what is included in 80ddb Section 80DDB of Income Tax Act Deductions Under Section 80DDB can be claimed with respect to the expenses incurred in medical expenses Know more on

Section 80DDB specifies the following medical ailments and diseases for which tax deductions can be availed Diseases that are neurological in nature such as Ataxia Show Section 80DDB of the Income Tax Act of 1961 allows tax deductions to taxpayers on the treatment of certain specified diseases According to Section 80DDB these taxpayers are individuals

what is included in 80ddb

what is included in 80ddb

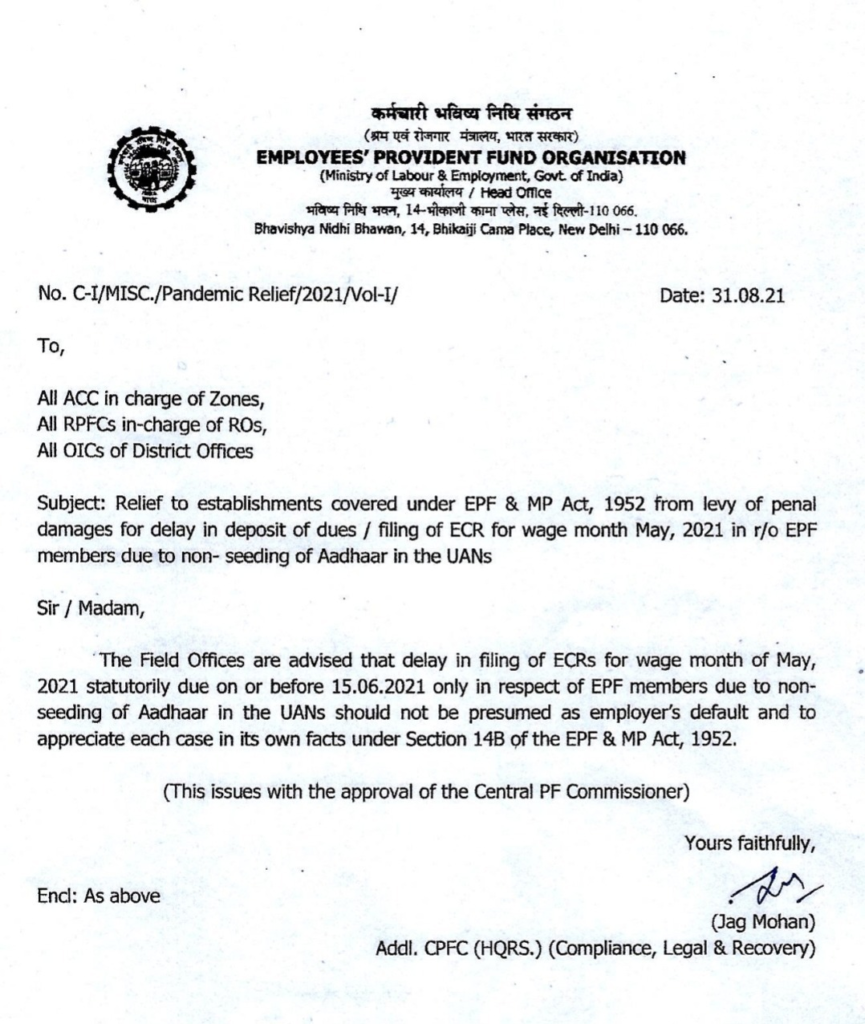

https://blog.pcsmgmt.com/wp-content/uploads/2021/09/image-6-865x1024.png

Deduction Under Section 80DDB Tutorial In Tamil YouTube

https://i.ytimg.com/vi/-tvbi_FDSo4/maxresdefault.jpg

Unexplored 2 Official Soundtrack Epic Games Store

https://cdn1.epicgames.com/offer/d396856ef66f4572af55519a8d2b99ed/EGS_Unexplored2OfficialSoundtrack_Ludomotion_DigitalExtras_S1_2560x1440-2d03c7e25aec754d69e0941f128ff25e

Section 80DDB includes tax deductions for specified diseases for individuals and HUF Deductions under this chapter cannot be claimed against long term capital gains short term capital gains Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in respect of amount actually paid by the taxpayer on medical treatment of

Section 80DDB of Income Tax Act covers deductions on expenses incurred while availing medical treatment for specific ailments or disorders It states that if an Section 80DDB provides tax deduction for treating specified illnesses covering medical expenses for dependents like spouses children parents and siblings

More picture related to what is included in 80ddb

What Is Provision Of Claiming Medical Expenses In Income Tax Sec 80ddb

https://i.ytimg.com/vi/1GCXvXTYHvE/maxresdefault.jpg

What Is 80DDB Deduction In Income Tax Archives InstaFiling

https://instafiling.com/wp-content/uploads/2022/12/Section-80DDB-of-Income-Tax-Act-980x551.png

What Are Sections 80DD 80DDB And 80U All About Rupiko

https://rupiko.in/wp-content/uploads/2023/01/Section-80DD-80DDB-80U-1024x510.png

Back to all resources Mutual Fund Investment What is Section 80DDB and its Importance By Jupiter Team December 02 2021 6 min read Chapter VI A of the Section 80DDB of Income Tax Act An individual can claim for deduction for incurring medical expenditure either for self or for a family dependent Under the Section

Section 80DDB allows deduction of expenditure incurred for self spouse children parents siblings on treating specified diseases Get complete detail on 80ddb 1183 2 Min Read Taxpaying individuals who spend on medical expenses for treatment of specified diseases or ailments for self or dependents are eligible to claim

Download Ask Video FabFilter 102 FabFilter Creative Bundle Explored

https://www.sampledrive.in/wp-content/uploads/2023/04/askvideo-fabfilter-creative-bundle-course.jpg

What Are Sections 80DD 80DDB And 80U All About Rupiko

https://rupiko.in/wp-content/uploads/2023/01/Disability.jpg

what is included in 80ddb - Section 80DDB provides tax deduction for treating specified illnesses covering medical expenses for dependents like spouses children parents and siblings