what is a 457b vs 401k In terms of how a 457 b plan works it s very similar to a 401 k when it comes to who makes contributions how much they can contribute and the tax treatment of those contributions For 2023 workers with a 457 b plan can contribute up to 22 500 to their account through elective salary deferrals

457 b plan 401 k plan Can state or local government maintain Yes No unless adopted before May 5 1986 Written plan document required Yes Yes Eligible participants Employees or independent contractors who perform services for the employer may participate For the exclusive benefit of employees independent contractors can t The IRS allows you to save to both a 401 k and 457 b plan at the same time because a 457 b plan is a nonqualified plan Early Withdrawal Penalties Saving to both types of plans allows you to double your tax deferred savings and reduce the income on which you re taxed

what is a 457b vs 401k

what is a 457b vs 401k

https://cdn.educba.com/academy/wp-content/uploads/2019/02/403b-vs-457-infographics.jpg

457 Vs 401k What s The Difference 2023

https://www.annuityexpertadvice.com/wp-content/uploads/457-Vs.-401k.png

Diferencia Entre 401k Y Pensi n Opinion Duel

https://opinionduel.com/wp-content/uploads/diferencia-entre-401k-y-pension.png

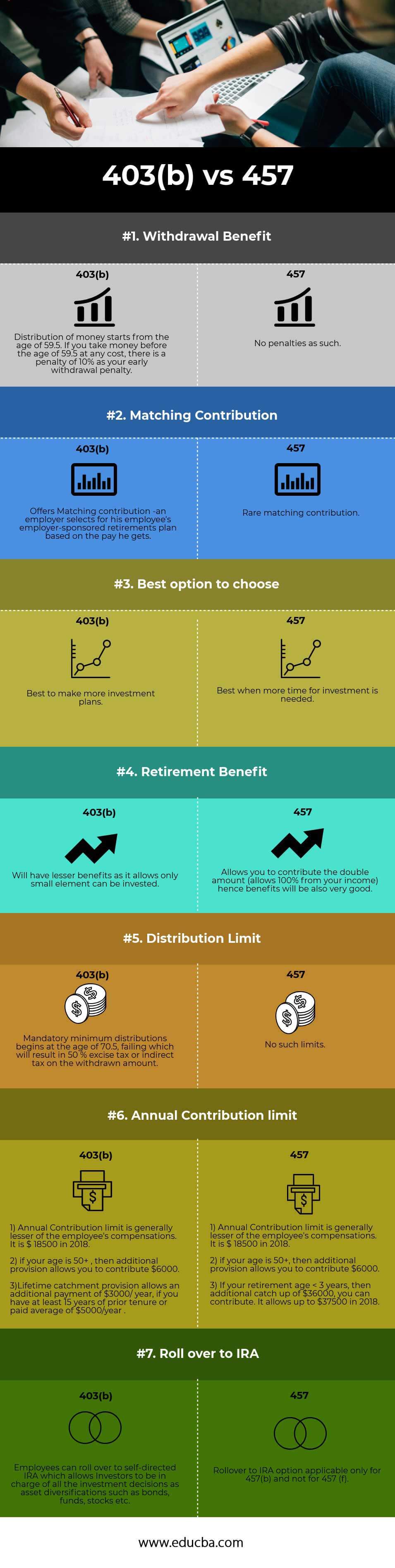

Learn the differences and similarities between 401 k and 457 retirement savings plans Understand the rules regarding contributions and withdrawals 457 b vs 403 b Although both 457 b s and 403 b s are employer sponsored retirement plans for employees of the government and tax exempt organizations there are some key differences Flexible withdrawals Unlike 403 b s and 401 k s you can withdraw funds from your 457 b before age 59 penalty free if you re no longer

The main difference between them is who can participate and how they are taxed 457 b plans are employer sponsored deferred compensation plans that offer tax advantages to employees They are mainly for workers at What Is the Difference Between a 457 b Plan and a 457 f Plan The 457 b plan is a version of the 401 k plan that is designed for public and nonprofit workers

More picture related to what is a 457b vs 401k

403 b Withdrawal Rules For 2023 The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/403b-vs-457b-retirement-plans-infographic.width-880.webp

403 b Withdrawal Rules For 2023 The Motley Fool In 2023 Simple Ira

https://i.pinimg.com/736x/e8/65/5b/e8655b174af9a9e4e87643ef4958dec7.jpg

401k Contribution Limits Employer Match Does It Count Toward Limit

https://www.annuityexpertadvice.com/wp-content/uploads/does-employer-match-count-towards-401k-limit.png

Getty A 457 b is a type of tax advantaged retirement plan for state and local government employees as well as employees of certain non profit organizations While Key Differences Between 457 b and 401 k There are key differences between the two plans and it s important to understand what those differences mean for your retirement results The most significant factors include Employee Eligibility 457 b plans are limited to employees of state and local governments as well as tax exempt

A 457 b is a type of retirement plan which is offered by either a local or state government agency or a nonprofit organization They are not as common as 401 k plans You ll find that there are some similarities but also some important differences between these plans too In terms of how a 457 b plan works it s very similar to a 401 k when it comes to who makes contributions how much they can contribute and the tax treatment of those contributions For 2019

457b Vs 401k WHAT S THE DIFFERENCE YouTube

https://i.ytimg.com/vi/ZDH8qKMrDGw/maxresdefault.jpg

Retirement Plan Contribution Limits Will Increase In 2020 Ward And

https://jdsupra-html-images.s3-us-west-1.amazonaws.com/7cf3a793-0db4-4a3e-81a6-dba037a8c2c2-book-1.jpg

what is a 457b vs 401k - A 457 b plan is an employer sponsored tax deferred retirement savings vehicle available to some state and local government employees It works like a 401 k in that employees can divert a portion of their pay to their retirement account This provides an immediate tax break by reducing participants taxable income