how to calculate depreciation rate in reducing balance method The reducing balance method of depreciation is a method in which depreciation is calculated at a fixed percentage rate of the book value of the assets This results in higher depreciation expenses in the initial years in line with the higher productivity showcased by the asset

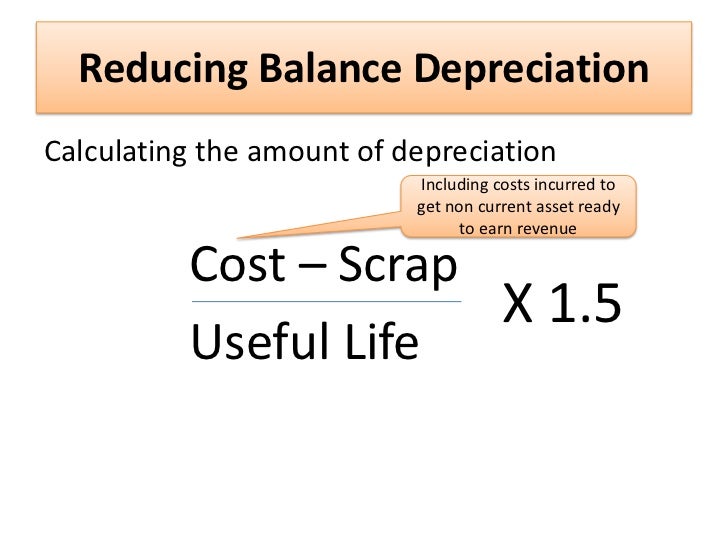

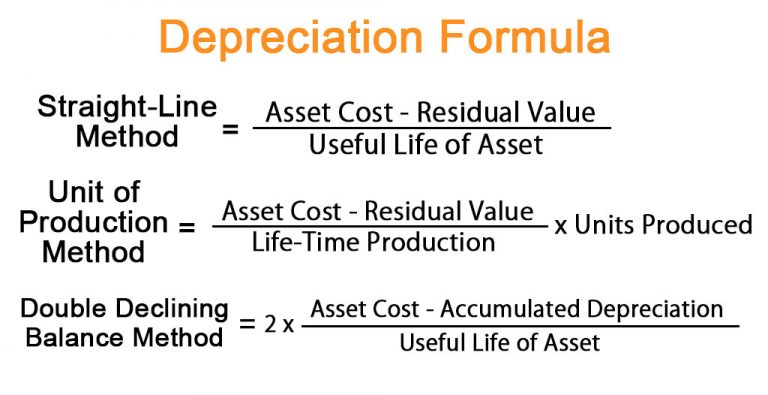

Reducing balance depreciation is a method to help you calculate the rate of depreciation of an asset when it s expensed at a percentage Basically you charge more depreciation at the beginning of the lifetime of an asset How to Calculate Reducing Balance Depreciation There is a formula for calculating depreciation using the reducing balance method which is as follows DB is a declining balance Salvage value is the scrap value that you expect to get at the end of its useful life Cost is the asset cost without VAT

how to calculate depreciation rate in reducing balance method

how to calculate depreciation rate in reducing balance method

https://image.slidesharecdn.com/diminishingbalancemethodofdepreciation-111127152247-phpapp02/95/reducing-balance-method-for-depreciation-12-728.jpg?cb=1322437121

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

https://www.double-entry-bookkeeping.com/wp-content/uploads/reducing-balance-depreciation-calculator-v-2.0-600x557.jpg

Depreciation Formula Examples With Excel Template

https://www.educba.com/academy/wp-content/uploads/2019/11/Depreciation-Formula-768x395.jpg

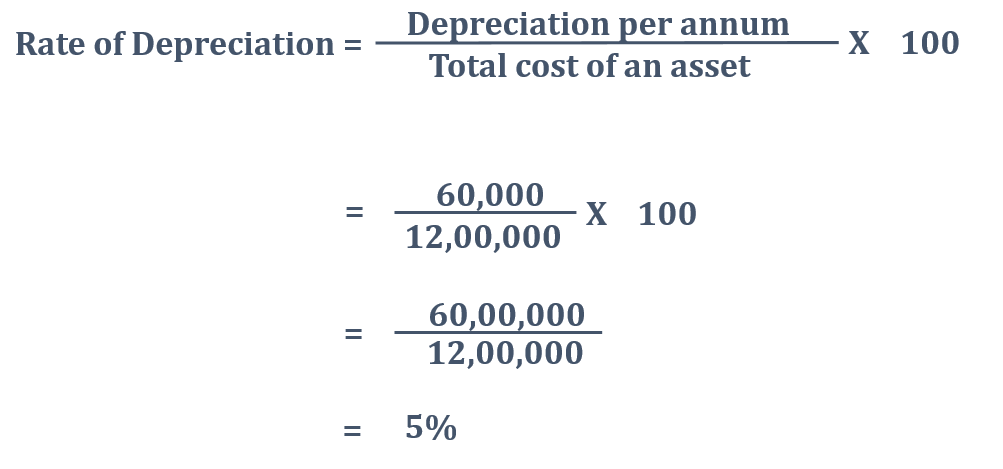

Under reducing balance method the depreciation is charged at a fixed rate like straight line method also known as fixed installment method But the rate percent is not calculated on cost of asset as is done under fixed installment method it Welcome to an exciting journey into the world of finding depreciation rates using the reducing balance method In this tutorial video we ll delve into th

