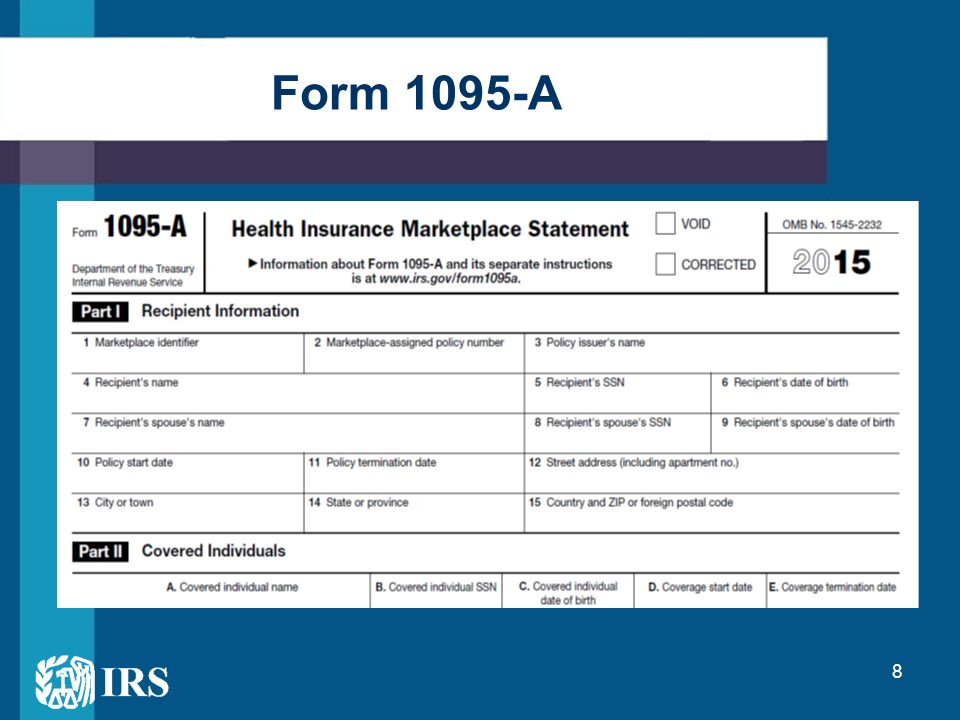

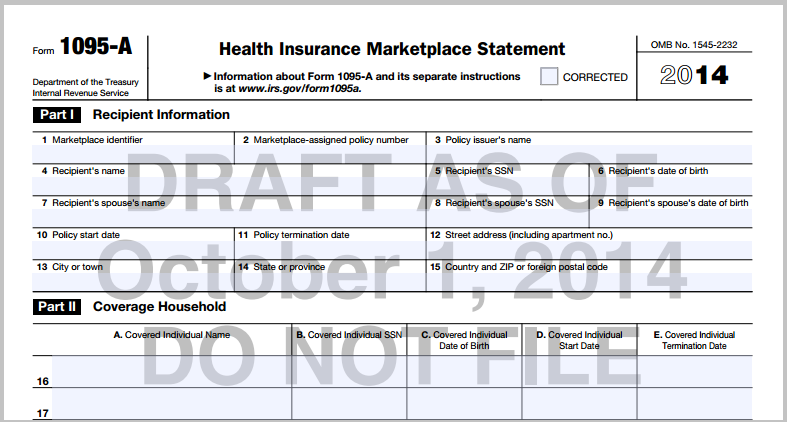

what is a 1095 tax form If anyone in your household had a Marketplace plan in 2023 you should get Form 1095 A Health Insurance Marketplace Statement by mail no later than mid February It may be available in your Marketplace account anytime from mid January to February 1 Your 1095 A includes information about Marketplace plans anyone in your household had in 2023

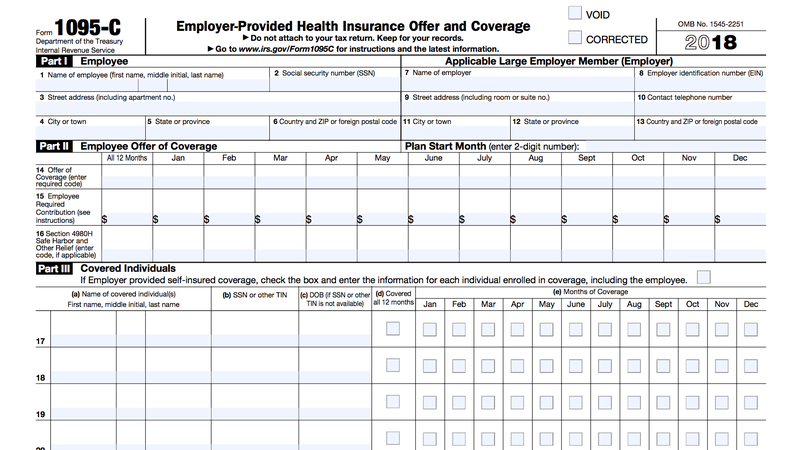

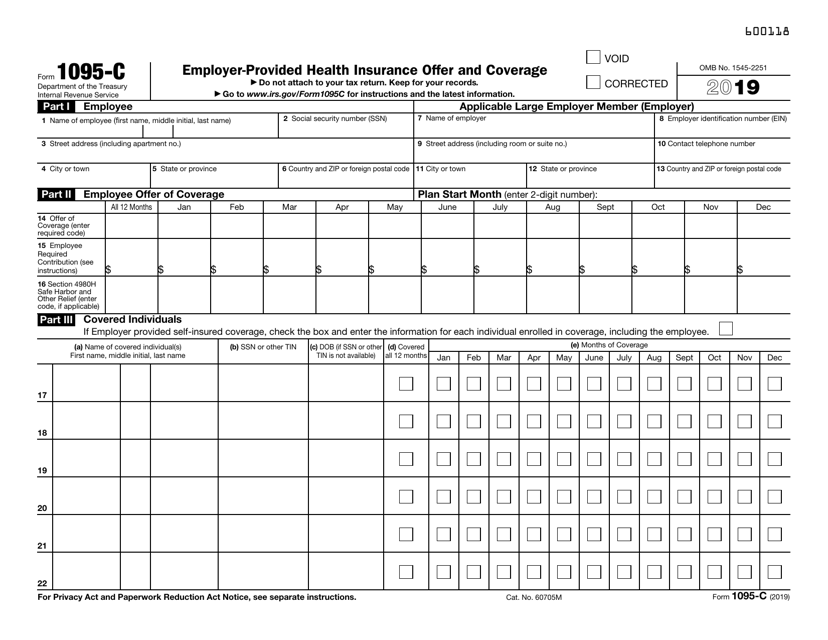

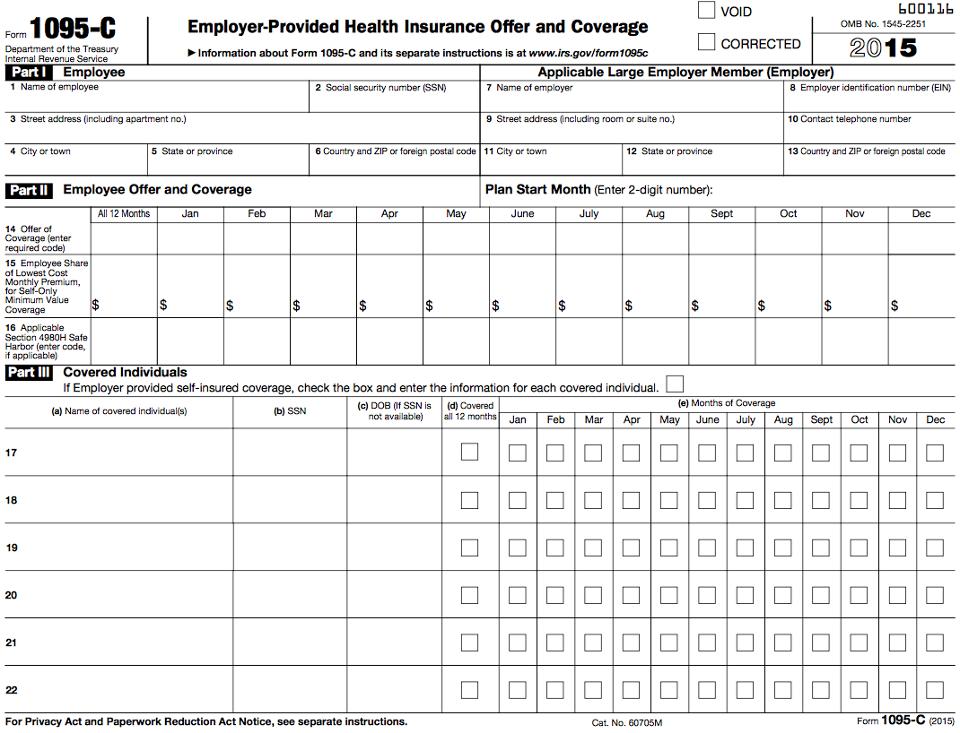

Information about Form 1095 A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace Form 1095 C Employer Provided Health Insurance Offer and Coverage Form 1095 C is issued by large employers required to offer coverage to employees This form reports both Offer of coverage to an employee Coverage of the employee if the employer is self insured and the employee enrolls in coverage However just like with the 1095 B most

