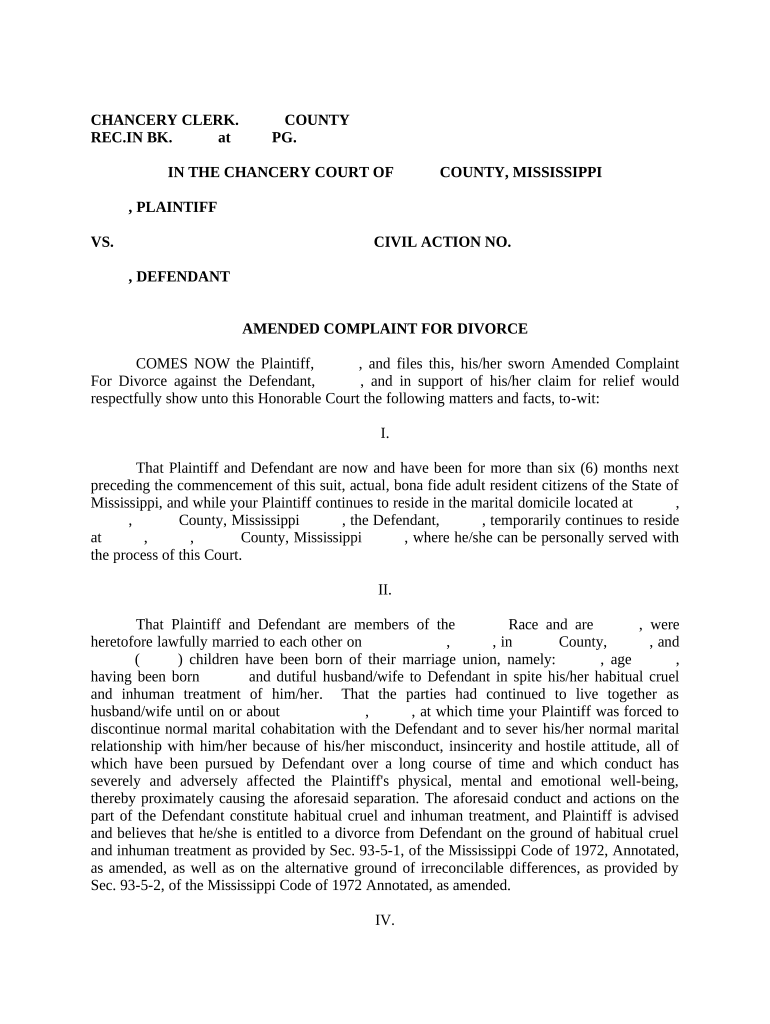

what is an amended 1120s called To correct a previously filed Form 1120 S file an amended Form 1120 S and check box H 4 on page 1 Attach a statement that identifies the line number of each amended item the corrected

What is an Amended 1120 S An amended 1120 S is essentially a corrected version of the original Form 1120 S It allows you to rectify errors incorporate new information or make adjustments to an already filed Form Amend an S Corporation return Follow these steps to amend an S Corporation return note Before amending a return you may want to maintain a record of the original return by copying

what is an amended 1120s called

what is an amended 1120s called

https://m.foolcdn.com/media/affiliates/images/S_corp_taxes_-_01_-_Form_1120-S_SLI0Nvc.width-750.png

Amended Complaint Divorce Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/314/497314015/large.png

