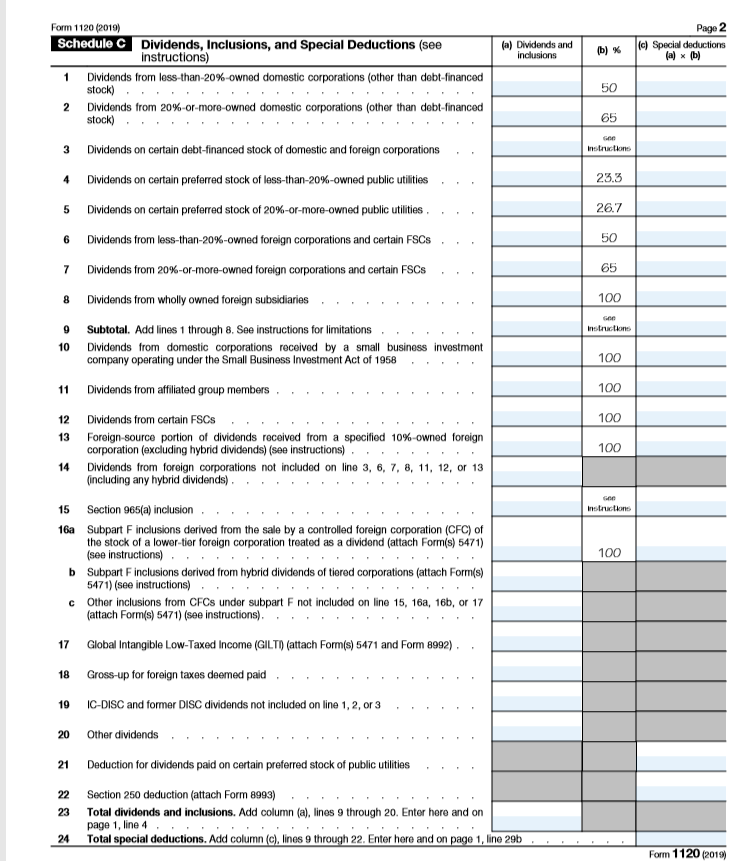

what are 1120s deduction Deduction for certain energy efficient commercial building property For tax years beginning in 2023 corporations filing Form 1120 S and claiming the energy efficient commercial

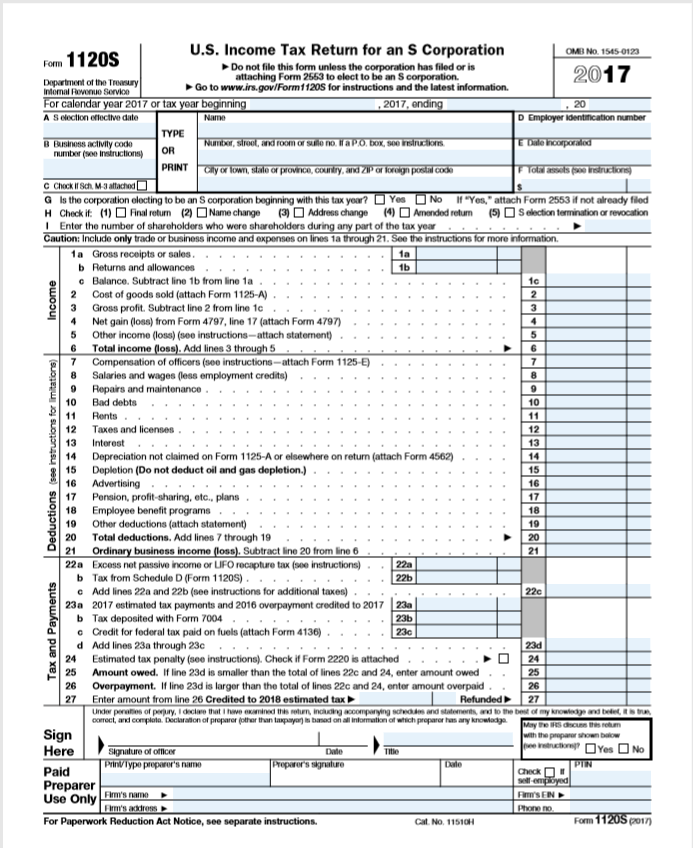

Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax If you own an S corp or share ownership in one with others you ll use Schedule K 1 Form 1120S to report your share of income from the S corp at the end of the year Schedule K 1 is where you ll report your share of income deductions

what are 1120s deduction

what are 1120s deduction

https://www.pdffiller.com/preview/624/654/624654269/big.png

Loi3dtN1iqvoAQrML OAYXTqCW

https://yt3.googleusercontent.com/loi3dtN1iqvoAQrML-OAYXTqCW-TG7zbSbXsWJm8RZbqp1A426URSwe65YV0l1BTomUOFrDY=s900-c-k-c0x00ffffff-no-rj

