is free rent taxable income Sorted by 6 In some cases rent free lodging can be excluded from taxable compensation to the employee The IRS Publication 15 b lists the

Think of it this way Although Sue s nanny would be living in the house for free the money the nanny saves on rent An IRS rule can sometimes be used but not abused to claim tax free rental income on your home Image credit Getty Images By Kelley R

is free rent taxable income

is free rent taxable income

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

What is taxable income Financial Wellness Starts Here

https://blog.navitmoney.com/wp-content/uploads/2020/07/what-is-taxable-income.png

The IRS treats rental income as regular income for tax purposes This means you ll need to add your rental income to any other income sources you may have when you file your Topic no 414 Rental income and expenses Cash or the fair market value of property or services you receive for the use of real estate or personal

Rental income is any payment you receive for the use or occupation of property You must report rental income for all your properties In addition to The house is appraised at 200 000 The average rent paid for comparable university lodging by persons other than employees or students is 14 000 a year

More picture related to is free rent taxable income

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

Income Stream Stock Illustrations 454 Income Stream Stock Clip Art

https://clipart-library.com/2023/27b47ca29ec3a8660d15ca576166f48f.jpg

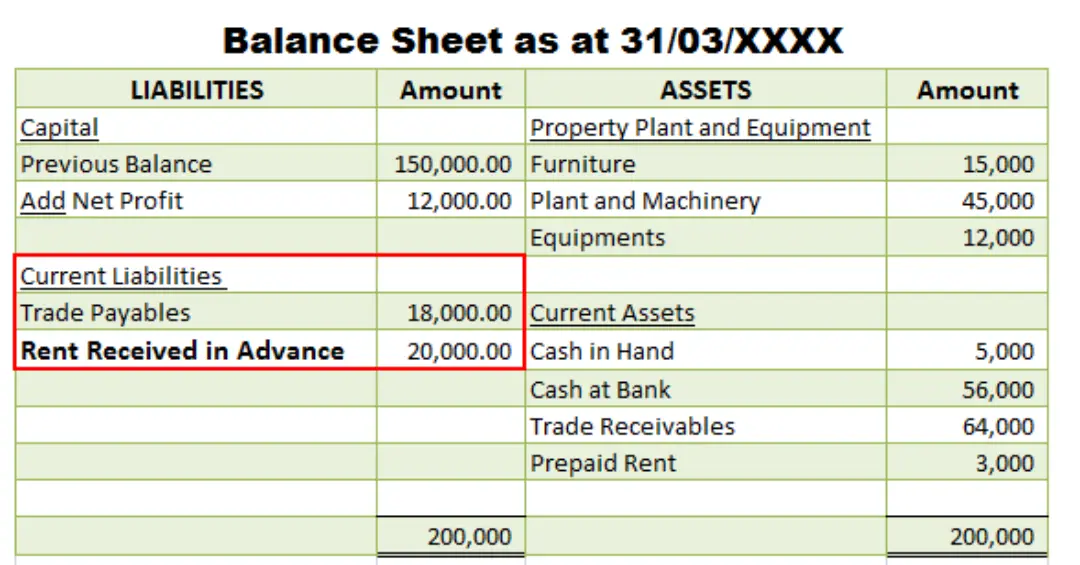

Is Rent Received In Advance Included In Taxable Income

https://www.accountingcapital.com/wp-content/uploads/2020/08/Advance-Rent-1080x565.png

Money Personal tax Income Tax Guidance Work out your rental income when you let property Find out about tax as a landlord and how to work The first 1 000 of your income from property rental is tax free This is your property allowance Contact HM Revenue and Customs HMRC if your income

8 min read CONTENTS Show As per the Income Tax Act employees receiving rent free accommodation RFA from their companies are eligible to pay tax on PLR 8128117 All of the tax rules for hiring employees apply to resident managers but there are a couple of special rules you need to know about No Payroll Taxes

T ml Rejtett tutal s Tax Payable Calculator Megfejt Tengerpart Kinyit

https://www.hrblock.com/tax-center/wp-content/uploads/2013/01/how-to-calculate-taxable-income.jpg

Taxable Income Vs Nontaxable Income What You Should Know Winning

https://winningstockplays.com/wp-content/uploads/2022/04/5803-taxable-income-vs-nontaxable-income-what-you-should-know.jpg

is free rent taxable income - Rental income is any payment you receive for the use or occupation of property You must report rental income for all your properties In addition to