Rental Income And Expense Worksheet Free 1 Income and expenses are an essential part of effectively managing your rental 2 Personalize your expenses with this worksheet 3 Totals are automatically calculated as you enter data 4 This sheet will also track late fees and any maintenance costs

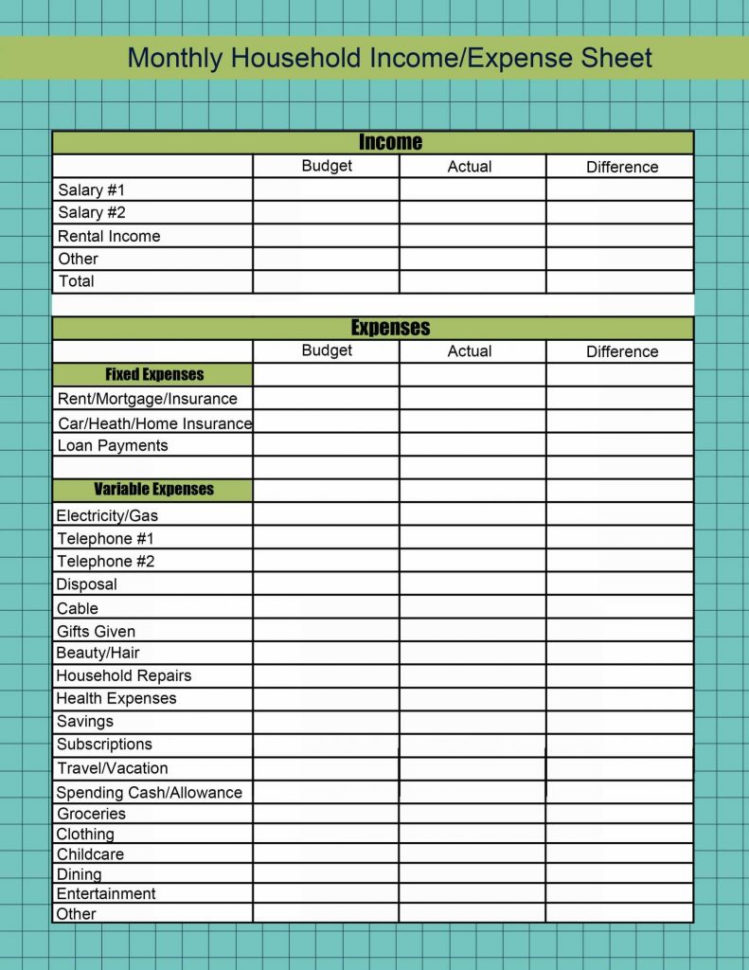

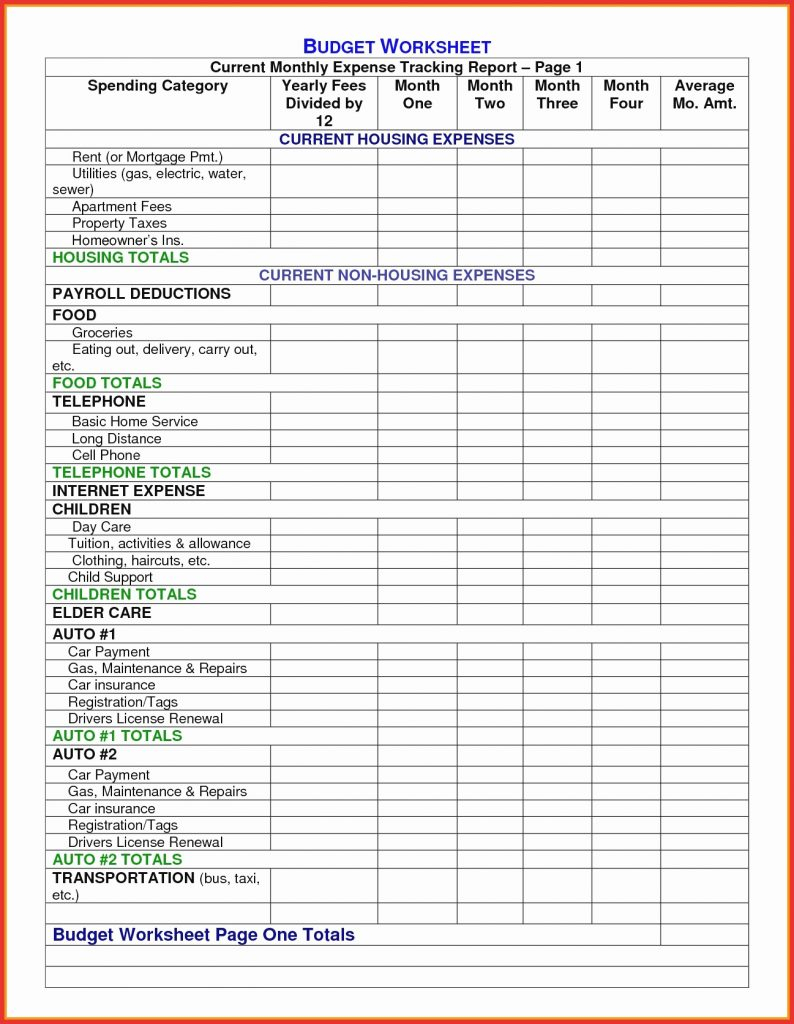

A good rental property spreadsheet organizes income and expense data from each real estate investment and forecasts their potential profitability Stessa has a simple rental property analysis spreadsheet that you can download for free Learn more about how to use a rental property analysis spreadsheet Rental property expenses Use the worksheet below to record and track your rental property income and expenses Allowable expenses may be deducted from your gross rental income to derive your adjusted gross rental income Tracking your rental income and expenses quarterly will assist in deriving your estimated quarterly taxes owed

Rental Income And Expense Worksheet Free

Rental Income And Expense Worksheet Free

https://db-excel.com/wp-content/uploads/2019/01/rental-income-and-expense-spreadsheet-template-throughout-rental-expense-spreadsheet-property-expenses-template-australia-749x970.jpg

Rental Income And Expense Spreadsheet Template Db excel

https://db-excel.com/wp-content/uploads/2019/01/rental-income-and-expense-spreadsheet-template-with-regard-to-rental-expense-spreadsheet-property-expenses-template-australia.jpg

Rental Income And Expense Worksheet PDF

https://www.templateegg.com/image/catalog/30814-Rental Income And Expense Worksheet PDF.PNG

Real estate investors use a rental income and expense worksheet to accurately track cash flow each and every month calculate return on investment or ROI identify opportunities to increase revenues and make sure they are claiming every tax deduction the IRS allows Personal Use of Dwelling Unit Including Vacation Home 17 Dividing Expenses 17 Dwelling Unit Used as a Home 18 Reporting Income and Deductions 19 Worksheet 5 1 Worksheet for Figuring Rental Deductions for a Dwelling Unit Used as a Home 20 Chapter 6

