what is u s 80ddb Learn about Section 80DDB of the Income Tax Act which provides relief to taxpayers for medical expenses on neurological cancer AIDS renal and hematological disorders Find out the diseases covered eligibility criteria

Learn how to claim tax deductions for medical expenses incurred for treatment of neurological cancer AIDS renal or haematological diseases under Section 80DDB of the Income Tax Act Find out the conditions capped Learn how to claim tax deduction under Section 80DDB of the Income Tax Act 1961 for treatment of specified diseases Find out the eligibility amount diseases covered and certificate requirements for this deduction

what is u s 80ddb

what is u s 80ddb

https://i.ytimg.com/vi/u4Z1UbmWkpc/maxresdefault.jpg

Deduction U s 80C To 80 U Part 8 In Tamil Deduction U s 80D 80DD

https://i.ytimg.com/vi/VpMhGqj7FeE/maxresdefault.jpg

Know About Health Insurance Tax Benefits Under Section 80D

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Know-About-Health-Insurance-Tax-Benefits-Under-Section-80D.png

Learn how to claim tax deduction under Section 80DDB of the Income Tax Act of 1961 for the treatment of specific diseases such as cancer AIDS or renal failure Find out the eligible Section 80DD allows deduction for differently abled dependents Maximum deduction is Rs 75 000 1 25 000 Documents needed are medical certificate Form 10 IA self

Learn how to claim deduction under section 80DDB for expenses on medical treatment of specified ailments such as cancer AIDS and neurological diseases Find out the eligibility criteria amount of deduction Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be spouse children parents brothers

More picture related to what is u s 80ddb

Deduction U s 80D 80DD 80DDB YouTube

https://i.ytimg.com/vi/v7VJVEmq67Q/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH6CYAC0AWKAgwIABABGEUgXihlMA8=&rs=AOn4CLDjxKzc26MCs1NKmrGwqMtg95kAFQ

Day 24 Deduction U s 80D 80DD 80DDB Empowering The Salaried

https://i.ytimg.com/vi/bp0l7V0Ohd0/maxresdefault.jpg

Lec 15 Deduction U S 80C 80G 80E 80D 80DD 80DDB B Com 4th

https://i.ytimg.com/vi/iz1FlSJoHMI/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGFUgXihlMA8=&rs=AOn4CLBUX5nRjnD0EewV5Q7hyAdt-e4Fnw

Learn how to claim deductions under Section 80DDB of the Income Tax Act for expenses incurred on treatment of specified diseases Find out the eligibility criteria deduction limit Learn how to claim deduction for medical expenses of specified diseases under section 80DDB of the Income Tax Act Find out the eligibility amount conditions and FAQs of

Learn how to claim tax deductions for medical expenses for treating specified diseases or disorders under Section 80DDB of the Income Tax Act Find out the eligibility Learn the differences between Section 80DD 80DDB and Section 80U of the Income Tax Act 1961 which provide tax benefits for medical expenses or maintenance of

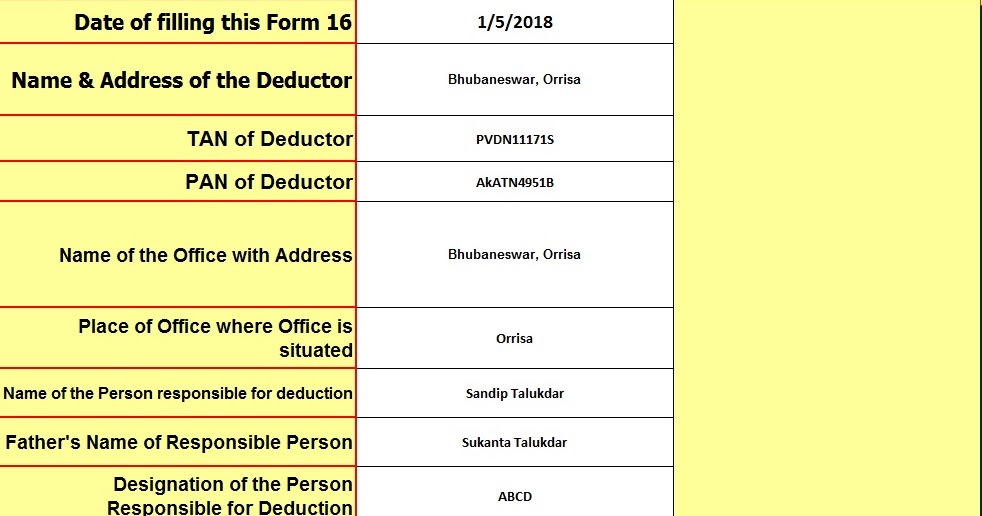

Tax Section 80DDB Tax Rebate From Sever Diseases Plus Automatic Master

https://4.bp.blogspot.com/-XYcrpcR1NgY/WpbQAo1nC8I/AAAAAAAAGpA/4RxYIZsplHAVLds8_H1yZqFIHG2x7RlmwCLcBGAs/w1200-h630-p-k-no-nu/Master%2BForm%2B16%2BA%2526B%2BPage%2B1.jpg

Tax Benefits On Healthcare U s 80D 80DD 80DDB Of IT Act Pankaj

https://i.ytimg.com/vi/SQYBcBbvWgg/maxresdefault.jpg

what is u s 80ddb - Learn how to claim income tax deduction under Section 80DDB for medical treatment of senior citizens suffering from neurological cancer AIDS renal or hematological diseases Find out