what is form 1120 c For tax years beginning in 2023 corporations filing Form 1120 and claiming the energy efficient commercial buildings deduction should report the deduction on line 25 See the instructions for

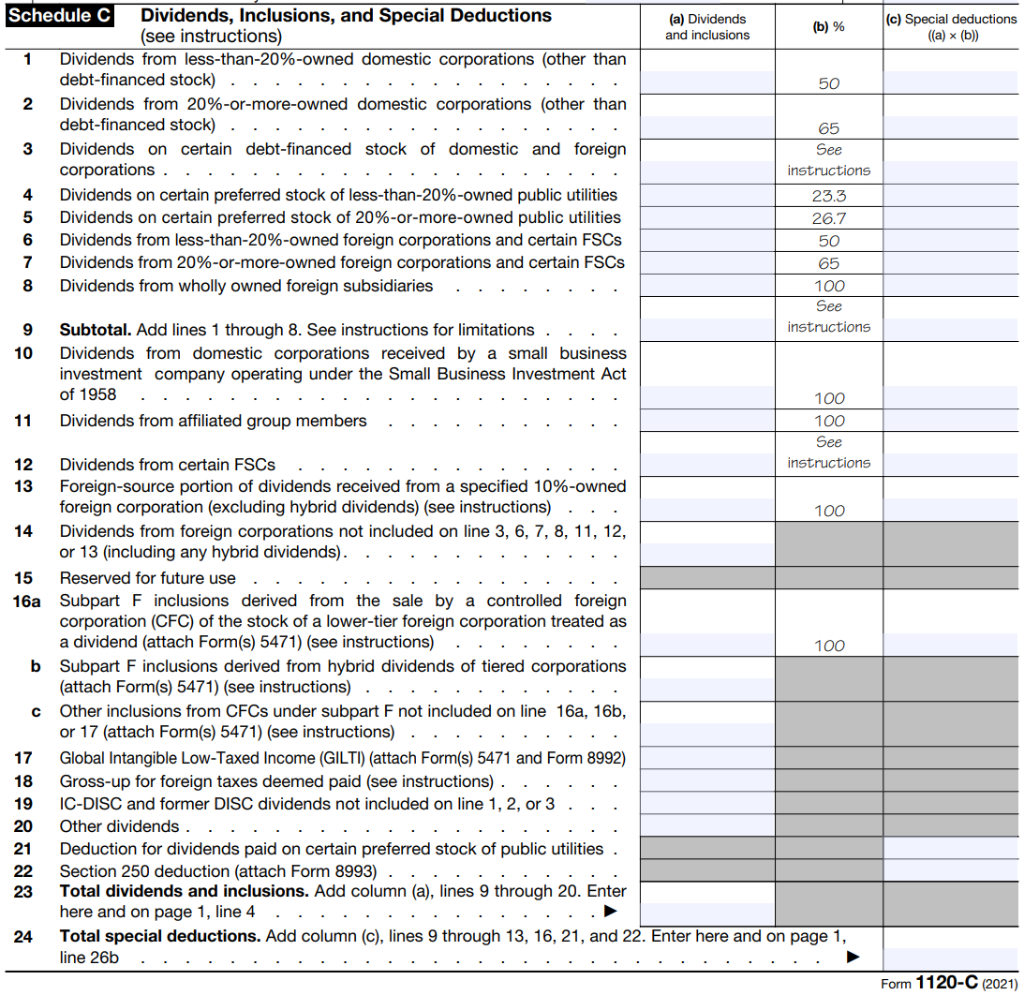

Form 1120 C is the annual U S income tax return that must be filed by cooperative associations This form reports income gains losses deductions credits and other tax related information to calculate the Form 1120 is the tax form that C corporations and LLCs filing as corporations use to report their income taxes to the IRS It helps these entities figure out their tax liability

what is form 1120 c

what is form 1120 c

https://d1chla7orn6rd0.cloudfront.net/wp-content/uploads/2020/04/Form-1120-Structure.png