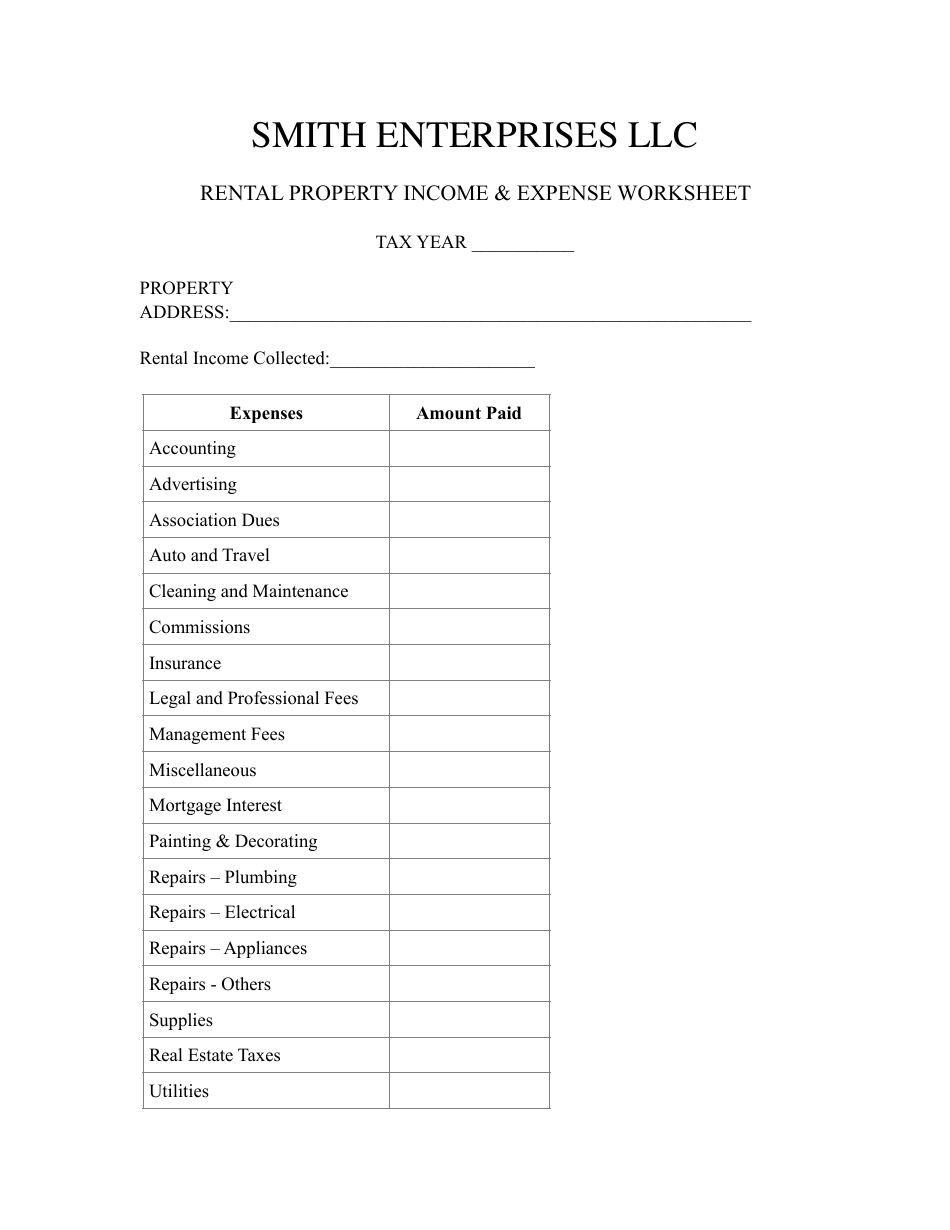

A Free Rental Income Expenses Spreadsheet If you have been managing your own rental property you should know that you need to report rental income on Schedule E of your income taxes Schedule E is fairly simple You just need to report the past year s rental income and expenses for each rental property Report income and expenses related to personal property rentals on Schedule C Form 1040 PDF if you re in the business of renting personal property Report income on line 8l and expenses on line 24b of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF if you re not in the business of renting personal property Rental Income

More picture related to Rental Income And Expense Worksheet Free

Rental Income and Expense Worksheet PropertyManagement

https://www.propertymanagement.com/wp-content/uploads/2019/02/sheet-screenshot.png

