form 1120 s amended Form 1120 X is used to correct or amend a previously filed Form 1120 or 1120 A or to make certain elections after the deadline Learn how to file Form 1120 X its recent

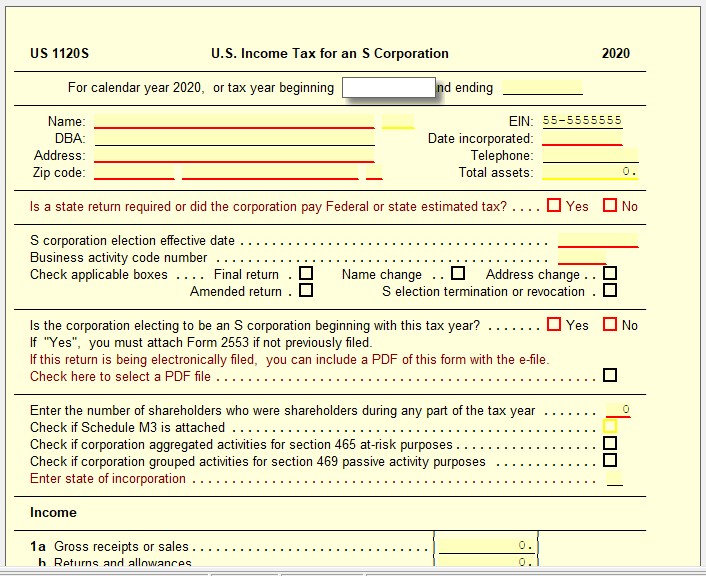

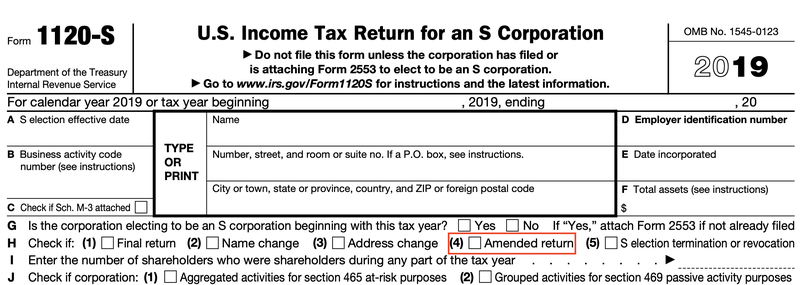

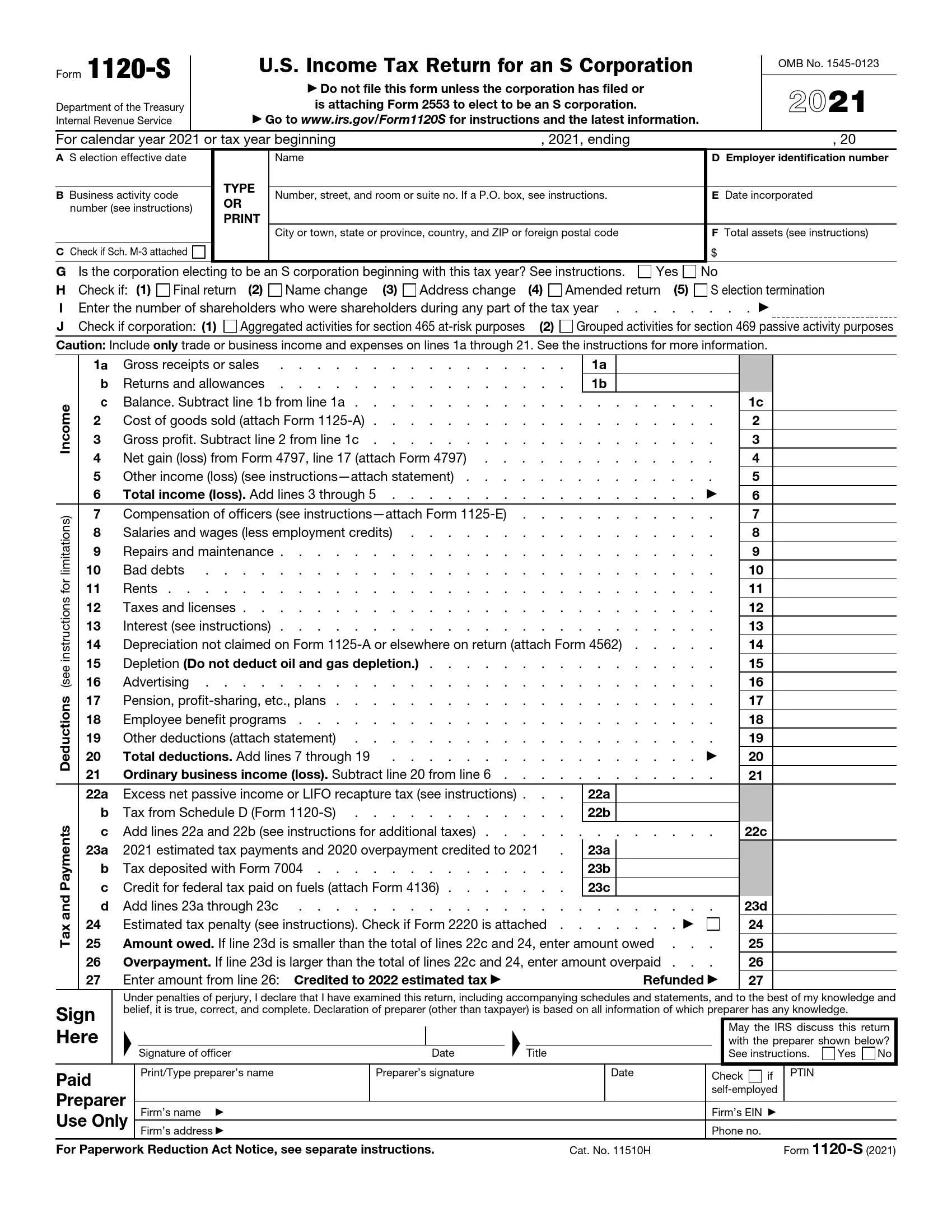

To correct a previously filed Form 1120 S file an amended Form 1120 S and check box H 4 on page 1 Attach a statement that identifies the line number of each amended item the corrected Form 1120 S U S Income Tax Return for an S Corporation is amended by checking the Amended Return box located at the top of Page 1 To access this checkbox through the Q A From

form 1120 s amended

form 1120 s amended

https://support.ultimatetax.com/hc/article_attachments/4406265218327/mceclip0.png

Form 1120 S What IRS Form 1120 S Is How To Fill It Out

https://jt.org/wp-content/uploads/2022/08/image-1120-S.png

1040 Distributions In Excess Of Basis From 1120S

https://kb.drakesoftware.com/Site/Uploads/Images/16511 image 2.jpg

An amended 1120 S is essentially a corrected version of the original Form 1120 S It allows you to rectify errors incorporate new information or make adjustments to an already filed Form 1120 S It s essential to note Follow these steps to amend an S Corporation return note Before amending a return you may want to maintain a record of the original return by copying the client

