who must complete the 28 rate gain worksheet If you are completing line 18 of Schedule D enter as a positive number the amount of your allowable exclusion on line 2 of the 28 Rate Gain Worksheet if you excluded 60 of

Do I need to complete the 28 rate gain worksheet You will need to complete the 28 Rate Gain Worksheet in the Schedule D Instructions Then you take your Subscribe to our YouTube channel youtube channel UCPQFIx80N8 a3MC6Gx9If2g sub confirmation 1

who must complete the 28 rate gain worksheet

who must complete the 28 rate gain worksheet

https://i2.wp.com/briefencounters.ca/wp-content/uploads/2018/11/28-rate-gain-worksheet-2016-with-i1040-instruction-pages-201-206-text-version-of-28-rate-gain-worksheet-2016.jpg

Maximizing Your Gains A Guide To The 28 Rate Gain Worksheet Style

https://i2.wp.com/media.cheggcdn.com/media/b1c/b1c9c544-a4ae-4f08-9655-8aca4f932f8f/php2MVcJa.png

28 Rate Gain Worksheet 2016

https://briefencounters.ca/wp-content/uploads/2018/11/28-rate-gain-worksheet-2016-as-well-as-texas-tax-angels-amp-bookkeeping-llc-of-28-rate-gain-worksheet-2016.jpg

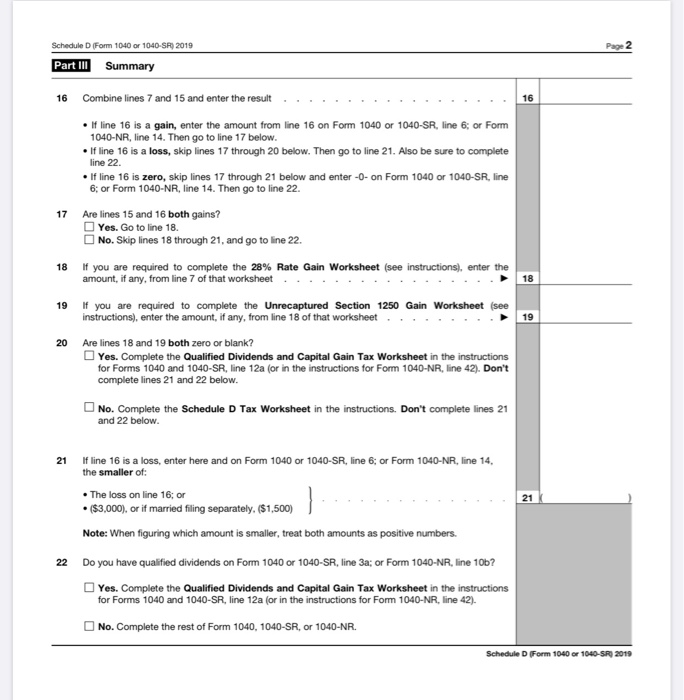

Complete the 28 Rate Gain Worksheet above if lines 18a and 19 of column 3 are both greater than zero and at least one of the following applies The type and rule above prints on all proofs including departmental reproduction proofs MUST be removed before printing Instructions for the Unrecaptured Section 1250 Gain

The following items entered in the return will pull to the 28 Rate Gain Worksheet Entries in Schedule D with an adjustment code of C Entries entered under Additional Capital Using the 28 Rate Gain Worksheet The 28 Rate Gain Worksheet is used by Schedule D filers who need to calculate the alternative minimum tax on