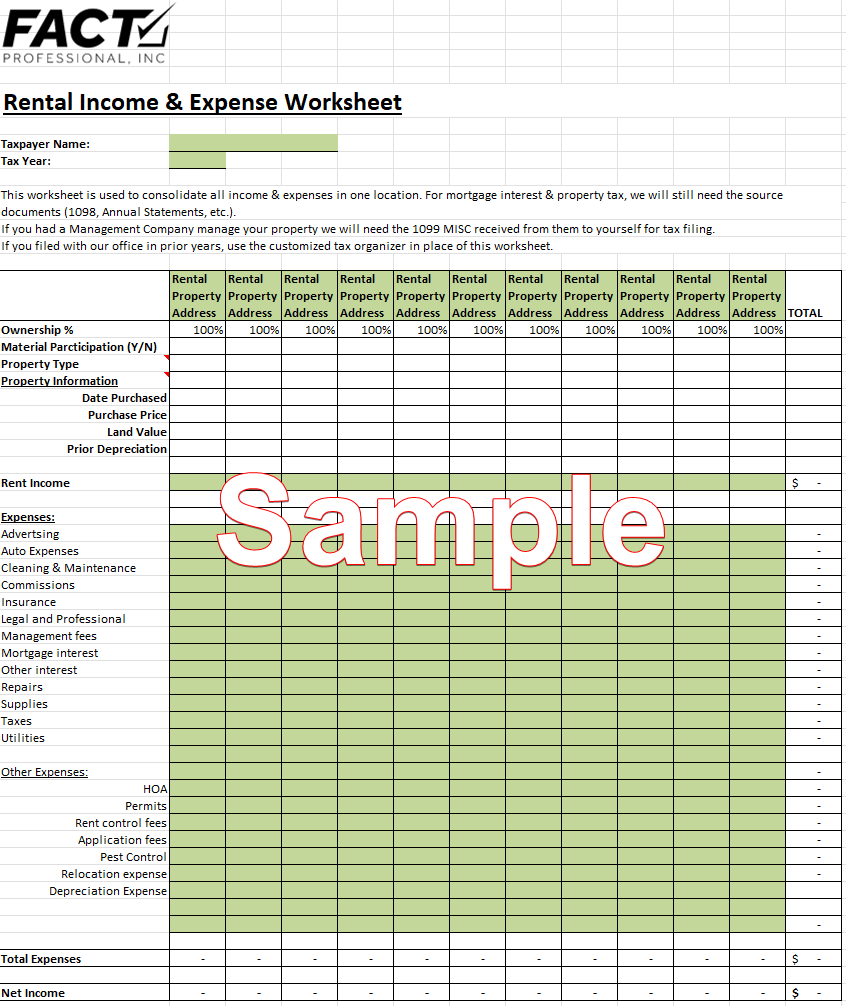

Rental Income and Expense Worksheet Fact Professional Accounting

https://factprofessional.com/wp-content/uploads/2022/08/image.png

Rental Property Income Expense Worksheet Template Smith Enterprises

https://data.templateroller.com/pdf_docs_html/270/2707/270747/rental-property-income-expense-worksheet-template-smith-enterprises_print_big.png

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs You can deduct the ordinary and necessary expenses for managing conserving and maintaining your rental The IRS broadly defines rental property expenses as operating expenses repairs and depreciation The benefits of accurately tracking the expenses of a rental property include calculating profit or loss monitoring for unexpected costs claiming tax deductions to which you are entitled and creating a digital paper trail for audit purposes

A rental property Excel worksheet is a tool that is often used by rental property owners to analyze several real estate properties and compare them based on numerous types of data A good alternative would be to use an online worksheet like Google Sheets Additional rental income Any additional money earned from the tenant like income from utilities laundry storage or parking fees Use our free rental income and expense worksheet to keep track of your monthly cash flow How to calculate ROI on rental property First calculate the return on investment by subtracting the total gains from the cost

Printable Rental Income And Expense Worksheet

https://i.pinimg.com/originals/ab/81/d4/ab81d41f7a91c95c6d3872cfcee4ba4b.png

Rental Income and Expense Worksheet Ideal REI

https://i1.wp.com/idealrei.com/wp-content/uploads/2017/12/expenses.png?resize=734%2C359&ssl=1

Rental Income And Expense Worksheet Free - One of the biggest benefits of a rental property spreadsheet is the income and expense worksheet it provides Property owners need a clear regularly updated document featuring all incoming and outgoing finances Logging the details surrounding monthly rental income is no walk in the park especially if you have several properties to manage