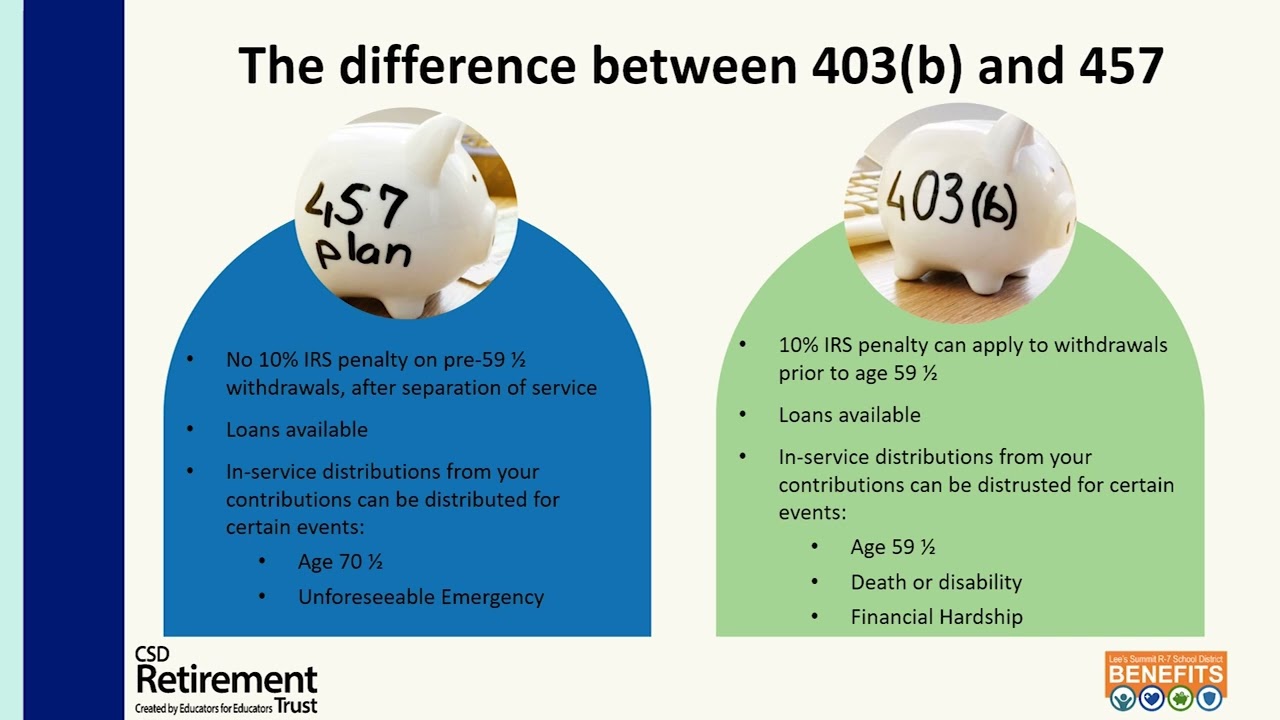

what is a 457 plan A 457 plan is a type of retirement plan offered by government and nonprofit organizations 457 plans allow you to defer a portion of your pay invest in various assets and pay taxes upon

A 457 b is a type of tax advantaged retirement plan for state and local government employees as well as employees of certain non profit organizations While the 457 b shares a few Just like a 401 k or 403 b retirement savings plan a 457 plan allows you to invest a portion of your salary on a pretax basis The money grows tax deferred waiting for you to decide

what is a 457 plan

what is a 457 plan

https://i.ytimg.com/vi/9b5ue9tuuYM/maxresdefault.jpg

What Is A 457 Plan Defintion Types Benefits TheStreet

https://www.thestreet.com/.image/t_share/MTk2MzI3Njk4ODkxNTQ3OTUy/457-plan.png

457 Deferred Compensation Plan Choosing Your Gold IRA

https://static.twentyoverten.com/58ae1c41dd96335b30ab0d96/GEkTMfMaJc/2-Types-of-457b-Plans-or-WealthKeel.png

