what is 1120h HOAs have two forms to choose from 1120 and 1120 H Form 1120 is used by C corporations while 1120 H is a tax form specifically designed for qualifying HOAs What makes HOAs unique is the ability to file two different tax returns

Form 1120 H is a tax return filed by certain homeowners associations HOAs to report income gains losses deductions credits and to figure the income tax liability Form 1120 H is the income tax return for homeowners associations Compared to Form 1120 this form allows for a more simplified HOA tax filing process It also allows HOAs to enjoy certain tax benefits that are outlined in Section 528 of

what is 1120h

what is 1120h

https://scx2.b-cdn.net/gfx/news/hires/2022/what-is-the-effect-of.jpg

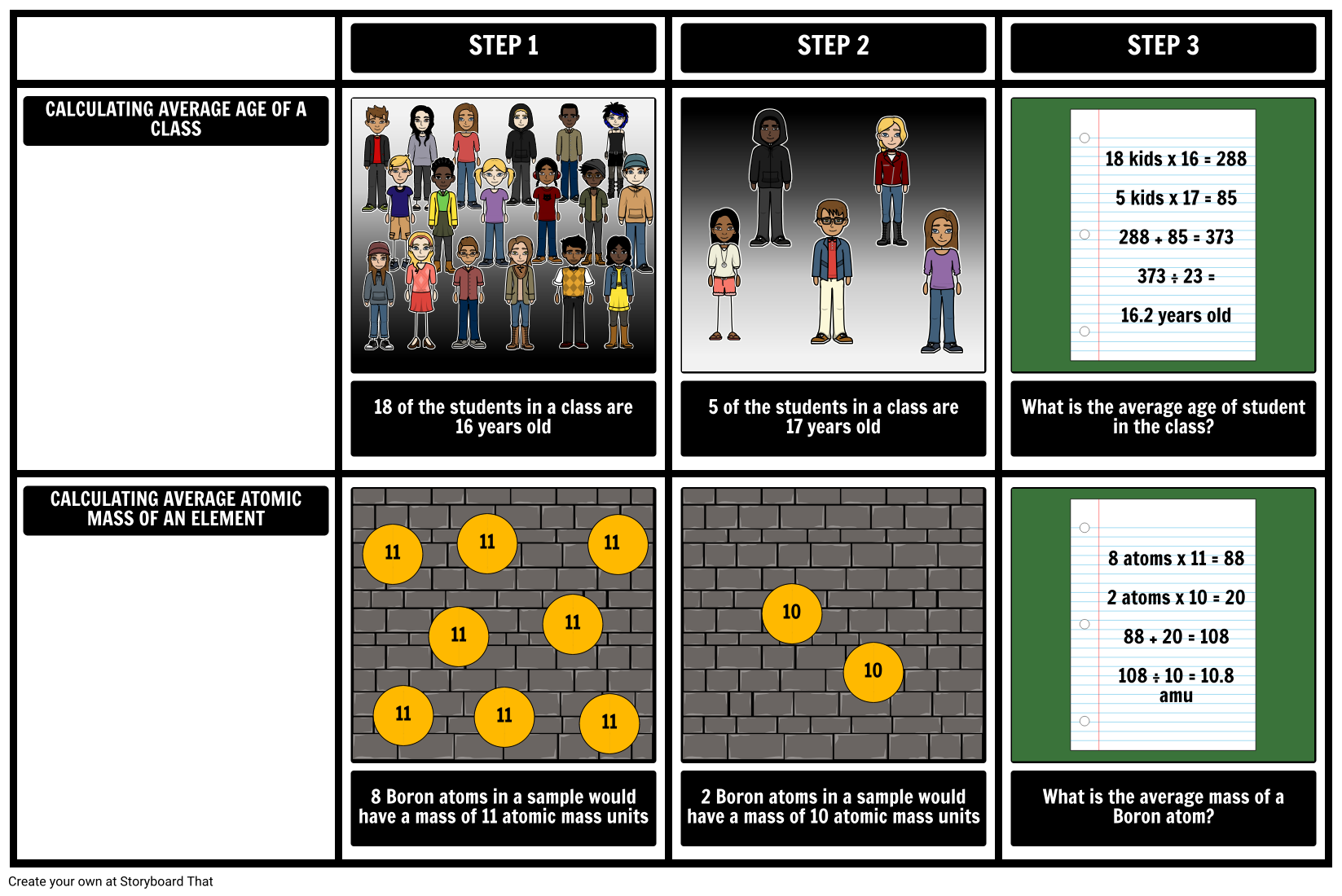

What Is Atomic Mass Storyboard By Amy roediger

https://sbt.blob.core.windows.net/storyboards/amy-roediger/what-is-atomic-mass-.png

What Is Einstellung Effect

https://therapistathome.com/resources/sharedfolder/Blog_what-is-einstellung-effect_Questions-pana.png

Few Homeowners Associations qualify as tax exempt organizations and file Form 990 Return of Organizations Exempt From Income Tax Form 1120 H is a tax form specifically created for Form 1120 H is a critical tool for Homeowners Associations and Timeshare Associations in managing their taxes With its flat rate tax structure it can help organizations maximize their after tax profits while ensuring they are

What is Form 1120 H Form 1120 H is a U S Income Tax Return for Homeowners Associations used by these associations to take advantage of certain tax benefits and One option is to file form 1120 H which is at the flat tax rate of 30 on net taxable income and is based on IRC Section 528 This is a one page form with minimal tax preparation issues Filing

