what is form 1120 h used for A homeowners association files Form 1120 H as its income tax return to take advantage of certain tax benefits These benefits in effect allow the association to exclude exempt function income

Choosing between Form 1120 H and Form 1120 should take into account various elements including the association s income sources deductible expenses potential tax credits Form 1120 is used by C corporations while 1120 H is a tax form specifically designed for qualifying HOAs What makes HOAs unique is the ability to file two different tax returns and the ability to change those forms each year

what is form 1120 h used for

what is form 1120 h used for

https://gusto.com/wp-content/uploads/2019/06/Form-1120S-instructions-Schedule-K.png

1120s Due Date

https://www.irs.gov/pub/xml_bc/51221535.gif

Sample Form 1120 Pokemon Go Search For Tips Tricks Free Nude Porn Photos

http://ww2.justanswer.com/uploads/wemba02/2011-10-24_010421_just_answers_1120_p1.jpg

Looking for a form 1120 H example We walk through the HOA tax return and point out some of the tips and tricks to stay compliant Let s take a look The IRS Form 1120 H is used by homeowners associations HOAs to report income expenses and tax liability The form contains specific instructions that provide guidance on various requirements including

Filing Form 1120 H is one of the most straightforward ways for HOAs to submit income tax returns The form has a flat tax rate of 30 on taxable income Under IRC Section 528 HOAs that use their function income Form 1120 H is the income tax return for homeowners associations Compared to Form 1120 this form allows for a more simplified HOA tax filing process It also allows HOAs to enjoy certain tax benefits that are outlined in Section 528 of

More picture related to what is form 1120 h used for

What Is Form 1120 Definition How To File More

https://www.patriotsoftware.com/wp-content/uploads/2020/03/form-1120-768x920.jpg

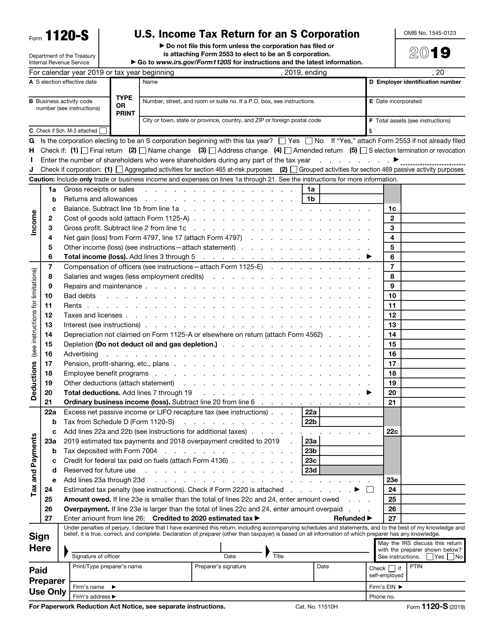

IRS Form 1120 S 2019 Fill Out Sign Online And Download Fillable

https://data.templateroller.com/pdf_docs_html/2017/20173/2017375/irs-form-1120-s-u-s-income-tax-return-for-an-s-corporation_big.png

2023 Form 1120 W Printable Forms Free Online

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

Form 1120 H is a critical tool for Homeowners Associations and Timeshare Associations in managing their taxes With its flat rate tax structure it can help organizations maximize their after tax profits while A homeowners association can take advantage of certain tax benefits by filing Form 1120 H which provides a flat tax rate of 30 32 depending on the type of association and excludes exempt function income

Form 1120 H is a specialized tax form designed explicitly for Homeowners Associations HOAs This form offers a simpler and often more beneficial way for HOAs to The IRS Form 1120 H is a tax form used by homeowners associations HOAs and condominium management associations for the purpose of reporting their federal income

:max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png)

IRS Form 1120 What Is It

https://www.thebalancemoney.com/thmb/-wWRc3-qPvbfC-d8ZzAm86DCMq4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png

