what is a 457 plan and how does it work Just like a 401 k or 403 b retirement savings plan a 457 plan allows you to invest a portion of your salary on a pretax basis The money grows tax deferred waiting

What is the 457 Plan The 457 Plan is a type of tax advantaged retirement plan with deferred compensation The plan is non qualified it doesn t meet the guidelines of the Employee Retirement Income Security Act ERISA 457 plans are offered by state and local government employers as well as certain non profit employers A 457 b is a type of tax advantaged retirement plan for state and local government employees as well as employees of certain non profit organizations While the 457

what is a 457 plan and how does it work

what is a 457 plan and how does it work

https://i.ytimg.com/vi/i3bl74Q4jm8/maxresdefault.jpg

LSR7 Voluntary Retirement Plan YouTube

https://i.ytimg.com/vi/9b5ue9tuuYM/maxresdefault.jpg

457 Plan What Is A 457 b Plan And How Does It Work Styleveer Finance

https://styleveer.com/wp-content/uploads/2023/02/457-Plan.png

A 457 b plan is a type of retirement plan available only to public sector employees and certain types of tax exempt organizations It has several benefits including being pre taxed tax deferred and containing many investment options for 457 b plans are tax advantaged employer sponsored retirement plans offered to some government employees as well as employees of certain tax exempt organizations 457 b plans are split into 2 different categories governmental and non governmental depending on whether you work for the government or not Although

457 plans allow you to defer a portion of your pay invest in various assets and pay taxes upon withdrawal Many employers offer 457 plans in tandem with other retirement A 457 plan is a type of non qualified tax advantaged deferred compensation retirement plan available to certain state and local public employees and employees of some tax exempt organizations These plans allow participants to save money for retirement by deferring a portion of their salary and contributing it to the plan

More picture related to what is a 457 plan and how does it work

What Is A 457 Plan Defintion Types Benefits

https://images.inkl.com/s3/article/lead_image/17931156/457-plan.png

What Is A 457 b Inflation Protection

https://i.ytimg.com/vi/K1t9TE-0jP0/maxresdefault.jpg

What Is A 457 b Plan How Does It Work WealthKeel

https://wealthkeel.com/wp-content/uploads/2022/03/What-is-a-457b-Plan-How-Does-it-Work.png

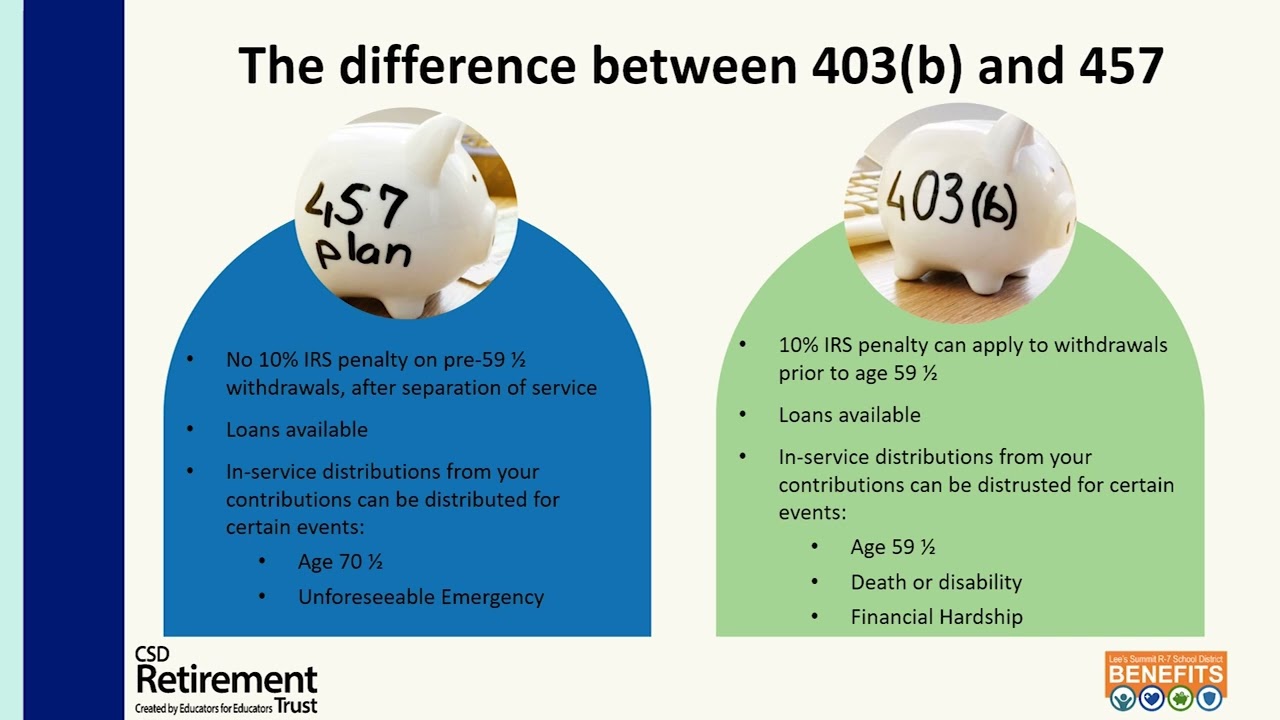

401 k plans and 457 plans are both tax advantaged retirement savings plans 401 k plans are offered by private employers while 457 plans are offered by state and local A 457 plan is a type of employer sponsored tax advantaged retirement account available to state and local government employees and certain usually highly paid nonprofit