Form 1120 Line 26 Other Deductions Worksheet Studying Worksheets

https://media.cheggcdn.com/media/165/1654ea34-55cf-4096-ab7a-629a93e3ec4b/phpLJTc4d.png

Form 1120 S is an important tax document used by S corporations to report their income gains losses deductions and credits as well as to determine their tax liability What is Form 1120 S Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains losses deductions and other credits for the tax year

IRS Form 1120S is the tax return used by domestic corporations that have made an election to be treated as S corporations for that tax year The return reports income losses credits and deductions before they flow Form 1120 S is crucial in reporting S corporations income losses and deductions It s essential to understand what this form is who needs to file it and how to do it correctly to ensure your business stays compliant

More picture related to what are 1120s deduction

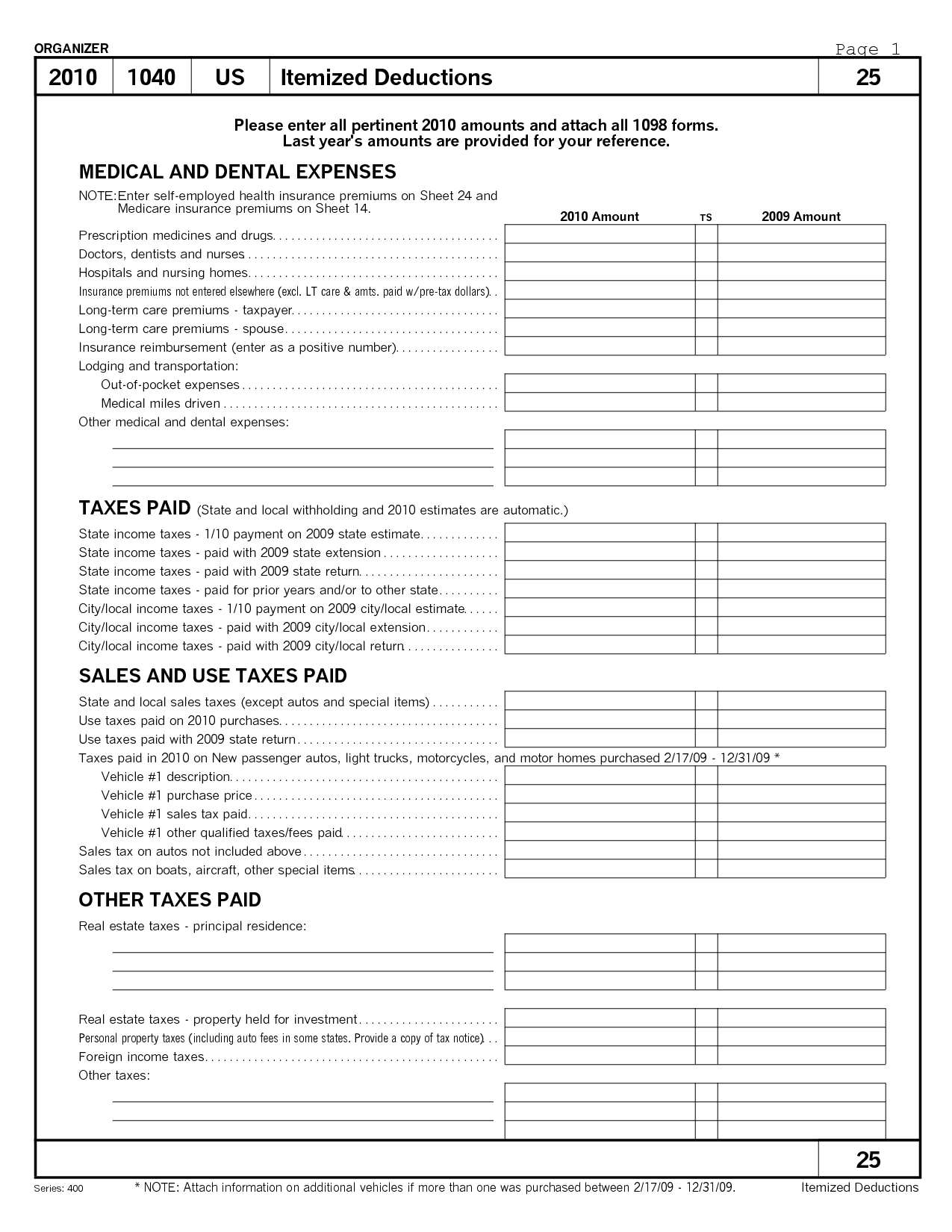

10 Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2012/03/2015-itemized-tax-deduction-worksheet-printable_426931.png

