what is form 1120s used for Form 1120 S is an important tax document used by S corporations to report their income gains losses deductions and credits as well as to determine their tax liability

IRS Form 1120S is the tax return used by domestic corporations that have made an election to be treated as S corporations for that tax year The return reports income losses credits and deductions before they flow Form 1120 S is used by S corporations to report their annual income gains losses deductions and credits to the IRS The form facilitates the pass through taxation unique to S corporations where income is taxed at

what is form 1120s used for

what is form 1120s used for

https://www.castroandco.com/images/blog/Form_1120-S_S_Corporation.jpg

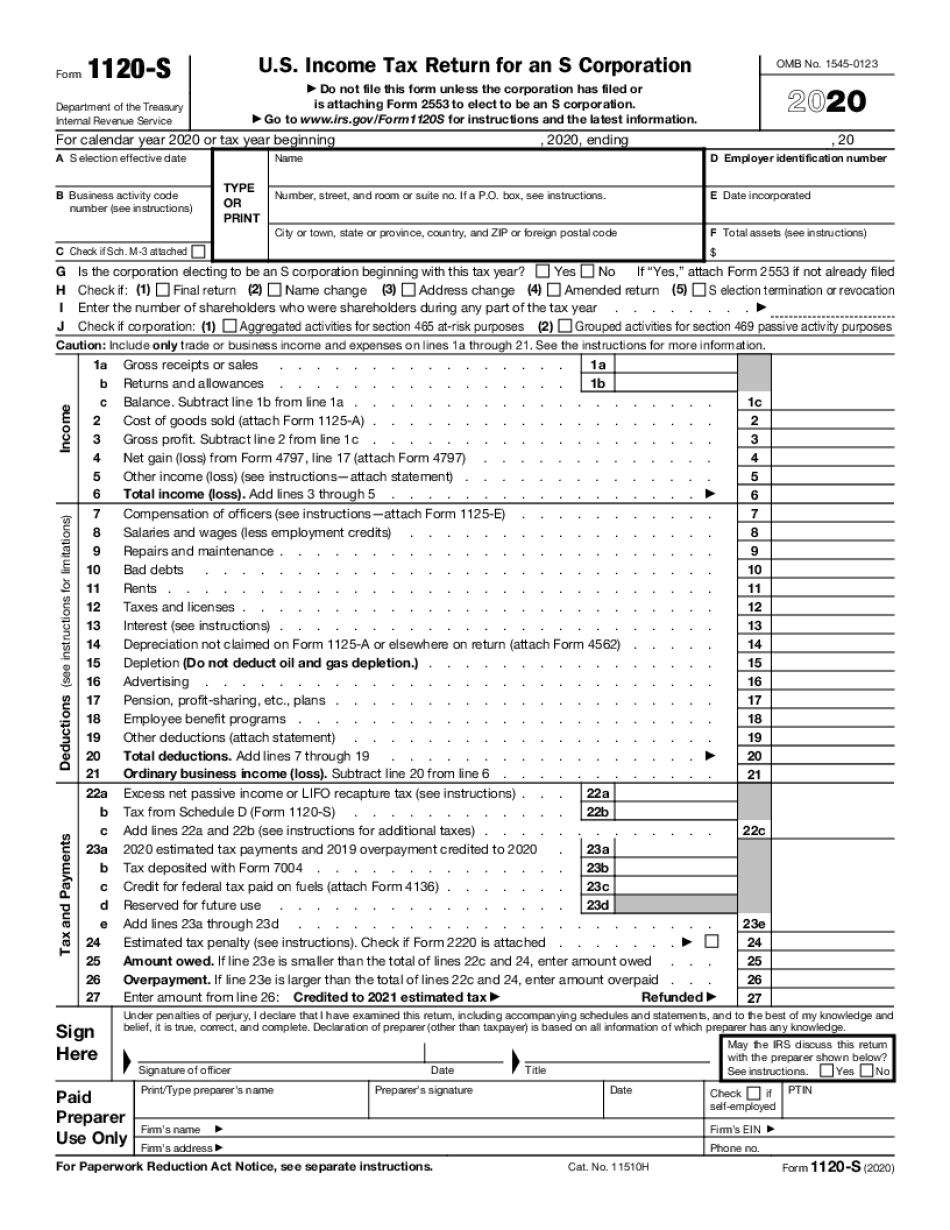

2020 1120s Editable Online Blank In PDF

https://www.pdffiller.com/preview/539/32/539032318/big.png

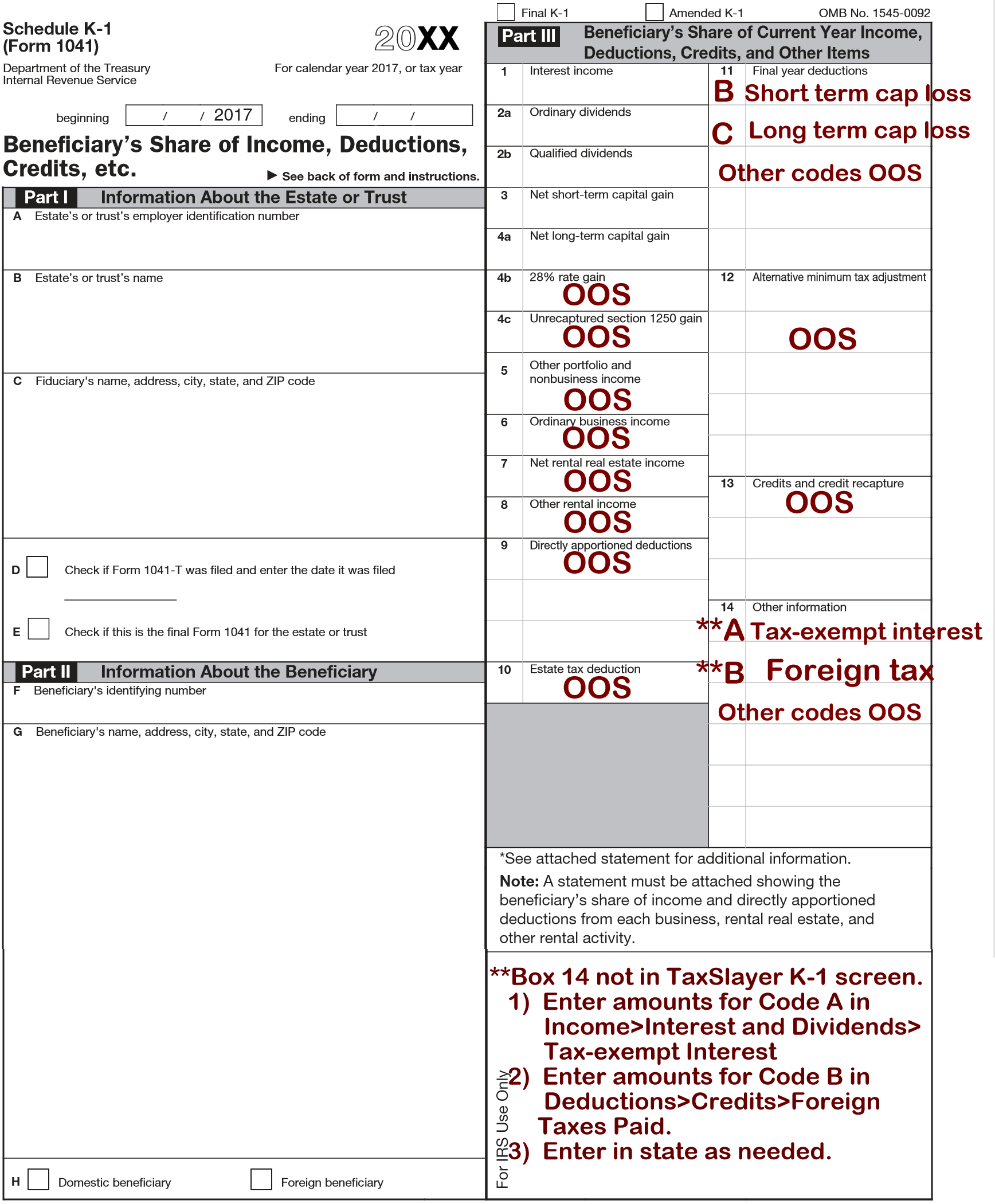

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

https://gusto.com/wp-content/uploads/2019/08/Schedule-K-1-instructions-for-business-owners-Form-1120S-788x1024.jpg

What is Form 1120 S Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains losses deductions and other credits for the tax year Form 1120 S is a U S Income Tax Return form used by S Corporations S corps to report income gains losses deductions and credits to the Internal Revenue Service IRS A sample 1120 S form is available

What is Form 1120 S and who needs to file it Form 1120 S is the tax form S corporations use to report their income deductions and losses to the IRS Form 1120S is the tax form S corporations use to file their federal income tax return not to be confused with Form 1120 for C corporations Every S corp needs to file one including LLCs that are taxed as S corps

