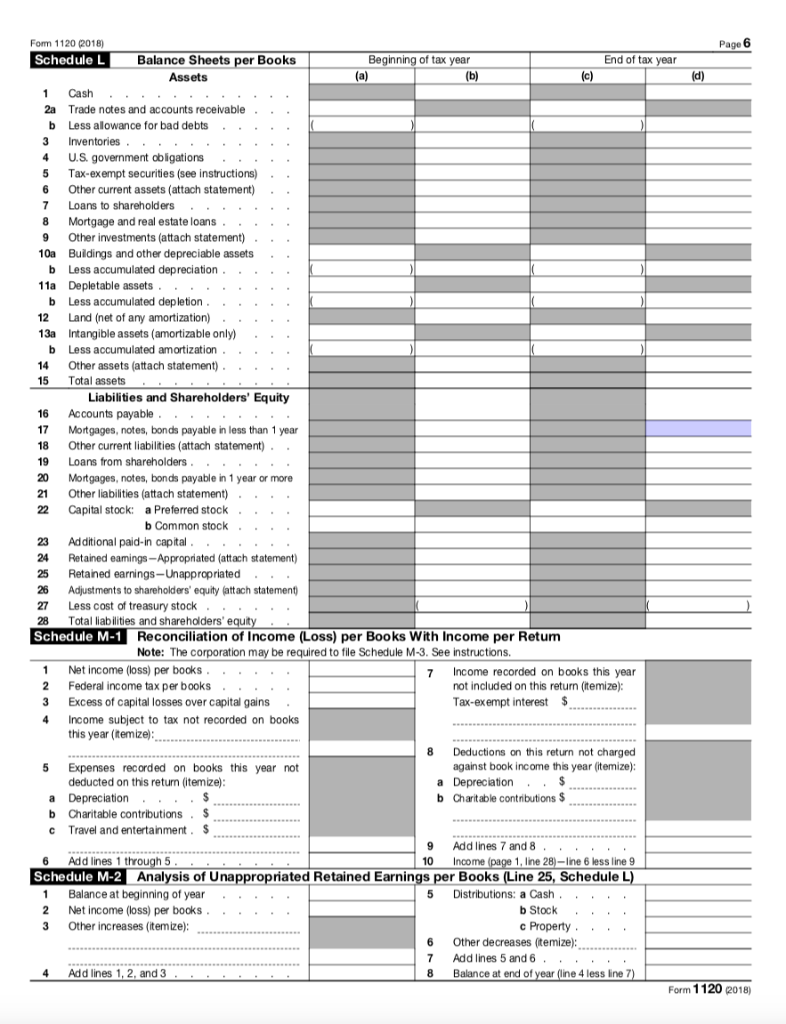

Solved Form Complete Schedule L For The Balance Sheet Chegg

https://media.cheggcdn.com/media/d55/d554511f-f9ec-4044-b5c8-2895a840218d/phpBiYm9C.png