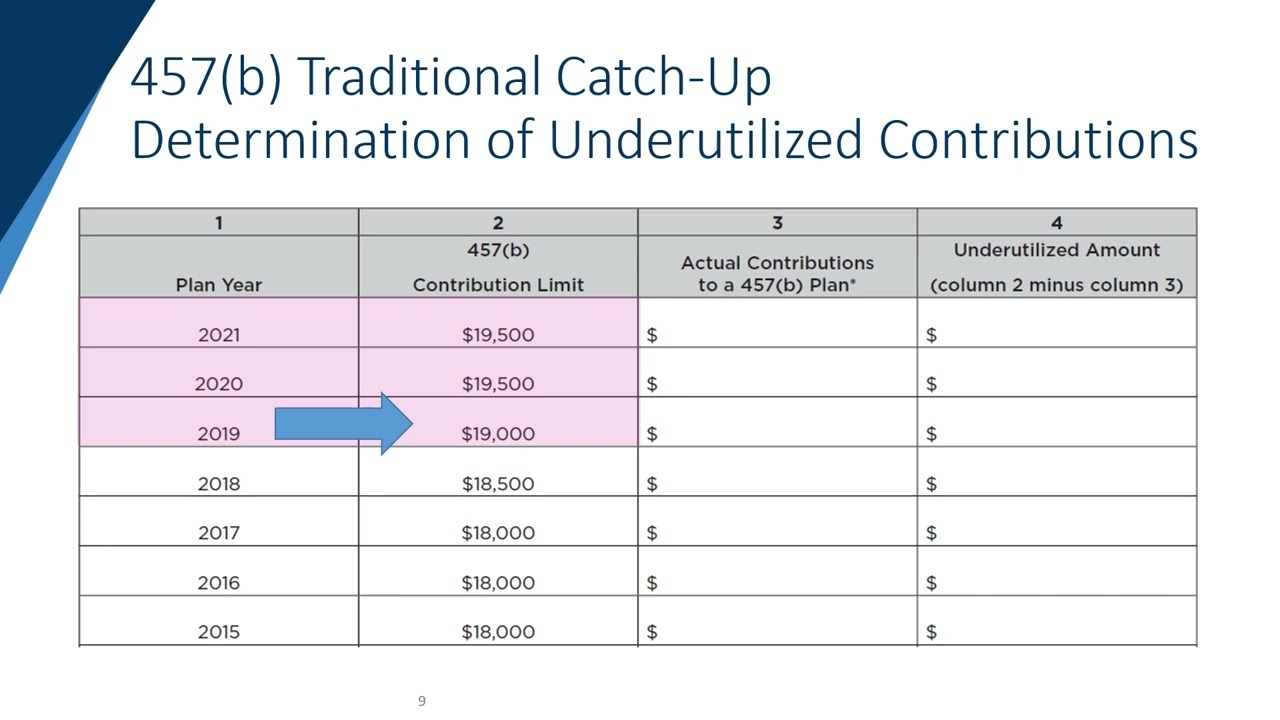

How do 457 b plans work Employers or employees through salary reductions contribute up to the IRC 402 g limit 22 500 in 2023 20 500 in 2022 19 500 in 2021 and in 2020 19 000 in 2019 on behalf of participants under the plan A 457 b plan is an employer sponsored tax favored retirement savings offered to public service employees and some nonprofit organization employees Like a 401 k plan a 457 b lets you contribute pre tax dollars from your paycheck invest it and not pay taxes on it until you withdraw it usually for retirement

How Much Can You Contribute To A 457 Retirement Plan For 2019

https://s.yimg.com/uu/api/res/1.2/_j6HtI.VYlB6ZDTYlO1lhg--~B/aD04NDI7dz0xMjgwO3NtPTE7YXBwaWQ9eXRhY2h5b24-/https://media.zenfs.com/en-us/kiplinger.com/cb528f054d3d576ae30cdf45015ed75e

How To Fill Out The 457 b Traditional Catch Up Form YouTube

https://i.ytimg.com/vi/lynrnjPA0kc/maxresdefault.jpg

what is a 457 plan and how does it work - A 457 b is similar to a 401 k in how it allows workers to put away money into a special retirement account that provides tax advantages letting you grow your savings tax deferred