can you amend an 1120s Follow these steps to amend an S Corporation return note Before amending a return you may want to maintain a record of the original return by copying the client

Follow these steps to prepare an electronic Form 1120S 1120C or 1120 F amended return When changing their filing status from a C corporation filing Form 1120 to an S corporation filing Form 1120 S the Internal Revenue Service reminds taxpayers to use the

can you amend an 1120s

can you amend an 1120s

https://profile-images.xing.com/images/91aa11f2ce3ade84064e60a5ed2b7db8-2/david-amend.1024x1024.jpg

Kellogg s Amend Elegant Gardens Nursery Moorpark CA

https://elegantgardens.com/wp-content/uploads/2023/02/Kelloggs-Amend-scaled.jpg

Current Developments In S Corporations

https://www.thetaxadviser.com/content/dam/tta/issues/2022/jul/s-corporation-aep-example-2.PNG

For 1120S returns make all necessary changes to the return and then complete the amended return changes detail under Organizer Amended Return Amended Changes Add new Amended Changes For 1065 and This article will help you create and file an amended 1120S in Intuit ProSeries If you are looking for how to amend a different return type select your return type below To

This article will help you create and file an amended return for Form 1120S in ProConnect Tax If you are looking for how to amend a different return type select your return type below Yes you can use the old s corp entity if you plan to continue business with it There are 3 ways you could do this 1 You can file an amended Form 1120S return to change the final box on

More picture related to can you amend an 1120s

Elvar Amend Junior Key Account Manager Memo AG XING

https://profile-images.xing.com/images/658e8d5a33346cd413a566399ae0d272-4/elvar-amend.1024x1024.jpg

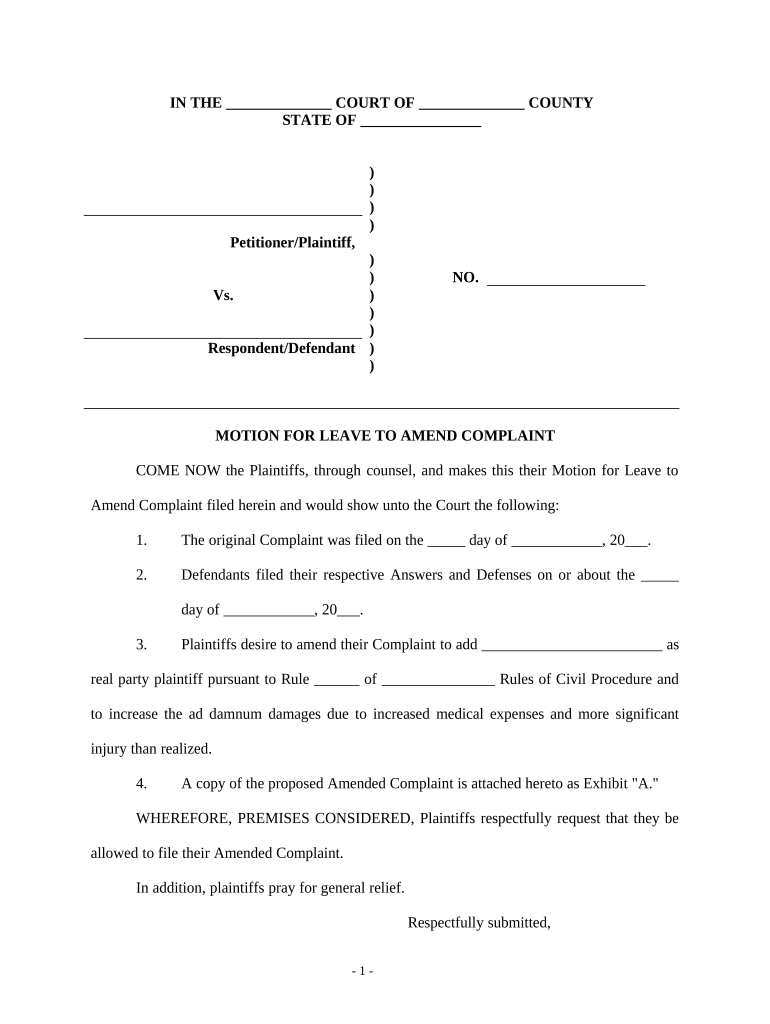

Leave Amend Form Fill Out And Sign Printable PDF Template AirSlate

https://www.signnow.com/preview/497/426/497426602/large.png

Sven Amend Angewandte Informatik HS Fulda XING

https://profile-images.xing.com/images/dc8ed1ea5ea4d8e1cc9e287fdd445917-1/sven-amend.1024x1024.jpg