what is a 1095 tax form

what is a 1095 tax form

https://robertwelk.com/wp-content/uploads/2018/06/Form1095-A.jpg

Filing Taxes How To Deal With Premium Tax Credits

https://www.peoplekeep.com/hs-fs/hub/149308/file-2337339258-png/1095A.png?width=612&name=1095A.png

What Is Form 1095 C And Do You Need It To File Your Taxes

https://www.mightytaxes.com/wp-content/uploads/2016/02/form_1095_c_taxes.gif

Form 1095 A is the health insurance marketplace statement This form shows you details about health coverage that you or a family member may have received from the marketplace Form 1095 A will help you complete Form 8962 This will help you claim your premium tax credit benefits on your tax return Basic Information about Form 1095 A If you or anyone in your household enrolled in a health plan through the Health Insurance Marketplace you ll get Form 1095 A Health Insurance Marketplace Statement You will get this form from the Marketplace not the IRS You will use the information from the Form 1095 A to calculate the amount of your premium tax

Form 1095 is a collection of Internal Revenue Service IRS tax forms in the United States which are used to determine whether an individual is required to pay the individual shared responsibility provision Individuals can also use the health insurance information contained in the form forms to help them fill out their tax returns The individual forms are Form 1095 A A Health Insurance The form provides information about your insurance policy your premiums the cost you pay for insurance any advance payment of premium tax credit and the people in your household covered by the policy Insurance companies in health care exchanges provide you with the 1095 A form This form includes Your name Amount of coverage you have

More picture related to what is a 1095 tax form

What To Do With Tax Form 1095 C

https://i.kinja-img.com/gawker-media/image/upload/s--bpX5v1i3--/c_scale,f_auto,fl_progressive,q_80,w_800/qldvmszowg9tagy0rx2b.png

IRS Form 1095 C 2019 Fill Out Sign Online And Download Fillable

https://data.templateroller.com/pdf_docs_html/2008/20082/2008206/irs-form-1095-c-employer-provided-health-insurance-offer-and-coverage_big.png

Benefits 101 IRS Form 1095 The Spot

https://spotlight.lehigh.edu/sites/spotlight.lehigh.edu/files/IRSart.jpg

Marketplaces use Form 1095 A to furnish the required statement to recipients A separate Form 1095 A must be furnished for each policy and the information on the Form 1095 A should relate only to that policy If two or more tax filers are enrolled in one policy each tax filer receives a statement reporting coverage of only the members of that Form 1095 C is used by applicable large employers those with 50 or more full time equivalent employees to report coverage and coverage offers The form is sent to full time 30 or more hours per week employees and the IRS It is sent by large employers that purchase health coverage for their employees and those that self insure

Form 1095 A Health Insurance Marketplace Statement This form includes details about the Marketplace insurance you and household members had in 2023 You ll need it to complete Form 8962 Premium Tax Credit Get a quick overview of health care tax Form 1095 A when you ll get it what to do if you don t how to know if it s Form 1095 B Health Coverage is a tax form used to report certain information to the IRS type of plan period of coverage and the names of dependents covered by the plan as well as to individuals who are covered by minimum essential coverage required by the Affordable Care Act Consumers must have 1095 B to verify on their taxes that they

What Is A 1095 A Form And How Does It Work Debt

https://www.debt.com/wp-content/uploads/2019/02/Obamacare-IRS-tax-form-1095.jpg

What Is Form 1095 B And Is It Necessary To File Taxes GoodRx

https://images.ctfassets.net/4f3rgqwzdznj/1T78IaGMbkkrcYgsE4zKSJ/0e3b9902726a759ddbd03876f4ac4152/filing_out_forms_doctors-1312745201__1_.jpg

what is a 1095 tax form - This form can be mailed to the IRS and to the policyholder by health insurance carriers government sponsored plans such as Medicaid CHIP and Medicare and self insured small employers But you may have to request Form 1095 B if you want it as it may not be sent to you automatically the way it was in the past 1095 C