who has to fill out the 28 rate gain worksheet If you are completing line 18 of Schedule D enter as a positive number the amount of your allowable exclusion on line 2 of the 28 Rate Gain Worksheet if you excluded 60 of

IRS Form 4684 Casualties Thefts teachmepersonalfinance co IRS Form 6252 Installment Sales teachmepersonalfinance co IRS Form 6781 28 Rate Gain Worksheet Line 18 Keep for Your Records 1 Enter the total of all collectibles gain or loss from items you reported on Form 8949 Part II 1 2 Enter

who has to fill out the 28 rate gain worksheet

who has to fill out the 28 rate gain worksheet

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/09/capital-lo-28-rate-gain-worksheet-2016-as-free-handwriting-768x994.jpg

Maximizing Your Gains A Guide To The 28 Rate Gain Worksheet Style

https://i2.wp.com/media.cheggcdn.com/media/b1c/b1c9c544-a4ae-4f08-9655-8aca4f932f8f/php2MVcJa.png

Capital Gains Worksheet Part 3 Line 1 Worksheet Resume Examples

https://www.thesecularparent.com/wp-content/uploads/2020/02/28-percent-capital-gains-worksheet.jpg

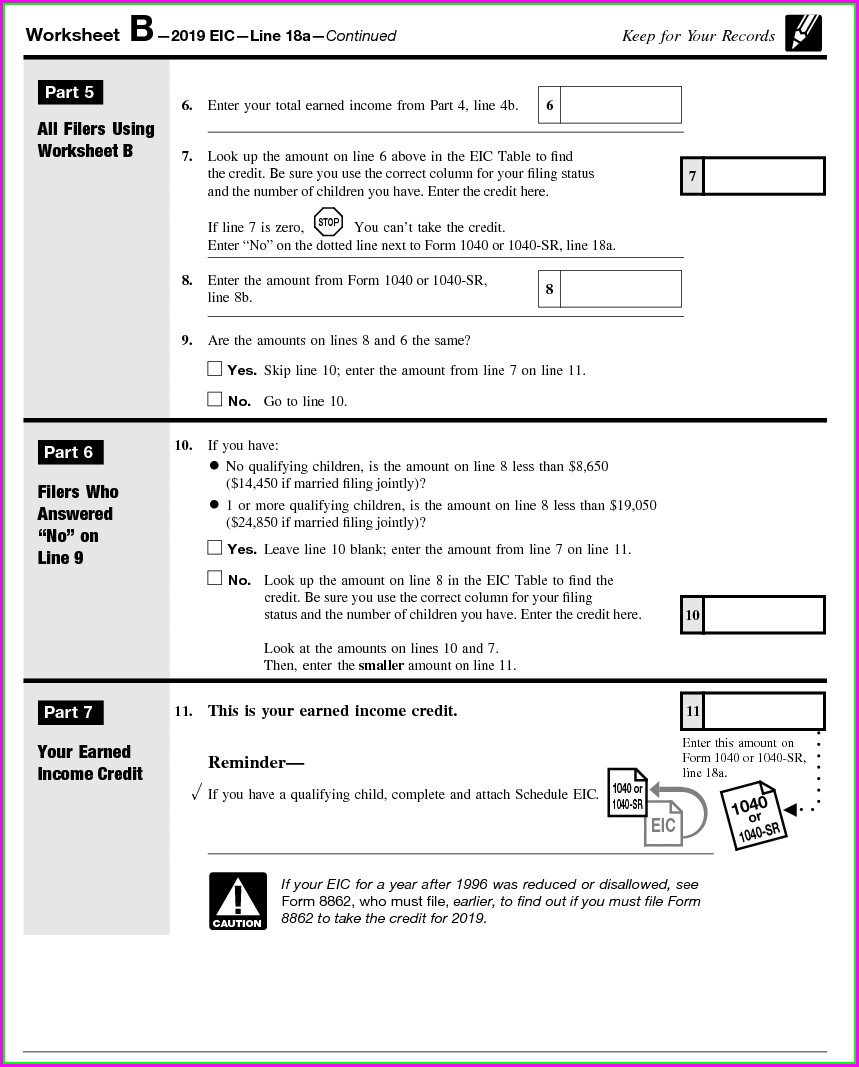

Schedule D Adjust 28 Rate 1250 Worksheet Menu In TaxSlayer Pro the 28 Rate Gain Worksheet and the Unrecaptured Section 1250 Gain Worksheet are produced Form 1041 e filing When e filing Form 1041 U S Income Tax Return for Estates and Trusts use either Form 8453 FE U S Estate or Trust Declaration for an IRS e file

Instructions Comments fillable forms Individual taxpayers who sell investments or other capital assets during the tax year may need to report those The 28 Rate Gain Worksheet is used by Schedule D filers who need to calculate the alternative minimum tax on collectibles and qualified small business stock

More picture related to who has to fill out the 28 rate gain worksheet

28 Rate Gain Worksheet Nursery Maths Worksheet

https://i.pinimg.com/originals/9a/32/a7/9a32a7ecd7f010e9fbf8a59d85adeb07.jpg

HOT 28 Rate Gain Worksheet Irs

http://www.jdunman.com/ww/business/sbrg/graphics/15112n11.gif

28 Rate Gain Worksheets Requirements

https://i.pinimg.com/originals/4d/e1/35/4de1354e6728c7704673c5e0d8496827.jpg

Exclusion of Gain on Qualified Small Business QSB Stock later If there is an amount in box 2d in clude that amount on line 4 of the 28 Rate Gain Worksheet in these Schedule D contains different worksheets that you may need to complete including the Capital Loss Carryover Worksheet 28 Rate Gain Worksheet and

Most people use the Schedule D form to report capital gains and losses that result from the sale or trade of certain property during the year In 2011 however the 28 Rate Gain Worksheet see instructions enter the Are lines 18 and 19 both zero or blank and are you not filing Form 4952 Yes Complete the Qualified Dividends and

28 Rate Gain Worksheet 2021

https://www.semesprit.com/wp-content/uploads/2018/08/28-rate-gain-worksheet-2016-or-28-capital-gains-tax-rate-worksheet-wp-landingpages-of-28-rate-gain-worksheet-2016-728x1240.jpg

10 28 Rate Gain Worksheet

https://i2.wp.com/briefencounters.ca/wp-content/uploads/2018/11/28-rate-gain-worksheet-2016-with-i1040-instruction-pages-201-206-text-version-of-28-rate-gain-worksheet-2016.jpg

who has to fill out the 28 rate gain worksheet - ProSeries Tax Discussions How can I enter information for the 28 Rate Gain Worksheet line 18 of Schedule D Which information needs to be added