what expenses can an s corp write off Did you know S Corps may be eligible to deduct the wages paid to employees and employee benefits This can be done by listing them on Form 1120 S S Corp tax return as expenses Make sure you include any

And according to the IRS S corp owners can also deduct a corresponding percentage of expenses such as rent or mortgage interest utilities business related phone expenses insurance and costs for or depreciation Your LLC or S Corp can deduct fees paid to accountants lawyers consultants and other service professionals However the expenses must be directly related to your current business and

what expenses can an s corp write off

what expenses can an s corp write off

https://wordtemplates.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

What Expenses Can I Claim For The Accountancy Partnership

https://www.theaccountancy.co.uk/wp-content/uploads/2014/02/manage-your-expenses-1110x511.jpg

Accounts Expense Report Template Sample Images And Photos Finder

https://i.pinimg.com/originals/d0/e9/5e/d0e95eac3b3732ea691f3c344d4a2c2d.jpg

1 Home Office Deduction 2 Self Employment Tax Deduction And Avoidance 3 Depreciation Deduction Sec 179 4 20 Pass Through Deduction QBI 5 Vehicle Tax Wondering what deduction items local taxes depreciation and expenses for business purposes you can write off to lower your taxable income Dive into our comprehensive guide on the top

The S corporation can pay you for the costs of a home office under an accountable plan for employee business expense reimbursement Accountable plan for s corporation deductions Employee wages and most employee benefits including your own can be deducted as long as you remember to list them as expenses on your Form 1120 S which is

More picture related to what expenses can an s corp write off

Paying Expenses To Non Employees Ad Hoc Costs ExpenseIn

https://img2.storyblok.com/1380x0/f/103607/1748x1240/d4748edacd/paying-expenses-to-non-employees-ad-hoc-expenses.jpg

What Expenses Can I Include In My Self Assessment Tax Return YouTube

https://i.ytimg.com/vi/RXgfncCEk7k/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGA8gZShOMA8=&rs=AOn4CLA4MBdKzWCeyrb653lPSIAI686BLA

How To Get Paid In An S Corp

https://stevebizblog.com/wp-content/uploads/2017/10/Get-Paid-S-Corp2-768x768.jpg

Allowable vehicle expense deductions include gas electric charging costs maintenance repairs parking fees road tolls and more Charity Charitable contributions are allowable tax deductions for S S corp tax deductions are passed through to the shareholders who can then set them off against their incomes while calculating their individual tax liabilities What Is an S Corporation S corp

Typically S corporation deductions are ordinary and necessary business expenses incurred by the S corp that reduce the taxable income These expenses can include Some allowed reimbursable expenses include property taxes utilities mortgage interest and general repairs If rather than utilizing space in your personal home you pay rent for an individual office or time shared space you

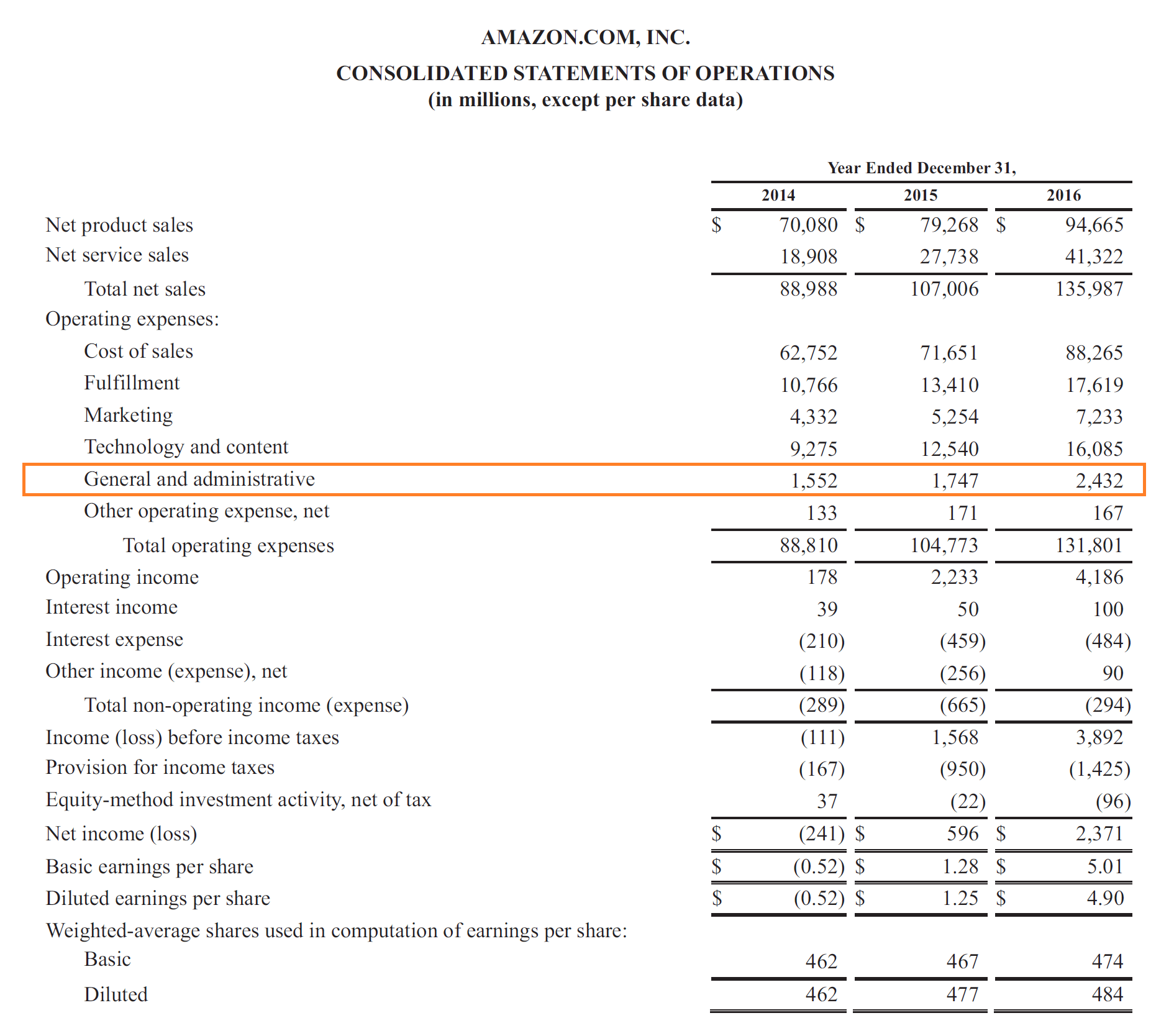

SG A Expense Selling General Administrative Guide Examples

https://cdn.corporatefinanceinstitute.com/assets/amazon-sga-expense.png

Key Considerations For ABLE Accounts Convergence Class VA

https://www.convergenceclass.com/sites/stephenadekeye.us1.advisor.ws/files/images/9._what_expenses_can_able_accounts_pay_for_-_pic.jpg

what expenses can an s corp write off - Wondering what deduction items local taxes depreciation and expenses for business purposes you can write off to lower your taxable income Dive into our comprehensive guide on the top