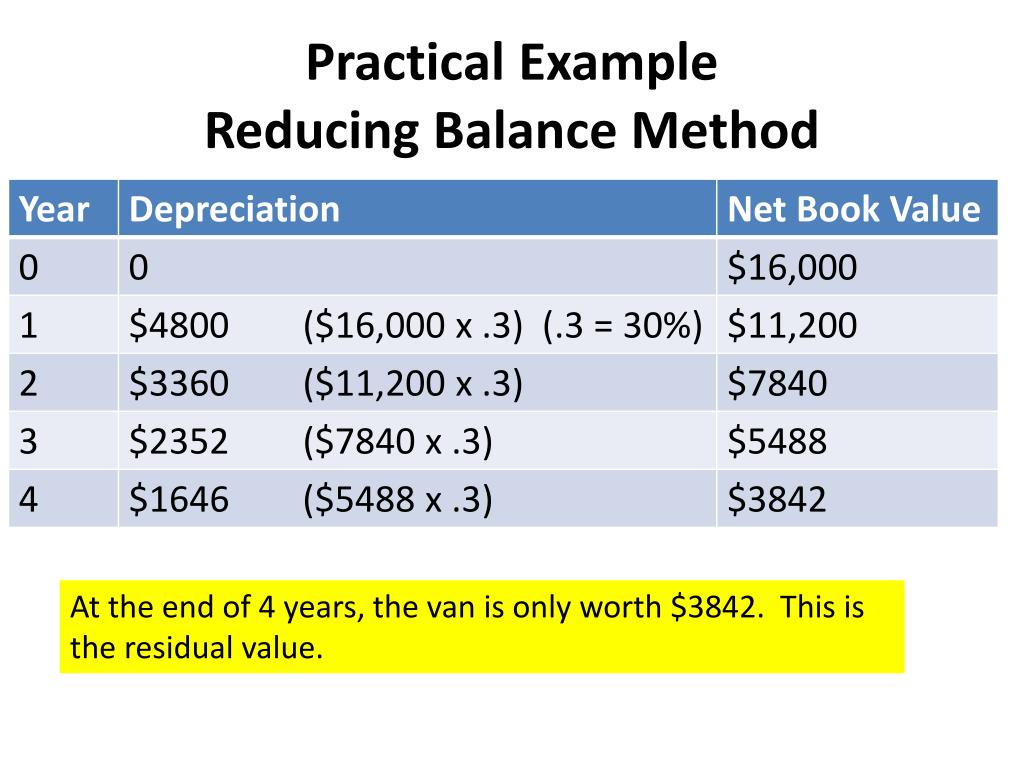

Using the Reducing balance method 30 percent of the depreciation base net book value minus scrap value is calculated at the end of the previous depreciation period Depreciation for the first three years is shown in the following table The declining balance method of Depreciation is also called the reducing balance method where assets are depreciated at a higher rate in the initial years than in the subsequent years Under this method a constant depreciation rate is applied to an asset s declining book value each year

More picture related to how to calculate depreciation rate in reducing balance method

How To Calculate Depreciation By Reducing Balance Method Haiper

https://image1.slideserve.com/2515132/practical-example-reducing-balance-method1-l.jpg

Double Declining Balance Method Of Depreciation Accounting Corner

http://accountingcorner.org/wp-content/uploads/2021/02/double-declining-balance_8.png

How To Calculate Depreciation Percentage Haiper

http://1.bp.blogspot.com/-WSKXJm_aXIk/Vhu1OF3l0tI/AAAAAAAAACM/4JvxHv1MceE/s1600/8-depreciation-19-638.jpg

The reducing balance depreciation method involves applying a constant depreciation rate to the value of the asset at the start of each period The time value of money calculations can be used to calculate depreciation using the reducing balance depreciation method Reducing Balance Method charges depreciation at a higher rate in the earlier years of an asset The amount of depreciation reduces as the life of the asset progresses Depreciation under reducing balance method may be calculated as follows Depreciation per annum Net Book Value Residual Value x Rate Where

Once it is determined that depreciation should be accounted for there are three depreciation methods that are most commonly used to calculate the allocation of depreciation expense the straight line method the reducing balance method and units of activity method Under reducing balance the rate of depreciation is deliberately calculated to be higher so most of the benefits of deducting the depreciation expense are seen early on Typically the percentages used are 200 the double declining balance formula and 150

How To Calculate Depreciation Expense Using Straight Line Method Haiper

https://1.bp.blogspot.com/-xLiuQXiWYMw/Xo3JESh6iFI/AAAAAAAATq0/MhuvqYZt1GgjOScqQokm1YTQtwTMgbnegCLcBGAsYHQ/s1600/Depreciation-Formula.jpg

How To Calculate Depreciation Macroeconomics Haiper

https://1investing.in/wp-content/uploads/2020/02/straight-line-depreciation_1.png

how to calculate depreciation rate in reducing balance method - How to calculate DEPRECIATION using the Reducing Balance Method Diminishing Balance Method Tutorial on how to calculate depreciation using the Straight line method How to