ERC Calculator Tool ERTC Funding

https://ertcfunding.com/wp-content/uploads/2022/07/941-screenshot.jpg

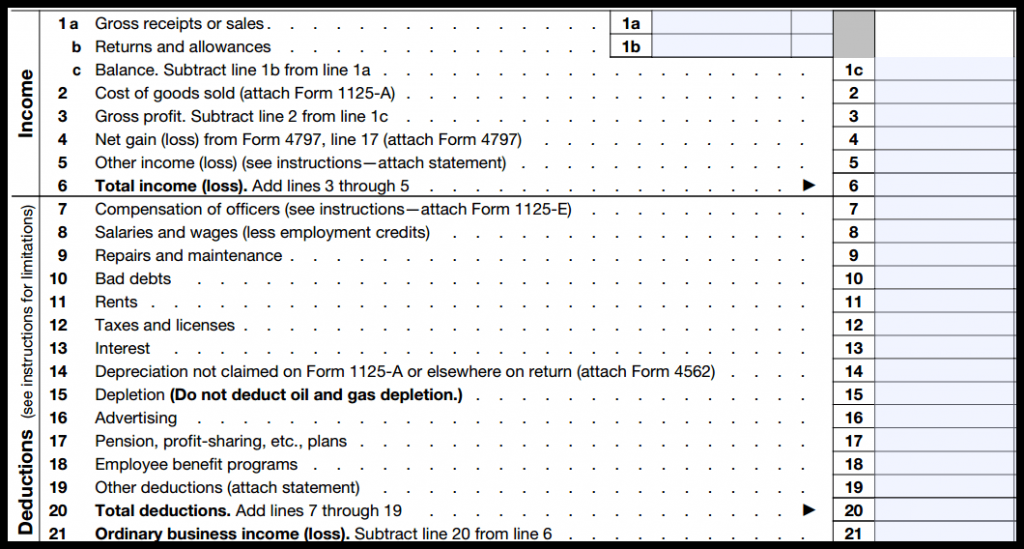

Automate sales and use tax GST and VAT compliance Consolidate multiple country specific spreadsheets into a single customizable solution and improve tax filing and return accuracy Information about Form 1120 S U S Income Tax Return for an S Corporation including recent updates related forms and instructions on how to file Form 1120 S is used by corporations

Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax Form 1120 S U S Income Tax Return for an S Corporation is amended by checking the Amended Return box located at the top of Page 1 To access this checkbox through the Q A From

More picture related to what is an amended 1120s called

Worksheet 2 941x

https://lithium-response-prod.s3.us-west-2.amazonaws.com/intuit.response.lithium.com/RESPONSEIMAGE/fde8297f-0e4c-4c2f-94d6-1d1cd9bdb0dc.default.JPG

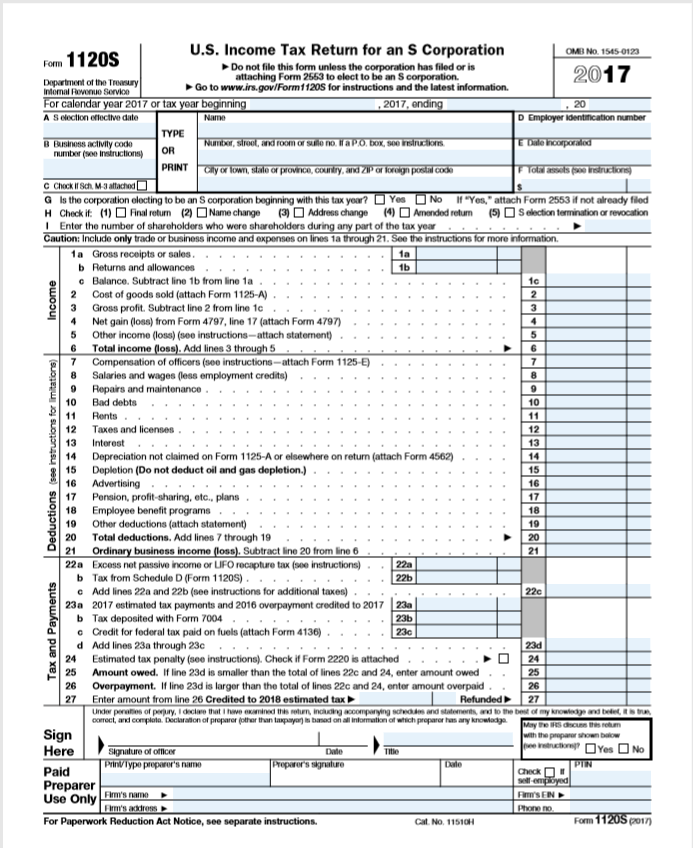

Fill Out The 1120S Form Including The M 1 M 2 With Chegg

https://media.cheggcdn.com/media/e63/e63bdf49-a965-4ee6-b546-748f7b0fb889/phpzQ34qC.png

How To File Tax Form 1120 For Your Small Business

https://m.foolcdn.com/media/affiliates/images/Form_1120_-_01_-_Front_Page_rT0vFkj.width-750.png

IRS Form 1120 S is specifically designed to report the income gains losses deductions credits and other financial information of a domestic corporation or other entity that has elected to be an S Corporation in the United States An S Corp client gave me what they said was their total ERCs receivable for 2020 As the rules dictate I e filed an amended 1120 S for 2020 to reduce salary wage expense

An amended Form 1120 also called Form 1120X comes into play when you make a mistake on the corporate income tax return Form 1120X Amended U S Corporation 1120 series amended returns such as Form 1120 S U S Income Tax Return for an S Corporation and checking a box on the form to indicate that the return is an amended return

41 1120s Other Deductions Worksheet Worksheet Works

https://media.cheggcdn.com/media/5f5/5f570c92-9ec5-44f4-a56b-010b229d90a0/phpzLTv9I.png

IRS Form 1120S Definition Download 1120S Instructions

https://fitsmallbusiness.com/wp-content/uploads/2019/01/form-1120s-income-and-expense-section-1024x549.png

what is an amended 1120s called - Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax