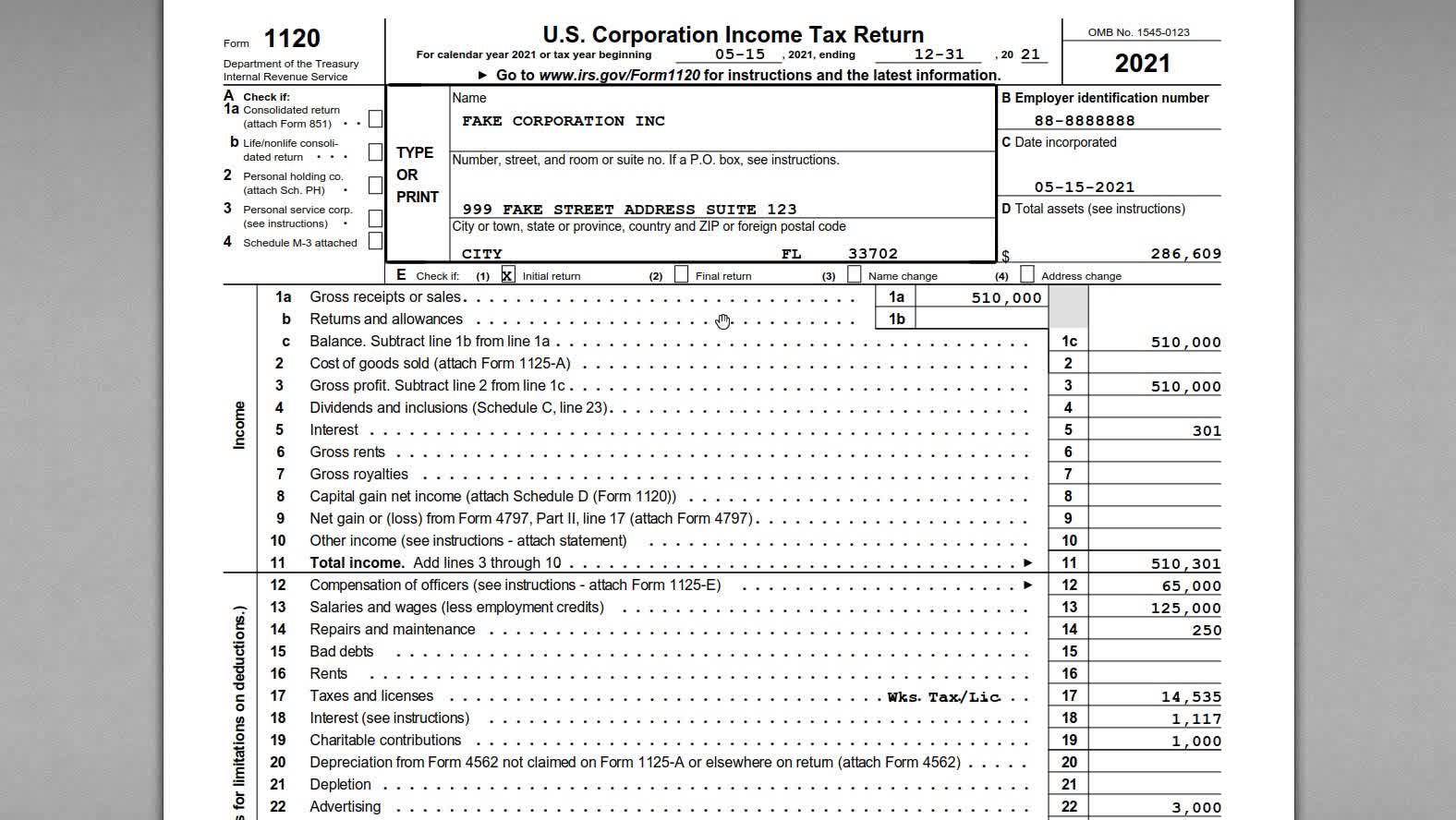

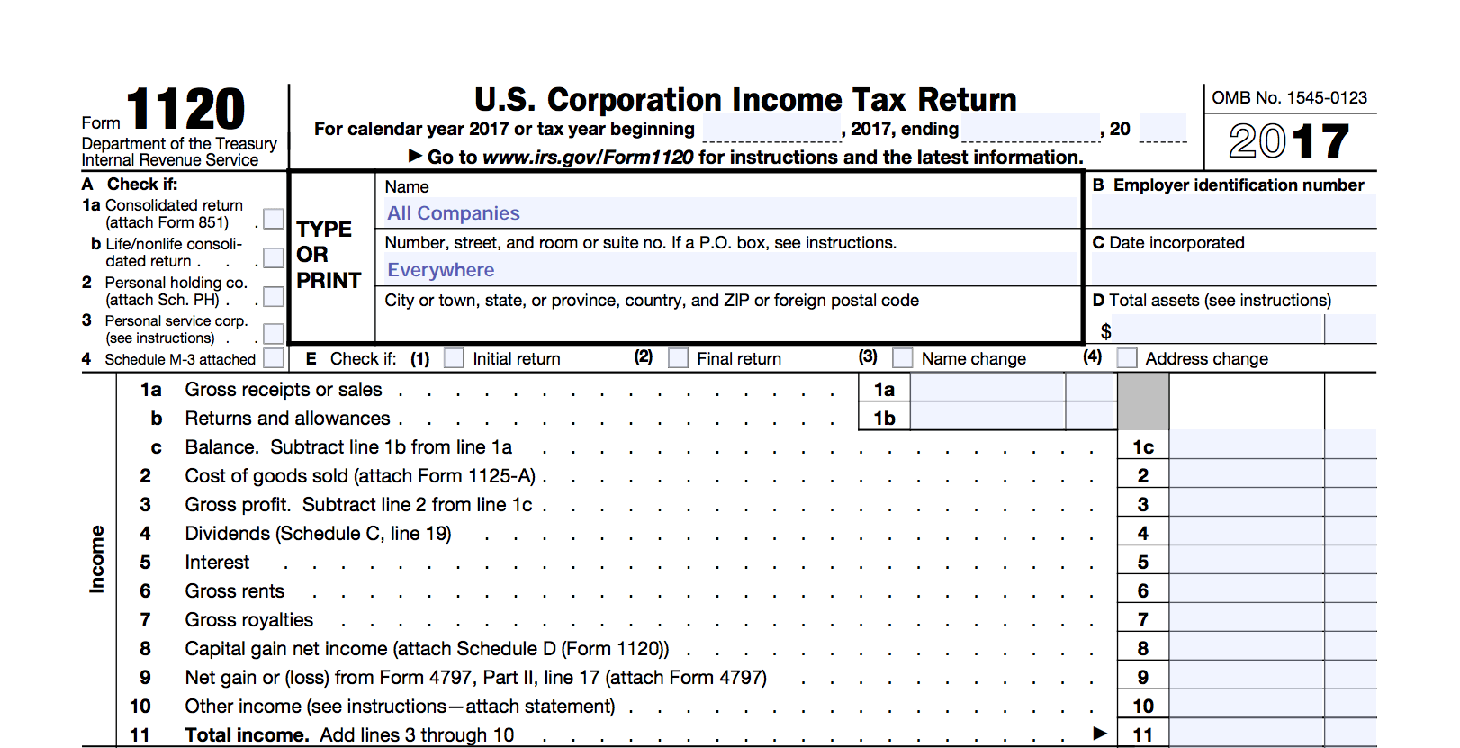

form 1120 example Enter on Form 1120 the totals for each item of income gain loss expense or deduction net of eliminating entries for intercompany transactions between corporations within the consolidated

For other Form 1120 tutorials see our playlist below youtube playlist list PLTdpzKOWNutTLPIHsm1STiioPex NElYUHow to fill out Form 1120 for t Learn how to file Form 1120 U S Corporation Income Tax Return with the IRS Find the current revision PDF instructions schedules FAQs and recent developments for this form

form 1120 example

form 1120 example

http://ww2.justanswer.com/uploads/wemba02/2011-10-24_010421_just_answers_1120_p1.jpg

Learn How To Fill The Form 1120 U S Corporation Income Tax Return

http://i.ytimg.com/vi/Z_0TWW8ZCzc/maxresdefault.jpg

How To Fill Out Form 1120 For 2021 Step by Step Instructions

https://ak2.rmbl.ws/s8/6/l/M/q/1/lMq1c.4-ag.jpg

Learn how to file Form 1120 the corporate income tax return for C corporations Find out who needs to file when how and what deductions and credits are available A 1120 tax form is an Internal Revenue Service IRS form that corporations use to find out their tax liability or how much business tax they owe It is also called the U S Corporation Income Tax Return

Form 1120 is the tax form C corporations and LLCs filing as corporations use to file their income taxes Once you ve completed Form 1120 you should have an idea of how much your corporation needs to pay in taxes IRS Form 1120 is the U S Corporation Income Tax Return It s also used by partnerships but not by S corporations Find out how to complete and file it

More picture related to form 1120 example

Do I Need To File A Form 1120 If The Business Had No Income

https://d1qmdf3vop2l07.cloudfront.net/friendly-barracuda.cloudvent.net/compressed/_min_/9d1d0ae01a0e9406e2c492f0c33da8a1.png

Tax Table M1 Instructions 2021 22 Brokeasshome

https://i.ytimg.com/vi/kJjaPwx_Vrc/maxresdefault.jpg

Form 1120 H Example Complete In A Few Simple Steps Infographic

https://hoatax.com/wp-content/uploads/2017/07/1120h-example.png

How to File Forms 5472 and 1120 for a Foreign Owned Single Member LLC If the LLC is at least 25 owned by a foreign person or entity they have to file some forms Namely they ll need to file Form 5472 and pro forma Form 1120 Learn how to fill out Form 1120S the annual return for S corporations and Schedule K 1 the shareholder report Download a free checklist and sample financial statements to help you prepare your taxes

Form 1120 tax returns are generally due by the 15th day of the 4th month following the close of the corporation s annual accounting period or tax year end as reflected on return 2023 Form 1120 For Paperwork Reduction Act Notice see separate instructions

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue

https://www.irs.gov/pub/xml_bc/51221535.gif

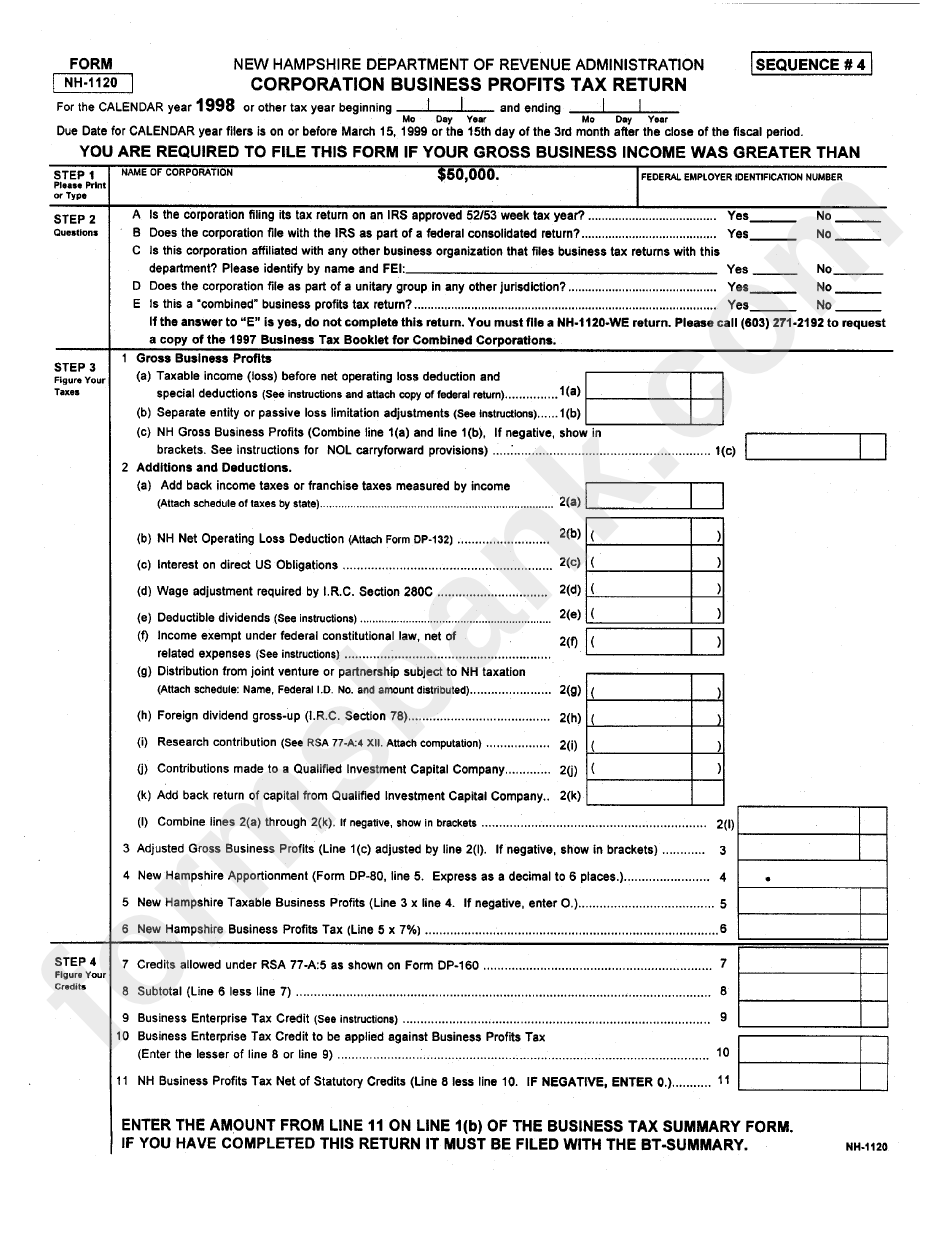

Fillable Form Nh 1120 Corporation Business Profits Tax Return

https://data.formsbank.com/pdf_docs_html/273/2732/273235/page_1_bg.png

form 1120 example - Learn how to file Form 1120 the corporate income tax return for C corporations Find out who needs to file when how and what deductions and credits are available