More picture related to who must complete the 28 rate gain worksheet

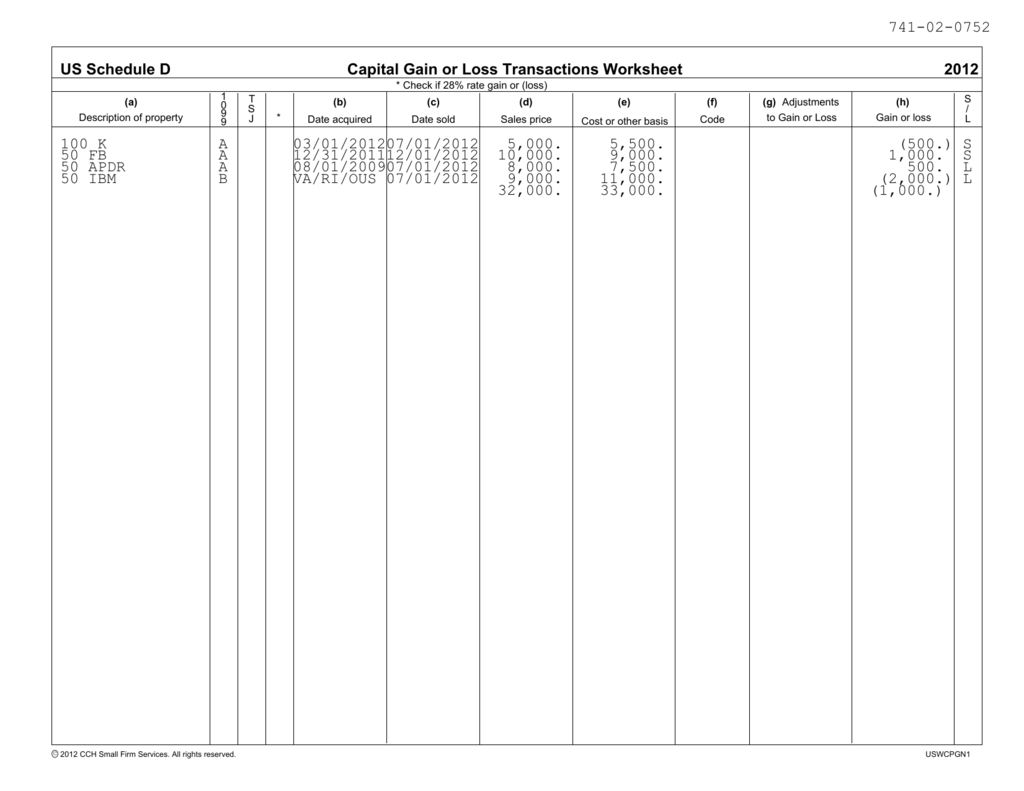

Capital Gain Or Loss Transactions Worksheet US Schedule D 2012

https://s3.studylib.net/store/data/008284704_1-b473b39ec859177aefc3e10ac6e27236.png

2023 Qualified Dividends And Capital Gains Worksheet Fill Out Sign

https://www.pdffiller.com/preview/1/575/1575301/large.png

28 Rate Gain Worksheet 2016

https://briefencounters.ca/wp-content/uploads/2018/11/28-rate-gain-worksheet-2016-as-well-as-internal-revenue-bulletin-2017-26-of-28-rate-gain-worksheet-2016.gif

I received a letter from the IRS regarding a rental property sale They re calculated the tax adding the 28 Rate Gain tax When I go to Line 18 of Schedule D it Oct 30 2023 These instructions explain how to complete Schedule D Form 1040 Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D

This form may be easier to complete if you round off cents to whole dollars d Proceeds sales price e Cost or other basis 28 Rate Gain Worksheet see instructions Required use this amount when completing the 28 Rate Gain Worksheet Line 18 in the instructions for Schedule D Form 1040 Box 3 Shows the part of the distribution that is

28 Rate Gain Worksheet 2022

https://media.cheggcdn.com/study/455/455edda2-e6bd-4509-b550-f20e83fa78ac/image.png

28 Rate Gain Worksheet Nursery Maths Worksheet

https://i.pinimg.com/736x/1f/68/27/1f68276136b196cd1d7448a22b237add.jpg

who must complete the 28 rate gain worksheet - The following items entered in the return will pull to the 28 Rate Gain Worksheet Entries in Schedule D with an adjustment code of C Entries entered under Additional Capital