The 457 plan is a type of nonqualified tax advantaged deferred compensation retirement plan that is available for governmental and certain nongovernmental employers in the United States The employer provides the plan and the employee defers compensation into it on a pre tax or after tax Roth basis 457 Plans By comparison 457 b plans are IRS sanctioned tax advantaged employee retirement plans offered by state and local public employers and some nonprofit employers They are

The 457 Plan is a type of tax advantaged retirement plan with deferred compensation The plan is non qualified it doesn t meet the guidelines of the Employee Retirement Income Security Act ERISA 457 plans are offered by state and local government employers as well as certain non profit employers A 457 plan is a type of non qualified tax advantaged deferred compensation retirement plan available to certain state and local public employees and employees of some tax exempt organizations These plans allow participants to save money for retirement by deferring a portion of their salary and contributing it to the plan

More picture related to what is a 457 plan

What Is A 457 b Plan How Does It Work Inflation Protection

https://i.ytimg.com/vi/i3bl74Q4jm8/maxresdefault.jpg

What Is A 457 Retirement Plan And Should I Use It ACEP Now

https://www.acepnow.com/wp-content/uploads/2023/02/457-art-feb-2023-642x336.png

403 b Withdrawal Rules For 2023 The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/403b-vs-457b-retirement-plans-infographic.width-880.webp

A 457 plan is a type of employer sponsored tax advantaged retirement account available to state and local government employees and certain usually highly paid nonprofit employees Some A 457 plan is a type of deferred compensation plan that s used by certain employees when saving for retirement The key thing to remember is that a 457 plan isn t considered a qualified retirement plan based on the federal law known as ERISA from the Employee Retirement Income Security Act of 1974

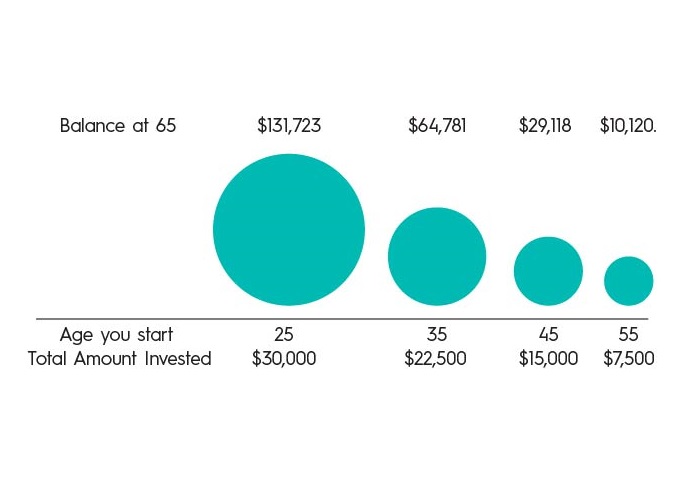

A 457 plan is a retirement savings scheme in which individuals contribute a portion of the income which is deducted without charging any tax The tax however is applied to this savings amount at the time of withdrawal mostly after retirement Therefore the amount gets enough time to grow before it becomes taxable A 457 b plan is an employer sponsored tax deferred retirement savings vehicle available to some state and local government employees It works like a 401 k in that employees can divert a portion of their pay to their retirement account This provides an immediate tax break by reducing participants taxable income

:max_bytes(150000):strip_icc()/457plan.asp-final-f27170b983d0496e86a246a0c1cb4602.png)

457 Plan

https://www.investopedia.com/thmb/S1lp4vKskF2NDwKfF2294Mj1uuA=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/457plan.asp-final-f27170b983d0496e86a246a0c1cb4602.png

Deferred Compensation Plan Calculator ErinneCathal

https://retirement.wyo.gov/-/media/Images/DC-and-Education/Quick-Start/457-Plan-QuickStart-3.ashx?bc=White&h=485&iar=0&w=685&hash=E247CE235550A6F7D756FAFA3FE73BF9

what is a 457 plan - Definition A 457 b plan is an employer sponsored tax favored retirement savings offered to public service employees and some nonprofit organization employees Like a 401 k plan a 457 b lets you contribute pre tax dollars from your paycheck invest it and not pay taxes on it until you withdraw it usually for retirement Key Takeaways