what is a 1095 form Form 1095 A 1095 B and 1095 C are tax forms that are used to report health insurance coverage to enrollees and to the IRS These forms came about as a result of the Affordable Care Act For most people who had marketplace exchange coverage during the year Form 1095 A is an essential part of the tax filing process as it s

Form 1095 A is sent by state and federal marketplaces to anyone who had marketplace coverage for the year This form is absolutely required for taxpayers who received advance payments of the Premium Tax Credit APTC to help pay for health insurance coverage during the year Form 1095 is filed by whoever provided health insurance coverage to an individual which means that individuals don t have to fill out Form 1095 themselves Form 1095 contains individual health insurance information

what is a 1095 form

what is a 1095 form

https://www.communitytax.com/wp-content/uploads/2017/10/Form-1095-1.-Form.png

Form 1095 A Sample Amulette

http://amulettejewelry.com/wp-content/uploads/2018/09/form-1095-a-sample-1095c-form.jpg

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

Form 1095 A Definition Filing Requirements How To Get One

https://www.investopedia.com/thmb/9iRoqibTFzjqaLBQ-r3z3n-G0oQ=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png

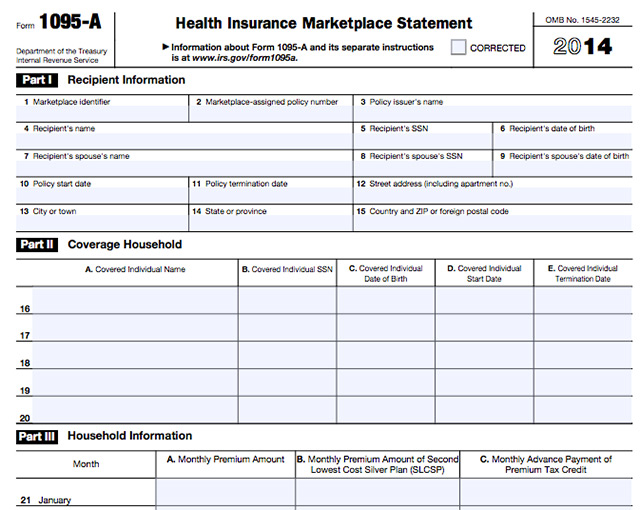

Form 1095 A Health Insurance Marketplace Statement is provided by the Marketplace to individuals who enrolled or who have enrolled a family member in health coverage through the Marketplace Form 1095 B Health Coverage is provided by insurance companies and other coverage providers Information about Form 1095 A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace

The Form 1095 A will tell you the dates of coverage total amount of the monthly premiums for your insurance plan the second lowest cost silver plan premium that you may use to determine the amount of your premium tax credit and amounts of advance payments of the premium tax credit File IRS form 1095 A to get highest federal tax return Learn what to do how to file why you got form what to do if no 1095 A

More picture related to what is a 1095 form

How To Use Form 1095 A During Tax Season Legacy Health Insurance

https://legacyhealthinsurance.com/wp-content/uploads/2018/01/How-To-Use-Form-1095-A-During-Tax-Season-1024x756.png

Benefits 101 IRS Form 1095 The Spot

https://spotlight.lehigh.edu/sites/spotlight.lehigh.edu/files/IRSart.jpg

Form 1095 A 1095 B 1095 C And Instructions Obamacare Facts

https://obamacarefacts.com/wp-content/uploads/2014/12/irs-form-1095-a-screenshot.jpg

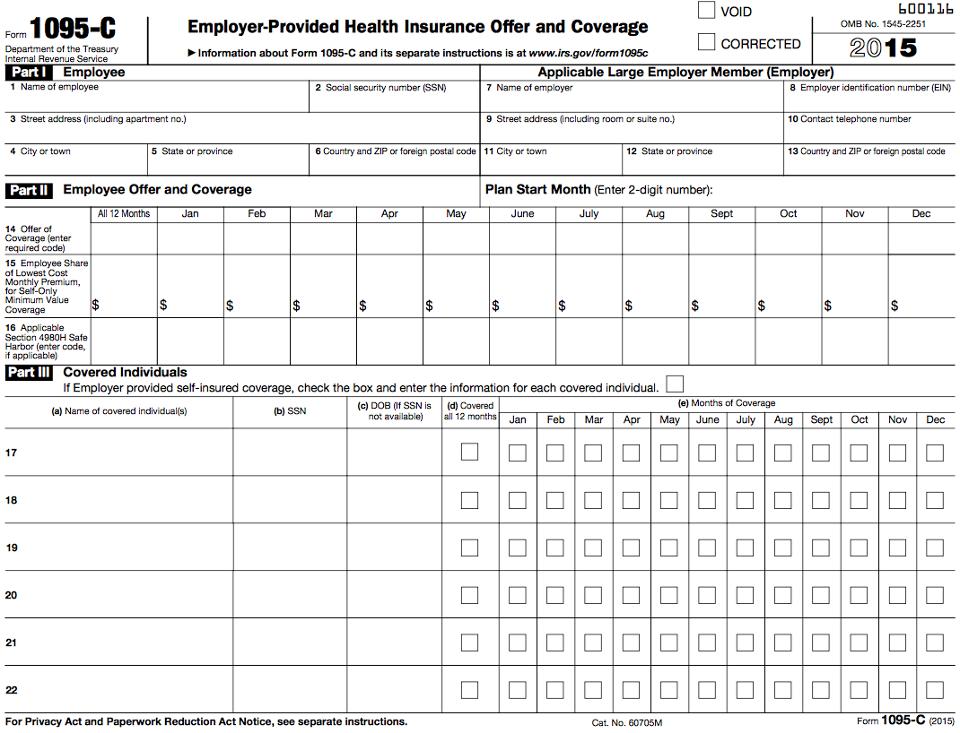

A 1095 form is a group of documents that are broken down into three forms 1095 A 1095 B and 1095 C These forms inform the government which employees are liable for paying a penalty called the individual shared responsibility payment Form 1095 A is your proof that you had Marketplace exchange health insurance coverage during the year and it s also used to reconcile your premium subsidy on your tax return using Form 8962 details below

The 1095 A form Health Insurance Marketplace Statement is for people who have health insurance through the Health Insurance Marketplace often called an exchange You should receive this form by mid February so make sure to wait to file your taxes until you have it What Is Form 1095 A Health Insurance Marketplace Statement Form 1095 A is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace

Form 1095 A Sample Amulette

http://amulettejewelry.com/wp-content/uploads/2018/09/form-1095-a-sample-1095-a-2015.jpg

What Is A 1095 C Form Do I Have To File It With Taxes Al

https://www.al.com/resizer/okegSglGKXF4skMK1NeWKItD5XI=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.al.com/home/bama-media/width2048/img/news_impact/photo/1095jpg-408cc8e1fb441447.jpg

what is a 1095 form - The Form 1095 A will tell you the dates of coverage total amount of the monthly premiums for your insurance plan the second lowest cost silver plan premium that you may use to determine the amount of your premium tax credit and amounts of advance payments of the premium tax credit