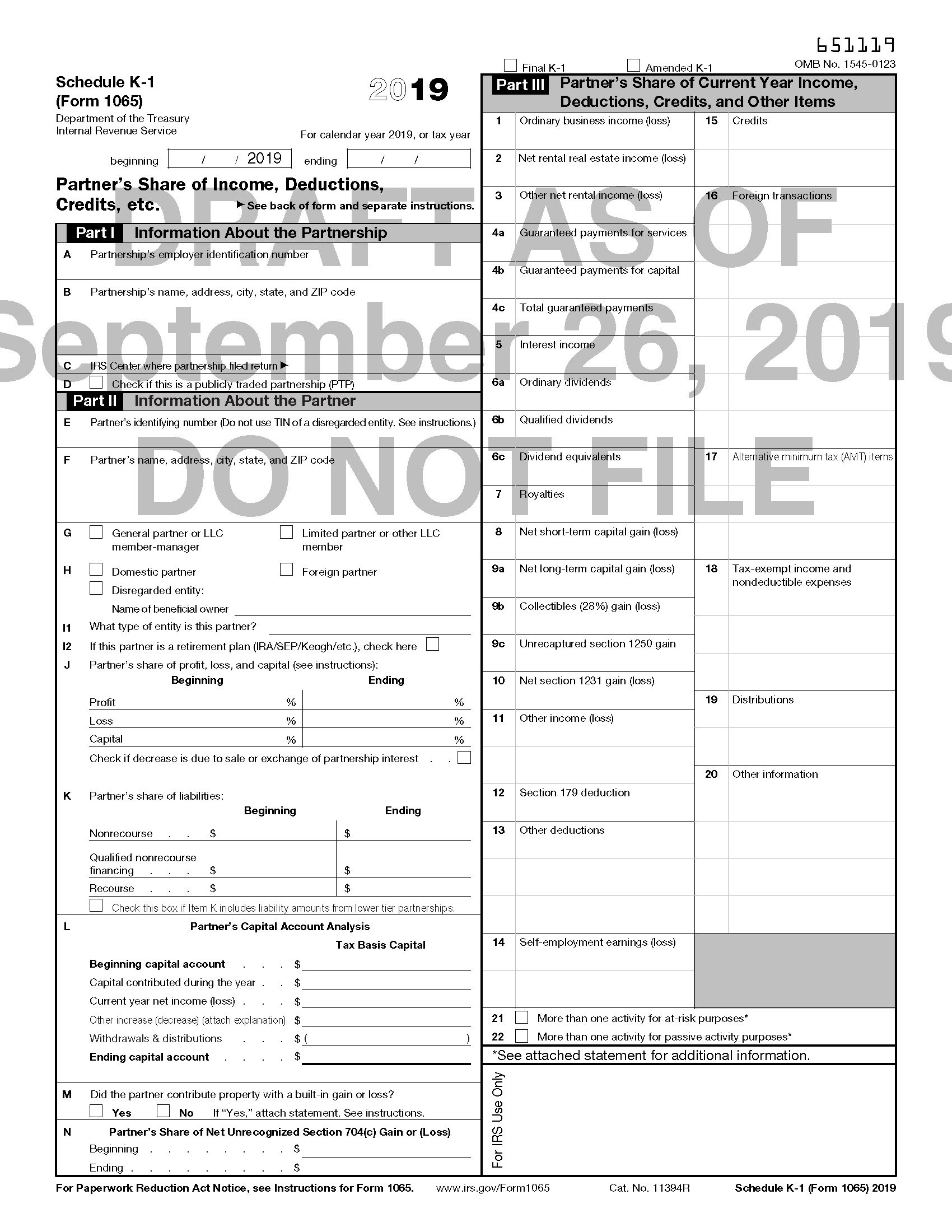

Drafts Of 2019 Forms 1065 And 1120S As Well As K 1s Issued By IRS

https://images.squarespace-cdn.com/content/v1/54a14f8ee4b0bc51a1228894/1569938249555-6764N9ELJMSKNZCFBOKH/image-asset.jpeg

What Is IRS Form 1120S

https://www.dimercurioadvisors.com/hs-fs/hubfs/the-learning-center/form-library/IRS/1120S-full.png?width=972&height=1260&name=1120S-full.png

Both Form 1120 and Form 1120 S report required tax information for a specific type of business entity Because Form 1120 calculates a C Corp s tax liability any amount Explore Tax Form 1120 S Understand its purpose requirements and how it benefits S corporations Your guide to tax compliance simplified

Form 1120 S U S Income Tax Return for an S Corporation is a tax form that S Corporations use to report their earnings losses and dividends to the IRS Form 1120 S is Form 1120S is the tax form S corporations use to file their federal income tax return not to be confused with Form 1120 for C corporations Every S corp needs to file one including LLCs

Form 1120S S Corporation Income Tax Skill Success

https://www.skillsuccess.com/wp-content/uploads/2020/07/scorp-income-tax-2.jpg

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Partner s Share Of Income Deductions Credits Etc

https://www.investopedia.com/thmb/W6GLzh84o8Vbv2Z7QBTqOnRkFw4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png

what is irs form 1120s - Form 1120 S is used by S corporations to report their annual income gains losses deductions and credits to the IRS The form facilitates the pass through taxation unique to S corporations where income is taxed at