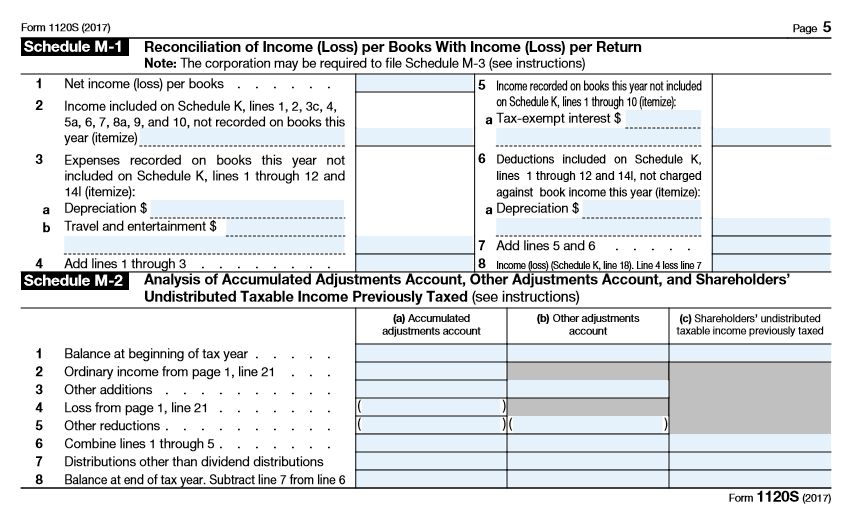

What Is Form 1120S And How Do I File It Ask Gusto

https://gusto.com/wp-content/uploads/2019/06/Form-1120S-instructions-Schedule-B-768x995.png

