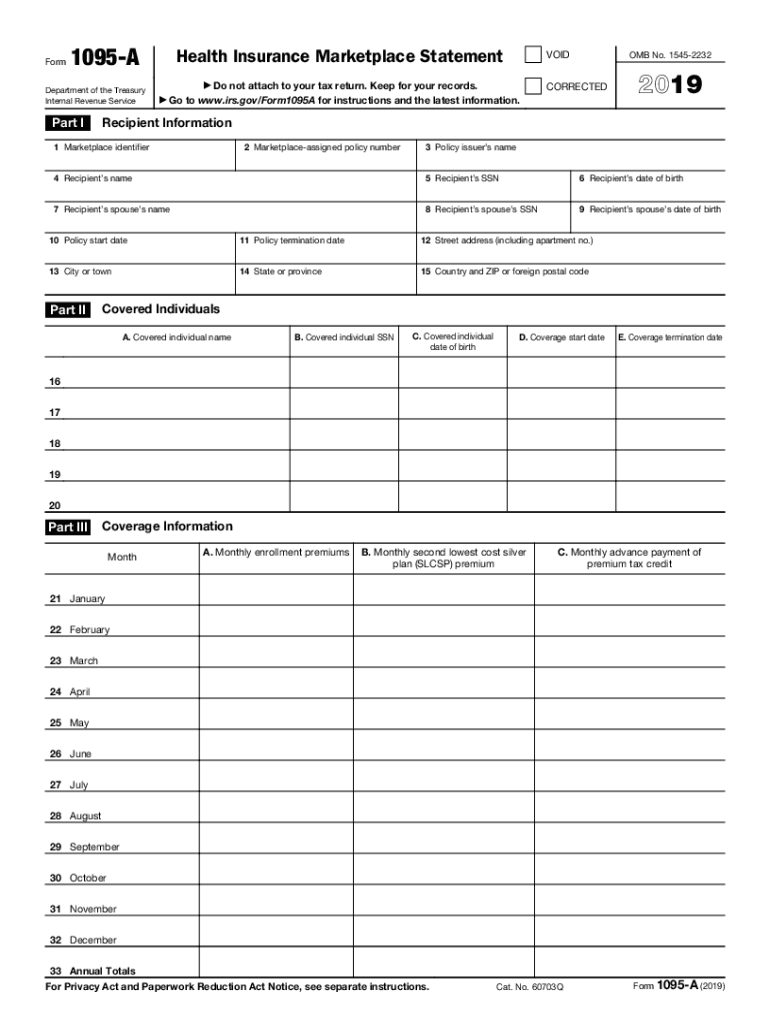

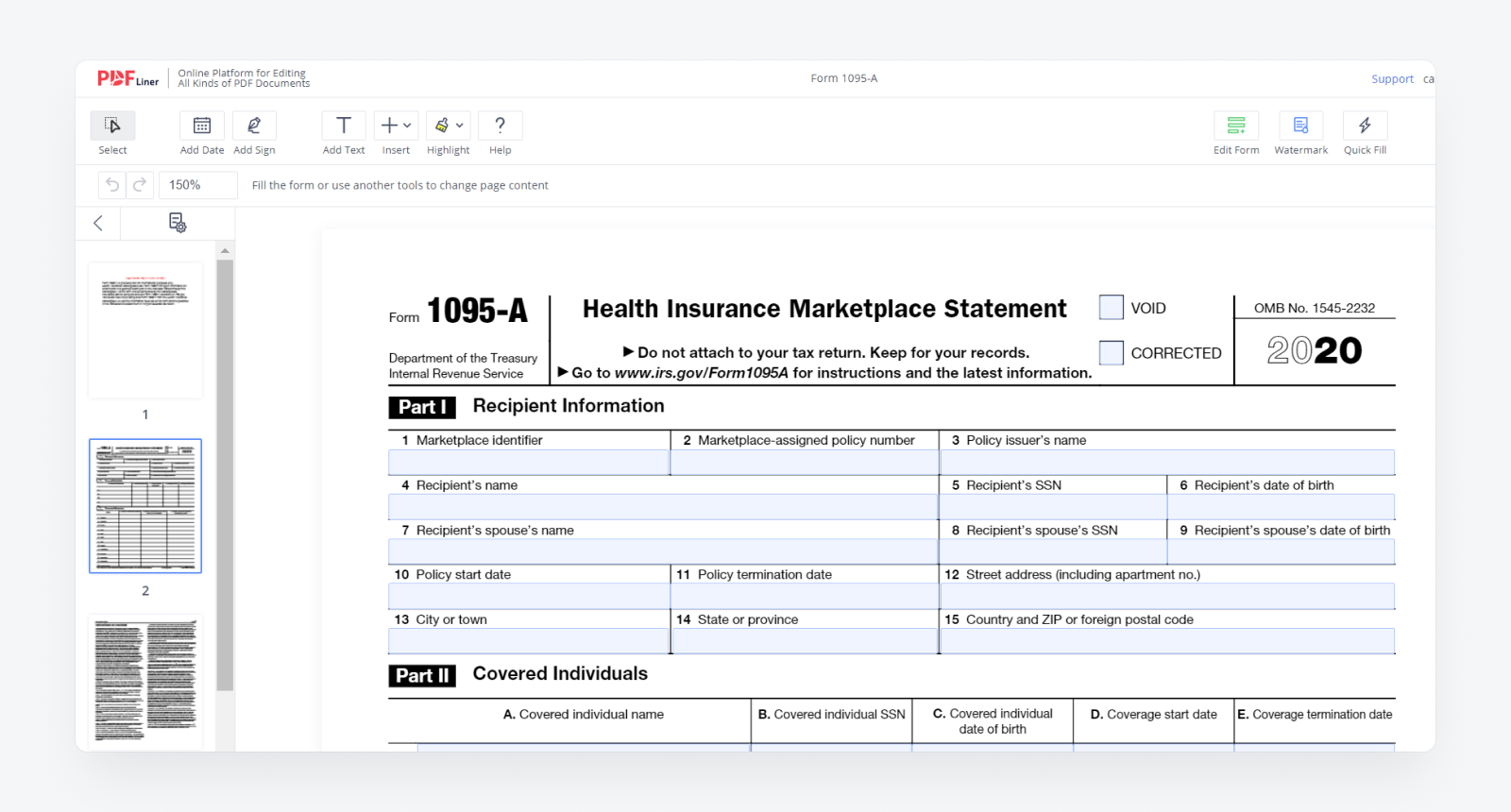

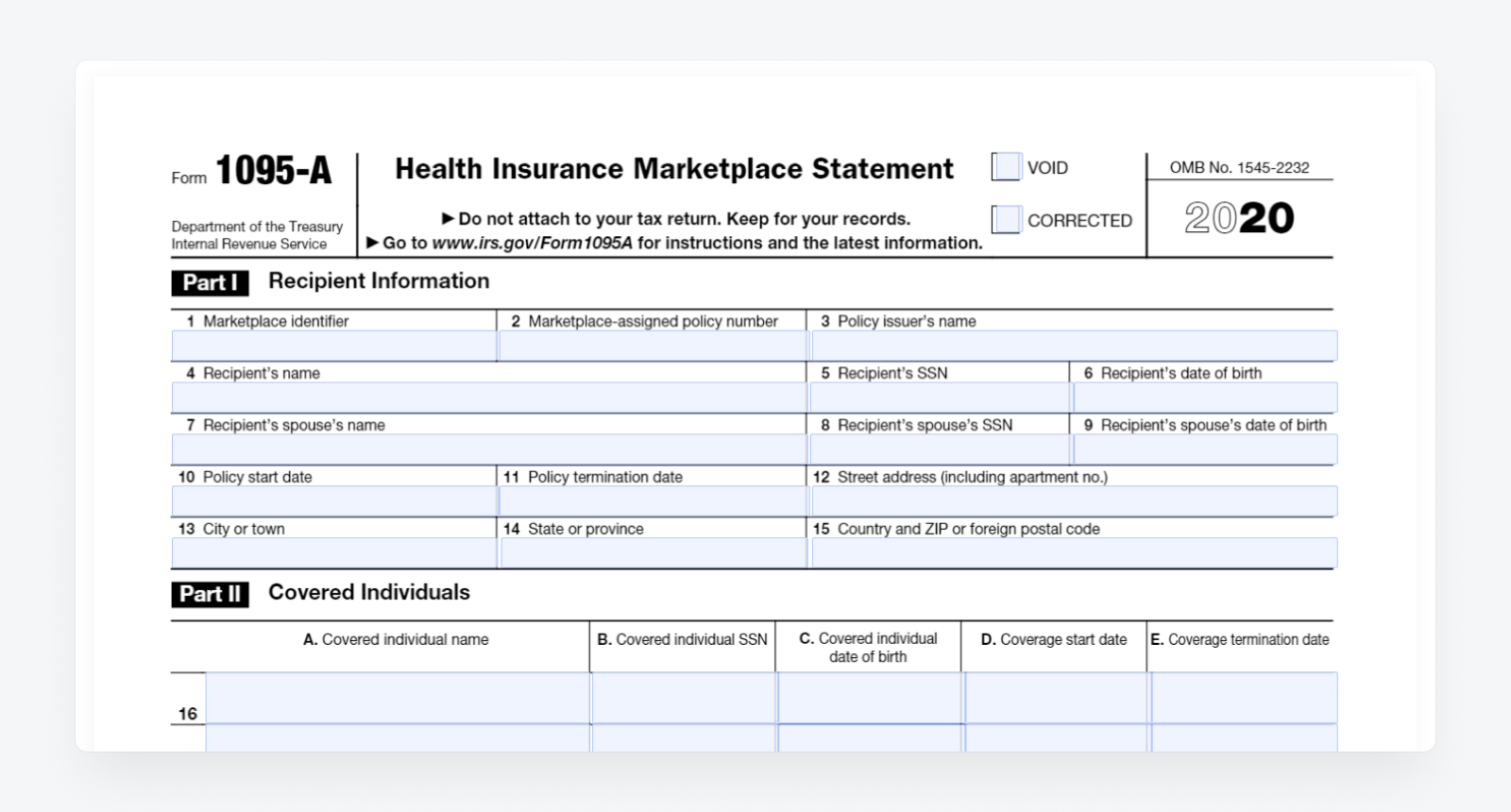

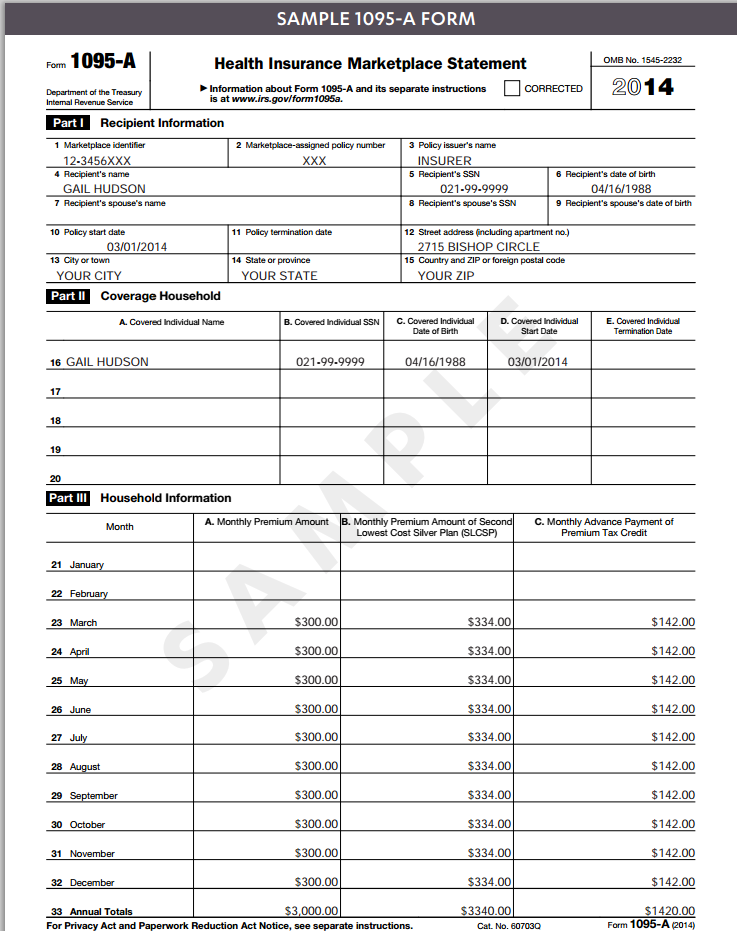

what is a 1095 form from the irs Form 1095 A is sent by state and federal marketplaces to anyone who had marketplace coverage for the year This form is absolutely required for taxpayers who received advance payments of the Premium Tax Credit APTC to help pay for health insurance coverage during the year