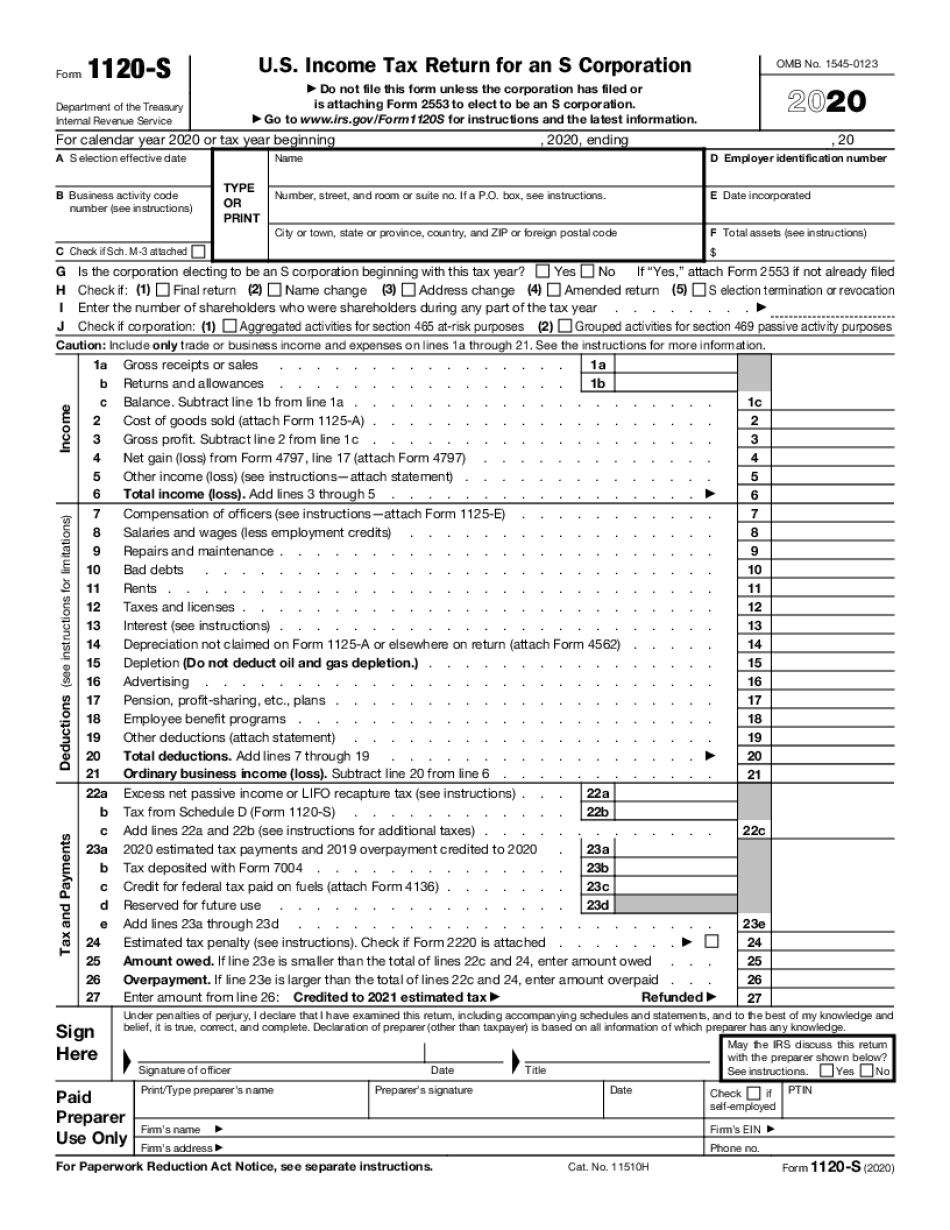

2020 1120s Editable Online Blank In PDF

https://www.pdffiller.com/preview/539/32/539032318/big.png

what is form 1120 h used for - In fact the IRS recognizes the unique status of community associations by providing for two methods by which a community association can file a tax return 1 an Internal Revenue