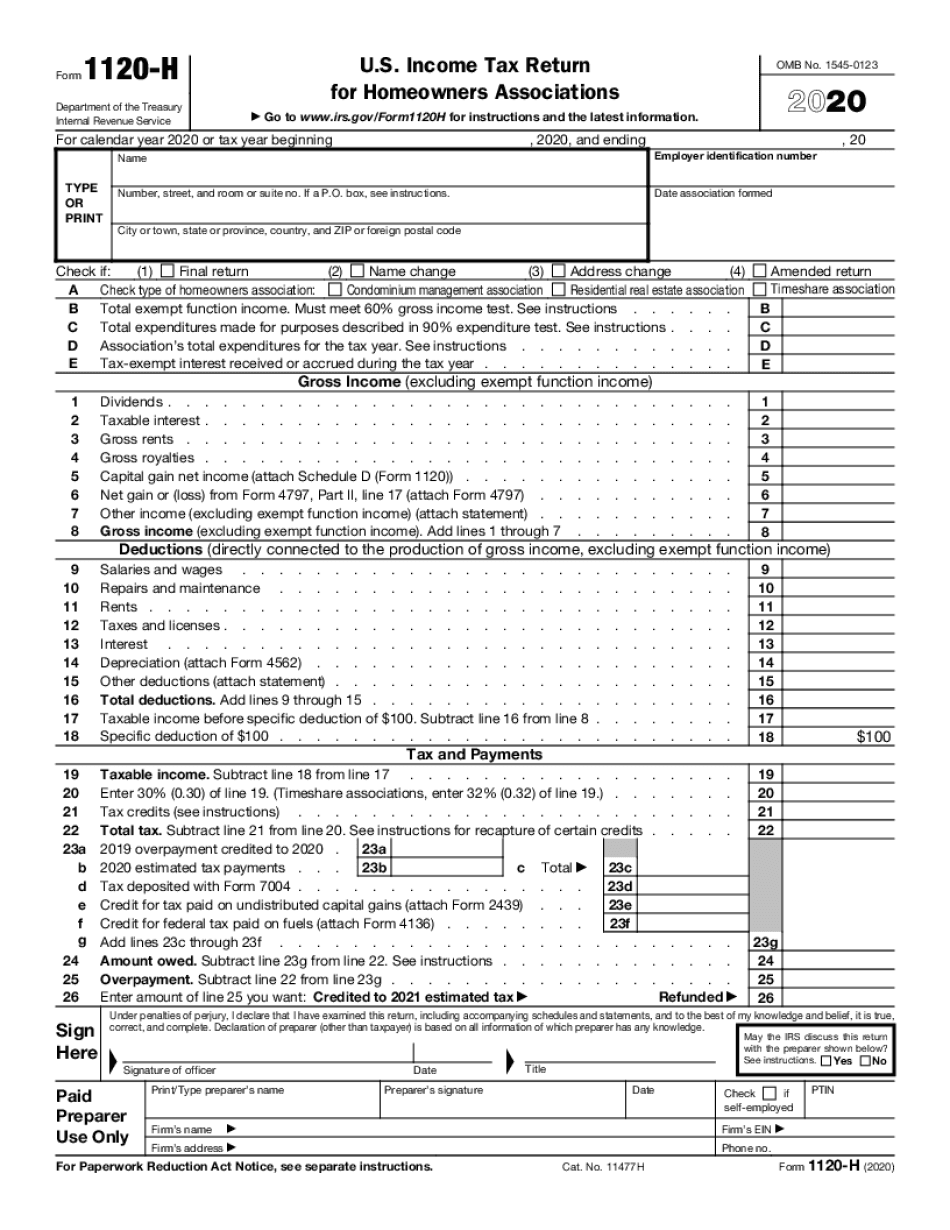

1120 H Fillable Form 2020 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/533/156/533156818/big.png

Form 1120 C caters specifically to the unique accounting and tax needs of cooperatives It allows them to report their income gains losses deductions and credits and So what is an 1120 tax form or a C corp tax form Form 1120 is used by corporations in the United States to report their income and calculate their taxes The form is also used to report any gains or losses and any

All domestic C corporations C corps must file IRS Form 1120 U S Corporation Income Tax Return every year they are in business even if they don t have any taxable income The financial information in Form 1120 is Still wondering which documents you need to file an 1120 C Corporation tax return Refer to our tax preparation checklist to easily file your taxes

More picture related to what is form 1120 c

Form 1120 Schedule M 3 Net Income Reconciliation For Corporations

https://www.formsbirds.com/formimg/more-tax-forms/7817/form-1120-schedule-m-3-net-income-reconciliation-for-corporations-2014-l2.png

Us Gov Tax Forms 2020 Form Resume Examples Kw9kDZKYJN

https://www.contrapositionmagazine.com/wp-content/uploads/2020/07/pdf-tax-forms.jpg

Form 1120 C 2019 Blank Sample To Fill Out Online In PDF

https://www.pdffiller.com/preview/490/783/490783251/big.png

What Is Form 1120 A corporation pays income tax by filing a corporate tax return on Form 1120 and paying the taxes as indicated by this return Forms 1120 and 1120S are IRS forms used to calculate and file corporate income taxes Filing Form 1120 is mandatory for all C corporations S corporations must file Form

How do I generate a Form 1120 C U S Income Tax for Cooperative Associations You can generate an 1120 C within any 1120 return FAQ P in an 1120 return advises Completing Form 1120 is a U S Corporation Income Tax Return form It is used to report income gains losses deductions and credits and to determine the income tax liability of a

Solved Required Information The Following Information Chegg

https://media.cheggcdn.com/media/8b3/8b342d81-f76c-49b9-a58c-04c656c2dc87/phpAnM7Pp

Fill Out The 1120S Form Including The M 1 M 2 With Chegg

https://media.cheggcdn.com/media/e63/e63bdf49-a965-4ee6-b546-748f7b0fb889/phpzQ34qC.png

what is form 1120 c - Form 1120 C Department of the Treasury Internal Revenue Service U S Income Tax Return for Cooperative Associations For calendar year 2023 or tax year beginning 2023 ending 20