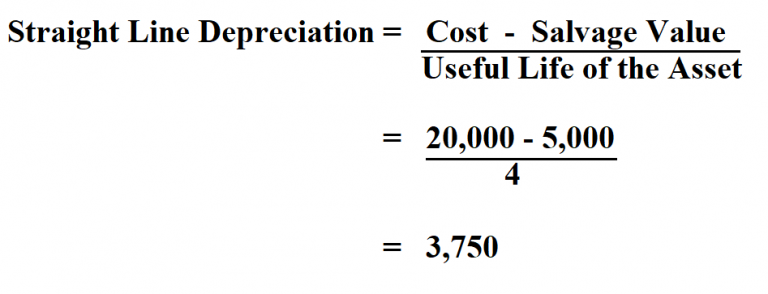

how to calculate depreciation rate in straight line method Straight line depreciation can be calculated using the following formula Cost Residual Value Useful Life Straight line depreciation method charges cost evenly throughout

By far the easiest depreciation method to calculate the straight line depreciation formula is Asset cost salvage value useful life annual depreciation 2 To calculate straight line depreciation you need to know three pieces of information about your asset purchase price or cost salvage value at the end of its useful life and estimated number of years

how to calculate depreciation rate in straight line method

how to calculate depreciation rate in straight line method

https://1.bp.blogspot.com/-xLiuQXiWYMw/Xo3JESh6iFI/AAAAAAAATq0/MhuvqYZt1GgjOScqQokm1YTQtwTMgbnegCLcBGAsYHQ/s1600/Depreciation-Formula.jpg

What Is Straight Line Depreciation Method PMP Exam YouTube

https://i.ytimg.com/vi/XTsP-PSRavM/maxresdefault.jpg

Depreciation Calculation Straight Line Method Written Down Value

https://value-mining.in/wp-content/uploads/2022/09/Document28_1.jpg

To calculate the straight line depreciation rate for your asset simply subtract the salvage value from the asset cost to get total depreciation then divide that by useful life to get To calculate depreciation using a straight line basis simply divide the net price purchase price less the salvage price by the number of useful years of life the asset has

How do you calculate straight line depreciation Straight line depreciation is calculated by dividing a fixed asset s depreciable base by its useful life The depreciable base is the difference between an asset s all The straight line method of depreciation posts the same dollar amount of depreciation each year The formula first subtracts the cost of the asset from its salvage

More picture related to how to calculate depreciation rate in straight line method

How To Calculate Straight Line Depreciation

https://www.learntocalculate.com/wp-content/uploads/2020/06/straight-line-depreciation.-2-768x294.png

Straight Line Depreciation Formula Calculator Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/07/Depreciation-Per-Year-Formula.jpg

Straight Line Method For Calculating Depreciation QS Study

https://qsstudy.com/wp-content/uploads/2017/10/Straight-Line-Method.jpg

The rate of depreciation under straight line depreciation is the percentage of an asset s total cost to be charged as depreciation during its useful lifetime Rate of Depreciation 1 Useful life of an asset 100 How to The straight line depreciation method can be calculated using the following formula Depreciation Per Annum Cost of Asset Salvage Cost Depreciation Rate or Depreciation Per Annum Cost

Calculate the straight line depreciation of an asset or the amount of depreciation for each period Find the depreciation for a period or create and print a Straight line depreciation is the simplest method of calculating depreciation for a fixed asset such as computer hardware equipment or a car This lets you write off

Depreciation Value Formula KhaleelZunair

https://cdn.corporatefinanceinstitute.com/assets/straight-line-depreciation-diagram.png

Acct076 Chp 5 App Acctg

http://image.slidesharecdn.com/acct076chp5app-acctg-110810122204-phpapp02/95/acct076-chp-5-app-acctg-21-728.jpg?cb=1312979104

how to calculate depreciation rate in straight line method - To calculate depreciation using a straight line basis simply divide the net price purchase price less the salvage price by the number of useful years of life the asset has