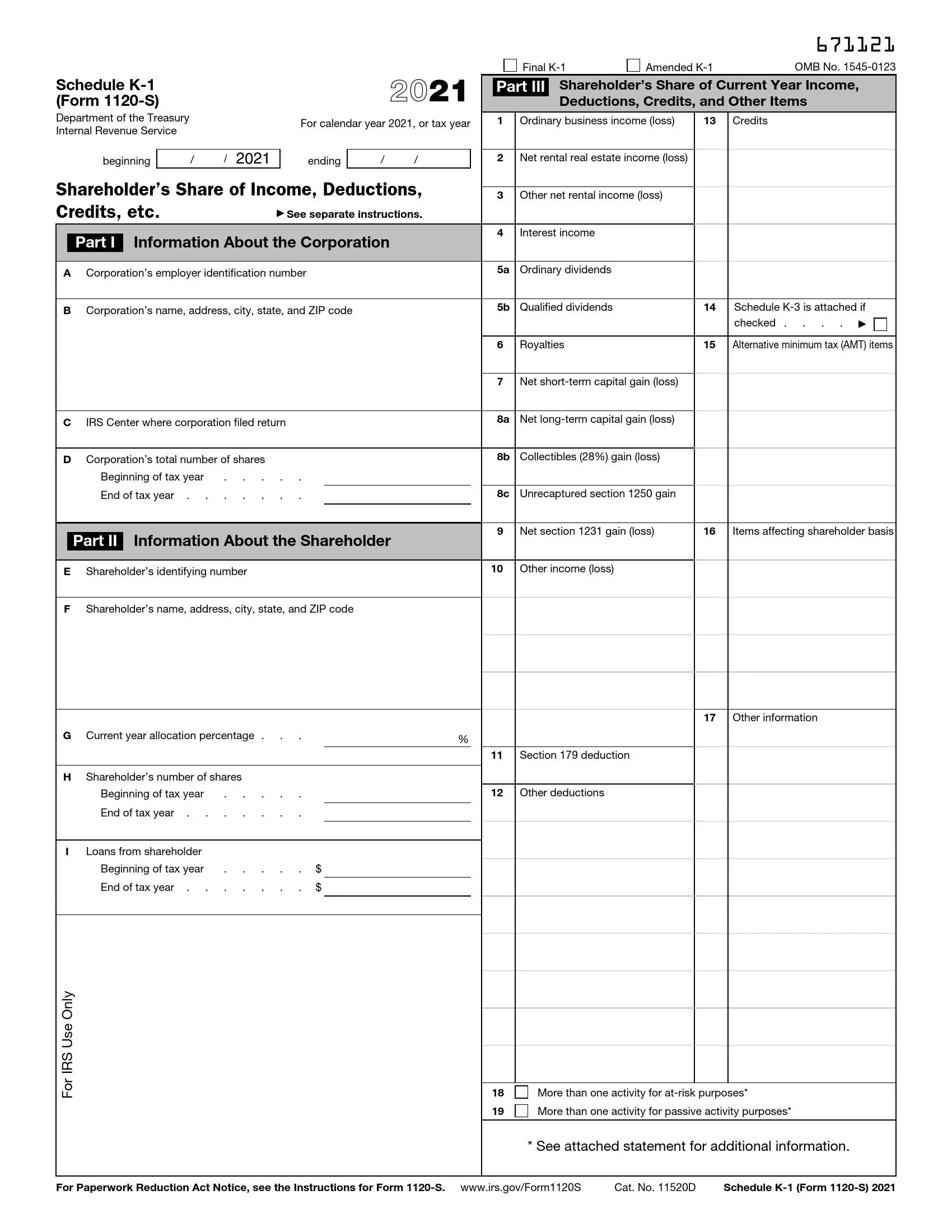

Follow these steps to prepare an electronic Form 1120S 1120C or 1120 F amended return note Create a copy of the return before you enter the amended information so that you have the On Form 1120S p1 2 check box H 4 to indicate an amended return Make the necessary changes to the return If Schedule K 1 s result in a change go to the Schedule K

More picture related to form 1120 s amended

How To File An Amended 1120 S With The IRS The Blueprint

https://m.foolcdn.com/media/the-blueprint/images/Amended_Form_1120-S_-_01_-_Top_of_Form.width-800.png

IRS Form 1120 S Fill Out Printable PDF Forms Online

https://formspal.com/wp-content/uploads/2022/01/irs-form-1120-s-2021-preview.webp

IRS Schedule K 1 Form 1120 S Fill Out Printable PDF Forms Online

https://formspal.com/wp-content/uploads/2022/01/irs-schedule-k-1-form-1120-s-2021-preview.webp

This is the official PDF form for filing or attaching Form 1120 S to elect or terminate S corporation status for tax year 2023 It contains instructions lines and spaces for reporting income If you re amending Form 1120 S due to missing Elections select the box Filing pursuant to section 301 9100 2 Enter Tax paid with original return line 22c less 23d if

Learn how to fill out Form 1120S the annual return for S corporations and Schedule K 1 the shareholder report Find out what information and documents you need This will allow you to prepare Form 1120 quickly and stress free as well as stay ahead of the curve when it comes to reducing your taxable income as much as Uncle Sam will

I Need Help With Schedule K 1 Form 1120 S For John Parsons And

https://www.coursehero.com/qa/attachment/20108940/

Form 1120 Amended Return Overview Instructions

https://www.patriotsoftware.com/wp-content/uploads/2020/09/form-1120-amended-return.jpg

form 1120 s amended - Follow these steps to prepare an electronic Form 1120S 1120C or 1120 F amended return note Create a copy of the return before you enter the amended information so that you have the