what expenses can a corporation write off While you may already know you can write off expenses like rent and office supplies there are many not so obvious tax deductions too To fill in the gaps your friends at TurboTax have put together a comprehensive guide

The main deductible categories are direct expenses indirect expenses and interest on debt Non deductible expenses include bribes kickbacks fines and political contributions Corporations and small businesses have a broad range of expenses that reduce taxable profits An expense write off increases expenses on an income statement lowering profit and taxable

what expenses can a corporation write off

what expenses can a corporation write off

https://lirp.cdn-website.com/b59b5872/dms3rep/multi/opt/Blogpost_14-1920w.jpg

What Expenses Can I Claim For The Accountancy Partnership

https://www.theaccountancy.co.uk/wp-content/uploads/2014/02/manage-your-expenses-1110x511.jpg

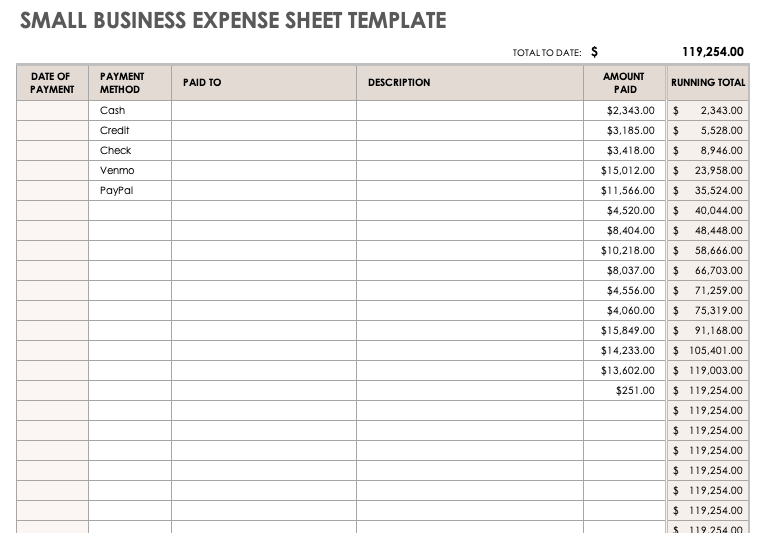

Small Business Printable Expense Report Template Printable Templates

https://www.smartsheet.com/sites/default/files/IC-Small-Business-Expense-Sheet-Template.png

All of these deductions can be claimed by sole proprietorships as well as C corps and S corps partnerships and LLCs although there might be different rules for each 1 Startup and Below is a mapping to the major resources for each topic For a full list go to the Publication 535 for 2022 PDF Also note that Worksheet 6A that was in chapter 6 is now new

Writing off business expenses can significantly reduce your tax liability but it s crucial to follow the proper steps to ensure compliance with IRS regulations Let s explore the What allowable business expenses can I claim Many expenses are potentially tax deductible depending on the nature of your business and its ongoing requirements Here are some of the common ones Office costs

More picture related to what expenses can a corporation write off

Accounts Expense Report Template Sample Images And Photos Finder

https://i.pinimg.com/originals/d0/e9/5e/d0e95eac3b3732ea691f3c344d4a2c2d.jpg

How To Categorize Business Expenses In My Home Budget The Mumpreneur

https://s3.amazonaws.com/external_clips/attachments/5274912/original/how-to-organize-business-expenses.png?1675457777

What Expenses Can I Include In My Self Assessment Tax Return YouTube

https://i.ytimg.com/vi/RXgfncCEk7k/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGA8gZShOMA8=&rs=AOn4CLA4MBdKzWCeyrb653lPSIAI686BLA

You can use one of two methods to write off these costs The regular method allows you to deduct actual expenses based on the percentage of your home used for business while the simplified method allows you to Knowing which expenses you can deduct from your business income can be tricky Get a take a closer look at business expense deductions including travel entertainment meals client gifts and vehicle expenses

Being able to write off certain expenses can allow you to increase cash flow reduce your taxable income amount and focus on growing your business into the future Tax What Business Expenses Can I Write Off 1 Self Employment Taxes If your business is set up as an S corp you can deduct part of your self employment taxes

Expense Claim Form Template Excel Printable Word Searches

https://i2.wp.com/wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

What Are Expenses Its Types And Examples Tutor s Tips

https://i0.wp.com/tutorstips.com/wp-content/uploads/2020/02/What-are-Expenses-1.png?resize=1080%2C608&ssl=1

what expenses can a corporation write off - Below is a mapping to the major resources for each topic For a full list go to the Publication 535 for 2022 PDF Also note that Worksheet 6A that was in chapter 6 is now new