A discussion thread about whether Section 179 can be claimed on an amended form 1120S filed after the original extended due date of March 15 2022 See the conflicting You can apply for a quick refund of estimated taxes for your corporation by filing Form 4466 You can use this form for forms 1120 1120 C 1120 F 1120 L and 1120 PC

Learn how to use Form 1120X to amend your original Form 1120 U S Corporate Income Tax Return if you made a mistake Find out who can file what information to include Learn how to use Form 1120 S to report the income gains losses deductions credits etc of a domestic corporation or other entity for any tax year covered by an election to be an S

How To Amend A Contract After Signing 2022 Release

https://public-site.marketing.pandadoc-static.com/app/uploads/sites/3/How-to-amend-a-contract-after-signing2x.png

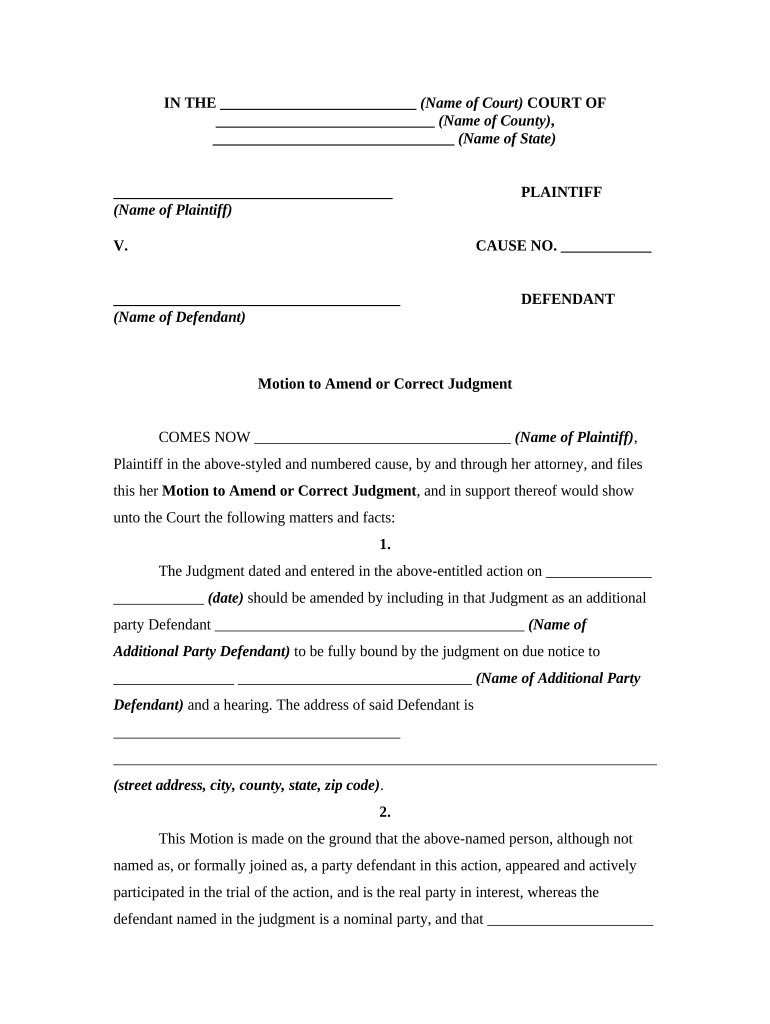

Correct Judgment Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/497/330/497330171/large.png

can you amend an 1120s - To amend an S corporate return and its Schedule K 1 s Before you start We recommend that you make a copy of the client file before amending it Go to Screen 79