is rent income an expense Key Takeaways Rent expense is the cost a business pays to occupy a property for an office retail space storage space or factory For a retail business rent expense can be one of

Definition Rent income refers to revenue earned from leasing out properties such as commercial spaces to third parties Classification and Presentation of Rent Income Rent Income is an income account It is presented in the income statement What is Rent Expense Rent expense is an account that lists the cost of occupying rental property during a reporting period This expense is one of the larger expenses reported by most organizations after the cost of

is rent income an expense

is rent income an expense

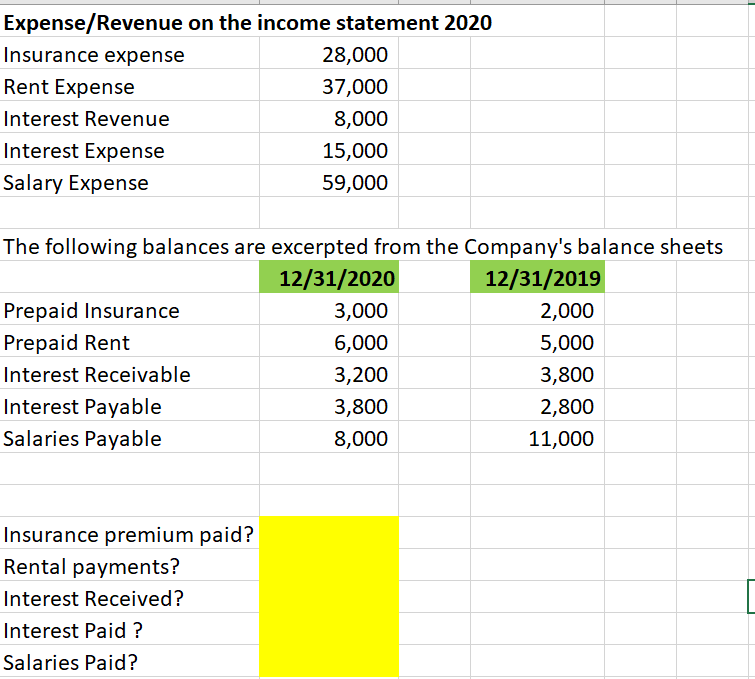

https://media.cheggcdn.com/media/330/3300ed09-cef1-4c26-b9ef-ab5f9f343c05/phpVli05o.png

Rent Income Excel Template Online Tax File Rent Expense Etsy Ireland

https://i.etsystatic.com/12299465/r/il/1ea198/3707891289/il_794xN.3707891289_prnz.jpg

What Type Of Account Is Rent Expense Financial Falconet

https://www.financialfalconet.com/wp-content/uploads/2023/03/What-type-of-account-is-rent-expense.jpg

Rent expense is an expense account representing the cost incurred by an organization for the right to use or occupy a specified asset that they do not own For many companies rent is a significant expense incurred to support their business Sometimes rent expense can be incurred for buildings warehouses or offices occupied by the organization Rent expense refers to the cost incurred by individuals or businesses for the use of property equipment or other assets owned by someone else It is a common expenditure for both commercial and residential properties and it needs to be properly recognized and recorded in financial statements

Rent Expense is the cost a business incurs for using a property such as an office retail space factory or storage facility Unlike variable expenses it represents a fixed operating cost for a business Rental costs are frequently subject to a one or two year contract between the lessor and lessee with renewal options Rent expense definition Under the accrual basis of accounting the account Rent Expense will report the cost of occupying space during the time interval indicated in the heading of the income statement whether or not the rent was paid within that period

More picture related to is rent income an expense

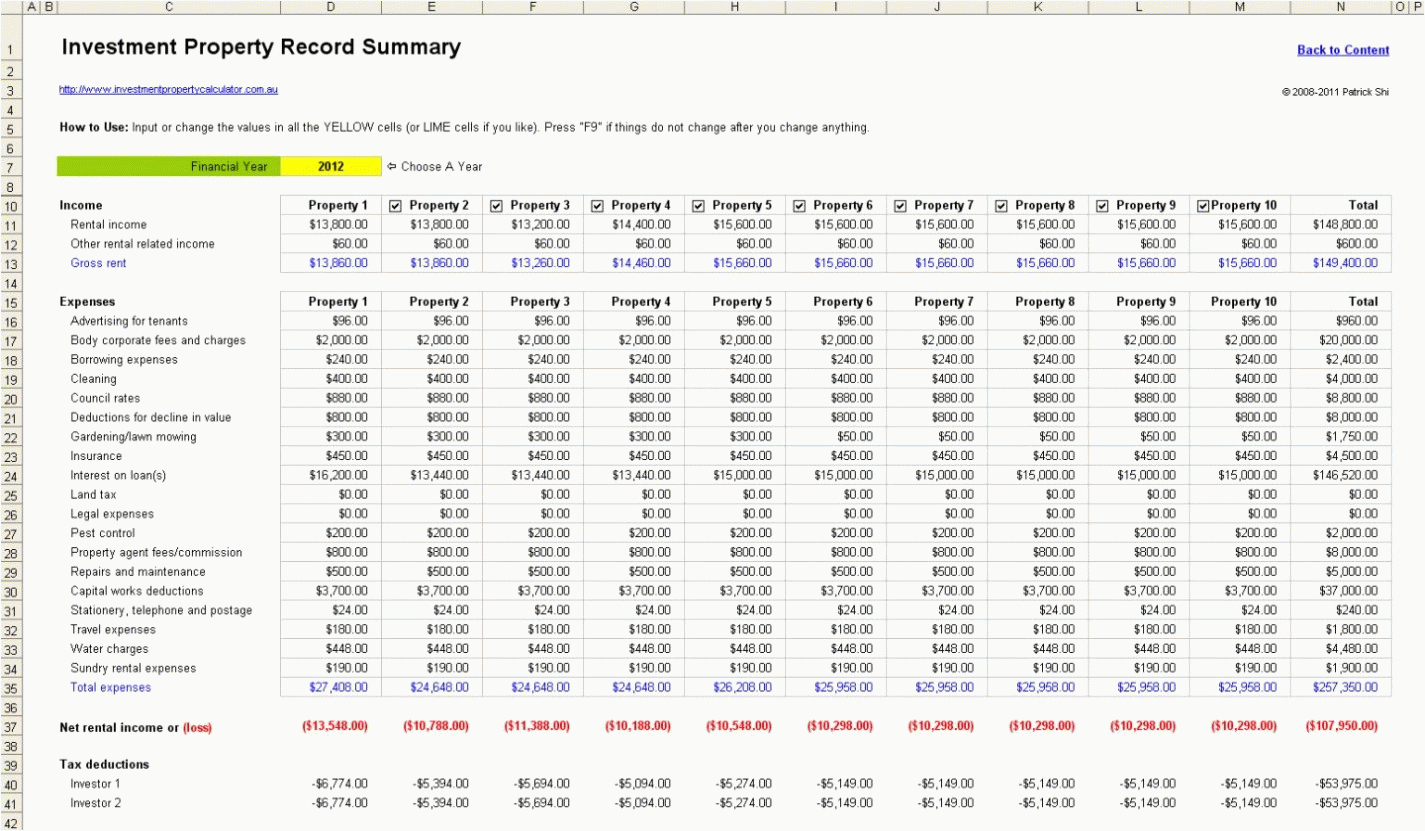

Rental Income Template

https://db-excel.com/wp-content/uploads/2019/01/rental-income-and-expense-spreadsheet-template-pertaining-to-rental-property-expensespreadsheet-uk-management-excel-template.gif

Printable Income And Expenses Spreadsheet Small Business For Self Self

https://dremelmicro.com/wp-content/uploads/2020/07/printable-income-and-expenses-spreadsheet-small-business-for-self-self-direction-budget-template-sample.jpg

Free Rental Property Income And Expenses Worksheet Commercial Real

https://dremelmicro.com/wp-content/uploads/2020/08/free-rental-property-income-and-expenses-worksheet-commercial-real-estate-budget-template-excel.png

Rent Expense refers to the cost incurred for the right to use a commercial space or a property belonging to another entity Classification and Presentation of Rent Expense Rent Expense is an expense account It is part of operating expenses in the income statement Rent expense is neither an asset nor a liability it is an expense However the associated rent payable is a liability and any prepayments of rent may be recorded as an asset prepaid rent on the balance sheet Rent Expense and Operating Expenses For businesses rent expense is typically classified as an operating expense

Is rent expense an expense 4 Is rent expense an asset or liability or equity 5 Is rent considered a liability or expense 6 What type of account is rent paid 7 Where does rent paid go on a balance sheet 8 How do you record rent 9 What category is rent expense 10 Is rent current liabilities 11 What type of asset is rent 12 Rent expense refers to the cost of rent as an operating expense which is used in financial reports Rent expenses are included with other expenses to determine the profitability of your

Rental Income Tax Property Investor s Guide Savings au

https://www.savings.com.au/contentAsset/image/fedab857-007a-4e81-88df-807db7bab5f6/fileAsset/filter/Webp/webp_q/50

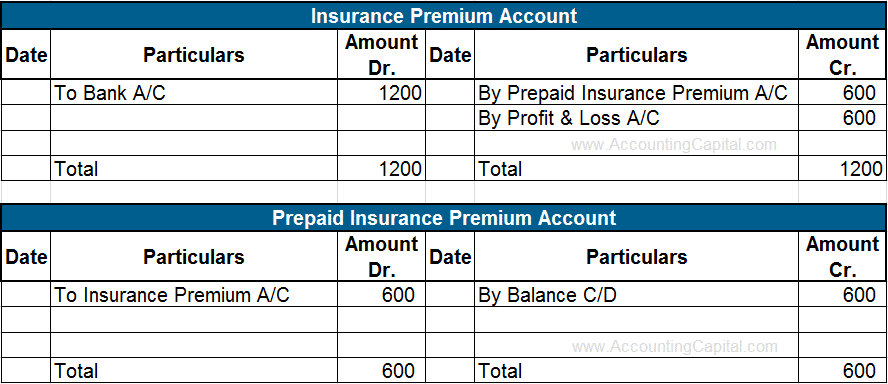

Unbelievable Treatment Of Prepaid Expenses In Profit And Loss Account

https://www.accountingcapital.com/wp-content/uploads/2018/05/Treatment-of-Prepaid-Expenses-in-Ledger-Accounts-5.png

is rent income an expense - Topic no 414 Rental income and expenses Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income In general you can deduct expenses of renting property from