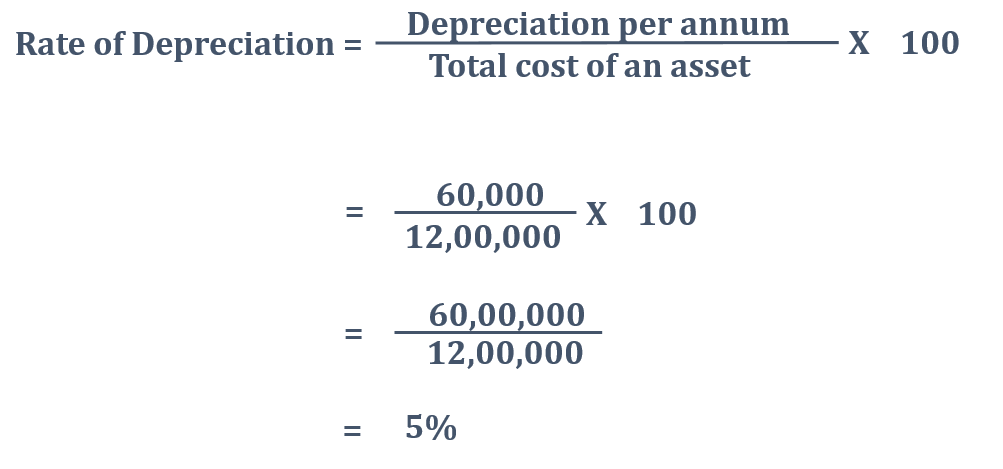

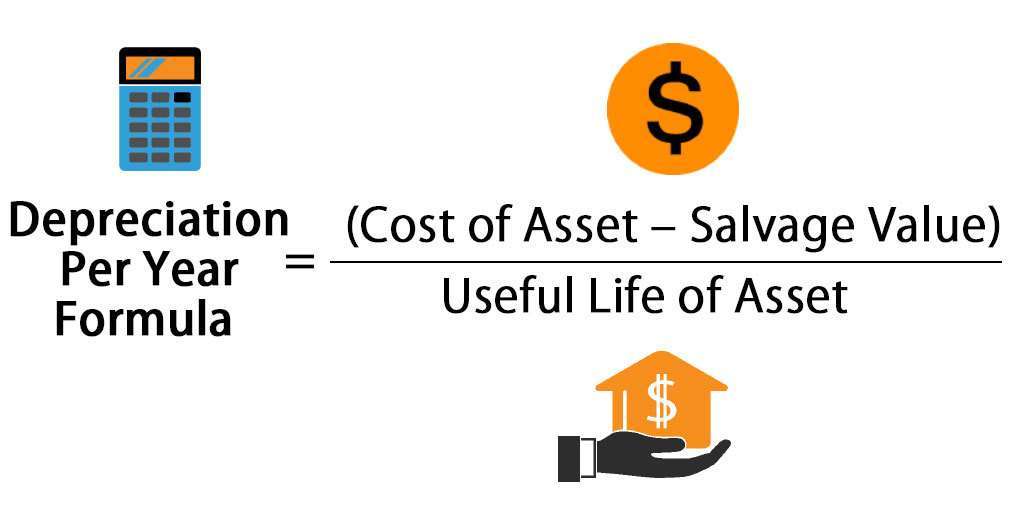

how to calculate depreciation rate Annual Depreciation rate Cost of Asset Net Scrap Value Useful Life There are various methods to calculate depreciation one of the most commonly used methods is the straight line method keeping this method in mind the above formula to calculate depreciation rate annual has been derived

Discover what depreciation is examine how it can help you make buying decisions and learn four methods to calculate it with examples for each calculation Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes Here are the different depreciation methods and how they work

how to calculate depreciation rate

how to calculate depreciation rate

https://1investing.in/wp-content/uploads/2020/02/straight-line-depreciation_1.png

How To Calculate Depreciation Percentage Haiper

http://1.bp.blogspot.com/-WSKXJm_aXIk/Vhu1OF3l0tI/AAAAAAAAACM/4JvxHv1MceE/s1600/8-depreciation-19-638.jpg

Annual Depreciation Cost Formula AmieAntonio

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/20034320/Simple-Example.jpg

To calculate depreciation follow these steps Get the original value of the asset OV the residual value RV and the lifetime of the asset n in years Apply the depreciation formula annual depreciation expense OV RV n Substitute the values Calculate the annual depreciation There are primarily 4 different formulas to calculate the depreciation amount Let s discuss each one of them Straight Line Depreciation Method Cost of an Asset Residual Value Useful life of an Asset Diminishing Balance Method Cost of an Asset Rate of Depreciation 100

How to Calculate Straight Line Depreciation The straight line calculation steps are Determine the cost of the asset Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount Determine the useful life of the asset Free depreciation calculator using the straight line declining balance or sum of the year s digits methods with the option of partial year depreciation

More picture related to how to calculate depreciation rate

How To Calculate Depreciation Expense With Residual Value Haiper

https://www.wikihow.com/images/thumb/f/f1/Calculate-Depreciation-on-Fixed-Assets-Step-7-Version-3.jpg/aid1410799-v4-728px-Calculate-Depreciation-on-Fixed-Assets-Step-7-Version-3.jpg

Refrigerator Depreciation Calculator IjazMansimar

https://i.ytimg.com/vi/ui9DQXNglJk/maxresdefault.jpg

Double Declining Balance Method Of Depreciation Accounting Corner

http://accountingcorner.org/wp-content/uploads/2021/02/double-declining-balance_8.png

The four methods for calculating depreciation allowable under GAAP include straight line declining balance sum of the years digits and units of production The Calculate depreciation of an asset s value over time and create printable depreciation schedules What is Depreciation Depreciation is a way to quantify how the value of an asset decreases over time It is an accounting method used by businesses to spread the initial cost of an asset over its years of useful life

[desc-10] [desc-11]

Straight Line Depreciation Definition And Formula Bookstime

https://www.bookstime.com/wp-content/uploads/2020/09/Depreciation-Per-Year-Formula-min.jpg

Depreciation Rate How To Calculate Depreciation Rate With Example

https://cdn.educba.com/academy/wp-content/uploads/2022/07/Depreciation-Rate.jpg

how to calculate depreciation rate - [desc-13]