More picture related to what is 1120h

What Is The Hormone Theory Of Aging

https://www.healthdigest.com/img/gallery/what-is-the-hormone-theory-of-aging/l-intro-1671460063.jpg

WW5000H 5

https://images.samsung.com/is/image/samsung/sa_WW50J3063LW-YL_001_Front?$L1-Thumbnail$

What Is A Service Mesh Koyeb

https://www.koyeb.com/static/images/illustrations/og/what-is-a-service-mesh.png

A homeowners association files Form 1120 H as its income tax return to take advantage of certain tax benefits These benefits in effect allow the association to exclude exempt function income Form 1120 H is a tax form used by homeowner associations It s an important tax form because it provides several specific tax benefits The form requests information related to

What Is Form 1120 H Filing Form 1120 H is one of the most straightforward ways for HOAs to submit income tax returns The form has a flat tax rate of 30 on taxable When it comes to filing tax returns for an HOA or condominium association there are generally two options Form 1120 H and Form 1120 The association will have to qualify in order to file

Maldy What Is U Do R Astros

https://preview.redd.it/maldy-what-is-u-do-v0-237w299w3wn91.jpg?auto=webp&s=ce41a034c6f30c1cbdb869045972e19a122bc6ad

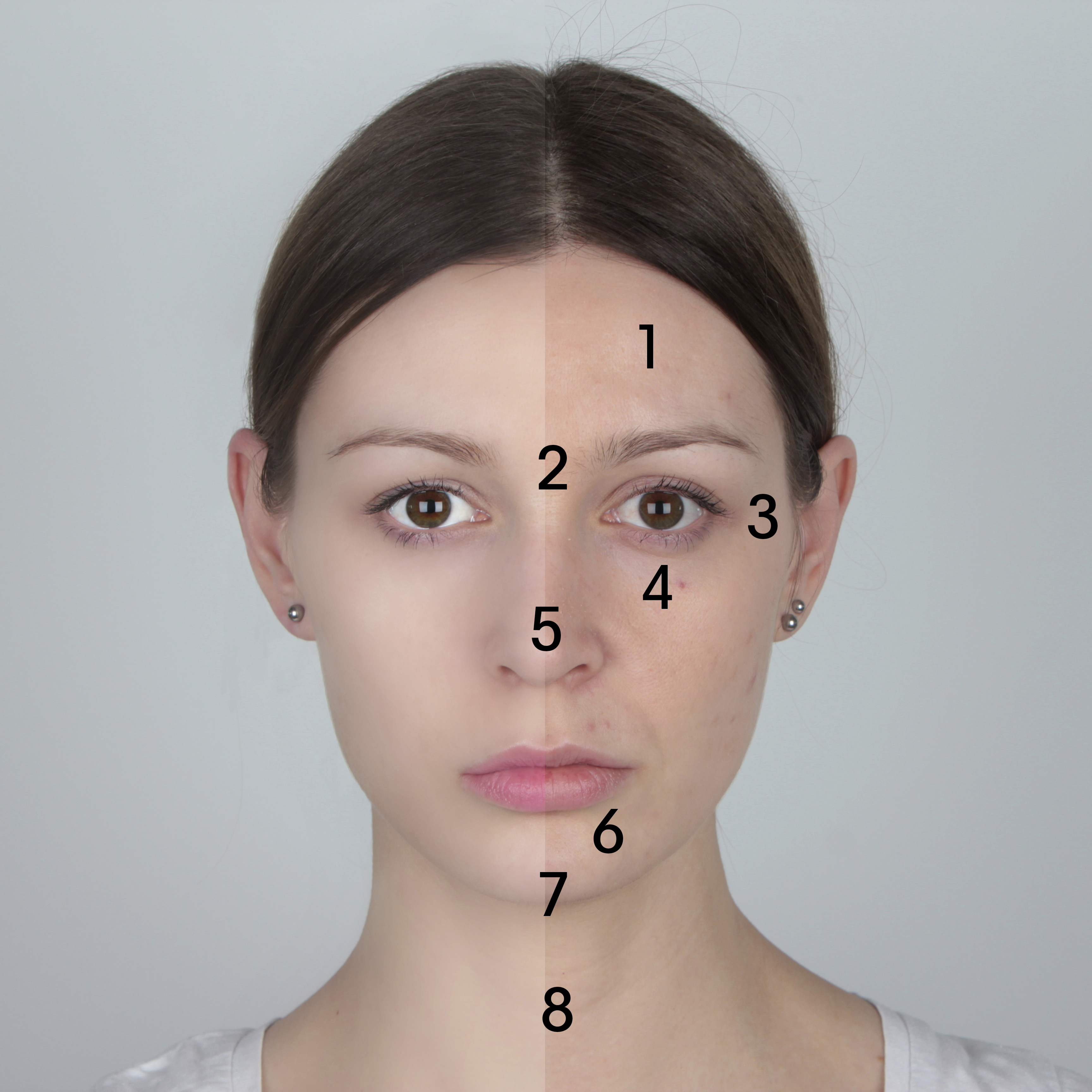

What Is Your Skin Telling You Fall Creek Skin And Health Rexburg

http://www.rexburgskincare.com/wp-content/uploads/2014/05/whatisyourskintellingyou.jpg

what is 1120h - Few Homeowners Associations qualify as tax exempt organizations and file Form 990 Return of Organizations Exempt From Income Tax Form 1120 H is a tax form specifically created for