what expenses can an s corp deduct Did you know S Corps may be eligible to deduct the wages paid to employees and employee benefits This can be done by listing them on Form 1120 S S Corp tax return as expenses Make sure you include any

S Corp Tax Deductions What Can I Write Off An S Corp has several tax benefits compared to other entities Yet these benefits are null if your business fails to generate enough income And according to the IRS S corp owners can also deduct a corresponding percentage of expenses such as rent or mortgage interest utilities business related phone expenses insurance and costs for or

what expenses can an s corp deduct

what expenses can an s corp deduct

https://sanepo.com/en/wp-content/uploads/2023/01/can-s-corp-deduct-health-insurance_4d8164b2c.jpg

How S corp Owners Can Deduct Health Insurance

https://www.peoplekeep.com/hubfs/All Images/Featured Images/How S Corp owners can deduct health insurance_featured.jpg#keepProtocol

Accounts Expense Report Template Sample Images And Photos Finder

https://i.pinimg.com/originals/d0/e9/5e/d0e95eac3b3732ea691f3c344d4a2c2d.jpg

Not everything can be deducted as an S Corp but there is a long list of allowable deductions The key is to be aware of and understand the S corp deductions so that expenses can be properly allocated in accounting software An S corporation is a business entity that is limited to a maximum of 100 shareholders By following certain restrictions this type of business can be treated as a pass

Your LLC or S Corp can deduct fees paid to accountants lawyers consultants and other service professionals However the expenses must be directly related to your current business and not for work to acquire business If you are an S corp owner that incurs business related travel expenses you must submit an expense report to achieve reimbursement by the S corp Travel expenses include

More picture related to what expenses can an s corp deduct

Expense Claim Form Template Excel Printable Word Searches

https://i2.wp.com/wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

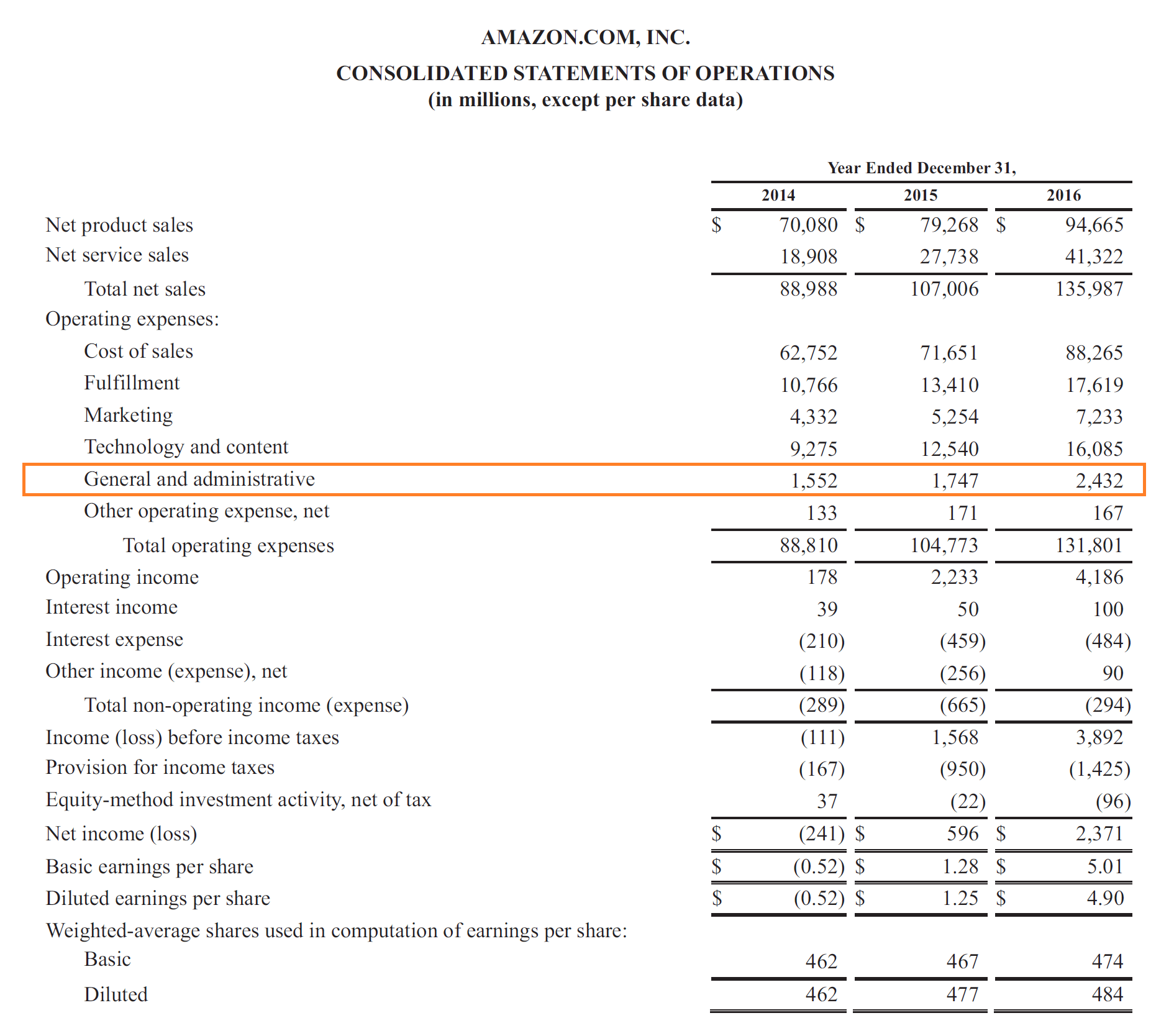

SG A Expense Selling General Administrative Guide Examples

https://cdn.corporatefinanceinstitute.com/assets/amazon-sga-expense.png

AAAR Workshop Commissions Deductions And Taxes Oh My With Penelope

https://res.cloudinary.com/micronetonline/image/upload/c_crop,h_1545,w_2001,x_-1,y_0/f_auto/q_auto:best/f_auto/q_auto:best/v1707687478/tenants/3ca9ab82-8ed3-41e3-9c6b-ae9ab17e7311/cd8f2ba6b7bc47818f3dd8432c9f4e4f/Commissions-Deductions-Taxes-2-22-24.png

S corp is a special status granted to a limited liability company under the federal tax law For the purpose of taxation an S corporation passes through its earnings gains losses and You can deduct the costs of a home office if you are filing a Schedule C Under the Tax Cuts and Jobs Act TCJA employees working remotely can no longer deduct home office

However if you elect to take bonus depreciation you can deduct up to 18 000 in year 1 Cargo vans semi trucks or vehicles that weigh more than 6 000 pounds these can generally be The IRS said in Rev Proc 2021 20 that fiscal year taxpayers who filed a 2020 return on or before Dec 27 2020 can deduct eligible expenses on their 2021 return rather

What Are Expenses Its Types And Examples Tutor s Tips

https://i0.wp.com/tutorstips.com/wp-content/uploads/2020/02/What-are-Expenses-1.png?resize=1080%2C608&ssl=1

UPDATED Can I Deduct My Business Related Auto Expenses On My S Corp

http://static1.squarespace.com/static/5ae5e31a1aef1d32d67003b6/5ae8e53bddff691e54e9a10a/5c58c8600d92970e36dfe8f6/1603904846325/1.png?format=1500w

what expenses can an s corp deduct - Not everything can be deducted as an S Corp but there is a long list of allowable deductions The key is to be aware of and understand the S corp deductions so that expenses can be properly allocated in accounting software