what type of entity is 1120h Information about Form 1120 H U S Income Tax Return for Homeowners Associations including recent updates related forms and instructions on how to file A homeowners

Discover everything you need to know about Form 1120 including variations like 1120 S 1120 H 1120 F and 1120 W Learn about IRS instructions filing requirements and Form 1120 H is a tax return filed by certain homeowners associations HOAs to report income gains losses deductions credits and to figure the income tax liability

what type of entity is 1120h

what type of entity is 1120h

https://www.startupblog.com/wp-content/uploads/2016/06/LLC.jpg

What Is An Entity Entity Type And Entity Set

https://afteracademy.com/images/what-is-an-entity-entity-type-and-entity-set-weak-entity-example-d5677f16eb8d6f9b.jpg

What Is An Entity Entity Type And Entity Set

https://afteracademy.com/images/what-is-an-entity-entity-type-and-entity-set-entity-set-examples-2dfbf816747e17dc.jpg

HOAs have two forms to choose from 1120 and 1120 H Form 1120 is used by C corporations while 1120 H is a tax form specifically designed for qualifying HOAs What makes HOAs unique is the ability to file two different tax returns For 1120 H they are nonexempt or taxable For 1120 they are membership However nonexempt income can be converted to exempt function income if the fees are charged on an

HOAs that file form 1120 H are taxed at a flat rate of 30 This rate applies to condo associations and residential real estate associations The tax rate for timeshare associations is a flat 32 While filing Form 1120 H is more straightforward it has stringent eligibility requirements for HOAs In contrast filing Form 1120 is more complex but easier to qualify than Form 1120 H Another notable difference is that

More picture related to what type of entity is 1120h

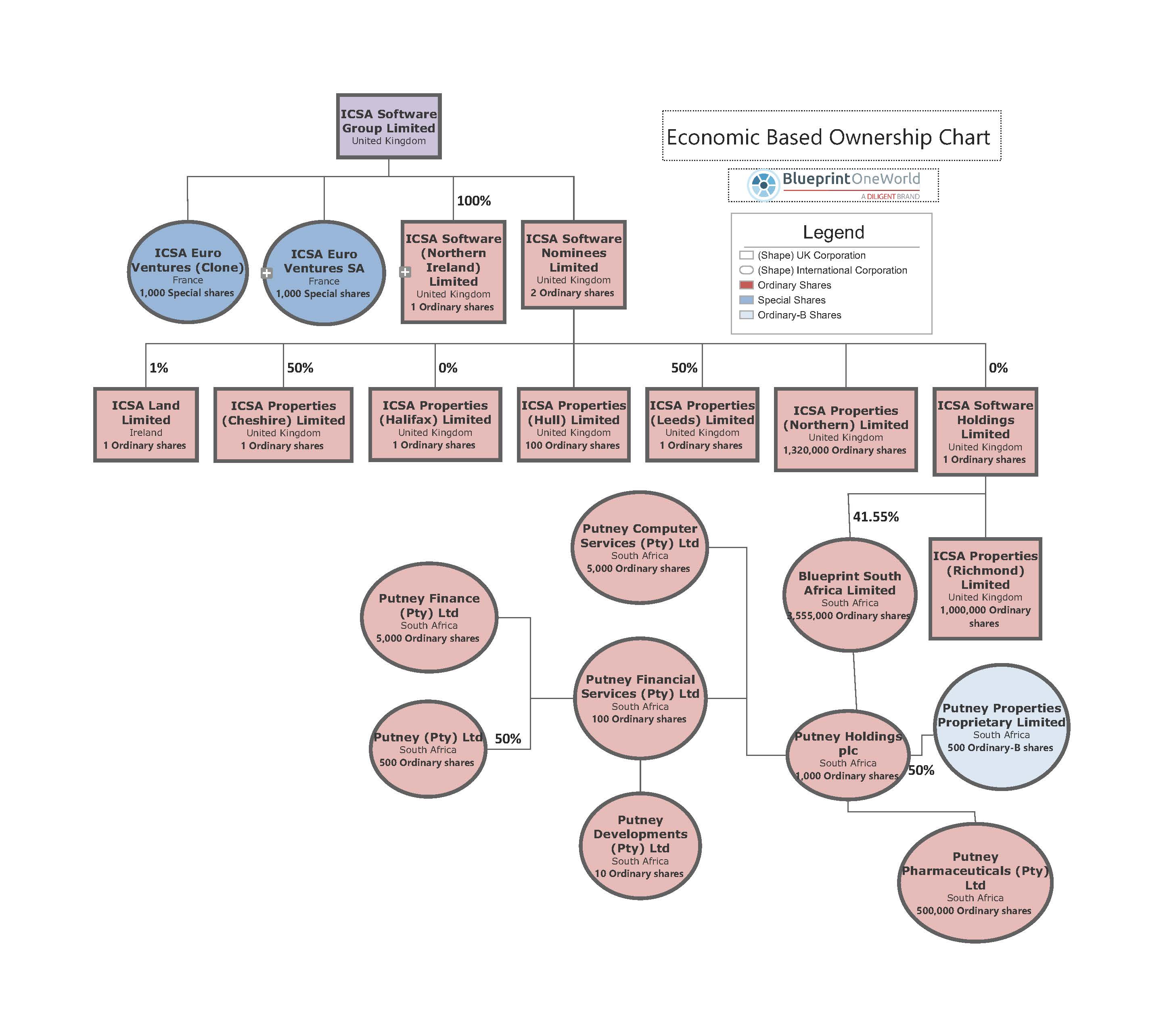

Examples Of Organizational Charts For Business

https://www.diligent.com/-/media/project/diligent/master/insights/articles/uploaded/entity-chart-1.jpg

What Is An Entity Entity Type And Entity Set

https://afteracademy.com/images/what-is-an-entity-entity-type-and-entity-set-strong-entity-example-92355a15fee8325c.jpg

What Is Entity Relationship Diagram Types Of Entities Attributes In

https://i.ytimg.com/vi/peE0rqw_KNo/maxresdefault.jpg

What is Form 1120 H Form 1120 H is a U S Income Tax Return for Homeowners Associations used by these associations to take advantage of certain tax benefits and Few Homeowners Associations qualify as tax exempt organizations and file Form 990 Return of Organizations Exempt From Income Tax Form 1120 H is a tax form specifically created for

What type of tax return does a homeowners association file Homeowners associations have a choice between two tax return forms Form 1120 and Form 1120 H Form 1120 is typically The following entities must file tax Form 1120 Businesses that have chosen to be taxed as corporations These businesses must also file Form 8832 and attach a copy of it to

Business Entity Comparison Chart

https://cdn.mycorporation.com/www/img/hero/business-entity-comparison-chart.jpg

What Type Of Entity Should You Form CARL ROBERTS

http://paulphoard.weebly.com/uploads/1/3/6/0/13608254/infographic-what-type-of-entity-final_orig.jpeg

what type of entity is 1120h - Form 1120 H offers simplicity and is specifically tailored for HOAs exempting exempt function income from taxes It s an ideal choice for associations with predominantly