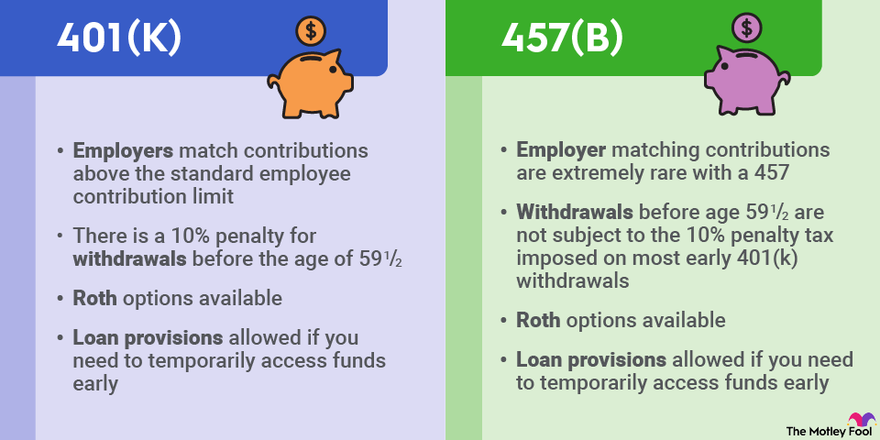

what is a 457 A 457 b is a type of tax advantaged retirement plan for state and local government employees as well as employees of certain non profit organizations While the 457 b shares a few features

The 457 plan is a type of nonqualified tax advantaged deferred compensation retirement plan that is available for governmental and certain nongovernmental employers in the United States The employer provides the plan and the employee defers compensation into it on a pre tax or after tax Roth basis 401 k plans and 457 plans are both tax advantaged retirement savings plans 401 k plans are offered by private employers while 457 plans are offered by state and local governments and some

what is a 457

what is a 457

https://www.annuityexpertadvice.com/wp-content/uploads/457-Vs.-401k.png

403 b Withdrawal Rules For 2023 The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/403b-vs-457b-retirement-plans-infographic.width-880.webp

KareesKarlis

https://m.foolcdn.com/media/dubs/images/401k-vs-457-retirement-plans-infographic.width-880.png

A 457 plan is a type of retirement plan offered by government and nonprofit organizations 457 plans allow you to defer a portion of your pay invest in various assets and pay taxes upon What is the 457 Plan The 457 Plan is a type of tax advantaged retirement plan with deferred compensation The plan is non qualified it doesn t meet the guidelines of the Employee Retirement Income Security Act ERISA 457 plans are offered by state and local government employers as well as certain non profit employers

A 457 plan is a type of employer sponsored tax advantaged retirement account available to state and local government employees and certain usually highly paid nonprofit employees Some 457 A 457 plan is a type of tax advantaged retirement plan offered primarily to state and local public employees and to some non profit employees It allows participants to defer a portion of their salaries into the plan for future use typically retirement

More picture related to what is a 457

What Is A 457 b Plan How Does It Work YouTube

https://i.ytimg.com/vi/i3bl74Q4jm8/maxresdefault.jpg

What Is A 457 Plan Defintion Types Benefits

https://images.inkl.com/s3/article/lead_image/17931156/457-plan.png

What Is A 457 Retirement Plan And Should I Use It ACEP Now

https://www.acepnow.com/wp-content/uploads/2023/02/457-art-feb-2023-642x336.png

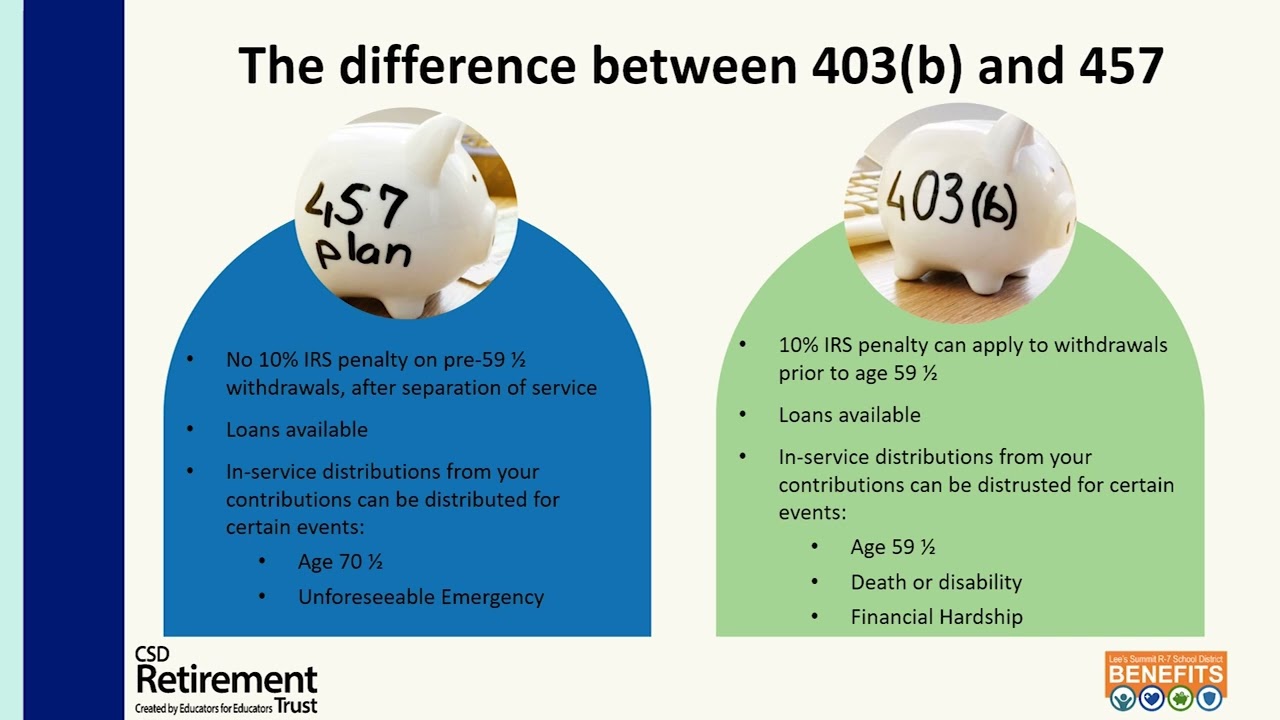

How Withdrawals Work If you have a governmental or non governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59 years old There is no 10 457 b plans are employer sponsored retirement savings plans that offer tax advantages through pre tax contributions helping individuals reduce their taxable income These plans have higher contribution limits allowing employees to save more for retirement compared to other plans

A 457 b deferred compensation plan is a type of tax advantaged retirement savings account that certain state and local governments and tax exempt organizations offer employees Think law enforcement officers civil servants and university workers A 457 b plan is an employer sponsored tax deferred retirement savings vehicle available to some state and local government employees It works like a 401 k in that employees can divert a portion of their pay to their retirement account This provides an immediate tax break by reducing participants taxable income

LSR7 Voluntary Retirement Plan YouTube

https://i.ytimg.com/vi/9b5ue9tuuYM/maxresdefault.jpg

What Is A 457 Plan

https://cdn.investmentzen.com/wp-content/uploads/2017/05/What-is-a-457-Plan.jpg

what is a 457 - A 457 plan is a type of retirement plan offered by government and nonprofit organizations 457 plans allow you to defer a portion of your pay invest in various assets and pay taxes upon