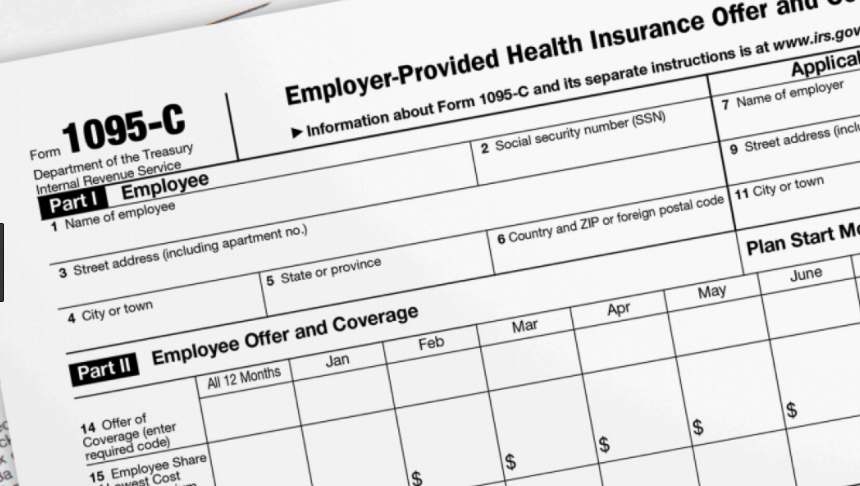

Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace Form 1095 A is also furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit Form 1095 A Health Insurance Marketplace Statement is provided by the Marketplace to individuals who enrolled or who have enrolled a family member in health coverage through the Marketplace Form 1095 B Health Coverage is provided by insurance companies and other coverage providers

what is a 1095 form from the irs

what is a 1095 form from the irs

https://www.pdffiller.com/preview/484/966/484966741/large.png

Instructions For Form 1095 A And How To Fill Out It PDFliner

https://blog.pdfliner.com/howTo/img/tild6536-3761-4039-a239-346663353333__how-to-fill-out-form.png

IRS Form 1095 Deadline For Employers Is Looming

https://www.retailers.com/wp-content/uploads/2018/02/Screen-Shot-2018-02-22-at-10.22.50-AM.png

Your 1095 A includes information about Marketplace plans anyone in your household had in 2023 It comes from the Marketplace not the IRS Keep your 1095 A forms with your important tax information like W 2 forms and other records How to find your 1095 A online Log in to your account Form 1095 A reports your amount of coverage any advance payment of tax credits you used to pay for health insurance and the names of people covered by the policy You can use the information on Form 1095 A to complete Form 8962 which you can file with your tax return to claim the premium tax credit

Form 1095 A is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier The form does not have to be returned to the government Form 1095 A 1095 B and 1095 C are tax forms that are used to report health insurance coverage to enrollees and to the IRS These forms came about as a result of the Affordable Care Act For most people who had marketplace exchange coverage during the year Form 1095 A is an essential part of the tax filing process as it s

More picture related to what is a 1095 form from the irs

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

https://www.investopedia.com/thmb/irRrzGQywwHt4TLkcYvmzx_LDYs=/1296x1062/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png

Instructions For Form 1095 A And How To Fill Out It PDFliner

https://blog.pdfliner.com/howTo/img/tild3830-3336-4662-b234-616236653764__how-to-get-form-1095.png

Form 1095 A Sample Amulette

http://amulettejewelry.com/wp-content/uploads/2018/09/form-1095-a-sample-sample-1095-c-form.jpg

The Affordable Health Care Act introduced three new tax forms relevant to individuals employers and health insurance providers They are forms 1095 A 1095 B and 1095 C These forms help determine if you the required health insurance under the Act Form 1095 is a collection of Internal Revenue Service IRS tax forms in the United States which are used to determine whether an individual is required to pay the individual shared responsibility provision Individuals can also use the health insurance information contained in the form forms to help them fill out their tax returns

Form 1095 A Health Insurance Marketplace Statement is an Internal Revenue Service IRS form provided to individuals who purchase health insurance through a health insurance marketplace carrier in time to file taxes Form 1095 A need not be returned to the IRS but is used to report health coverage on individual tax returns Form 1095 A provides details about your insurance policy coverage dates monthly premiums and any advance payments of the premium tax credit You will need Form 1095 A before you file your taxes otherwise you

Free Printable 1095 Form Printable Forms Free Online

https://robertwelk.com/wp-content/uploads/2018/06/Form1095-A-960x650.jpg

New Tax Forms In 2015

http://lerablog.org/wp-content/uploads/2015/03/sample-1095.png

what is a 1095 form from the irs - Information about Form 1095 A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace