what is the difference between irs form 1120 and 1120s Information about Form 1120 S U S Income Tax Return for an S Corporation including recent updates related forms and instructions on how to file Form 1120 S is used by corporations

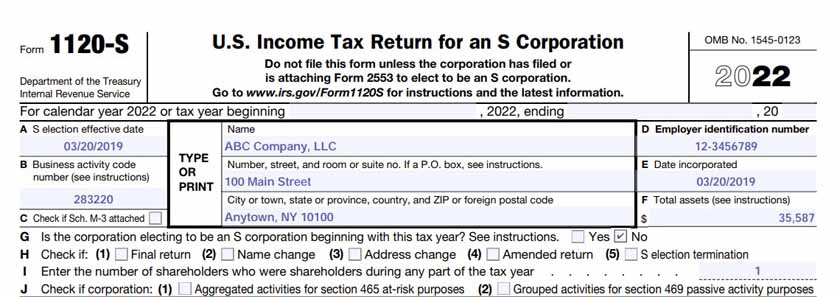

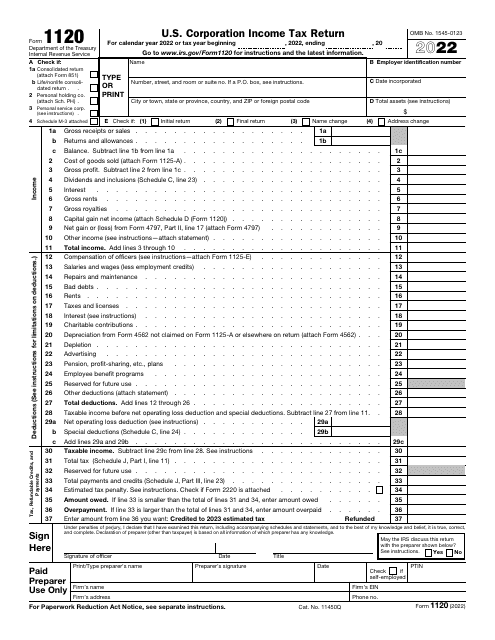

Both C and S corporations must file a federal income tax return C corporations use Form 1120 to calculate their taxes due S corporations use Form 1120S as an information return S corporations must also prepare a form 10 K 1 for How does Form 1120 differ from Form 1120S Form 1120 is for C corporations and Form 1120S is for S corporations Each form is set up to record the information needed

what is the difference between irs form 1120 and 1120s

what is the difference between irs form 1120 and 1120s

https://gusto.com/wp-content/uploads/2019/06/Form-1120S-instructions-Schedule-K.png

IRS Form 1120S Definition Download 1120S Instructions

https://fitsmallbusiness.com/wp-content/uploads/2019/01/form-1120s-income-and-expense-section.png

How To Complete Form 1120S Schedule K 1 Free Checklist

https://fitsmallbusiness.com/wp-content/uploads/2023/03/Screenshot_IRS_1120_S_Information_Section.jpg

Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax Corporations use IRS Form 1120 to file their taxes S corporations use IRS Form 1120 S Profits and losses are passed through to the shareholders personal tax returns

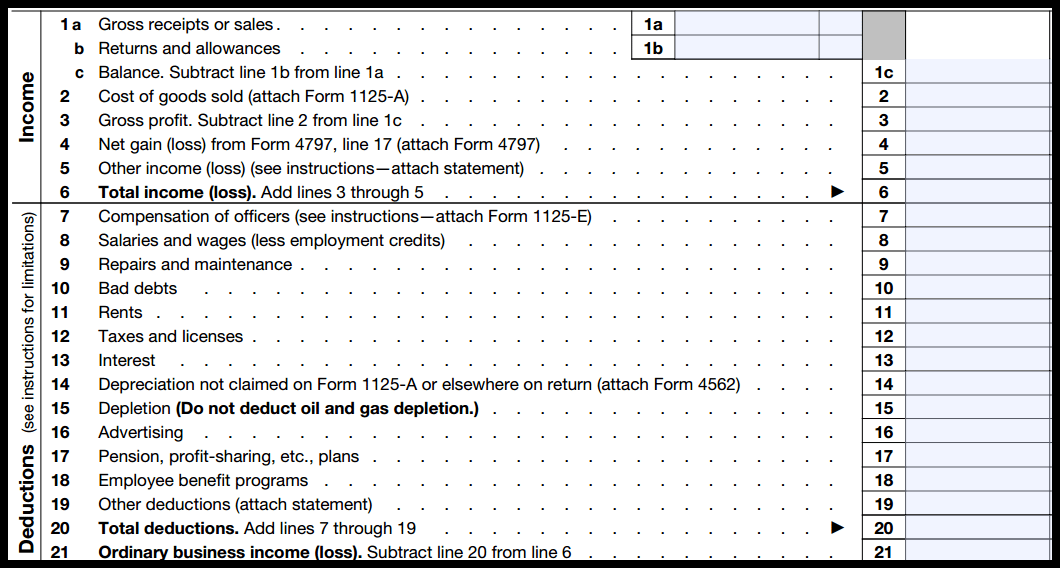

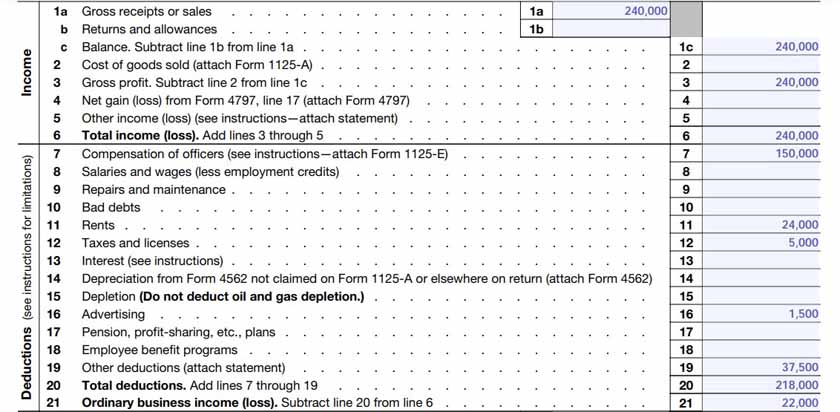

How does IRS Form 1120 differ from Form 1120S IRS Form 1120 is for regular C Corporations while Form 1120S is specifically for S Corporations The main difference between the two forms lies in their tax treatment The information on Form 1120S falls into three general categories income deductions and taxes and payments Here s an overview of some of the main information the IRS requires you to provide Your

More picture related to what is the difference between irs form 1120 and 1120s

IRS Form 1120S 2020 U S Income Tax Return For An S Corporation

https://lh5.googleusercontent.com/m3vpQcIMbTzDcrA-ThqUR7yvGwZv0hisbLPTdjScGGO1qxVDWLNdEbhUdAcjmz_rLqg=w1200-h630-p

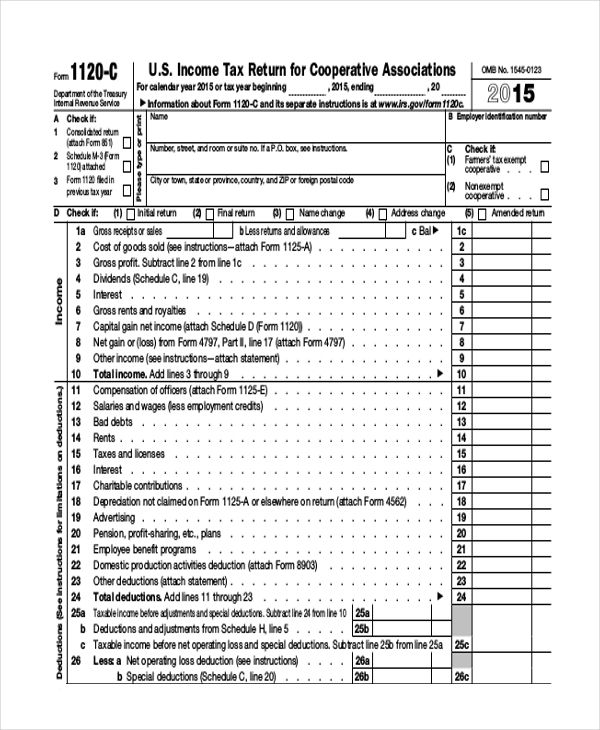

IRS Form 1120 Download Fillable PDF Or Fill Online U S Corporation

https://data.templateroller.com/pdf_docs_html/2553/25536/2553670/irs-form-1120-u-s-corporation-income-tax-return_big.png

How To Complete Form 1120S Schedule K 1 Free Checklist

https://fitsmallbusiness.com/wp-content/uploads/2023/03/Screenshot_IRS_1120_S_lline__-through_21.jpg

What s the difference between forms 1120 1120 S Regular C corporations use Form 1120 while Form 1120 S is specifically for an S corporation s business income The critical disparity lies in how these entities are taxed and how they IRS Form 1120S is the tax return used by domestic corporations that have made an election to be treated as S corporations for that tax year The return reports income losses credits and deductions before they flow

Form 1120 S is filed by S Corps for federal taxes while Form 1120 is filed by C Corps for taxes S Corps and C Corps are both classified as corporations however they have Form 1065 is ideal for partnerships while Form 1120 is used by C corporations which are subject to double taxation Form 1120S on the other hand is tailored to S

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue

https://www.irs.gov/pub/xml_bc/51221517.gif

Free Printable Schedule C Tax Form

https://images.sampleforms.com/wp-content/uploads/2016/11/Form-1120-Schedule-C.jpg

what is the difference between irs form 1120 and 1120s - Differences Between Form 1120 and 1120 S What s the difference between the two forms Quite simply Form 1120 is the tax return form for C corporations showing