More picture related to what is form 1120s used for

How To Complete Form 1120s S Corporation Tax Return Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/5w14Hif2akkIcgQa6QgSkk/ba522649e4382133bec2ff9301b05ff6/IRS_Form_1120S.png

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 Db excel

https://db-excel.com/wp-content/uploads/2019/09/form-1120s-k-1-instructions-2016-2018-codes-line-17.png

PPP Guide For Businesses With Payroll HomeUnemployed

https://homeunemployed.com/wp-content/uploads/2021/01/940-Form-2020.jpg

IRS Form 1120 S is used to report income or gains losses tax deductions and business tax credits for an S corporation To elect to file as an S corporation a business must first file IRS Form 2553 Form 1120 S is an Internal Revenue Service form that S Corporations use to report the company s financial activity for each tax year Learn how to file in 2023

Purpose and Importance of Form 1120 S Your S corporation s tax return Form 1120 S serves as a critical document for reporting income gains losses credits deductions What is IRS 1120 S IRS Form 1120 S is the tax form S corporations use to file a federal income tax return This tax form informs the IRS of your total taxable earnings in a tax

Form 1120 When And How To File

https://assets.website-files.com/6094875660e7caf817a85eb9/6372485a389c7a400ba41658_Blank.jpg

I Need Help With Schedule K 1 Form 1120 S For John Parsons And

https://www.coursehero.com/qa/attachment/20108940/

what is form 1120s used for - What is Form 1120 S Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains losses deductions and other credits for the tax year