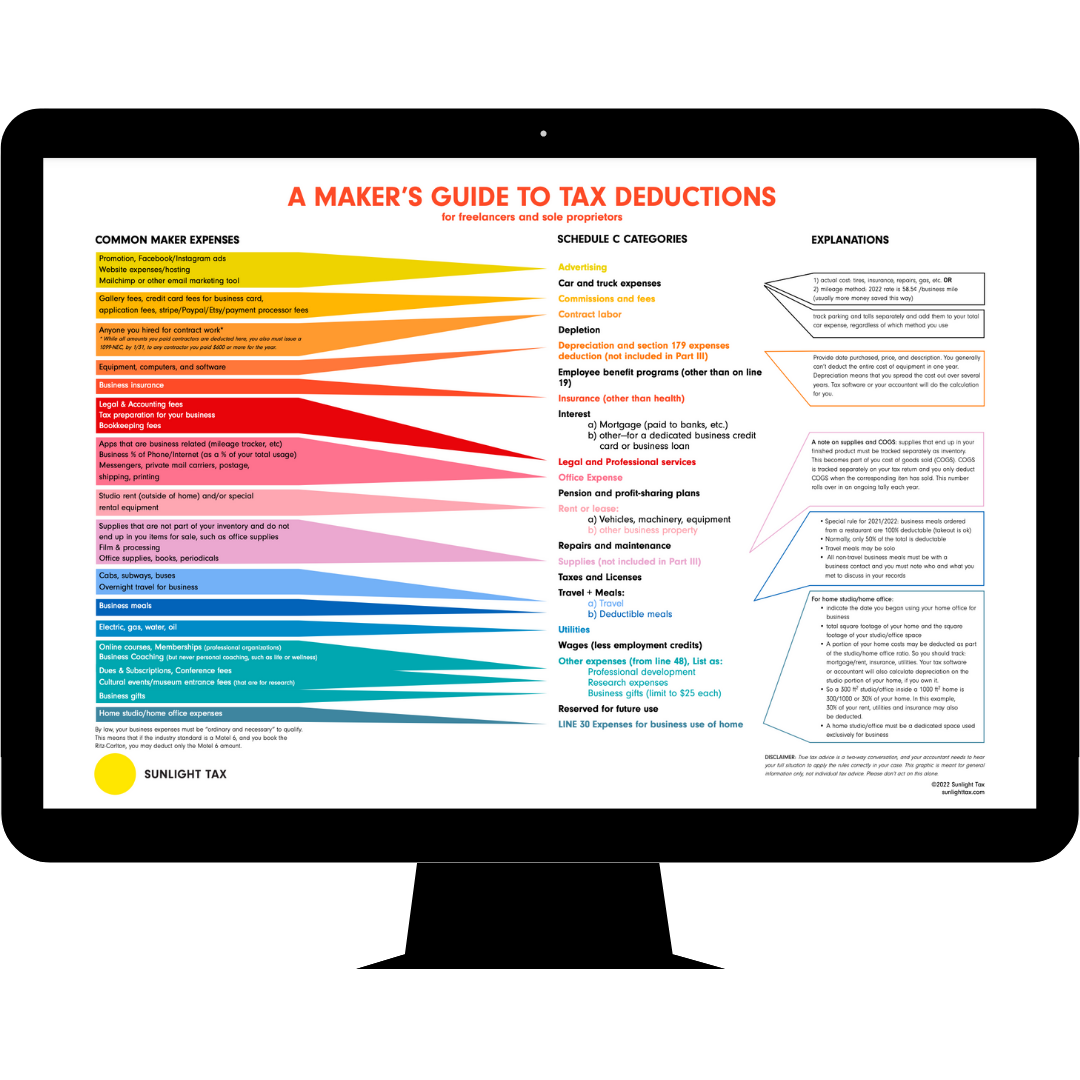

Tax Deductions Guide Sunlight Tax

https://images.squarespace-cdn.com/content/v1/5693d8a2a976af0bfc5ec849/192a5ae8-9c24-417c-bc8e-778b3db4a7d4/makerdeductionguide.png

20k Deduction For electrifying Your Business HCG Development

https://hallconsulting.com.au/wp-content/uploads/2023/10/20k-deduction-for-electrifying-your-business-scaled.jpg

If your business has an S corp tax classification status you must file form 1120S which is essentially the annual tax return for your business Use this form to report deductions gains income and losses from the business Form 1120S is specifically designed for S corporations offering a distinct approach compared to the more common Form 1120 used by C corporations S corporations

What is Form 1120s S Form 1120S is an annual tax return used by S Corporations to report their financial activities Unlike C Corporations S Corporations are pass Form 1120S is the tax form S corporations use to file their federal income tax return not to be confused with Form 1120 for C corporations Every S corp needs to file one including LLCs

41 1120s Other Deductions Worksheet Worksheet Works

https://media.cheggcdn.com/media/5f5/5f570c92-9ec5-44f4-a56b-010b229d90a0/phpzLTv9I.png

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

https://www.hdfcsales.com/blog/wp-content/uploads/2021/06/tax-deduction-on-fixed-deposit.jpg

what are 1120s deduction - To have a better understanding of how taxes work and how to maximize deductions take a look at IRS Form 1120 S that I completed for my S Corp this year