tax code 18 4 January 2018 Last updated 22 February 2019 See all updates Get emails about this page Contents PAYE tax and Class 1 National Insurance contributions Tax

Treasury regulations commonly referred to as federal tax regulations provide the official interpretation of the IRC by the U S Department of the Treasury and give directions to 05 Apr 2024 Understand your tax code Your tax code is used to tell HMRC how much tax you need to pay out of your salary Find out what yours means how to check your tax

tax code 18

tax code 18

https://ma-banque.ma/wp-content/uploads/2022/05/28-768x768.png

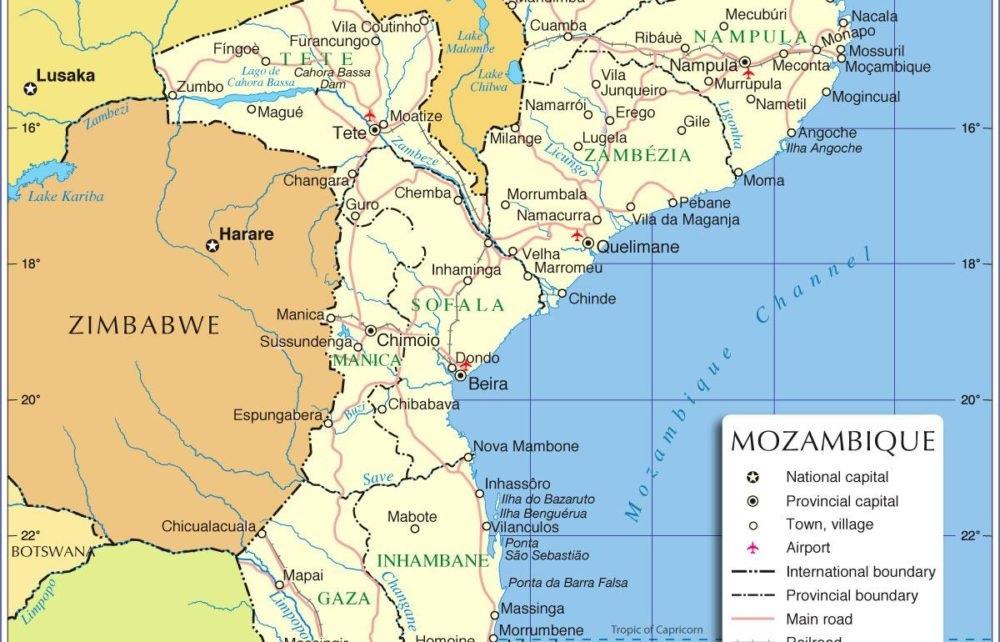

Value Added Tax Code Mozambique

https://static.africa-press.net/mozambique/sites/64/2023/02/postQueueImg_1676701411.66.jpg

https://c.pxhere.com/images/38/2b/139c5771ccf68374d3fc7581ece3-1444833.jpg!d

Let s take a common example if you ve got one employer no work perks such as a company car live in England Northern Ireland and earn under 100 000 your code for The Internal Revenue Code of 1986 IRC is the domestic portion of federal statutory tax law in the United States It is codified in statute as Title 26 of the United States Code

Tax payable on income you receive if you re under 18 years old and not an excepted person with excepted income Last updated 28 September 2023 Print or Download On Updated December 18 2023 Reviewed by Ebony Howard Fact checked by Yarilet Perez What Is a Tax Code The term tax code refers to a series of laws and regulations

More picture related to tax code 18

SCOTUS Case Could Quash Democrats Wealth Tax Plans

https://d2eehagpk5cl65.cloudfront.net/img/q60/uploads/2023/06/sipaphotossixteen096496-scaled.jpg

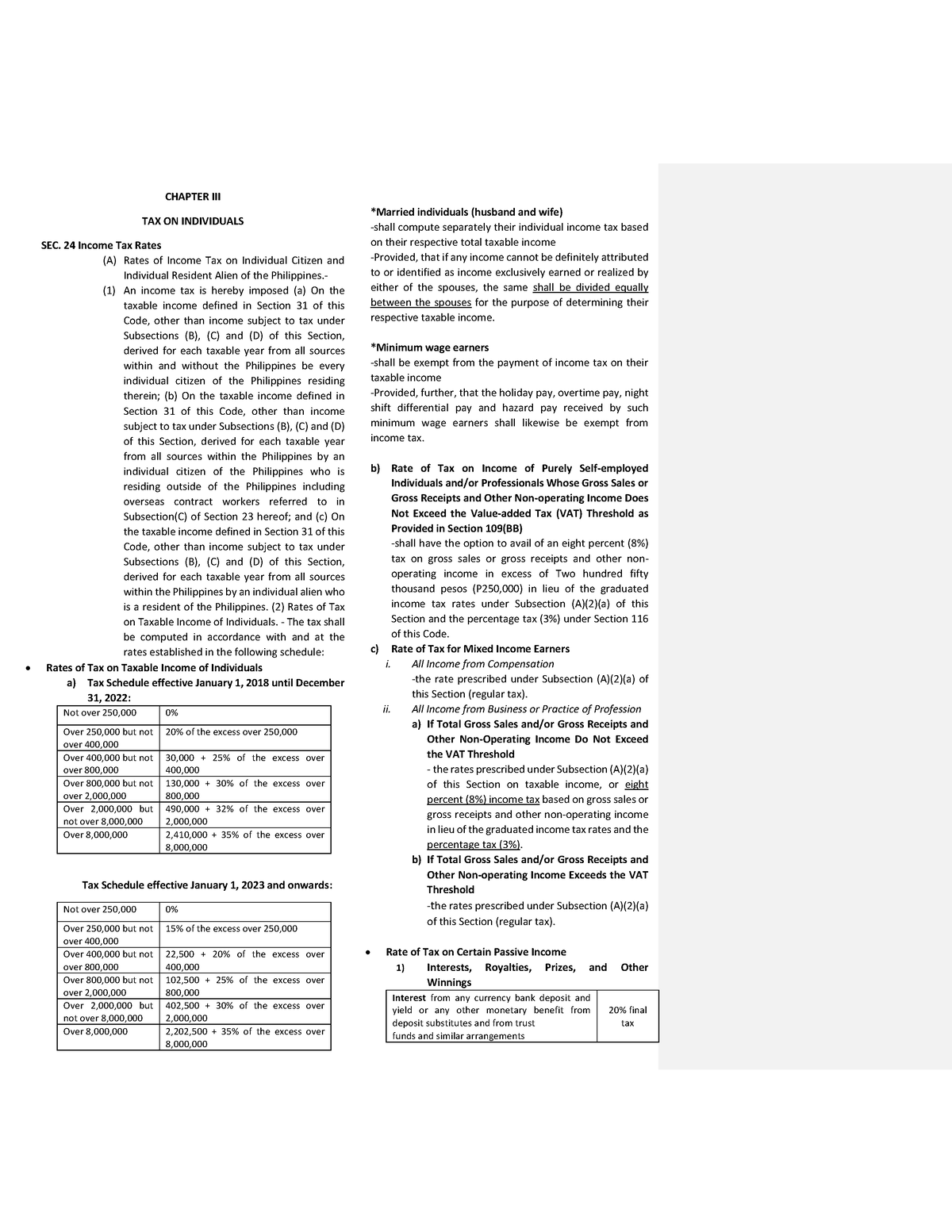

TAX CODE Summary CHAPTER III TAX ON INDIVIDUALS SEC 24 Income Tax

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/931f688ab519b9279df08bda96cd3450/thumb_1200_1553.png

Broken Tax Code Legalities

https://image.cnbcfm.com/api/v1/image/103537941-2ED1-PL-US-TAX-REFORM-041116.jpg?v=1529471211&w=1920&h=1080

Lawmakers Will Have to Reform the Tax Code in 2025 The 2017 Tax Cuts and Jobs Act JCT estimated the number of itemized filers would decline from 46 5 million in 2017 to Subtitle C of title III of the Employee Retirement Income Security Act of 1974 is classified to subtitle C 1241 et seq of subchapter II of chapter 18 of Title 29 Labor and amended

Estimated annual total income from all sources Secondary tax code for the second source of income Secondary tax rate before ACC levies 14 000 or less SB 10 5 You can select I Accept to consent to these uses or click on Manage preferences to review your options and exercise your right to object to Legitimate Interest where used

Trends In State Tax Policy 2018 Tax Foundation

https://files.taxfoundation.org/20171213152636/AdobeStock_53050132-e1529345716705.jpeg

New Income Tax Slabs Fy 2023 24 Ay 2024 25 2022 23 Rates For

https://assets1.cleartax-cdn.com/cleartax/images/1627889850_topcta2.jpg

tax code 18 - Let s take a common example if you ve got one employer no work perks such as a company car live in England Northern Ireland and earn under 100 000 your code for